An anomalies means a situation or a circumstance where a security or a group of securities represent a contrary in their performance to the notion of the efficient market. This refers to the occurrence of an unusual performance depending on the market information with in an efficient market hypothesis. A market anomalies explain the market pattern which may cause by random market information changes. As some of the information are caused by the changes in the financial report this represents a challenge into the semi strong form of the EMH. This indicates that the fundamental analysis does not reflects the same value for the individual investor. As per efficient market hypothesis a stock is properly priced in the efficient market as price of the security includes all the information (Akbas et al. 2015).

Efficient market hypothesis

According to the EMH, an efficient market represent a stock price at a fair value where all the information such as current information and the future expectation on earnings and dividends gets included. An abnormal return can to be earned through the misprice of the stock. EHM refers a behavioural finance where the market trade proves an indication of price increase or decrease with following a proper pattern. This also reflects the impossibility for a stock or for a portfolio to outperform the whole market through expert stock selection and or understanding market timing. Since the stock price changes with the new information updates, the future stock price cannot be predicted. However, there is a market pattern where chance of earning or an abnormal return through violating efficient market hypothesis is present, particularly in the semi strong form. This is because; this state neglects the public information that is being served into the semi strong form of the EMH.

This predicts that it is not possible to earn abnormal profit just by learning all the accessible information on the companies and their available stocks or any other variable that has an impact on the stock price, such as economic factor. Hence, thus the semi strong form of EMH ignores the value of fundamental analysis. Although with the internal information update into a stock that cannot be helpful for the investors to make an exact predict over the stock’s price increase or decrease. This may outperform while there is a possibility of occurrence of abnormal information and same is informed to the investors (Hamid et al. 2017).

Violating the semi strong form

The semi strong form of the Efficient Market hypothesis refers to a market form where the efficient market reflects the historical information as well as the current public information. The semi strong form extend to the public information other than the market information, acquired from the company management, financial report and company product information. This form of efficient market follows a belief that, as all information is used by the public for the calculation of current stock price, the investors cannot apply fundamental or technical analysis for the calculation to gain a higher return. The loopholes can be used for the generation of the high risk adjusted return through the information collection that are not readily available to the public. In such a way the investors boosts their return to a performance level above the market return. It is considered that the semi strong form of the efficiency does not provide information related to the material non-public information. Considering the fact that this phase of efficiency does not provide any opportunity to make any company analysis through using technical or fundamental analysis, superior gains can only be achieved through the adoption of the material non-public information where the investors seek to earn benefit through earning above average return on investment (Archana et al. 2014).

As the information associated with the stock price gets rapidly changed with the update of the new information, the investors find this difficult to calculate or to identify the return. Hence investors earn their portion of profit through the effective use of non-public information.

Financial market anomalies

Anomalies are the indicator of the occurrence of an unusual event into the market which puts huge effect on the stock price. This reflects an inefficient market where the opportunity of outperformance gets generated. In this way the inventors looks to get more return on their investment without using the public information as suggested into the semi strong form of the efficiency. While the market information has been judged, the inefficient market does not reflect the true value of the financial statement. This includes the non-public information that suggests the bargains are available (Fischer and Krauss 2018).

EHM fails to explain the market anomalies including the speculative babbles and the excessive amount of volatility of the stock. The public information into the semi strong form does not include the market volatility as the public information reflects he market pattern only. The market anomalies defers with the EMH as the anomalies occurs with the occurrence of inefficient market and due to the effective use of the non-public information. This results in the violation of the utilisation of the public information into an efficient market. However this helps in earning more return for the investors in a short time period. In the semi strong form of efficiency the market anomalies are not explained by the traditional pricing model. In this semi strong form of the efficiency, the systematic occurrence of the violation has been recognized in the equity market due to the effect of timing. Such occurrence of the event makes a significant difference between return on investment and expected returns. Therefore, with such kind of advantage of anomalies one can earn superior market return over a stock. Within the strong form of efficient market the market anomalies theory states that under-developed or emerging market once suffers from the market inefficiency at a specific calendar time period. Due to higher correlation in between the world indices, the international diversification has reduced its charm. However, in recent times it has become utmost important for professionals and as well as for individuals to study and tap such abnormalities (Rossi 2015).

Ignoring the semi strong form of the efficiency the market anomalies occurs during the selected calendar period such as: turn of the month effect, turn of the year effect, Friday of the 13th effect and lastly the weekend effect reflect the market anomalies through ignoring the public information which is reflected by the stock price (Pallais 2014).

Explaining the CAPM

The capital assets pricing model has been followed to acquire the expected return or the risk adjusted return. This explains a future rate of return of an underlying assets that are expected after taking a specific amount of risk. This compares the risk with the return. Therefore both the elements represents a high level of relationship in the effective market place. Investors calculates the expected return using CAPM method as the investors finds the scope of investment into a portfolio through maximizing return. This does not differentiate the assets type for the investment opportunity as long as the investment generates high rate of return. Regardless the probability of future return it has a nature of being different in future. The beta value represents the risk associated with the stock (Zabarankin, Pavlikov and Uryasev 2014).

Risk and return relation in an inefficient market

The inefficient market does not reflect a true value of the company’s financial statement hence; this reflects a risk while calculating a risk adjusted return. The inefficient market represents the violation of the semi strong form of the efficiency where the information are being collected based on the non-public information. These are the information that does not provide any reliable sources. There the risk associated with the information limits the opportunity to include the fundamental or technical analysis (Ghysels, Plazziand and Valkanov 2017).

Following the CAPM model, this includes the market volatility through the representation of the beta value. Hence, this helps in identifying the periodical risk associated with the stock. This generates a state where the higher return has been expected with the adoption of the high amount of risk. Therefore, a high beta is measured with the high systematic risk which would give a high return in an in-efficient market (Cremers, Hallingand and Weinbaum 2015). Therefore, following the information in an inefficient market provides a high beta. Investment in inefficient market has been done by the investors to earn a high return through the violation of the efficient market hypothesis. The motivational factor into the inefficient market has been recognised while the investment has been done with the expectation of earning higher return. As the inefficient market provides more opportunity to earn more profit through taking more risks, this helps in generating more investment opportunity into capital market (Baker, Bradley and Taliaferro 2014).

Risk return trade off in inefficient market

The inefficient market represents

a high risk hence investors expects higher return. The risk return trade off in

an inefficient market depends on various factors. Such as: Investor’s risk

tolerance, the investor’s years to retirement and lastly the potential to

replace the lost fund. As previously explained that in an inefficient market

the market anomalies occurs in a different calendar periods, hence time plays

an essential role in determining a portfolio return with the specific level of

risk. Furthermore, following the CAPM model the long term investment in an

inefficient market generates low risk which is represented through low beta

value while on the other hand the relation reflects an inverse value for the

investor (Kinnunen 2014).

References

Akbas, F., Armstrong, W.J., Sorescu, S. and Subrahmanyam, A., 2015. Smart money, dumb money, and capital market anomalies. Journal of Financial Economics, 118(2), pp.355-382.

Archana, S., Safeer, M. and Kevin, S., 2014. A study on market anomalies in Indian stock market. International Journal of Business and Administration Research Review, 1(3), pp.128-137.

Baker, M., Bradley, B. and Taliaferro, R., 2014. The low-risk anomaly: A decomposition into micro and macro effects. Financial Analysts Journal, 70(2), pp.43-58.

Cremers, M., Halling, M. and Weinbaum, D., 2015. Aggregate jump and volatility risk in the cross‐section of stock returns. The Journal of Finance, 70(2), pp.577-614.

