Introduction

The report brings out a discussion on LVMH Group and the acquisition of Tiffany Co., which discusses on corporate strategy, situational analysis, resources and competencies analysis, and business level strategy. To analyse the competition and external environment, Porter five forces analysis is being used. SWOT analysis is the internal analysis considering key important critical success factors complying with the recent data available. Ansoff`s matrix. This matrix is strategic planning tool, which avails to assist executives and top-level managers to make strategies to grow in future. LVMH was introduced in 1987 ads it is one of the biggest luxury brand goods. The company avails a huge portfolio of goods such as leather goods, jewellery, wines, watches, and cosmetics (Liu, 2019). The company focused on performance to strong reducing the tourist and the effect of higher tariffs for the Chinese imports. Tiffany has been working in progress where leadership is quite confident where Tiffany, 2019 has disappointments with declining sales with comparable sales.

Pestle analysis

This framework will analyse main factors that include political, social, economic, environment, technological and legal factors affecting the company from outside.

Political factors-

This factor is crucial factor of business environment as several policies, regulations, and business rules considering the political stability of UK market. Establishment of (ACTA) Anti-counterfeit trade agreement affects the business. The company faces debate with the French unions with balance of the foreign workers. These regulations impose influence on people while spending income where it can increase by 4.1 percent creating impacts on taxation policy especially the indirect taxation (Rastogi, & Trivedi, 2016).

Social factors-

Social factors symbolises demographics, religious norms, trends, and the practises of society. The sales of LVMH is affected by social trends as customers belong to different backgrounds in society with preferences and opinions. Geographical segmentation segregates the market in geographical areas that can assist wealthy nations like UK to maintain better positioning to enhance status symbol (Mathooko, & Ogutu, 2015).

The company targets people with higher income creating an image as per the social identity leading to build social image. Most buyers are graduates who have a greater sense of social reputation. British women use fragrance on festivals and marriages, which indicates that they tend to use fragrance with fewer times when comparing it to others such as European and American women.

Economic factors-

LMMH has huge market in Asia. Currency fluctuation depends on global economic situation. Exchange rate of risk has hedged risk through contracts. The revenue of this industry is US$101,237 million by number of users 1353.5 million. recent data has led to increase in the demand of perfumes and the cosmetics items by 7 percent as compared to previous years. The household disposable income in UK is Euro 29400 for 2019 when comparing it to the 2018. The income shows an average increase of 0.7 percent between FYE 2017 and FYE 2019.

(Source: Office for national statistics, 2018)

(Source: Trading economics, 2018)

The above table indicates that demand of the bags, accessories, and jewelleries in these five nations named as China, Japan, US, South Korea, and United Kingdom.

Technological factors-

This factor will include success in regards to online marketing. New manufacturing machines will allow LVMH to allocate cheaper costs and manufacture efficiently. LVMH conducts research to gather information, data, opinions, and families, reviews, from internet with the help of forums, chat groups, websites, and blogs. This is a growing trend in regards to the shopping facilities and enhancing the E-tailing trends in UK market (Sukma, Lubis, & Utami, 2019).

Environmental factors-

The factor will maintain high level of standards regarding the environmental obligations. It will include implementation of environment sustainability with reporting system. Perfumes and cosmetics organisations often seek for the green way to produce products when they need technological support where customer are likely to purchase products to increase sales and maintain brand image. It is seen that in summer time, British women purchase fragrance which lead to increase in sales of LVMH and affect UK market. To ensure high level of environmental performance, the company believes it as vital for company and implement an appropriate management system to manage the environmental chaos.

Legal factors-

The organisation has several issues when knocking off the brands to imitate intellectual property of organisation.

SWOT analysis

| Strengths | Weaknesses |

| Higher customer loyalty as they have strong faith on LVMH servicesExtensive range of target groupBrand recognitionHigher profitabilityGrowth strategy continues to merger of higher ending brands. Strong distribution channel across the globe | Extremely expensiveDistribution channels are limitedNo discountsBrand dilutionIntense and close competition including Prada and GucciThe company has limited customer base Fake copies of LVMH items that has affected the profits and sales |

| Opportunities | Threats |

| Increasing and growing market potential for the luxury goods avails opportunity for merchandise organisationRe-brandingDevelopment of social networks and the internet with celebrity’s endorsement (Financial Times, 2019) Increase in per capita income with resultant sharpened PDI leading to increase in the demand of luxury products and non-essential items (Fozer et al., 2017). | Increasing advocacy in against the use of animal skinsFluctuations in currency ratesChanging trends in every seasonSlowing economic conditions, financial crisis and recessionIncrease in the number of brands have been hampering the market of LVMHCompetitors for product offered are poloralph lauren corporation, vaudan international flavors and fragrance, signet group and tiffany (Otieno, 2016). Imitation of products |

Porter`s five forces model

Threat of new entrants-

The level of threat of entrants is low because of high capital, high market size, with established reputation (Song, Sun, & Jin, 2017).

Threat of substitution-

This threat is medium as other luxury brands in the market who too accepts changing preferences of the customers.

Bargaining power of suppliers-

The level of bargaining power of suppliers is low because of LVMH`s reputation, and supplier`s code of conduct.

Bargaining power of buyers-

The level of bargaining power is medium because of differentiated features, loyal customers, counterfeit items, and low switching costs.

