Task 1: The dialog between me and the CEO

ME:

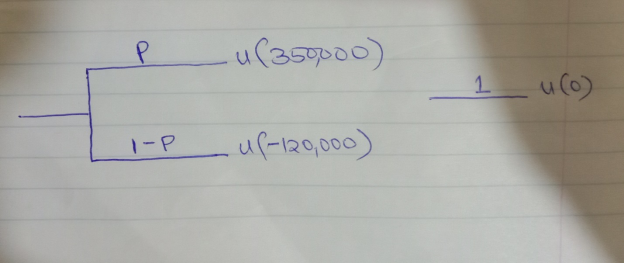

Mr. CEO for us to construct utility function for the investment with a potential loss of $120000 and a potential profit of $350000, we are going to set;

and

Then you are going to tell me the value of that makes you indifference between the following choices;

MR CEO:

The value of that makes me indifferent is 0.25,

ME:

Now to construct a utility function of profit $350000,

Therefore, the utility you will enjoy for the profit of $350000 is $450000

TASK 2: DECISION TREE

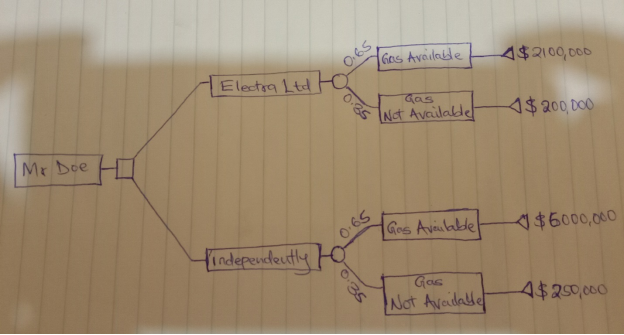

- The figure below shows the decision tree of the choices Mr. Doe has

- When Mr. Doe allows Electra Ltd to carry out the exploration on his land, then he will receive a total of $2100000 when the oil is found while when there is no oil found he will still get $200000. If he decides to do exploration independently and hire Experta & Co. for consultation, then he will be able to get $6000000 net profit when he finds oil or he will lose $250000 if he doesn’t find the oil.

- Expected Monetary Value (EMV) for the decisions

When exploration is done by Electra, the EMV is given by;

When Mr. Doe carry out exploration independently, EMV will be;

- Five scenarios

- Electra Ltd. offers Mr. Doe a deal of $240,000, if natural gas is discovered Mr. Doe will be paid an additional $1,900,000.

If he goes independently consultation fee $250000 and net profit of $6000000 when oil is found

- Electra Ltd. offers Mr. Doe a deal of $200,000, if natural gas is discovered Mr. Doe will be paid an additional $22800000.

If he goes independently consultation fee $250000 and net profit of $6000000 when oil is found

- Electra Ltd. offers Mr. Doe a deal of $200,000, if natural gas is discovered Mr. Doe will be paid an additional $1,900,000.

If he goes independently consultation fee $200000 and net profit of $6000000 when oil is found

- Electra Ltd. offers Mr. Doe a deal of $200,000, if natural gas is discovered Mr. Doe will be paid an additional $1,900,000.

If he goes independently consultation fee $250000 and net profit of $4800000 when oil is found

- Electra Ltd. offers Mr. Doe a deal of $200,000, If natural gas is discovered Mr. Doe will be paid an additional $1,900,000.

If he goes independently consultation fee $300000 and net profit of $6000000 when oil is found

- For scenario 1.

When Mr. Doe allows Electra Ltd to carry out the exploration on his land, then he will receive a total of $2140000 when the oil is found while when there is no oil found he will still get $240000. If he decides to do exploration independently and hire Experta & Co. for consultation, then he will be able to get $6000000 net profit when he finds oil or he will lose $250000 if he doesn’t find the oil.

Expected Monetary Value (EMV) for the decisions

When exploration is done by Electra, the EMV is given by;

When Mr. Doe carry out exploration independently, EMV will be;

For scenario 2

When Mr. Doe allows Electra Ltd to carry out the exploration on his land, then he will receive a total of $2480000 when the oil is found while when there is no oil found he will still get $200000. If he decides to do exploration independently and hire Experta & Co. for consultation, then he will be able to get $6000000 net profit when he finds oil or he will lose $250000 if he doesn’t find the oil.

Expected Monetary Value (EMV) for the decisions

When exploration is done by Electra, the EMV is given by;

When Mr. Doe carry out exploration independently, EMV will be;

For scenario 3

When Mr. Doe allows Electra Ltd to carry out the exploration on his land, then he will receive a total of $2100000 when the oil is found while when there is no oil found he will still get $200000. If he decides to do exploration independently and hire Experta & Co. for consultation, then he will be able to get $6000000 net profit when he finds oil or he will lose $200000 if he doesn’t find the oil.

Expected Monetary Value (EMV) for the decisions

When exploration is done by Electra, the EMV is given by;

When Mr. Doe carry out exploration independently, EMV will be;

For scenario 4

When Mr. Doe allows Electra Ltd to carry out the exploration on his land, then he will receive a total of $2100000 when the oil is found while when there is no oil found he will still get $200000. If he decides to do exploration independently and hire Experta & Co. for consultation, then he will be able to get $4800000 net profit when he finds oil or he will lose $250000 if he doesn’t find the oil.

Expected Monetary Value (EMV) for the decisions

When exploration is done by Electra, the EMV is given by;

When Mr. Doe carry out exploration independently, EMV will be;

For scenario 5

When Mr. Doe allows Electra Ltd to carry out the exploration on his land, then he will receive a total of $2100000 when the oil is found while when there is no oil found he will still get $200000. If he decides to do exploration independently and hire Experta & Co. for consultation, then he will be able to get $6000000 net profit when he finds oil or he will lose $300000 if he doesn’t find the oil.

Expected Monetary Value (EMV) for the decisions

When exploration is done by Electra, the EMV is given by;

When Mr. Doe carry out exploration independently, EMV will be;

- From the different scenarios we had, scenario 4 have the largest effect on the best solution. This scenario had the net profits reduced by 20% to $4800000. It has seen to reduce the best solution by 780,000 from expected monetary return of $3812500 to $3032500.

References

Anomneze, D., 2015. Application of seismic stratigraphy and structural analysis in the determination of petroleum plays within the Eastern Niger Delta Basin, Nigeria. Journal of Petroleum Exploration and Production Technologies, 5(2), pp. 76-171.

Brandão, L., 2014. Using Binomial Decision Trees to Solve Real-Option Valuation Problems. Decision Analysis, 2(2), p. 78.

Caineng, Z., 2010. Geological features, major discoveries and unconventional petroleum geology in the global petroleum exploration. Petroleum Exploration and Development, 37(2), pp. 65-176.

LIU, X., 2015. Structural architecture differences and petroleum exploration of passive continental margin basins in east Africa. Petroleum Exploration and Development, 42(5), pp. 34-89.

Rutkowski, L., 2014. Decision Trees for Mining Data Streams Based on the Gaussian Approximation. Transactions on Knowledge and Data Engineering, 26(1), p. 79.

ZHANG, Q., 2012. Guidelines for seismic sedimentologic study in non-marine postrift basins. Petroleum Exploration and Development, 39(3), p. 65.