Fischer, T. and Krauss, C., 2018. Deep learning with long short-term memory networks for financial market predictions. European Journal of Operational Research, 270(2), pp.654-669.

Ghysels, E., Plazzi, A. and Valkanov, R.I., 2016. The risk-return relationship and financial crises. Available at SSRN 2776702.

Hamid, K., Suleman, M.T., Ali Shah, S.Z., Akash, I. and Shahid, R., 2017. Testing the weak form of efficient market hypothesis: Empirical evidence from Asia-Pacific markets.

Kinnunen, J., 2014. Risk-return trade-off and serial correlation: Do volume and volatility matter?. Journal of Financial Markets, 20, pp.1-19.

Pallais, A., 2014. Inefficient hiring in entry-level labor markets. American Economic Review, 104(11), pp.3565-99.

Reinganum, M.R., 1983. The anomalous stock market behavior of small firms in January: Empirical tests for tax-loss selling effects. Journal of Financial Economics, 12(1), pp.89-104.

Rossi, M., 2015. The efficient market hypothesis and calendar anomalies: a literature review. International Journal of Managerial and Financial Accounting, 7(3-4), pp.285-296.

Zabarankin, M., Pavlikov, K. and Uryasev, S., 2014. Capital asset pricing model (CAPM) with drawdown measure. European Journal of Operational Research, 234(2), pp.508-517.

Introduction

The trade-off theory and pecking order theory are regarded as two major theories that are used by a company for determining its optimal capital structure. The theories play an important role in the decision-making process by financial managers for determining the optimal level of debt in the capital structure of a firm for avoiding the occurrence of bankruptcy. In this context, the present essay seeks to provide an explanation of trade-off and pecking order theory use by companies for selecting an optimal capital structure.

Critical analysis of Trade off theory & Pecking Order Theory and choice of capital structure

Trade-Off Theory

Jahanzeb (2013) has stated that the trade-off theory has been developed by Modigliani and Miller for explaining the amount of debt and equity that should be maintained by a company in developing its capital structure. It has been stated by the theory that a company can reduce its Weighted Average Cost of Capital (WACC) by increasing the proportion of debt over equity in its capital structure. This is because debt financing is cheaper as compared with the equity financing. However, the increasing proportion of debt leads to rise in the financial risk present within the company which can offset the benefits that it can realize by enhancing the amount of debt. Hence, the theory seeks to define an optimal mix of debt and equity that should be maintained by a company so that decrease in WACC offsets the financial risk present due to rise in debt proportion.

The fact has been supported by Muneer (2012) and it has been said by the researcher that the use of debt in the capital structure leads to reduce the cost of capital by achieving tax benefits on its interest payments. In addition to this, it also helps in resolving the principal-agent problem by restricting the free cash flows to the managers and thus resolving the agency conflict. However, the theory has stated that excessive use of debt in the capital structure can lead to causing financial distress within a firm when it is not able to meet its debt obligations. Therefore, it is largely important to determine the optimal debt ratio that offsets the financial risk and leads to maximizing a firm value.

Empirical Evidence for Depicting the use of trade-Off theory for Explaining the choice of Capital Structure by Companies

In this context, the research findings proposed by Hardiyanto (2014) have proposed that proportion of debt as a significant influence on capital structure of firms. In this context, the researcher has adopted the use of partial adjustment model for providing the presence of adjustment of selected companies from Indonesia towards achieving an optimal capital structure. The data is gathered from about 228 companies of Indonesia with the use of regression techniques. The model is applied to the data selected and it has been deuced that the companies adjust their capital structure towards a defined target for gaining advantages of debt in the capital structure. As such, the researcher has focused on developing a cost-benefit analysis that can be achieved by developing an optimal debt ratio leading to maximizing a firm value. The optimal proportion of debt can be determined when the benefits of using debt are able to overweigh the financial risk that is present within a company due to debt obligations.

Consistent with the findings of the previous author stated that the researcher Leary and Roberts (2009) has stated that firms tend to maintain target leverage ratio for obtaining the advantage of debt and maximizing the value of their firm. In this context, the researcher ahs carried a comparative analysis of the capital market based system and bank based financial systems in five countries. It has been depicted by the result of the researcher that French firms rapidly adjust to the leverage while Japanese firms are slow in adjusting towards a target leverage ratio. On the contrary, Matemilola (2012) have suggested that there many factor that determines the capital structure of affirm such as tax system or corporate governance in addition to the amount of leverage. It has been revealed by the researcher that leverage ratio is negatively related to the profitability of a firm and the performance of its stocks. As such, the researchers has contradicted the views and opinions provided by trade-off theory to a large extent.

Pecking order theory

Pecking order theory has been derived to explain the capital structure and cost of capital of the company. Julius, (2012), argues that pecking order theory has been successful in explaining the difference in cost of internal capital (Retained earnings) and external capital (Debt and equity). Pecking order theory reflects that due to information irregularity between the entity and investors in regard to the real cost or values of current operations and future prospects, there will always be difference between the cost of external capital and internal capital. Further this theory has explained that external cost is relatively costlier than the internal capital due to irregularity of information between investors and firm (Julius, 2012). In this context Zurigat (2009), argued that issue of information irregularity leads mis-pricing of equity shares at the market place that will leads to loss of return to the existing shareholders. It happens due to improper selection issue that arises when managers are more knowledgeable as compared to investors. It can be explained by an example related to use of outside capital as source of finance. If any company finances its new venture or expansion plan through use of new issue of securities than it is certain that price of such securities will be low as compared to price of old securities. It is because initially managers cannot credibly provide the quality of the already existing assets and available opportunities of investment to their new investors. As a consequence, investors will not able to predict what is good or bad for their investment and they will definitely think that company’s decision of issuing new securities is bad for them and they will not take part in such securities. On the contrary investor will definitely demand for some premium on their investment to cope with the loss of their investment but in reality it is not the case. This is the reason why, companies have to issue the new securities at discount (Zurigat, 2009).

Gunarsih and Hartadi, (2017), provide a clear and important rationale regarding the decision of financial policy of the firm and it is known as pecking order theory of capital structure. As per this capital structure theory, firm tends to use internal sources of capital first through adjusting the dividend payout ratio in light of investment decision taken by them. In case, firm requires external capital due to the policy of fixed dividend policy, high fluctuations in profitability position and there is high uncertainty regarding the investment opportunities that managers will seek mostly of debt capital or hybrid capital such as convertible bonds and lastly equity (Gunarsih and Hartadi, 2017). Further Gunarsih and Hartadi, has articulated that if cash flow generated by the internal sources or business operations is greater that total outlays than company will use extra funds to pay off the debt first or if market return is more than company will invest its funds in capital market to earn more. As per this theory, business managers react differently in different situation i.e. financial behavior of finance manager react differently for surplus and deficits firms. This theory also provides that firm’s behavior upon the use of capital also depends upon the transaction cost involved for financing the capital. Transaction is occurred at the time of raising the external capital such as debt and equity (Gunarsih and Hartadi, 2017).

This theory has also faced many criticisms due to its underlying arguments and suggestions. This theory has ignored other theories and impact of institutional factors that also impact the choice of capital financing instruments such as level of interest rates relation of borrower and lender etc.

Empirical evidence for choice of capital structure in UK market as suggested by pecking order theory

Matemilola and Ariffin, (2011), have used the pecking order theory to test the capital structure choice in UK market. The results gathered by this research shows that issue of new debt capital does not have one to one relationship or direct relationship with the firms financing deficit as per pecking order theory. In this case only 22% of financing deficit has been financed with issue of debt capital (Matemilola and Ariffin, 2011).

