A bank officer is an employee who is committed to the legal work capacity to agree as well as indulge in signing the documents on the behalf of the institution. This title is generally used by the branch managers of a particular bank the assistant managers, loan officers as well as the other experienced personnel. Apart from this the designation of the bank officers are also been considered as the personnel of the bank focusing on the retail purposes. Hence the basic use of this tittle is to designate the same for the branch personnel and the same could be looked at the supervisory capacity. Hence the same could be considered for the other larger banks also where it is seen that the branch officials sometimes reviews the account of the said office in the quarter or monthly or yearly ended of the financial year and makes certain decisions to return them. Hence such decisions make the persons response properly to the queries who are directly related to the banks such as the bank officers. On the other hand the prices of the banks shares fully depends upon the past performance of the respective banks (Onali & Ginesti, 2014). However since the share market is continuously volatile on a certain period of time and the share value depends upon the past performance, it is quite important for the banks to increase the share value only through increasing the performance of the bank in the certain financial year. Thus in order to increase the market share price the performance of the banks will need to be increasing consistently. The share price depends upon the risk taking capacity of the banks, good maintain of the financial assets, increase of profit in the quarter ended period etc. hence there is no such relation between the bank officials and the market perception of the prices of the bans share. The only difference between them is the bank officials are the persons who are directly involved and are responsible towards the highs and lows of the banks, fulfilling the needs of the customers and conducting all the transactions effectively (Dooms, Verbeke & Haezendonck, 2013). Whereas the market predictions of the price of banks share depends upon the overall market performance of the banks. Thus indirectly the market performance highly depends on the performance of the branch officials (Fritz ,Levy & Ort , 2014). Thu it is an important area to consider upon. The same thing could be applied in the case of the Youngstown banks financial performance where it is important for the bank officials to perform well on a daily basis in order to increase productivity and ensure good business. Thus all these policies and procedure will if implemented properly will be helpful for the yougstone bank to increase profitability and ensure good amount of business profit throughout the year. Hence the share price of yougstone bank could gradually increase throughout the financial year. This is the way the bank could survive in the market despite of high competition and Mr Shelton and Mr Standard could look to implement these within the bank. ( Devereux ,2014)

During the last decade of the twelfth century there has been an immense number of increase in the banking sectors. However the private commercial banks play an important role in improving the performance of the economy and improving the specific banking sectors of the country. Though it is a profession which gives full of challenges and the job seekers have a priority over to consider this as a career. Thus on a high note the bank jobs are been considered as a job to increase the social status and provides a healthy package towards the early career stage and hence people likes to choose the banking job. But there are some crucial factors for the bank officers post which are defined below-

Thus for the bank officers the main factors are to be divided into two factors and these are been inherent to the jobs (Vegh, 2013).

Personal factors;

Male or female bankers:

Through the number of working in a bank is increased but the investigation tells that women less likely to love banking jobs. Apart from this another reason is that the banking job is a challenging job and it need determination and focus to succeed. However it is also seen that most of the women do not initially go for the banking job. Since they basically are housing women thus they prefer desk jobs most of the time and the banking officers job are very much flexible. Thus it is important that the banking officers get the taste of this high end jobs.

Age factor: it is another important area to consider since the maximum age limit for the bankers will be limited to 28-30 years. So as far as female employees are concerned the general duty of the employees are been related to taking care of beloved ones. Hence the same process could be also implemented in case of yougstone bank.

