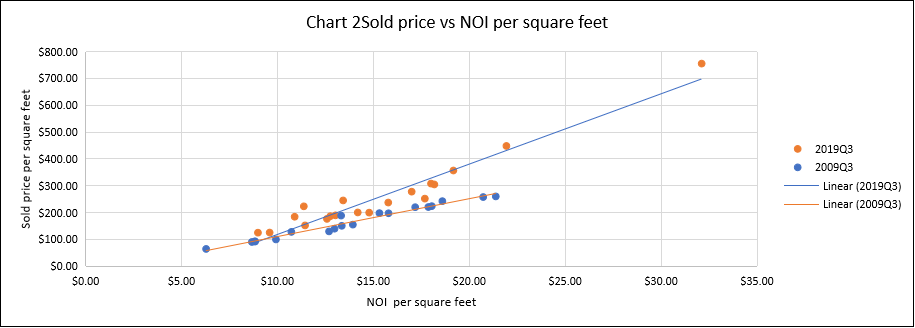

b. Asset Market: Valuation(NW Quadrant):

Chart 2 shows that as the transaction price per square foot increases as the NOI per square foot increases. In addition the NOI yields increases from 2009Q3 and 2019Q3. This can be seen by an increase in the steepness of the 2019 sales per square foot vs NOI per square foot. When NOI per square feet increases, the NOI CAP yields increased. This explains why the trend lines are not parallel to each other but instead forms an angular arc. The angle indicates that the rate of increase in the sold price per square feet increased exponentially between the two periods. Consequently, the office market heated up during the two periods.

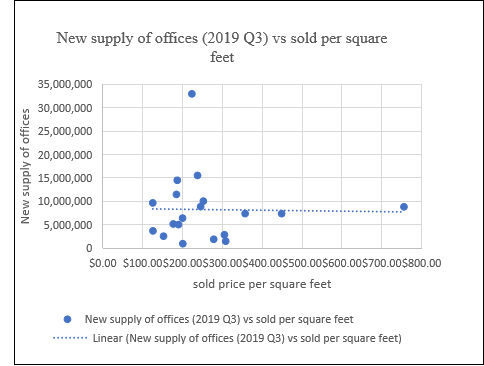

New supply of offices (2019Q3) vs sold per square feet

Comments on higher changes in spsf with marginal increase in housing

It was observed that the actual SW Quadrant graph of New Supply as a function of Sold Price per square feet does not conform to the theoretical version of the SW Quadrant in the Torto-DiPasquale Model. The sold price per square feet increased significantly with a marginal increase in the number of new supply of offices. In most cases, the price should decrease as additional offices are built in a particular region. The increase in the sold price indicates that the demand for offices is high and the rate at which they are built is lower than the actual demand. As a result there is shortage in supply and every available space is attracting many interested parties leading to an increase in the sold price per square feet.

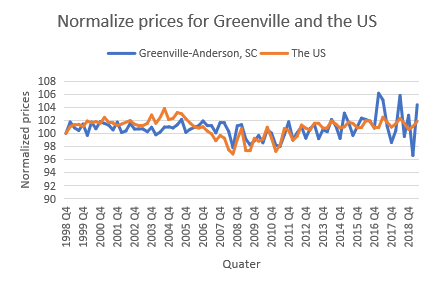

Normalizing Price

The normalized prices in the Greenville Anderson SC was relatively lower compared to the US office rent prices. Until the last quarter of 2006, the prices for the US were relatively higher than those in Greenville. However, between 2006Q4, and 2008 Q4, the normalized price were higher in Greenville compared to the US. Between 2008 Q4 and 2018Q4, the normalized prices oscillated in a manner either the US or Greenville had a higher normalized price at any given time. Until 2005, the price of housing was on rise and this led to increase in construction activities and an increase in office spaces that exceeded demand. Unoccupied offices resulted in default in repayment of loans by the constructors. As a consequence, the unoccupied houses were rented at a price lower than the ideal market price resulting to the bursting of the housing bubble in 2005 Q4. A housing crisis in 2006 resulted in a decrease in housing demand occasioning falling of the house prices. A fall in house prices resulted in a decrease in the normalized prices for rental spaces in both the United States and Greenville.