Conclusion

It can be said for the overall

discussion held within the essay that trade theory and pecking order theory

contradicts each other. Trade theory has determined positive relation between

the capital structure and amount of debt whereas pecking order has stated that

a form should finance itself from internal finance as compared with external.

As such, it can be said that financial managers need to implement the use of

both the theories in developing an optima capital structure for deriving lager

returns on the capital employed.

References

Gunarsih, T. and Hartadi, M.M. 2017. Pecking Order Theory of Capital Structure and Governing Mechanism: Evidence from Indonesian Stock Exchange. [Online]. Available at: https://www.researchgate.net/publication/313476411_PECKING_ORDER_THEORY_OF_CAPITAL_STRUCTURE_AND_GOVERNING_MECHANISM_EVIDENCE_FROM_INDONESIAN_STOCK_EXCHANGE [Accessed on: 4 April 2019].

Hardiyanto, A. 2014. Testing Trade-Off Theory of Capital Structure: Empirical Evidence from Indonesian Listed Companies. Economics and Finance Review 3 (06) pp. 13-20.

Jahanzeb, A. 2013. Trade-Off Theory, Pecking Order Theory and Market Timing Theory: A Comprehensive Review of Capital Structure Theories. International Journal of Management and Commerce Innovations (IJMCI) 1(1), pp.11-18.

Julius, A. 2012. Pecking Order Theory of Capital Structure: Another Way to Look At It. Journal of Business Management and Applied Economics, 5, pp. 1-11.

Leary, M.T. And Roberts, M.R. 2009. Do Firms Rebalance Their Capital Structures? Journal of Finance 60(6), pp. 2575-2619.

Matemilola, B.T. 2012. Trade Off Theory Against Pecking Order Theory Of Capital Structure In A Nested Model: Panel Gmm Evidence from South Africa. The Global Journal of Finance and Economics 9(2), pp.133-147.

Matemilola, B.T. and Ariffin, A.N. 2011. Pecking Order Theory of Capital Structure: Empirical Evidence from Dynamic Panel Data. International Journal on GSTF Business review, 1(1), pp. 185—189.

Muneer, S. 2012. A Critical Review of Capital Structure Theories. Information Management and Business Review 4 (11), pp. 553-557.

Zurigat, Z. 2009. Pecking Order Theory, Trade-Off Theory and Determinants of Capital Structure: Empirical Evidence from Jordan. [Online]. Available at: http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.465.8550&rep=rep1&type=pdf [Accessed on: 4 April 2019].

Expansion of Multination Corporation

Introduction

A company, that operates in simultaneously in the domestic and the internal levels is known as a multinational company. A company goes international when they are seeking an opportunity to go beyond their domestic market. In the initiative of expanding their market share, the companies establish their operation overseas. Internationalisation of an organisation is occurs as a result of the mission to utilise the resources, conditions and opportunities that are provided by nations other than the domestic country where the country is operating in (Akehurst and Alexander 2013). It is evident that the companies who want to go international have to adapt with the local rules and regulations of the state that they are expanding to. Other than the regulations of the state, the other factor that is crucial for establishment of a company to a foreign nation is adaptation to the culture that is existent in the nation. The aim of the paper is to critically evaluate the differences in the culture which can be utilised by the companies while they seek to explore markets overseas. The paper will also critically evaluate the conditions that have to present in the host countries in order to bolster the amount of foreign direct investment in a country along with the policies which the companies can incorporate in order to incorporate uniformity across all the countries where branches of the company are established in.

Discussion

It can be said that a company has gained multinational stature, if they have been successful in establishing themselves in the domestic and foreign nations, they have been successful in gaining international of multinational stature (Csomós and Derudder 2014). Companies, such as Vodafone, Unilever and Nestle are the examples of the companies who have been able in gaining the stature of multinational companies (Abugre, Gasor and Sarwar 2013). In order to gain such a stature, a company has to ensure, that they incorporate policies through which they can maintain uniformity in operation across the nations that they are operating in. Furthermore, the organisations would have to ensure, that they incorporate the operations of their functional division according to the policies and regulations that are implemented by the regulatory bodies and the government of the foreign nations or states that they are established in. It has been found out that expansion of the countries into foreign states results in increase of the amount of foreign direct investment the country (Wei et al. 2014). This bolsters the economy of the country and contributes to the economic development of the country. Following are the factors that affect the efficacy of operations of a multinational company;

- Culture: Culture is one of the most important factors that determine the sustainability of a company in the long run (Inglehart 2018). In order to be successful in a state or country, the company has to make sure, that they implement policies and operate according to the cultural implications that are present within the organisation. Culture is the assimilation of the etiquettes and values of the people of a state or country (Mukherjee and Salazar 2014). The operations of the company should be aligned the culture of the people according to which they should implement policies in the organisation. The companies should pay due attention to the culture of the nation that they are moving into. The companies should make sure that they take care of the multicultural considerations that are present within the value system of a country (Clarke and Georges 2014).

- Rules and regulations: The rules and regulations of a company are different in different countries. There are various tariffs, import and export duties that exist in different countries (Kennan and Riezman 2013). Furthermore, there are various regulations of employee and labour regulation laws that exist in a country. The tax laws are one of the most important regulations that affect the viability of a multinational company in a country.

- Valuation of the currencies: With the change of nationality of the base of operation of a country, the valuations of the currencies, is subject to change. A rate of currency that might be valuable at one state or nation, might not be valuable in the other country (Abdoh et al. 2016). Furthermore, the currencies of the countries keep on fluctuating (Runo 2013). This results in increasing difficulties that can be faced by the companies. Thus, while seeking the opportunity to present itself in a different country, the multinational company should pay close attention to the value of the currency that exists in the state where they aim to move.

- Location: Just as every other implication that affect the sustainability of an organisation in the long run, the location of the organisation is important when it comes to the establishment of a business in the foreign nations (Nasri and Zarai 2013). The geographical location of a country determines the nature of the climate that could affect the production of raw materials that can be used by the company. Furthermore, the location determines, the workforce that is available for utilisation of the companies (Herd et al. 2017). Thus, location is crucial for the viability of an organisation in a foreign country in the long run.

- Accounting standards: The accounting standards that are established in different countries, might not be similar. There are accounting standards that are established in to maintain uniformity of operations. Such a regulation is known as GAAP or Generally Accepted Accounting Principles (Glover 2014). Hence, before commencement of operations, a company that is seeking to go multinational should carry out research regarding whether, the accounting standards present in the countries that they are operating in, are accepted in the global levels (Poulis, Poulis and Plakoyiannaki 2013). This would help the company in maintaining uniformity of operations.

Location Advantages

The advantages that a company are subject to when they opt to stick to the location of a certain advantages are known as the location advantages (Dunning 2015). The location advantages are the reasons behind selection of a certain location rather than the other are due to the advantages that the former provides, that the latter does not provide. Thus, location advantages, determine, the efficacy of the operations of national branch of a multinational company. In order to be deemed by multinational companies as a favourable location, the destination country must provide certain advantages (Verbeke 2013). Foreign direct investment sis valued by countries as they bolster the economy of a country. Increase in foreign direct investment, results in the increase of the standard of living and infrastructure of a country. Thus, countries around the word aim to increase the amount of inward investment that goes into the economy of a country. Following are certain advantages that can be provided by the destination nations in order to boost the amount of foreign direct investment towards the country,

- Economic Development: One of the major factors that determines the amount of the foreign direct investment that a country offers to potential investors is the economic development of the country (Soumaré and Tchana 2015). The presence of favourable economic condition in a country attracts the potential investors and the companies who could potentially invest in a country (Guimón and Filippov 2017). Thus, in order to attract foreign direct investment, the government and regulatory bodies should pay close importance to the development of the economic standards of the country.