Job timing:

Employers who provide higher need of achievement time on job and hence it may be considered as a crucial factor if disallowed. Hence it is been seen that the employees want to shoe their competence to the higher level and demand promotion. It is observed that most of the employees put a lot of efforts in their work in the initial stage of the careers. Apart from this there are different job related factors to be included like work type, skillset, occupation status and commitment towards the organization (Xu, 2016)

Factors related to the market perceptions to the value of banks share price:

In bigger sense the banks share price are driven by the any other major share price changes. Hence the major factors are considered as the forces which are essential to drive in the main targeting factors. These factors include the overall market differentiation, future expectation and valuation of the banking services. Apart from this the demand for the banking services are also been considered. Hence the banks provide some unique techniques somewhat related to the functions of the central banks activity. Thus the job of the federal banking reserve plays a significant role for this process. On the other hand the stock valuation will be reflecting the current health of the banks by describing the growth potential. All these requirements cover the healthy loans, to receive interest and fees on the other accounts to limit the risk valuation (Buch, Hilberg & Tonzer ,2016).

Valuating components:

Investors are widely using a variety of valuation method, but there are some several components which are unique and hence all these comply risks , expected growth, discounted cash flow return and the cost of capital (O’Neill et al.,2017).

Growth potentialities;

This factor ensures growth potentialities and sustainability. Hence generally most of the investors look for dividends and various other areas are needed to be considered in this case. Thus for banks it is important that the monitory policies influence increase in the profitability by manipulating the interest rates. Hence sometimes it is seen that after the financial crisis in 2007 and 2008 , the government could directly issue extra amount of capital to the banks to pull over the financial sectors. However the banks are likely to grow and produce profits by attracting depositors and making sustainable loans, issue credit amount in the form of the banking investments. Since the federal deposit insurance corporation guaranties depository amount thus the business risks could be defined through this aspect.

Risks:

Bank stocks are fully relied over different type of risk like interest rate risk, counterparty risk and regulatory risk. This a large majority of bank assets and liabilities are known as interest t rate sensitive. In general the banks look to maximize a good amount of interest which they basically generate from loans and thus would likely to minimize the interest rate and keep pay out deposits. Thus it is important to keep in mind the deposits and liabilities and banking assets.

Earnings and future returns:

The banks which have higher profitability ratio are likely to have higher price to books ratio and hence the share price will also increase in the future share price. Since the banks are highly levered and hence it is very much significant in the short term.

Cost of capital:

It is very much significant and thus it is very much difficult to assess with banks, and hence it is not easy to know about how much amount is considered for the cost of capital and it is actually reflected by the banks valuation. It happens because most of the banks have a lot of provisional and final balance sheet with the Federal Reserve. Thus the major source of bank capital comes mostly out of the depository amounts during the interest rate differentials. Thus in order to attract more amount of deposits the banks could initially look to assess the cost of capital and along with the relevant difficulty related to the share prices of the banks. Thus similarly the yougstone bank could also like to follow all the above factors in the case of share price of the yougstone bank.

Answer to question 2:

The share price always depends upon the performance which the banks or any non-banking financial organization have done over the past financial years. Hence the rise or fall of any financial institutions are taken place in respect of the previous year’s performance, number of effective decisions are taken and business done in the current financial year. But if a bank is not performing well, suffering from loss on a continuous basis then it will be tough for them to run the business further and thus it totally effects the performance of the banks, apart from this high amount of competition from the other banks , un parallel loan taking, overflow of capital in the financial year and showcase of extra profits than the expected one could also affect the share price of the banks. Thus the share price likely to degrade. Similarly the same kind of problem has happened with the yougstone bank also. And hence Mr Standard was appointed as the new CEO of the banks because of his capability to handle management and being an experienced person in this field he knew how to deal with this issue. however at that point of time the banks had faced some issues related to the internal management rules and regulations which had been quite old fashioned and required some internal changes in the rules and regulations as well as implementation of some new policies in the banks itself. For example the son of the founder of yougstone bank believed in utilising old techniques like using of legacy systems, inefficient operating procedures , apart from this the employees did not even knew about the loan policies of the banks and hence after appointment of new CEO new policies have been applied into the banks relating to the loan procedures and due to the implement of this policies within the banks the risk inherence capacity of the banks had increased and more diversification had been introduced to the portfolio of the customers. Thus due to this factor the bank saw an increase in the share price which had doubled in the financial year to $9 and continued to increase till 2010. But after the end of 2011 there had been an immense decrease in the share price of the banks despite of the good performance of the balance sheet and the financial report. Hence it is important for the banks to implement the strategy to the business of the banks. Apart from this the as per the meeting of the CEO and the financial advisor of the bank, it is seen that the changes in interest rate and the performance of the banks as per the balance sheet from 2000 to 2005 was very much stable and it can be depicted that the future financial prosperity has been good for them. Here an analysis is done to see what will be the effect on the banks if share price decreases.