Competitive rivalry-

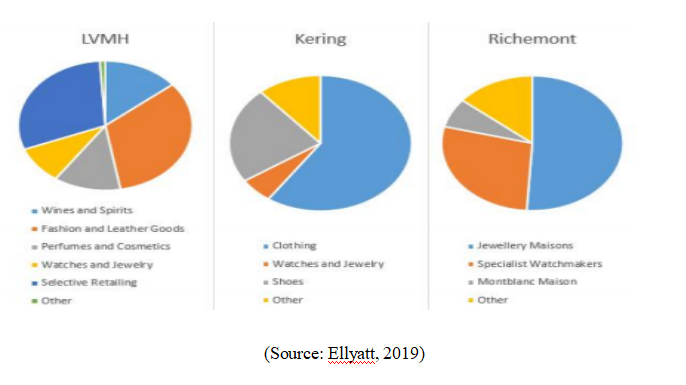

The structure of the industry is oligopoly where large organisation dominate the market with their luxury products. Among its competitors named as LVMH, Richemont, and Kering, it is seen that LVMH dominate the market operating in decentralised manner. LVMH has positioned itself in market comprising of leather bags, spirits, and wines as it creates its own position in retailing through DFS and Sephora. The level of industry rivalry is medium.

(Source: Ellyatt, 2019)

Ansoff`s matrix

It is evident from the case highlights that offer a range of products that are being offered such as leather bags, luxury notepads, shoes, and jewellery. The company focus on focused differentiation strategy. This strategy aims narrow segment tailoring services to the specific customers. It states that competitive advantage, which can be achieved as they do not avail broad range of segments. Targeting customers with appropriate amount is regarding the disposable income. Moreover, the uniqueness is based on service rather than products (Yenidogan, & Aksoy, 2018).

Business level strategies

Mile and Snow indicating defenders, prospector, reactor, and analyser. Companies implement defender strategy that attempt to preserve market from the new competitors and opt to grow. Companies implement analyser the strategies to maintain current business environment. Current business environment focuses on keeping on overall perception of brands as this helps to heighten demand for the prestigious markets (Yenidogan, & Aksoy, 2018).

Corporate strategy: mergers and acquisitions

With the competency available to the company, it is seen that competitive advantage includes-

Intangible- Artistic flavours considered from the top-level management as they combine with innovative production procedure as it possess trademarks.

Tangible- Large financial abilities and other numerous factories with its sophisticated machinery in varied places.

Core competencies- LVMH uses efficient planning and also it has strong control over the distribution channels.

The competitive strategy comes up with the acquisition offer by Tiffany & Co. neatly with the portfolio of the brands by strengthening the jewellery business.

LVMH is very strong financially to conduct takeover. Details of offering are quite public as they expect the transaction that has been valued near to $15 to $16 billion inclusive of the premium level (Statista, 2018).

Conclusion

From the above discussion, it is seen that after the short market analysis, the organisation has found several opportunities and the threats to minimise the risks regarding the business decision. LVMH make several changes and required modification as per customers and their way to offer to suit the audience and create company regarding the awareness products as being planned, which the market needs. This market research for LVMH get all the related data ideas that are decided whether to take decisions regarding the success and help to maximise the products. The report has conducted Pestle analysis, SWOT analysis, Ansoff matrix and business level strategies are being used to analyse the internal and external business environment of LVMH. As the company is powerful enough, it must acquire and takeover Tiffany Co.

References

Christoph Liu, (2019). An Acquisition Of Tiffany & Co. Would Make LVMH SE A Global Leader In The Jewellery Business. Retrieved from: https://seekingalpha.com/article/4299663-acquisition-tiffany-and-co-make-lvmh-se-global-leader-jewelry-business

Ellyatt, H., (2019). LVMH confirms deal to acquire Tiffany for $16.2 billion. Retrieved from: https://www.cnbc.com/2019/11/25/lvmh-confirms-deal-to-acquire-tiffany-for-16-billion.html

Financial Times, (2019) LVMH clinches takeover of Tiffany after raising offer to $16.6bn. Retrieved from: https://www.ft.com/content/c7a7b230-0ec2-11ea-a7e6-62bf4f9e548a

Fozer, D., Sziraky, F. Z., Racz, L., Nagy, T., Tarjani, A. J., Toth, A. J., … & Mizsey, P. (2017). Life cycle, PESTLE and multi-criteria decision analysis of CCS process alternatives. Journal of cleaner production, 147, 75-85.

Gurcaylilar-Yenidogan, T., & Aksoy, S. (2018). Applying Ansoff’S Growth Strategy Matrix To Innovation Classification. International Journal of Innovation Management, 22(04), 1850039.

Mathooko, F. M., & Ogutu, M. (2015). Porter’s five competitive forces framework and other factors that influence the choice of response strategies adopted by public universities in Kenya. International Journal of Educational Management, 29(3), 334-354.

Office for national statistics, (2018). Average household income, UK: Financial year ending 2018: Retrieved from: https://www.ons.gov.uk/peoplepopulationandcommunity/personalandhouseholdfinances/incomeandwealth/bulletins/householddisposableincomeandinequality/yearending2018

Otieno, K. E. V. I. N. (2016). Growth strategies and transformational orientation adopted by Unaitas Sacco in Kenya. An unpublished MBA Thesis, University of Nairobi.

Rastogi, N. I. T. A. N. K., & Trivedi, M. K. (2016). PESTLE technique–a tool to identify external risks in construction projects. International Research Journal of Engineering and Technology (IRJET), 3(1), 384-388.

Song, J., Sun, Y., & Jin, L. (2017). PESTEL analysis of the development of the waste-to-energy incineration industry in China. Renewable and Sustainable Energy Reviews, 80, 276-289.

Statista, (2018). Bags and Accessories. Retrieved from: https://www.statista.com/outlook/358/100/bags-accessories/worldwide

Sukma, D., Lubis, P. H., & Utami, S. (2019). Analysis of Marketing Strategy of Minyeuk Pret Using STP, Ansoff Matrix, and Marketing Mix.

Trading economics, (2018). United Kingdom GDP Growth Rate. Retrieved from: https://tradingeconomics.com/united-kingdom/gdp-growth