- Efficacy of international trade: In order to attract potential investors, the regulatory bodies of a country should incorporate favourable relations with other countries. The latter must pay specific attention to the trade relations that exist within the country and other countries. A country that has favourable trade relations with other countries attract increased good amount of foreign direct investment. Thus, countries should try to incorporate favourable relations with nations who possess the propensity to invest in a country.

- Human Capital Resources: Form the early 1800s, European countries have been colonising various third world countries. This can be termed as early stages of internationalisation. Countries such as South Africa, Brazil and India have been some of the major targets of the countries as a result of the cheap and skilled labour available in the country (Buckley, Doh and Benischke 2017). Just is in those days, the availability of skilled and abundant labour is one the major factors that determine the motive of a country to invest in a country. Thus, the availability of human capital is one of the major contributors to the viability of the location advantage that it has.

- Tax Incentives: Foreign direct investment results in the incidence of various taxation advantages that the investing company may be subject to. Tax incentives ensure increase the likeliness of investment (Abeler and Jäger 2015). The tax incentive schemes are decided by the government or the regulatory bodies of the host country, which makes the latter favourable for investment. A company might be subject to perks such as complementary technology, expertise and products or services as a result of the investment that the company made in the country. Accordingly, availability of tax incentives makes multinational companies invest in that country rather than in a different country (Abeler and Jäger 2015). Furthermore, it improves the amount of investment that the companies are likely to make in the countries.

- Favourable regulations: Regulations include trade practices, the import and export rates the economic tax-free zones and other favourable policies that favour the operation of a multinational company, urge the latter to invest in a country. The latter, backed up by support from the government results in favourable working conditions for the foreign investors. It further incorporates smooth functioning of operations of the multinational company that has contributed to the economy of the host nation by investing. Thus, the availability of such favourable laws and regulations promote direct investment in a country. Hence, the host nations that provide such regulations and laws make investment a favourable and healthy practice.

International Uniformity

In the motive of going international, it is the aim of the multinational corporations to establish the uniform policies by the help of which they can establish uniformity in operation of every branch of the organisation that is operating at international level (Baran et al. 2015). The organisations can maintain uniformity in their policies while operating at domestic levels by abiding by the motive of glocalisation. Glocalisation is a belief where international organisations “Think globally, Act locally” (Fujita and Thisse 2013). It is a practice in which the MNCs maintain international stature, while operating as domestic bodies within the foreign countries that they are established in. The motive of the companies abiding by this belief is to stick to the locally aligned operations in the foreign country or countries that they are established in.

The companies operate in a domestic level and implement strategic goals and policies through which they can attain competitive advantage in the local markets. When they are able to achieve competitive advantage in the locally in the countries they are established in, it can be said that they can achieve competitive advantage as a whole or in the international level. The same can be explained by the help of the following example. McDonalds have been established a successful multinational company for decade (Nandini 2014). The main product that the company deals in is hamburger. The prime ingredient to make the patties is beef and pork. Thus, in their motive to move to Indian they had to modify their products according to the consumer behaviour in the country. Most of the population of the country is vegetarian. Thus, the beef and pork patties would not be consumed by majority of the population. The initiative of McDonalds in India would have failed if they had not modified their products according to the behaviour of the Indian consumers. Furthermore, there exists various religious taboos against the consumption of beef and pork in India. Accordingly, the company created Burgers with chicken based patties for the first time (Nandini 2014). Chicken is a form of meat that is common for consumption of the non-vegetarians in the country. Moreover, they devised potato based patties and called it the “Alo Tikki Burger” (Nandini 2014). They were successful in maintaining parity with the behaviour of the locals of the country and thus the move became a huge success in the country. At that point, the company was one of the first fast food multinational organisation to establish themselves in the India. This is one of the many examples that justify the power of glocalisation and maintaining uniformity in operations of companies across different countries. Hence, different organisational policies help in attaining the favourable nature of operation of the company that helps them in gaining competitive advantage in the international as well as the domestic markets of the countries that they are established in.

The regulations that are present in and the countries that the company are present in determine the nature of operations that are carried out or implemented by the companies. The regulations are important factors that have to be considered by the companies before incorporating their objectives that they have established in a particular country. The mission of the MNCs are to maintain uniformity in their mission. The aim to maintain the main goals that is gaining competitive advantage and being successful at establishing corporate governance while maintaining their profitability at the same time. While policies and strategies that are used to the aforementioned factors might be different for the different countries, it is the company as a global unit who would be affected as a whole by the favourable activities that are being carried out by the company in a multinational level. The ultimate goal of the company is to satisfy their stakeholders, thus, glocalisation is a policy which helps the companies in satisfying the stakeholder of the company and achieve corporate governance as a result of the same. Hence, it can be said that the operations of a company might be different in different countries, however, they should be perfectly aligned with the needs and behaviour of the people of the country that the company is operating in.

Attracting Foreign Direct Investment

Foreign Direct Investment in a country contributes to the economic development of a country. Thus, it should be the aim of government of countries to boost the amount of foreign direct investment that flow inward to the country as it helps in developing the economic condition of a country. Encouraging the amount of foreign direct investment showcase the social responsibility that the governments have for the people of the countries (Kastrati 2013). This is more applicable for the government and regulatory bodies of developing and underdeveloped countries as foreign direct investment would help in bolstering the economic conditions of the country. Following are the reasons why foreign direct investment should be encouraged by the governments of developing and under developed countries:

- Employment opportunities: The incidence of the former implies that there will be incidence of opportunities that will be available for the employable population of the country. Employment is an issue in developing countries and foreign direct investment helps in creation of opportunities that help in advancement of the people of the community.

- Improves the skills of the workforce: People of a country who are employed in MNCs come in contact with their foreign peers and thus they can learn skills and tricks that they were not aware of. The company who are investing in the country van also benefit from the same as they can learn skills and improve on the same that they already possessed.

- Healthy competition: As a result of the foreign direct investment in the country, new standard benchmarks would be established in the country. Thus, the locally established firms would aim to gain party with their international competitors. Healthy competition would lead to improvement of services that the companies provide to the people of the country. Thus, this would help in boosting the quality of life of the people of the country.

There are various strategies that should be adopted by the regulatory authorities of country or the government bodies. These strategies help in boosting the amount of foreign direct investment in the country. Following are the strategies that can be used by the governments and regulatory authorities to encourage the inflow of foreign direct investment in their country.

- Mobilise FDI: By incorporating favourable regulations towards the investment of FDI, the countries can ensure that they maximise the inflow of investment in their country. Governments who aim to increase the amount of FDI inflow should make sure that they revoke or remove impositions and restriction on FDI (Tingley et al. 2015). This would encourage FDI inwards.

- Establishment of IPA: IPA is the short form of investment promotion agencies. The main purpose of creation of such agencies is to highlight the industries in a country which would result in high amount of profitability for the investors (Antonopoulos and Bachtler 2015). It is a body that is used to create a link between the foreign investors and the economy of the country.

- Infrastructure: Favourable infrastructure attracts potential investors to a country. The availability of operations such as turnkey project and others, attract potential investors who want to save their time, maximise their profitability and associate themselves with a country that offers favourable infrastructure.