Apart from this in order to see an impact of the share price over bank rates it is important to assess the current market scenario and analyse the same into the functioning and improvement of the bank in the future period.

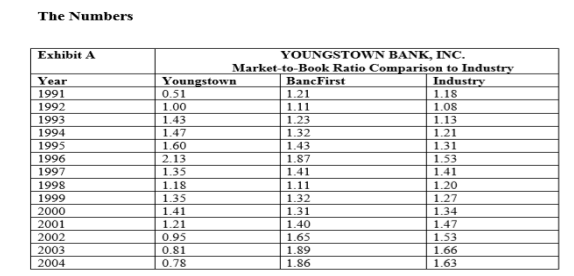

The above table discusses about the market to book ratio which is an important item to consider to calculate the market share price of the banks. Hence in a comparison between the performances of yougstone, bank first and industry bank. Thus it is seen that the market to book ratio of the bank has been very much volatile. The market to book ratio in the year 2000 is 1.41. However it has been decreased in the next year and have been increased in the next years also. Thus it can be predicted that the share price could be increasing if market to book ratio is high and the share price will fall if the market to book ratio decreased.

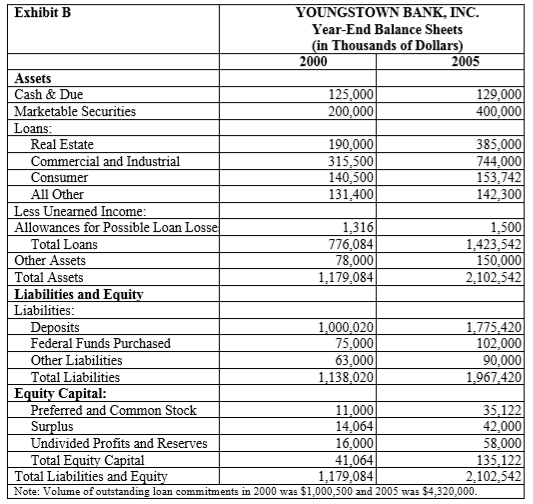

In comparison to the balance sheet of yougstone bank which compares the overall performance of the banks. Thus it is seen that the total assets and liabilities have been increased from $1179084 in 2000 to $2102542 in the year 2005. Apart from this bank had also increase the total equity capital and the profits and reserve capital have also been increased to the during 2005. Hence it can be concluded that yougstone bank had performed well in the year 2005 which had caused increase in share price.

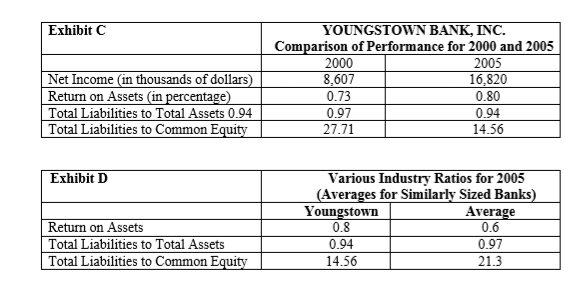

From the above table it is seen that the banks performance in the year 2005 have been better than that of 2000as well as the net income of the banks have also been increased in the financial year. In the next table it is seen that the return on assets as well as the liability to assets have been increased also. Thus all these factors have been worthy to increase thee share value of banks.