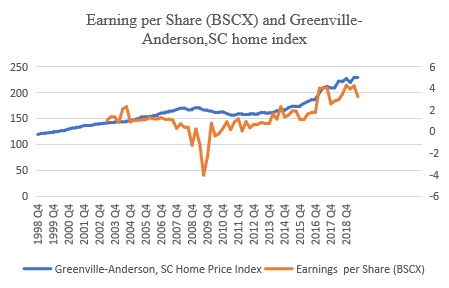

Earning per Share (BSCX) and Greenville-Anderson,SC home index

Explanation for Earning per Share (BSCX) and Greenville-Anderson. SC home index

The earning per share trend has a positive relationship with the Greenville home index. When the earning per share increase so does the Home price index. On the other hand, when the earning per share decreases, the home index decrease as well. Therefore, there is a positive relationship between the earning pers share (BSCX) and the Greenville Anderson home index

As the house price increases, the earnings increases. Earnings are dictated by the price at which products are availed in the market. Home index of 100 and below results in negative earnings meaning that the losses are incurred for transactions that takes place in the real estate.

House prices shows the actual performance in the real estate compared to the stock prices that are influenced by perceptions of investors. This explains why earnings have more positive co-movement with house prices relative to stock prices.

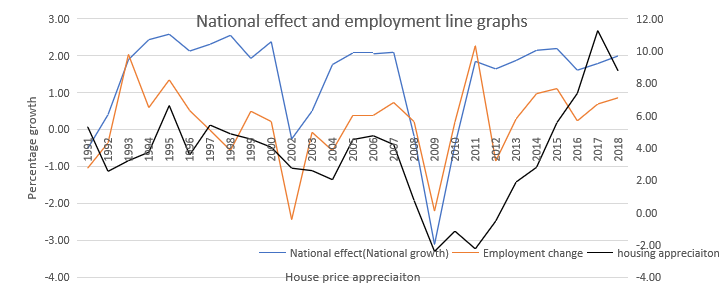

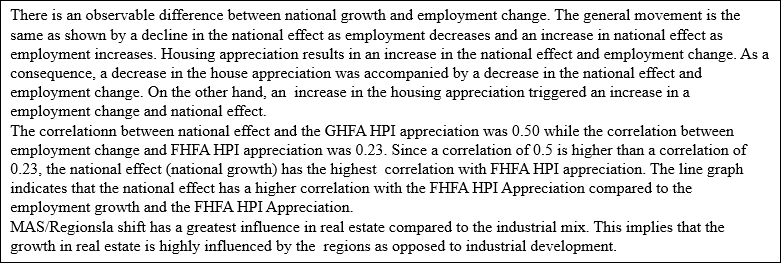

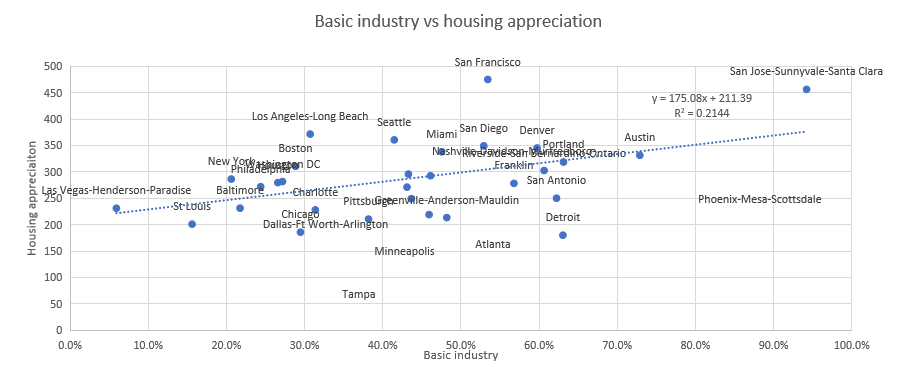

Shift share analysis line graphs for Greenville

The results from the chart above shows that an increase in basic industry resulted in an increase in the housing appreciation. However the relationship is relatively weaker as shown by a R-Squared value of 0.2144. Growth in the income t have an impact on house appreciation.