- Location of the target industry: The government should be able to locate the industry in which FDI is needed. The industries that are considered bolstering on the country do not require foreign direct investment. However, the industries that are lagging behind could use foreign direct investment that could boost the competency of the industry. Thus, location of the target industry is of key consideration.

Conclusion

On a concluding

note it can be said that FDI helps in improvement and development of the

economy of the country that is aiming to attract the investment. The culture of

a nation, rules and regulations, locations and accounting standards that are

resent within a country help in turning out to be a favourable destination for

foreign direct investment. The economic development of a country, the

availability of skilled workforce, tax benefits and the infrastructure of a

country contribute to the location advantages of a country in attracting

foreign direct investment. The government of countries should incorporate

methods in which they can attract FDI. It can be carried out by mobilising

restrictions to FDI, by establishing IPA, by establishing favourable

infrastructure and by locating the target industries that need improvement.

Carrying out the latter will ensure that the country is able to attract FDI and

bolster the economy of the nation.

REFERENCES

Abdoh, W.M.Y.M., Yusuf, N.H.M., Zulkifli, S.A.M., Bulot, N. and Ibrahim, N.J., 2016. Macroeconomic Factors That Influence Exchange Rate Fluctuation in ASEAN Countries. International Academic Research Journal of Social Science, 2(1), pp.89-94.

Abeler, J. and Jäger, S., 2015. Complex tax incentives. American Economic Journal: Economic Policy, 7(3), pp.1-28.

Abugre, J., Gasor, G. and Sarwar, S., 2013. The role of HR managers in facilitating the acquisition of Public enterprises of developing countries by MNCs. The Business & Management Review, 3(4), p.76.

Akehurst, G. and Alexander, N. eds., 2013. The internationalisation of retailing. Routledge.

Antonopoulos, E. and Bachtler, J., 2014. The role of EU pre-accession assistance in the establishment of national coordination structures for EU funding: the case of Croatia. Journal of Contemporary European Research, 10(2), pp.185-202.

Baran, J., Janik, A., Ryszko, A. and Szafraniec, M., 2015. Making eco-innovation measurable-are we moving towards diversity or uniformity of methods and indicators. In SGEM2015 Conference Proceedings, Book (Vol. 2).

Buckley, P.J., Doh, J.P. and Benischke, M.H., 2017. Towards a renaissance in international business research? Big questions, grand challenges, and the future of IB scholarship. Journal of International Business Studies, 48(9), pp.1045-1064.

Csomós, G. and Derudder, B., 2014. Ranking Asia-Pacific cities: Economic performance of multinational corporations and the regional urban hierarchy. Bulletin of Geography. Socio-economic series, 25(25), pp.69-80.

Dunning, J.H., 2015. The eclectic paradigm of international production: a restatement and some possible extensions. In The Eclectic Paradigm (pp. 50-84). Palgrave Macmillan, London.

Fujita, M. and Thisse, J.F., 2013. Economics of agglomeration: cities, industrial location, and globalization. Cambridge university press.

Glover, J., 2014. Have academic accountants and financial accounting standard setters traded places?. Accounting, Economics and Law Account. Econ. Law, 4(1), pp.17-26.

Guimón, J. and Filippov, S., 2017. Competing for high-quality FDI: Management challenges for investment promotion agencies. Institutions and Economies, pp.25-44.

Herd, M.S., Bulsara, M.K., Jones, M.P. and Mak, D.B., 2017. Preferred practice location at medical school commencement strongly determines graduates’ rural preferences and work locations. Australian Journal of Rural Health, 25(1), pp.15-21.

Inglehart, R., 2018. Culture shift in advanced industrial society. Princeton University Press.

Kennan, J. and Riezman, R., 2013. Optimal tariff equilibria with customs unions. In International Trade Agreements and Political Economy (pp. 53-66).

Kurtishi-Kastrati, S., 2013. The effects of foreign direct investments for host country’s economy. European Journal of Interdisciplinary Studies, 5(1), p.26.

Mukherjee, S. and Ramos-Salazar, L., 2014. ” Excuse Us, Your Manners Are Missing!” The Role of Business Etiquette in Today’s Era of Cross-Cultural Communication. TSM Business Review, 2(1), p.18.

Nandini, A.S., 2014. McDonald’s Success Story in India. Journal of Contemporary Research in Management, 9(3).

Nasri, W. and Zarai, M., 2013. Key success factors for developing competitive intelligence in organisation. American Journal of Business and Management, 2(3), pp.239-244.

Poulis, K., Poulis, E. and Plakoyiannaki, E., 2013. The role of context in case study selection: An international business perspective. International Business Review, 22(1), pp.304-314.

Runo, F.N., 2013. Relationship between foreign exchange risk and profitability of oil Companies listed in the Nairobi securities exchange. Unpublished MBA Project, University of Nairobi.

Soumaré, I. and Tchana Tchana, F., 2015. Causality between FDI and financial market development: evidence from emerging markets. The World Bank Economic Review, 29(suppl_1), pp.S205-S216.

Tingley, D., Xu, C., Chilton, A. and Milner, H.V., 2015. The political economy of inward FDI: opposition to Chinese mergers and acquisitions. The Chinese Journal of International Politics, 8(1), pp.27-57.

Tomlinson-Clarke, S.M. and Georges, C.M., 2014. ” DSM-5″: A Commentary on Integrating Multicultural and Strength-Based Considerations into Counseling Training and Practice. Professional Counselor, 4(3), pp.272-281.

Verbeke, A., 2013. International business strategy. Cambridge University Press.

Wei, Y., Zheng, N., Liu, X. and Lu, J., 2014. Expanding to outward foreign direct investment or not? A multi-dimensional analysis of entry mode transformation of Chinese private exporting firms. International Business Review, 23(2), pp.356-370.

MNCs Seeking to Exploit National and Regional Differences in Culture and Regulation

Introduction

The multinational companies are likely to desire to pursue international uniformity within their organisation and also focus on obtaining distinct organisational policies within distinct host nations. In consideration to same, it is important to analyse the extent to which states must seek to increase foreign direct investment along with exploiting certain other strategies in successfully exploiting the regional and nation based differences focussed on regulation policies and the counties culture (Arregle et al. 2016). The objective of the report is to analyse the ways in which the multinational organisations seek to exploit national along with regional differences within the regulation and culture along with evaluating the ways in which states respond to same. The report will also evaluate the ways in which distinct host nations offer location advantages for inward investment and the ways in which this might be impacted by different regulation forms.

MNCs Seeking to Exploit National and Regional Differences in Regulation and Culture and States Response

MNCs exploit national along with regional differences in consideration to regulation and culture within various nations of the world. Moreover, there are several state responses to such to such advantages attained by the MNCs. Bhawe and Zahra (2019) elucidated that the market position of MNCs is highly distinct in various regions of the world which signifies the need for different competitive strategies. Moreover, a leadership role of these companies within the market needs different patterns of actions and decisions in comparison to the role of a small player within the market. It has also been revealed that there are four aspects that have vital implications for the governance and regulation of MNCs. This considers existence of several environmental circumstances such as powerful international competitors within different regions of the world, government shelter of the domestic industries, buyer preferences for the local goods, regulation and cultural differences in comparison to the domestic region (Buckley and Casson 2016). For instance, Apple Inc attained success in the international market through being ahead of the companies in its innovations through reaping national and regional differences in regulation. In case the MNCs have exhausted all their growth potential within the home region and then take decision to venture within the other regions, these companies might deal with the regional foreignness liability. The states respond to such situation through presenting the MNCs with certain additional risks that were not present within the host region and can be of cultural, economic, geographic and administrative nature. Based on the size of the region or states, MNCs can exploit the opportunities of standardization and such process can also be improved in case the governments of the states respond to the MNCs by payment policies that promotes internal coherence through social, political and cultural harmonization (Cole, Elliott and Zhang 2017).