Strategies to implement in the banks:

As per the history people invest to make investment and are likely earn positive returns in the long term perspective. All these happens when the markets tends to fluctuate and thus it helps to make good amount of decisions. The same aspect is also applicable for the banks also since it is known that past and present performance plays an important role in the overall performance of the bank. Hence there are some strategies which could be implemented by the banks which could be as follows –

Asset allocation:

The banks need to make sure that the customers’ investments are being made properly as well as the assets are being allocated properly. Asset allocation refers to making good amount of investments and thus it is important to diversify the assets and to construct a standard portfolio. For example, in order to increase the growth rate of the banks they might look to invest 80% of the assets in stocks and 20% in the bonds. Thus it is important for the banks to invest in proper time frame to diversify the risks and reap rewards of the assets class.

Risk and rewards of the assets class:

- For stocks:

They stocks could carry a high level of risk and short term due to the fluctuating markets.

Historically the long term assets returns of higher class.

Generally could downgrade long term inflation.

- Bonds:

They have less severe short term price fluctuations than stocks and therefore offer lower market risk.

There will be a long term return and higher interest rate in the inflation over time.

- making of diversified portfolio investment decision:

It is a process of selecting various of investment in which the assets help to create to reduce the investments and thus it could help to diversify the portfolio risks of the banks. For example the banks while taking money from investors tries to invest the money in different segments and thus they may try to grow the investment value. Hence it is shown as single security risks and thus the investment value could make the price on hold. But at the same time the if the bank invest the clients amount on a single platform, there is a big chance of incurring loss in the process.

· Averaging the dollar cost:

It is a disciplined investment strategy which have been implemented within the banks in order to influence the market return of the portfolio. Hence by this approach it will be easy to apply a specific dollar to the valuation of the stocks and hence the investors will be able to purchase more amount of shares. Thus the funding of the banks will be increasing a bit and they will be able to increase business profitability of the business. Thus this technique will be proven to be an important area to concentrate on. On the other hand this will be helping to increase the average cost of the shares on a massive way. Apart from this since technique is systematic and updated thus it will help to improve the overall performance of the banks. Thus it can br said that the banks will find it easier to make any investment decisions. Now considering an example of how the rupee cost average will be useful in making the banking decision making and transactional process easy, if an investor deposits $100 in the bank and with the amount collected purchased 10 shares of some companies where 6 shares are priced high and rest of the four are priced low, thus from this example it is seen that the dollar cost average technique will be implemented in those shares which have been priced below in the market rather than on those shares which are been overpriced. Thus it can be concluded from this process that the investor will be profitable for only the low priced shares rather than for the high priced shares. This technique is also good for investors who bought equal number of shares (Orphanides , 2016).

Part B

In respect to the above article professor Davies have examined and analysed the economic value which could be implemented by some of the big banks as well as implement the same technique which could be evaluated by most of the banks to justify and support the new changes imposed over the big banks. This article also describes whether the banks could see some profitability’s in respect to those changes implemented. The article deals with all the economic rules , regulations and policies imposed in the banks. However while asking for the changes in economic condition of the banks and whether it could affect the assets and liabilities on a whole, it is politically sensible. However the banks may not be able to accept any public sympathy and there will be no chance of economic argument on it. However as per this process the persons who provide interest should be paying the overall cost and insurance value by investing $25000 as financial claim. Thus it could be said that the failed banks will not be able to bear any risk out of it , thus proving it to be less economical. However an example could considered in this case stating that most of the banks in Australia could be insolvent owing to fall on the asset value by 15% in the last financial year. Thus for example if an asset value of $100 of any certain bank comes down to $8, due to this result the liability value will be increased to $90 by assuming $10 as additional equity value. However f APRA could have liquidated the banks they could have given the insurer depositors a claim of $300 in which the asset value of $35 is included. Hence if the government does not pay for the costs, they will not be eligible to receive any insurance fee for that point of time. Thus in order to levy the possible course of actions, the banks need to ensure certain strategies within the banking department –

