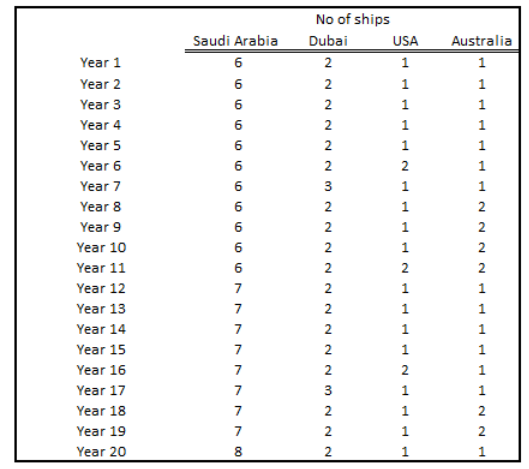

The excel solver is given us the below results:

And the total cost will be $11,063.63 million

Task 2:

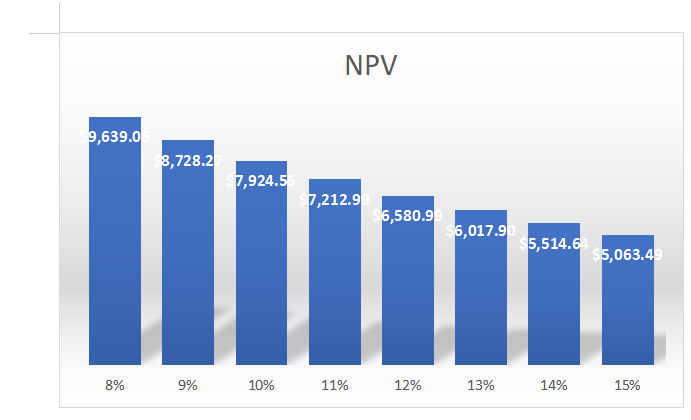

The NPV of the project will be $7,924.55 million and IRR will be 59%. Since, the NPV is positive and IRR is greater than the discount price, it can be said that the project is financially viable.

Task 3:

The above section has shown the NPV results and basis which a decision has already been recommended. Now, if the discount rate is varied from 8% to 15% then also the project will be remain profitable.

It has seen that the cost of capital has an inverse relationship with profitability of this proposed project. While, the cost of capital gradually increases, the NPV is gradually decreasing. It indicates that the profitability is also gradually decreasing.

If the gasoline price increment rate becomes 1.6% instead of 2.3% per year, then also the project will remain financially feasible, however, in such case the NPV will reduced to $7,112.47 million

Even though the maximum supply will drop by 32%, there won’t be any impact on supply, as the reduction percentage will be within allowable decrease range which will not influence the optimal decision made though solver.

Finally, the number of ships from Australia will be remain same as initial solution even though shipping cost increase as the minimum cost target would not be affected because of this decision.