Host Countries Providing Location Advantages for Inward Investment and Regulations Impacting its Different Forms

Multinational companies are positioned as that firms that are incorporated within one nation and own, control as well as manage the distribution as well as production facilities within several nations (Freund and Moran 2017). In ensuring increased FDI, the MNCs consider taking the location advantages through implementing strategies of horizontal and vertical integration. In fulfilling this propose, it is considered advantageous for the companies to set up their production as well as distribution units outside their home nation. In supporting this advantage of the MNCs, the host nations offer several location advantages for inward investment. Location advantages can be obtained by MNCs through inward integration by entering into an agreement with the local companies for the sale of their offerings. However, several regulations impact the various forms of inward investment opportunities tapped by the MNCs (Harzing and Pudelka 2016). The host nations offering the extent of location advantages for inward investment to MNCs can be analysed through analysing the inward and outward FDI location determinants such as human capita and infrastructure. The host nations offer location advantages for MCs inward investment through facilitating them to employ to company-specific assets along with location based assets or location advantages offered by host nations. Such advantages are associated with use of hierarchies rather than the market mechanism. For instance, it is revealed that Wal-Mart has attained host nation advantages through its international business through capitalising on high technology advantages in US along with successfully managing regulatory constraints affecting the company.

The relevance of country level economic structure is high in case of inward FDI advantages attained from location advantages offered by host nations (Hitt, Li and Xu 2016). This is specifically where these investments are intended to ensure location advantages in the form of market seeking investments, export based investments along with natural resource seeking investments that are basically related with the industrialised and developing nations along with strategic asset acquiring investment related with industries economies. Location advantages to inward FDIs is offered by host nations on the form of ownership benefits that encourages the foreign investors seeking to invest (Iamsiraroj 2016). Such location advantages of host nations includes increasing percentages of skilled personnel within the home country that can ensure better infrastructure and serves as a necessary condition for better exploitation of ownership advantages of foreign companies at a specific location. It has also been evident that the host nations attempts to offer increased location advantages for attracting inward FDI through offering opportunities to sustain relative abundance of natural resources within a nation for increasing international competitiveness (Jackson and Rathert 2016).

There are certain regulations within the host nations that impact various forms of location advantages offered by the host countries. For instance, the import-substituting policy orientation existence within the host nations is deemed to attract less inward FDI from the multinational organisations in comparison to the host nations that have export based economy tending to have a high trade intensity. In such situation the developing nation MNCs might consider undertaking international production due to existence of certain restrictions within the international trade activity (Jones and Temouri 2016). This is by means of acquiring technology and capital for using in foreign business operations that is actively encouraged by the government policy or regulation. In certain home countries, the investment is observed to relax the government or labour laws and regulations in attracting an MNC’s foreign direct investment. This might have negative environmental impact but the local companies within the home countries can also bring in advantages from such relaxed regulations (Li, Cui and Lu 2018). For instance, Tesco has attained successful global business advantages through embracing technology, building the team and the fostered talent in the international market.

Certain regulations imposed by different host countries can affect the location based advantages likely to be ensured by FDI of the multinational companies and such policies and regulations different in various nations. One of the major reasons ensuring the growth of multinational organisations is through identifying operations in nation that offers best location advantages. In case such host nations imposes regulations such as tariff on imports it can make production of goods within the host country by an MNC quite difficult (Liang 2017). Conversely, the companies that find labour and environmental regulations of host nations extremely strict can consider relocating to another host nation that has more business friendly laws. Certain tax laws or regulations imposed by the host nations can impose major effects to the FDI decisions of multinational companies (Wu et al. 2016).

MNCs Obtaining International Uniformity or Different Organisational Policies within Host Countries

To achieve the advantages of international trade, the multinational companies are focused on realise international uniformity within their organisations and also focus on obtaining distinct organisational policies within distinct host nations. For this reason, the political metaphors concerning the multinational organisations signify their activity as an impact of mutual struggle between the strategy towards receiving organisational uniformity along with various types of influence imposed by its environment (Zhang, Zhao and Ge 2016). It is also evident that the existing internationalization operations that is marked by standardization of the products along with procedures uniformity. Moreover, it has also been analysed that nationality will not result in uniform effects and its impact is highly varied that is shaped by factors including the range of management styles asked on the culture of the host nations such as uniform substitution approaches. Increased benefits of synergies are managed by MNCs by means of global standardization or uniformity. The cultures within the host nations that support the globalization perspective take into account that the international uniformity is of increased importance through which the cross-border synergies can be attained (Meyer, Ding, Li and Zhang 2018). By implementing a series of uniform operations like leveraging resources, integrating activities along with aligning products offering across host nations, additional values can be generated. For instance, US MNCs such as Nike and IBM attained internationalization advantages in Netherlands as it offers direct access to a number of European consumers along with offering increased diversification opportunities.

It has been evident that various host nations have various cultural background based on which the external environment for the multinational organisations are broken down into smaller formative parts that is simpler to understand and analyse. Based on same, a uniform model is developed by the MNCs that makes the environment highly intelligible and focused on same, these quality as relevant institutions. Uniformity is received by the MNCs in host countries through employing international management practices with regards to the raining and recruitment (Meyer, Ding, Li and Zhang 2018). With the policy level abstraction, affiliates are offered with the freedom to implement their own uniformity strategy within the broad parameters of the standardization regulations. It has also been revealed that there are increased pressures on MNCs to adopt business practices styles based on host country cultures. At the time the size of the domestic market is limited, the company can be idle resources transferred within other nations and along with that specialization is achieved by MNCs in maintaining higher uniformity based production in order to accomplish economies of scale of production (Meyer, Ding, Li and Zhang 2018).

The host country policies developed by the MNCs are shaped by several domestic political along with market forces. Considering the same, the FDI decision made by an MNC within the host nation is predicted based on the contingencies faced by both the parties. The host nations use of regulations and laws for controlling the MNC activities is represented as the regulation policy. Additionally, the intervention and participation by the host nation’s government within an industry is incorporated within its market policy (Liu, Gao, Lu and Lioliou 2016). The host country policy along with the MNC strategy is determined by the relative power potential explained by strategic position of each party. Based on same, the MNCs consider developing policies relied on the offensive and defensive state regulations implemented by the host nations market approach and regulatory policies. The host nation’s defines policy is deemed to be highly discontinuous and unpredictable for the MNCs. On the other hand, host nations defensive policy developed for regulating FDIs of MNCs is basically characterized by non-intervention and the states are likely to intervene at the time such economies and socio-political contingencies take place. The offensive policy of the host nation demands on going, continuous as well as dynamic interaction with the MNC. The host country policy along with the MNC strategy is determined by the relative power potential explained by strategic position of each party. When the offensive policy is employed by the host nations it is proactive to needs of citizens and exploits its position through individualistic interaction (Liu, Gao, Lu and Lioliou 2016).