- Risks bearing by the creditors: the main risk bearers of the banks are wholesale claim. Considering an example in this case it can be considered that the banks have only $55 amount of total assets left while they have owned $60. Thus for the creditor it will be easy to realise such credit value and hence the banks have charged corresponding amount to that asset. Thus in this scenario it is often seen that the way the banks get depositors money by effectively paying creditors to insurance receive and the monitory funds providing guarantee towards the asset valuation., hence it is a important aspect or factors to be considered by the banks regarding economic levy to the net asset value. Thus the creditors will get the benefit if no loss is occurred to the large banks failure. Thus the government will make implicitly insurable to them and then they could be requiring to compensate the actual risk related to this (Novotny-Farkas, 2016).

- Implicitly in the government guarantee: as per this scenario it is clarified that the banks will be having the benefit to the insurance premium built into the higher insured rates over generally uninsured liabilities. Thus the government may find it difficult to take the risk via insured value and thus it could ensure risk minimization. Thus one big question thus arises is whether the new economic values and policies are to be appropriate and whether it is credible to general insurance value (Chawla et al.,2016). In response to this question it can be noted that the large banks have lower borrowing costs than the small banks and thus have perceived governmental support on this. Apart from this the article also states that the banks can only levy the economic approach only if it could be they could be having alternative approach towards the changes implemented in capital ratios and the prudential measures here the banks could be implementing the same strategy and signify the changes where the banks could say that they are unconditionally strong and the same could be removing all the implemented guaranties over some redundant policies of the banks (Fjeldstad, & Semboja, 2013). Thus as per the view of this article it can be concluded that the capital ratios are to be payable and preferable and the banks have registered the same technique and thus have faced consequence in respect of the economic policy and make some alternative approach to this process. And lastly in this way they could make the policies more attractive and add some alternatives (Wiesner ,2017).

Business models in respect of IFRS 9:

The banks may face a new change towards the environmental process and valuation in IFRS 9. This model addresses the challenges which could implement some fundamental changes required in this context. Thu the challenges which could be facing all these aspects include treasury, IT, wholesale, retail, global market and risk management aspects. Thus here the IFRS 9 plays an important role and helps the banks to get ahead of the environmental techniques, commercial policies, and credit management techniques and lastly people management (Ahmed , Chalmers & Khlif , 2013). Hence there are some business models which have been implemented. These are as follows –

Adjustment of portfolio strategy:

IFRS could go for making some products and business lines which is less structured and less profitable to the economic sectors. Hence the transactional durations for this process will support the portfolio strategy to the guarantor level (Vegh, 2013).

- Economic sector: the forward looking strategy to the nature of credit provision to IFRS 9 rule consider the allocation in a greater sensitivity rule.

- Transactional duration: there will be a chance of highest counterparty if the business profitability increases. Thus under IFRS 9 rule there will be stage two implementation model and expected credit loss will be resulting from all possible default events to the financial rules and regulations over higher profit and loss strategy.

- Collateral: here the unsecured exposures will be having a huge impact over collateral guaranties which could help to reduce the provision for losses resulted in by default under IFRS 9 and the exposures will be utilised in two different stages (Ramirez, 2015).

Rating process: The IFRS 9 policy impose heavy average to the proportional penalties and also see what will be the counterparty efforts to the clients will have a direct impact over the profitability and the industry observers expect for higher risk provision and performing clients to see the new framework in the Place.

Thus the shift towards structural profitability suggest that the bank must implement new techniques where possible and steer the focus to the sectors to make a good economic style. Thus this process could reduce stage 1 and stage 2 exposures in the profit and loss statement with great care (Fritz ,Levy & Ort 2014).

