Financial statement for the year closed dated 30th June 2019

Notes to financial statements

- Basis of preparation

Consolidated financial statements have been prepared in compliance with AAS that assures that financial reports are complied with the IFRS issued by IASB. Further, these have been prepared in compliance with IASB and IFRS. Accounting policies have been consistently applied to all the periods those are presented under consolidated financial statements unless it has been stated otherwise.

- Significant accounting policies

Inventories – the inventories are valued at lower of the cost and net realisable value

Revenue – for the goods in store, control over the same is transferred to customer at the point of purchase by the customer. Where the payments for the goods are received before transfer of control to customers, recognition of revenue is deferred under contract liabilities under accounts receivable in statement of financial position.

- Provisions

The entity records provisions where uncertainty is there regarding the amount or timing that will be paid, however likely amount of settlement can be estimated reliably by the entity. Major provisions held are associated with legal cases, annual leave for employees, long service leave of employees and warranty.

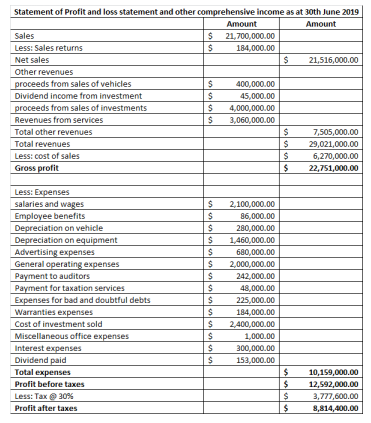

- Notes related to Statement of Profit and loss statement and other comprehensive income

- Opening balance of employee benefits has been adjusted with closing balance of employee benefits for computing the payment towards employee benefits.

- Loan on interest was paid at the rate of 6%

- Dividend recommended by the directors eventually has been authorised as well as approved amounted to $153,000.

- Applicable tax rate on the income was 30%

- Proceeds from sale of land are expected to be collected from August 2019 onwards. Hence, the same will not be considered in the financial statement dated 30th June 2019.

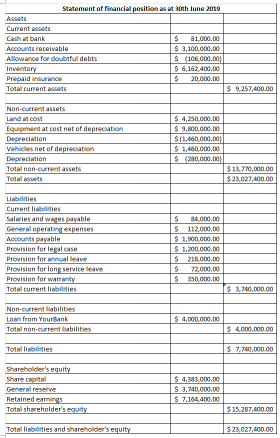

- Notes related to Statement of financial position

- The entity was involved in the legal dispute; however, at the year closed dated 30th June 2018 it has been recognised that the entity is not liable and is not required to pay any amounts associated with the same.

Directors Declaration

It has been declared by the directors that

- In the opinion of the directors, reasonable grounds are there for believing that company will be able paying the debts as and when the same become due as well as payable.

- In the opinion of the directors, consolidated financial statements attached are in conformity with the International Financial Reporting Standards as stated in the notes to consolidated financial statements.

- In the opinion of the directors, consolidated financial statements attached and notes thereon are in compliance with Corporation Act 2001 that includes compliance with the accounting standards and provides trues and fair view of financial position as well as performance of the entity and

- Directors provided declaration as required by section 295A of Corporation Act 2001.

On the date of declaration, the entity is within the class of the entities those are impacted by ASIC Corporations Instruments 2016/785. Nature of deed for cross guarantee is such that each of the entity that is the party to deed guarantee to each of the creditor payment in full of any debt as per the deed of cross guarantee. In the opinion of director reasonable grounds are there for believing that company as well as companies to which instruments applies, as prescribed in notes to consolidated financial statements as the group will be able meeting the obligation if any or liabilities to which they are or they may become subject by the virtue for the cross guarantee deed.

Independent auditor’s report

Opinion

Audit for the financial report of XYZ Group Ltd and subsidiaries those comprises consolidated financial position statement dated 30th June 2019, consolidated statement for profit and loss, consolidated statement of other comprehensive income, consolidated statement of changes in the equity and consolidated statement of the cash flows for 1 year period along with notes to financial statements including the summary of significant accounting policies and declaration of the directors.

In the opinion of the auditor, associated financial report of the entity is conformity with Corporation Act 2001 including –

- Providing true and fair view of the financial position of the entity dated 30th June 2019 and financial performance for 1 year ended and

- Are in compliance with the Australian Accounting standards and Corporation Regulations 2001.

Basis for the opinion

The auditors conducted the audit as per the requirement of AAS. Responsibilities of the auditors under the standards are described further in auditor’s responsibilities for audit of financial report section of report. The auditors are independent of the entity as per the independence requirement as per Corporation Act 2001 and ethical requirement of accounting professional as well as ethical requirements of APES 110 code of ethics for the professional accountant.

Annual director’s report

This director’s report is in respect of the entity and its associated entities those have been controlled at the close of the year dated 30th June 2019.

Principal activities – the entity operates mainly in Australia with 12 stores and approximately at the close of the year. Principal activities of the entity include selling foods, endeavouring drinks and supplying foods to the supermarket as whole sellers.

Name of the directors –

- P A Tesija

- S F Kramer

- M C Cairns

- T S Perkins

- S L McKenna

Environmental regulation

Operations of the entity are regulated by wide range of environmental regulations in accordance with law of Commonwealth of Australia and its territories and states. It is further subjected to different state as well as local government food licensing requirement and are further subjected to environmental regulations associated with development of the cites for shopping centre. However, the entity has not incurred any notable liabilities under the environmental legislation.

Bibliography

Australian Accounting Standards Board, 2015. AASB 13: Fair Value Measurement. Melbourne: Author.

Böcskei, E., Fenyves, V., Zsidó, E. and Bács, Z., 2015. Expected risk assessment—Annual report versus social responsibility. Sustainability, 7(8), pp.9960-9972.

Bond, D., Govendir, B. and Wells, P., 2016. An evaluation of asset impairments by Australian firms and whether they were impacted by AASB 136. Accounting & Finance, 56(1), pp.259-288.

Kabir, H., Rahman, A. and Su, L., 2017. The Association between Goodwill Impairment Loss and Goodwill Impairment Test-Related Disclosures in Australia. In 8th Conference on Financial Markets and Corporate Governance (FMCG).

Standard, I.A., 2015. Presentation of Financial Statements. Balance Sheet, 54, p.80A.