States Seeking to Maximize FDI or Other Strategies

Foreign direct investment is considered to have a vital role in the development of the nation or region within which it is operating. States visualize FDI as the flow of capital within the region by the established multinational companies from the industrial nations investing within the developing nations (Liu, Gao, Lu and Lioliou 2016). They also perceive that the MNCs are traditionally aimed at exploiting the natural resources or substructure trade as a means of serving the domestic consumption markets. In taking the FDI decision within other nation, the companies or the policy-makers deal with the difficulty to recognise the starting process along with recognising the investment actions that can have an increased impact. Investment policy of MNCs includes a wide range of issues and for a state that attempts to reap maximum benefits of the FDIs; it can be difficult to recognise the starting point (Meyer, Ding, Li and Zhang 2018). In consideration to such situation, the states develop necessary strategies in recognising the opportunities to reap increased advantages from the existing investments. The states also develop strategies to take into consideration the other types of investments that are needed by the nations for supporting such investments within the nation. Certain other strategies that are implemented by the states in maximising the FDIs within the nations include investment policy formulation, implementation and coordination that can undermine their competitiveness along with comparing the capability to attract and increase the benefits from FDIs (Nielsen, Asmussen and Weatherall 2017).

States have developed several effective strategies in increasing the benefits of FDI in their nations. For instance, certain state based strategies includes setting foreign equity limits that that projects the local companies along with facilitating the investors to share profits and technologies with the local partners. In addition, the improving the approval mechanisms for foreign investment can act as vital means in extracting maximum commitments to the local economy from the individual investors (Rudy, Miller and Wang 2016). The states are also ensuring to develop a strategy of maintaining political security and stability along with the stable legal and regularity surrounding that can encourage the multinational organisations to increase their FDI within new ventures of the foreign regions. The states have different strategies to maximise FDI within the nations through developing effective industrial along with macro-economic policies. Such strategies include maintaining global integration of the region along with maintaining international, regional along with bilateral traits. The states also ensure to develop strategy of increasing availability of infrastructure along with skilled workforce along with maintaining effective labour relations (Sornarajah 2017).

Other strategies to maximize FDIs from the multinational companies include increased generation of skilled and educated labours, labour mobility along with beneficial competition policy and export promotion benefits. Strategies of developing better industrial policies within the states are considered to be the vital determinants of FDIs and one among this strategies includes increasing FDI promotions significantly that is positively associated with FDI inflows. Moreover, the state governments also develops strategies to offer special financial and fiscal incentives to governments by offering discretionary grants to the MNCs along with special tax rates on business profits within host nations along with on the dividend payments to home nations (Stoian and Mohr 2016). Certain other effective strategies developed by the states in increasing chances of FDIs from the multinational companies is through maximising divergence within availability of skills by means of diverging trends within education as well as research and development. For instance, Tesla has attained successful global business advantages through embracing technology, building the team and the fostered talent in the international market.

Ensuing existence of competitive wages either for the unskilled and skilled workforce are likely to result in increased inflows of efficiency-seeking FDIs (Verbeke and Asmussen 2016). This strategy of the state includes development of effective wage moderation along with preventing excessive wage demands. This strategy is effective as it can facilitate in maintaining better labour relations that prevents labour disputes that is considered to be important impendent of FDI inflows particularly within nations that receive relatively less FDIs. States also focus on developing strategy of maintaining adequate infrastructure system to attract FDI as it can encourage existence of specialised support services increasing chances of FDIs from the established multinational companies (Vogel 2018).

Conclusion

The objective of the report was to analyse the

ways in which the multinational organisations seek to exploit national along

with regional differences within the regulation and culture along with

evaluating the ways in which states respond to same. It was gathered from the

report that there are four aspects that have vital implications for the governance

and regulation of MNCs. This considers existence of several environmental

circumstances such as powerful international competitors within different

regions of the world, government shelter of the domestic industries, buyer

preferences for the local goods, regulation and cultural differences in comparison

to the domestic region. In ensuring increased FDI, the MNCs consider taking the

location advantages through implementing strategies of horizontal and vertical

integration. In fulfilling this propose, it is considered advantageous for the

companies to set up their production as well as distribution units outside

their home nation. Moreover, it is also gathered that investment policy of MNCs

includes a wide range of issues and for a state that attempts to reap maximum benefits of the FDIs; it can be difficult to

recognise the starting point. In consideration to such situation, the states

develop necessary strategies in recognising the opportunities to attain

increased advantages from the existing investments.

References

Arregle, J.L., Miller, T.L., Hitt, M.A. and Beamish, P.W., 2016. How does regional institutional complexity affect MNE internationalization?. Journal of International Business Studies, 47(6), pp.697-722.

Bhawe, N. and Zahra, S.A., 2019. Inducing heterogeneity in local entrepreneurial ecosystems: the role of MNEs. Small Business Economics, 52(2), pp.437-454.

Buckley, P.J. and Casson, M., 2016. The future of the multinational enterprise. Springer.

Cole, M.A., Elliott, R.J. and Zhang, L., 2017. Foreign direct investment and the environment. Annual Review of Environment and Resources, 42, pp.465-487.

Freund, C. and Moran, T., 2017. Multinational investors as export superstars: How emerging-market governments can reshape comparative advantage.

Harzing, A.W. and Pudelko, M., 2016. Do we need to distance ourselves from the distance concept? Why home and host country context might matter more than (cultural) distance. Management International Review, 56(1), pp.1-34.

Hitt, M.A., Li, D. and Xu, K., 2016. International strategy: From local to global and beyond. Journal of World Business, 51(1), pp.58-73.

Iamsiraroj, S., 2016. The foreign direct investment–economic growth nexus. International Review of Economics & Finance, 42, pp.116-133.

Jackson, G. and Rathert, N., 2016. Private Governance as Regulatory Substitute or Complement? A Comparative Institutional Approach to CSR Adoption by Multinational Corporations☆. In Multinational corporations and organisation theory: Post millennium perspectives (pp. 445-478). Emerald Publishing Limited.

Jones, C. and Temouri, Y., 2016. The determinants of tax haven FDI. Journal of world Business, 51(2), pp.237-250.

Li, M.H., Cui, L. and Lu, J., 2018. Varieties in state capitalism: Outward FDI strategies of central and local state-owned enterprises from emerging economy countries. In State-Owned Multinationals (pp. 175-210). Palgrave Macmillan, Cham.

Liang, F.H., 2017. Does foreign direct investment improve the productivity of domestic firms? Technology spillovers, industry linkages, and firm capabilities. Research Policy, 46(1), pp.138-159.

Liu, X., Gao, L., Lu, J. and Lioliou, E., 2016. Does learning at home and from abroad boost the foreign subsidiary performance of emerging economy multinational enterprises?. International Business Review, 25(1), pp.141-151.

Meyer, K.E., Ding, Y., Li, J. and Zhang, H., 2018. Overcoming distrust: How state-owned enterprises adapt their foreign entries to institutional pressures abroad. In State-Owned Multinationals (pp. 211-251). Palgrave Macmillan, Cham.

Nielsen, B.B., Asmussen, C.G. and Weatherall, C.D., 2017. The location choice of foreign direct investments: Empirical evidence and methodological challenges. Journal of World Business, 52(1), pp.62-82.

Rudy, B.C., Miller, S.R. and Wang, D., 2016. Revisiting FDI strategies and the flow of firm‐specific advantages: A focus on state‐owned enterprises. Global Strategy Journal, 6(1), pp.69-78.

Sornarajah, M., 2017. The international law on foreign investment. Cambridge University Press.

Stoian, C. and Mohr, A., 2016. Outward foreign direct investment from emerging economies: escaping home country regulative voids. International Business Review, 25(5), pp.1124-1135.

Verbeke, A. and Asmussen, C.G., 2016. Global, local, or regional? The locus of MNE strategies. Journal of Management Studies, 53(6), pp.1051-1075.

Vogel, S.K., 2018. Freer markets, more rules: Regulatory reform in advanced industrial countries. Cornell University Press.

