Introduction:

The following project is a project analysis report for the company Latech Ltd. The company is involved in manufacturing gaming consoles and a new project is undertaken by the company in this regards. The project Neuro Power is the name of the new project which is being analyzed using the Net Present Value and the discounted Payback period. The company also has an alternative project which is also being analyzed in this analysis with the name of IQ power. Thus both the projects are analyzed in this report and a recommendation is provided to the company for the project which is to be undertaken.

Discussion:

Neuro Power Project Analysis:

NPV Analysis and Discounted Payback Period analysis at 16%:

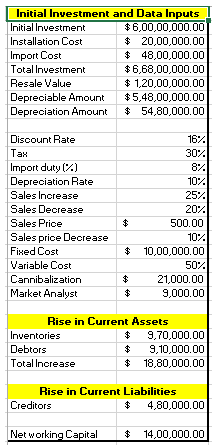

The Initial investment of the project along with the different inputs which is required for the analysis of the project is highlighted in the figure below,

Figure 1:

Source:

Thus the inputs and the initial investment for the project is depicted in the above figure and the discount rate is taken as 16%, while the initial investment for the project is taken as $ 66800000. Thus the NPV calculation is conducted in the next figure and it is followed by the discounted payback period in the figure below,

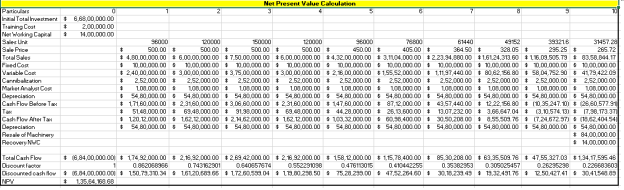

Figure 2:

Source:

The Net present value of the project at the 16% discount rate is calculated to be $13564168.68. Thus the project is generating a positive net present value for the company and thus can be undertaken by the company. However, a further analysis in the form of discounted payback period is done and is presented in the figure below,

Figure 3:

Source:

The discounted payback period at the 16% discount rate provides a value of 5.09 years for the Neuro power Project.

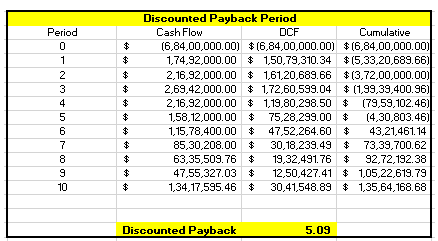

NPV Analysis and Discounted Payback Period analysis at 22%:

The inputs which are used for the analysis at the 22% discount rate is the same while the only change is the discount rate. Thus the NPV which is calculated while using this discount rate provides a value of $ 545067 while the Discounted payback period provides a value of 7.57 years when the 22% discount rate is used for the project.

Figure 4:

Source:

IQ Power Project Analysis:

NPV Analysis and Discounted Payback Period analysis at 16%:

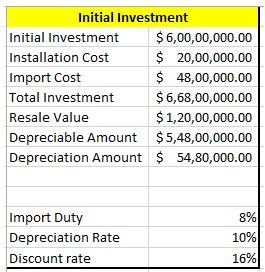

The IQ Power is an alternative project which is undertaken by the company Latech Ltd, the NPV analysis of the project is also undertaken at the 16% discount rate. The initial investment of the project is the same as the Neuro Power project and is highlighted in the figure below,

Figure 5:

Source:

The initial investment for the project is $ 66800000, and the discount rate which is undertaken for the project is 16%. The Net Present Value analysis of the project along with the discounted payback period of the project at the 16% discount rate is presented in the figure below,

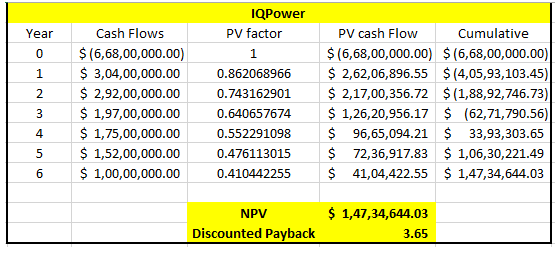

Figure 6:

Source:

The NPV of the project is $ 14734644.03 and thus the project is generating a higher net present value which is positive and thus can be undertaken by the company. Also the discounted payback period for the project 3.65 years which is also very less than the Neuro Power project.

