Introduction

In the recent past, the global market has seen the increased exploration of Internet based electronic banking information systems where the financial institutions are leveraging the latest system to gain a competitive advantage on the market. This demands development of systems that will offer customer satisfaction and offer accessibility of finance at any given time by the clients. Therefore the achievement of the Internet banking will be a success if tailored to financial operations and services that offer the consumer wants and expectations to the quality of preferences. In order to achieve these wants the satisfaction of any consumer is the key objective of any institution. In addition the customer perception, of security of data and transactions, the user friendliness, accuracy and reliability and the efficiency are some of the critical aspects for success in the online banking (B Romney, 2018).

Therefore we start by defining the internet banking. The idea of internet banking involves the system that comprises of several components that provide banking information and services by financial institutions to consumers through several platforms that can be utilized with diverse terminal Internet of Things devices. Thus this report provides an abstract visual data of the proposed systems for Xanji banking services where all the system details are not captured. System design serves a significant responsibility in system development (Hassan, 2018).

PROJECT OBJECTIVES AND SCOPE

Project Objective and scope

The objective of the project is to implement online account management system so that the ban can provide more efficient and faster service to the customers. The main objective is to design the internet banking system which can be accessed by the customers remotely using the computer systems or even mobile phone.

The scope of the project is developing an application system that will allow the customers to access their accounts online and process with online payment system. The customers can get service 24 hours without any interaction with the bank officials. The scope of the project is to lessen the pressure of the bank officials and to sustain in the competitive market.

The constraints of project is that the project will be completed within the given budget and within the provided time that is allowed for the project.

Proposed solution

The Xinja Bank wants to provide the customers online service to increase their efficiency and provide faster service to the customers. This would help them to compete with other banks in the market and save the bank from losing customers (Parvez, Eity and Morsalin 2018). The solution proposed of developing online banking system will help the banks to provide service 24 hours to the customers and lessening the pressure on the bank officials to attend the customer for small reasons.

The online account system will help the customers to

1. Access their bank account from their mobile phones.

2. Make online payments from their banks remotely.

3. Get 24 hours service from the bank.

4. No place for error resulting in increased efficiency of the bank service.

5. Will provide security to the customer data.

6. Get transactional report for the account.

7. Generate interest information on loan taken by customers.

SYSTEM ANALYSIS AND DESIGN

Existing system

The current system being utilized in the bank is the manual performance of operations executed by the bank officials which is a slow process. In order for the customer to access the bank account, the customer physically visits the bank and requests for the details over the counter. These operations are much slower in that the operability of the bank is limited only to 8-9 hours a day. Therefore Xanji bank lags behind from other banks in the country. In addition the processes are not efficient enough and reliability is minimal due to the human errors of the system.

Proposed IS System

The proposed IS system is based on online account management banking system which will increase the efficiency and reliability which therefore reduces much of the manual paper work done by the bank officials. The online management system retains the records on the account activities of the customer. These activities involve the fund deposits, withdrawal, transactional reports and the load application reports. The proposed system will have the ability to display the transactional reports of the corresponding accounts, the interests and rates and make online payments of the customers.

Existing System analysis

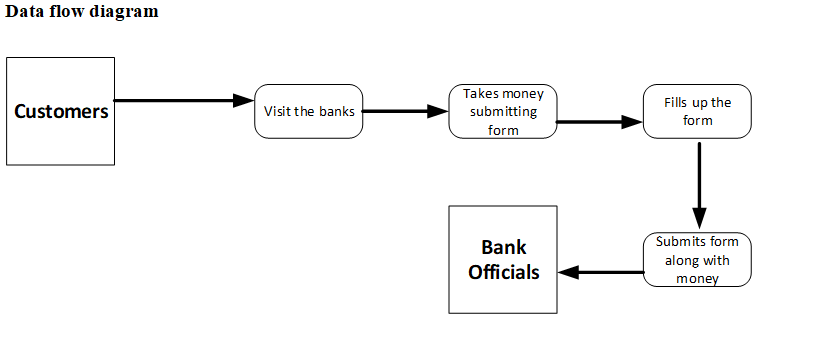

Data flow diagram

Figure 1: DFD for transaction process (Source: Created by Author)

Proposed system

Considering the slow process of the existing system and its limitation to time, the development of the new design will ensure the clients are able to create a bank account at the comfort of their location. In addition the proposed system will be available throughout. It will also see a reduction in the human effort in the bank consequently reducing the errors that can be witnessed.

Functional requirements

The following are the functional requirements of the information system. It involves the facilities and performance required by the customer:

- Check balance online

- Pay bills online through the system

- The online data entry by the staff

- Updating data

- Balance transfer

- Check book Allotment

Non- functional requirements

Usability requirements

These involve the needs which are considered by the clients.

- The system shall be user friendly that means the system shall be easy to navigate.

- All the actors have the ability to communicate with one another utilizing the chat function

- Running of the application in available Operating Systems

- Integration of multiple language options

- FAQ availability in the system

- Provision of feedback option to all the consumers

Reliability requirements

This involve the failure ability of the system and recovery time from the initial failure

- The tendency of the Xanji system failure must be at the bottom level since the vitality shall involve the financial institution to lack their system down

- The system will have the ability to recover all the data without mismatch of account numbers

- Total failure shall be made through the system to consumers through notification.

Performance requirements

These involves all the response period and output of the system

- The restart cycle of the proposed system shall be successful in a maximum of 200 seconds.