Wu, J., Wang, C., Hong, J., Piperopoulos, P. and Zhuo, S., 2016. Internationalization and innovation performance of emerging market enterprises: The role of host-country institutional development. Journal of World Business, 51(2), pp.251-263.

Zhang, Y., Zhao, W. and Ge, J., 2016. Institutional duality and political strategies of foreign-invested firms in an emerging economy. Journal of World Business, 51(3), pp.451-462.

INTRODUCTION

The information on the Oral B Braun 5000 electric toothbrush and SmartGuide is derived from the user manual provided alongside the purchase of the toothbrush. The information determines the functionality of both the toothbrush and the SmartGuide. The paper seeks to determine these functionalities and to improve the state transition of the entire system. The toothbrush can be used with or without the SmartGuide. There is a smartphone App that guides the user on how to connect the toothbrush to the charging unit as well as wirelessly connect to the SmartGuide. Most users mount the SmartGuide on the bathroom walls using an adhesive ring. More than one user can connect to the SmartGuide within a given radius as defined under the Bluetooth radio communication guidelines.

The interactive wireless display may encounter electromagnetic interference and some compatibility conflicts while a toothbrush seeks a connection. There are restricted surroundings where the connection may be inhibited and users are notified using warning signs in these specific areas such as the aircraft sanitation rooms. It is also important to recommend that the people with heart problems or a pacemaker to ensure they do not go close to the SmartGuide. The estimated distance from the SmartGuide is six inches. The electric toothbrush has brush head, pressure sensor light, on/off button, brushing mode button, handle, radio transmission display, charge level display, charging unit, SmartGuide, wall mount, travel case, travel charger pouch and an adhesive ring for mounting purposes.

OBJECTIVES

- To determine the operation of the Oral B Braun 5000 electric toothbrush.

- To determine the operation of the SmartGuide and SmartScreen.

- To develop state transition diagram for the operation of the toothbrush and SmartGuide.

ORAL-B BRAUN ELECTRICAL 500 TOOTHBRUSH

- The electric toothbrush is charged using the charging unit which enables the system to obtain the required power levels before being used.

- The rechargeable battery on the low shows a blue light that flashes on the charge level display on the SmartScreen. There is a 40-minute charge for a 2-minute brushing

- The toothbrush has a SmartScreen that demonstrates the battery status, brush mode, pressure sensor level, and timer for the brushing process.

- The brush heads allows for two modes for the flossing and cross action modes. The two modes ensure the teeth are cleaned on the outer sections as well as the sections between the teeth. The brush heads are delivered with substitute in case the brush heads get damaged.

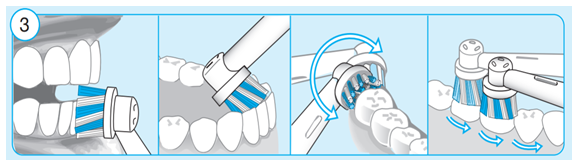

- The toothbrush divides the time spent in brushing the teeth into 45 seconds per quadrant with a few seconds pause. Some timers will allow for 30 seconds per quadrant. The brush is able to carry out the cross action and floss action on all the quadrants. The illustration below shows how the two modes are activated.

- The toothbrush can be turned on and the different SmartScreen modes are changed accordingly using the arrow button to determine the different modes. The brushing mode is memorized even when the handle is briefly switched off during brushing. When pausing longer than 30 seconds or briefly pressing the mode button during pause the brushing mode resets to the «Daily Clean» mode.

ORAL-B BRAUN SMARTGUIDE

- The SmartGuide and SmartScreen are used to indicate the status of the Oral-B Braun 5000 Electric toothbrush at a given time. The SmartScreen indicates the battery status, pressure sensor levels, and the brush mode.

- The SmartGuide instructions are stored in the Smartphone App before using the toothbrush. To do so, push the «h/min» button in the battery compartment for at least 3 seconds. The SmartGuide shows «L—». Turn on your handle to start the synchronization process. It is finished when «L-1-» is displayed. Turn off the handle. To assign a second handle to the same SmartGuide turn on the other handle until «L-2-» is displayed.

- After having synchronized the second handle, «Full» will be displayed. Exit the synchronization mode by pressing the «h/min» or «set» button, otherwise it will end automatically after 30 seconds.

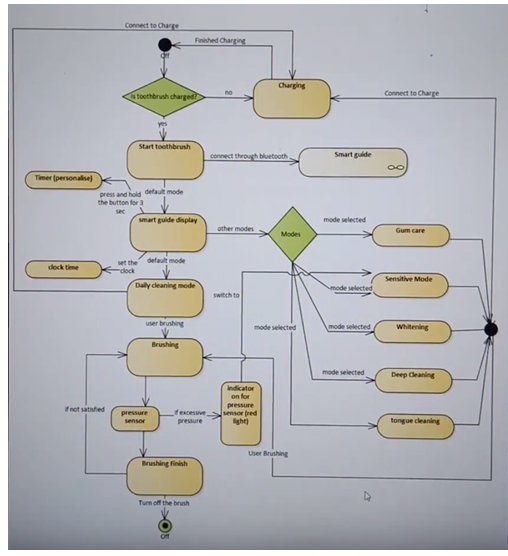

STATE TRANSITION DIAGRAM

The system develops a state chart diagram for the Oral B Braun 5000 Electric toothbrush. The state transition diagram seeks to show how the status of a toothbrush and SmartGuide changes from one state to another once an action is taken. The software chosen to develop the state transition diagram for this assignment is the UML diagram software. There are other alternative software such as Matlab and UML software which perform a similar task.

CONCLUSION

The quality measures are considered in the implementation of the system. The electronic handling of batteries is considered alongside the guidelines for proper disposal.

Managing Employment Relations

Introduction

The Trade Union Act 2016 (hereinafter referred as ‘the Act’)

is a significant piece of legislation the United Kingdom which is implemented

by the government with an objective to protect people from undemocratic

industrial action. This Act is implemented because the union Unite is described

as in its “dark day” which negatively affects workers in England (Ewing and

Hendy, 2016). Through this Act, the government implemented a number of new

rules and policies which are targeted towards making the industrial act lawful.

This Act is a part of the UK labour law which was enacted the David Cameron

administration. Through this act, the provisions gave under the Trade Union and

Labour Relations (Consolidation) Act 1992 is amended. New policies and rules

were implemented in this Act with an objective to make the freedom of

association and collective action harder for parties (Bogg, 2016). The

objective of this report is to evaluate the incidences and conduct of

collective industry dispute while taking these considerations the provisions of

this Act to determine how these policies have changed after the introduction of

this Act. This report will also evaluate how this act has given rise in

leverage tactics and how these factors affect the rights of parties. This

report will also make recommendations for the management of employment

relations for organisations involved in industrial disputes. This report will

evaluate how industrial dispute, childcare and other factors affect their

ability of employees to attend work and what actions can be taken to address these

issues.

Incidences and Conduct of Collective Industrial Disputes

Industrial dispute is a major issue which affects many people and corporations operating in the country, and it also affects their operations. In 2017, more than 276,000 working days were lost by companies in the UK as a result of industrial disputes (ONS, 2018). Although the process has been made because it is the sixth lowest annual total when compared to the records that go till 1891; however, it is still a major issue which is a result of lack of management of industrial disputes. Due to these disputes, the transportation and storage sector suffered as well which accounted for 68 per cent for all working days in the UK. Mainly these working days were lost as a result of strikes in public transport due to the lack of management of trade disputes (ONS, 2018).