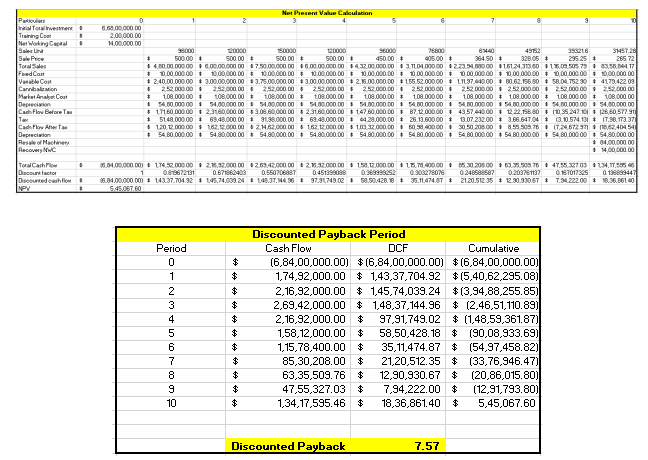

NPV Analysis and Discounted Payback Period analysis at 22%:

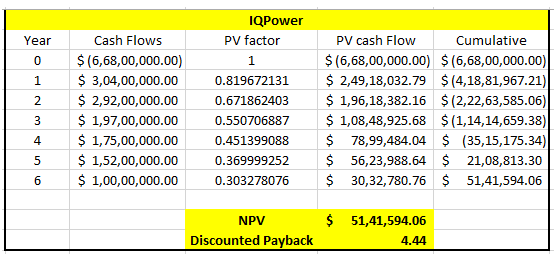

Thus the inputs which are used for the project analysis are the same only the discount rate for the project has been increased to 22%. Thus the NPV and the discounted payback period is provided in the figure below,

Figure 7:

Source:

The NPV of the project is positive and is at $5141594.06 while the discounted payback period for the project is 4.44 years. Thus the project is generating positive NPV even at the higher discount rate.

Conclusion:

Thus at the 16% discount rate the Neuro Power project provides a Net present value of $13564168, while the IQ power Project provides a NPV of $14734644. Thus the IQ power project should be undertaken if the company decides to accept the project only on the basis of net present value. Also at the 16% discount rate the payback period is 5.09 years for the Neuro power project, while the IQ power project has a payback period of 3.65 years. Thus on the basis of the discounted payback period at the 16% discount rate Project IQ power should be undertaken.

At the 22% discount rate Neuro Power has a NPV of $545067 while the discounted payback period is of 7.57 years. While at the 22% discount rate the NPV and the discounted payback period of IQ Power is $5141594 and 4.44 years. Thus the Project IQ power should be undertaken at the 22% discount rate since the NPV is higher while the payback period is lower.

Bibliographies:

Baucells, M. and Bodily, S.E., 2018. Net Present Value Analysis of Projects Under Expected Utility.

Gorshkov, A.S., Vatin, N.I., Rymkevich, P.P. and Kydrevich, O.O., 2018. Payback period of investments in energy saving. Magazine of Civil Engineering, 78(2).

Hadidi, L.A. and Omer, M.M., 2017. A financial feasibility model of gasification and anaerobic digestion waste-to-energy (WTE) plants in Saudi Arabia. Waste management, 59, pp.90-101.

Maghsoudi, P. and Sadeghi, S., 2019. A novel economic analysis and multi-objective optimization of a 200-kW recuperated micro gas turbine considering cycle thermal efficiency and discounted payback period. Applied Thermal Engineering, p.114644.

Marcu, M.I., Kellermann, A.L., Hunter, C., Curtis, J., Rice, C. and Wilensky, G.R., 2017. Borrow or serve? An economic analysis of options for financing a medical school education. Academic Medicine, 92(7), p.966.

Rich, S.P., Rose, J.T. and Delaney, C.J., 2018. Net Present Value Analysis in Finance and Real Estate: A Clash of Methodologies. Journal of Real Estate Portfolio Management, 24(1), pp.83-94.