- Back servers will always be available to the system admins

Security requirements

- Third party users shall not access the system nor modify any detail

- Sensitive information on customers shall only be accessed by system admin and authorized users if and only if it’s necessary for account details

- Information in database shall be never be downloadable

- Account details of the consumers shall never be saved or printed unless authorized through security clearance.

Quality attributes

- Ensure a user friendly environments that is eye appealing

- Simple to navigate and visualize

- Maintenance of clear visual content

- The homepage should be accessible to users not logged in

Methodology

This project adopts the object oriented approach of utilizing the UML tools in software engineering. The steps considered involves

- Feasibility approach where the existing and the proposed system is studied

- Analysis of the suggested solution and problems

- Design- the solution will be achieved through object oriented software tools

- In the coding of the system

Risks and management strategies

Personal limitations- this involves the individuals who are novice in the security problems. In addition the technology of the system to be utilized in the implementation

User interface- in the user interface designed, suppose after verification from the other side it denies to agree with the existing user interface

Requirement changes- Suppose the clients side after contract agreement are persistently asking for the changes and modification. This results in the delay of the project.

System dataflow diagram

Source: Author

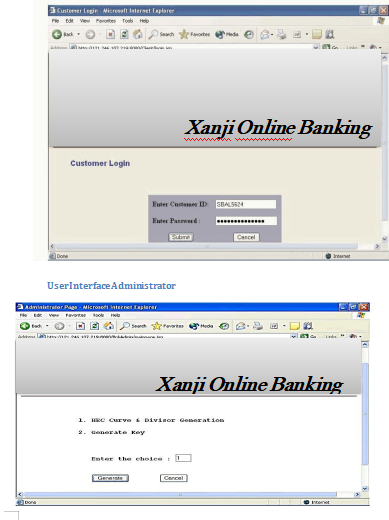

User interface diagrams customer

User Interface Administrator

System performance

In this part the description of how the system works is covered

Login- each client will have an account ID and the corresponding Password. The login page will require the customer to provide both the attributes

Bank features- Not all the visitors of the web page are necessarily registered members of Xanji bank. Therefore the Home web page will comprise of all the basic features the bank offers and a registration module is provided in the page

New account- A new user will be provided with a digital form to fill the details with the Bank. The details of the user when correct will be sent to the administrator for verification then sent to the banks database. In not valid the user will be prompted to enter details again

Welcome page- new users and existing users of the online banking system will be provided with several functionality task. The users just have to click/tap on the links module to be directed to the operations.

SYSTEM IMPLEMENTATION

In the implementation phase the following items are required

Hardware requirements

- Internet Explorer Processor at 750 MHz or more

- Minimum of 1 Gigabyte storage disk space for installation

- Minimum RAM of 512 Mega Bytes

Communication requirements

- Client on internet will utilize HTTP/HTTPS protocol

- Clients on the Intranet will utilize the TCP/IP protocol

Software requirements

- The customers on internet will require Web Browser, Operating System of choice

- Customers on Intranet will require Client Software, Web Browser, and Operating System of Choice

- Database Server will require DB2 and any operating system

- In the developers end; WSAD (J2EE, Java, Java Bean, Servelets, HTML) DB2 Operating system Windows, Web Server

- The overall system will be three-tier system.

SYSTEM ARCHITECTURE

[Source: Imported from Adobe Dreamweaver]

Trouble shooting Problems

The web version

Time Out loading

- Ensure the internet connectivity is working. In persistence reboot the router and check the connection of the internet. Alternatively check on the router user documentation to complete the task

- Clear the data cache and reboot the web application for instance CHROME

Invalid Logins

- The details typed do not match with the database information. Try login to validate the information

- In response select the forgot password option and ensure the email provided in registration is working

Page not Available:

- Ensure that the URL searched is correct

- If the URL is valid contact the organization to alert on the missing web link

System software

Client’s registration is delayed:

- Make sure the connection on the internet is functional

- If the issue persist contact the organization and the requested respond will be available within 10 minutes from the initial request

Account details not found;

- This means that the customers information have been removed from the database and the system and/or the user have not yet registered with the internet banking

Consult the system administration for clarification

REFERENCES

B Romney, M. (2018). Accounting information systems. Pearson Education Limited .

Chiu, C. L. (2019). Stages in the development of consumers online trust as a mediating variable in online banking system: a proposed model. International Journal of electronic Finance 9(3), 170-201.

Cram, W. B. (2016). Information systems control alignment:Complementary and conflicting systems development controls. Information & Management, 183-196.

Hassan, N. a. (2018). Distilling a body of Knowledge for information systems development. Information Systems Journal , 175-226.

Jan SR, s. S. (2016). An innovative approach to investigate various software testing techniques and strategies. International Journal of Scientific Research in Science Engineering and technology (IJSRSET) , 2395-1990.

Khan and Mohmood, M. S. (2012). A graph based requiremnts clustering approach for component selection selection. Advances in Engineering Software vol 54 , 1-16.

Khandelwal, V. S. (2020). “The study of Customer Preference in Online And Offline system banking. Tathapi with ISSN 2320-0693 is an UGC CARE Journal 19(2) , 369-376.

Pandya, N. (2019). DEMONETIZATION-ITS INPACT ON ONLINE BANKING TRANSACTION. Global Journal fro Research Analysis 8(5).

Rawashdeg A, .. N. (2016). .” A new Software quality model for evaluating COTS components”. Journal of Computer , Science vol 2, 373-381.

Sanchez, O. a. (2017). Cost and time project management success factors development projects. International JOurnal of Project management, 1608-1626.