Revision in the commercial policies:

IFRS 9 could try to reduce the change in profitability margins for some medium and long term,, exposures. Since capital consumption is affected by higher provisional levels, hence the low rated clients and poor granters will be looking to get a good amount of provision. thus the loan amount required for a minimum of ten years is required , whereas in the case of lifetime provisions it maybe 15 to 20 times longer than the stage 1provisions. Therefore it is fully based on the commercial strategies needed to be implemented by the banks. The process followed in this case includes things like pricing and production strategies (Veblen, 2017) .

Credit reformation:

Under this rule the behaviour of the credit policy after originating will be considered an important aspect for the business in regard to the non-performing of the banks. Thus the banks must enhance performing and monitoring the portfolio and providing guidance to the credit facilities in the stage two group by trying to reduce the inflows. Therefore different approaches can be used in this case which includes early waiting system. Thus by rating the advisory services banks could be avoiding client to maintain good credit quality, try to provide proper solutions and obtain new credit facility thus to reduce the business liability. Moreover the banks could offer a fee based service by using a rating stimulus tool which enables the credit officers and relationship managers in order to propose how clients could try to improve the rating. It is used in a macroeconomic outlook and insist them to provide forecasts over different economic sectors proposed in the IFRS 9 rule. Thus this process helps to implement new revenue making structure, decrease in profitability or resolve liquidity issues.

Involvement in more risk:

In this rule the banks get to know about their involvement and ensuring credit facilities and to reintroduce new mechanisms to discourage credit providing facilities for the clients, sectors and the time duration which could re appear as risky way to implement in the lights of the new standards. For example the banks global project finance to be subjected to volatile, cyclical behaviour and the same may effectively arise and make possible issues to successfully project finance. Thus it can be concluded that these new strategies could be effectively evaluating the economic techniques which could be levied in the banks (Jaffe , Levy Carciente & Zanoni 2017).

References:

Abad, J., & Suarez, J. (2017). Assessing the cyclical implications of IFRS 9-a recursive model (No. 12). ESRB Occasional Paper Series.

Ahmed, K., Chalmers, K., & Khlif, H. (2013). A meta-analysis of IFRS adoption effects. The International Journal of Accounting, 48(2), 173-217.

Ball, R., Li, X., & Shivakumar, L. (2015). Contractibility and transparency of financial statement information prepared under IFRS: Evidence from debt contracts around IFRS adoption. Journal of Accounting Research, 53(5), 915-963.

Beerbaum, D. (2015). Significant increase in credit risk according to IFRS 9: implications for financial institutions. International Journal of Economics & Management Sciences, 4(9), 1-3.

Beerbaum, D., & Piechocki, M. (2016). IFRS 9 for Financial Institutions–The Case for IFRS and FINREP Taxonomies–A Conceptual Gap Analysis. Available at SSRN 2857939.

Bernhardt, T., Erlinger, D., & Unterreiner, L. (2014). IFRS 9: the new rules for hedge accounting from the risk management perspective. ACRN Journal of Finance and Risk Perspectives, 3(3), 53-66.

Bischof, J., & Daske, H. (2016). Interpreting the European Union’s IFRS endorsement criteria: The case of IFRS 9. Accounting in Europe, 13(2), 129-168.

Buch, C. M., Hilberg, B., & Tonzer, L. (2016). Taxing banks: An evaluation of the German bank levy. Journal of banking & finance, 72, 52-66.

Carraher, S. M. (2014). Consumer behavior, online communities, collaboration, IFRS, and Tung. Journal of Technology Management in China, 9(1).

Chawla, G., Forest, J., Lawrence, R., & Aguais, S. D. (2016). Point-in-time loss-given default rates and exposures at default models for IFRS 9/CECL and stress testing. Journal of Risk Management in Financial Institutions, 9(3), 249-263.

Devereux, M. (2014). New bank taxes: Why and what will be the effects. Taxation and Regulation of the Financial Sector, 25-54.

Dooms, M., Verbeke, A., & Haezendonck, E. (2013). Stakeholder management and path dependence in large-scale transport infrastructure development: the port of Antwerp case (1960–2010). Journal of Transport Geography, 27, 14-25.

Du Plooy, C., De Vries, K. J., & Fromont, A. (2014). IFRS 9 hedging. Was it worth the wait, 33-36.

Fjeldstad, O. H., & Semboja, J. (2013). Why people pay taxes: The case of the development levy in Tanzania. World Development, 29(12), 2059-2074.

Fritz, V., Levy, B., & Ort, R. (Eds.). (2014). Problem-Driven Political Economy Analysis: The World Bank’s Experience. The World Bank.

Fritz, V., Levy, B., & Ort, R. (Eds.). (2014). Problem-Driven Political Economy Analysis: The World Bank’s Experience. The World Bank.

Fritz, V., Levy, B., & Ort, R. (Eds.). (2014). Problem-Driven Political Economy Analysis: The World Bank’s Experience. The World Bank.

Gebhardt, G. (2016). Impairments of Greek government bonds under IAS 39 and IFRS 9: A case study. Accounting in Europe, 13(2), 169-196.

Gornjak, M. (2017). Comparison of IAS 39 and IFRS 9: The Analysis of Replacement. International Journal of Management, Knowledge and Learning, 6(1), 115-130.

Hashim, N., O’Hanlon, J., & Li, W. (2015). Expected-loss-based accounting for the impairment of financial instruments:: the FASB and IASB IFRS 9 Approaches.

Jaffe, K., Levy Carciente, S., & Zanoni, W. (2017). The economic limits of trust: The case of a Latin-American urban informal commerce sector. Journal of Developmental Entrepreneurship, 12(03), 339-352.

Jaffe, K., Levy Carciente, S., & Zanoni, W. (2017). The economic limits of trust: The case of a Latin-American urban informal commerce sector. Journal of Developmental Entrepreneurship, 12(03), 339-352.

Nobes, C. (2013). The continued survival of international differences under IFRS. Accounting and Business Research, 43(2), 83-111.

North, D. C., Wallis, J. J., Webb, S. B., & Weingast, B. R. (Eds.). (2013). In the shadow of violence: Politics, economics, and the problems of development. Cambridge University Press.

Novotny-Farkas, Z. (2016). The interaction of the IFRS 9 expected loss approach with supervisory rules and implications for financial stability. Accounting in Europe, 13(2), 197-227.

O’Neill, B. C., Kriegler, E., Ebi, K. L., Kemp-Benedict, E., Riahi, K., Rothman, D. S., … & Levy, M. (2017). The roads ahead: Narratives for shared socioeconomic pathways describing world futures in the 21st century. Global Environmental Change, 42, 169-180.

Onali, E., & Ginesti, G. (2014). Pre-adoption market reaction to IFRS 9: A cross-country event-study. Journal of Accounting and Public Policy, 33(6), 628-637.

Orphanides, A. (2016). What happened in Cyprus? The economic consequences of the last communist government in Europe. Cyprus Bail-in, The: Policy Lessons From The Cyprus Economic Crisis, 163.

Ramirez, J. (2015). Accounting for derivatives: Advanced hedging under IFRS 9. John Wiley & Sons.

Reitgruber, W. (2014). Methodological thoughts on expected loss estimates for IFRS 9 impairment: hidden reserves, cyclical loss predictions and LGD backtesting. arXiv preprint arXiv:1411.4265.

Veblen, T. (2017). Absentee Ownership: Business Enterprise in Recent Times-The Case of America. Routledge.

Vegh, S. (2013). Classifying forms of online activism: The case of cyberprotests against the World Bank. In Cyberactivism (pp. 81-106). Routledge.

Vegh, S. (2013). Classifying forms of online activism: The case of cyberprotests against the World Bank. In Cyberactivism (pp. 81-106). Routledge.

Wiesner, E. (2017). Evaluation and development: the institutional dimension. Routledge.

Xu, X. (2016). Estimating lifetime expected credit losses under IFRS 9. Available at SSRN 2758513.