Introduction:-

A blockchain is an unchallengeable, time-stamped sequence record of information that is scattered and coped by a collection of computers. The blockchain also can progress upon systems by now in use during society (Sahlin and Levenby 2018). Blockchain technology suggests an immense potential troublemaking power, and businesses are already in the competition for several product offerings. As the business stays to grow, the blockchain stands out as the most significant venture for expected returns. It is to be capable of creating and confirming trust, lacking the need for a centralized structure. As an alternative, this power would be specified to a distributed network, making it not only more protected but also well-organized and quicker to scale (Kokina, Mancha and Pachamanova 2017). This report demonstrates the basic description of blockchain technology and also develops the importance of this technology in the business organization.

Discussion:-

Blockchain Technology:-

Blockchain can be demonstrated as a series of the block that holds enormous information. The method is proposed to timestamp digital evidence so that it’s impossible to temper or validate them. It is using for the protected transfer of objects like property, money, contracts without demanding a third-party intermediate like government or banking sector. Once a piece of evidence is documented inside a blockchain, it is tough to alter it (Yaga et al. 2019). This technology characteristically mentions to the trustless, transparent, openly accessible record that permits the user to steadily relocate the unit’s ownership of worth using public-key encryption and evidence of approaches.

Without the help of the internet, it is impossible to run this technology. It is also named meta-technology as it disturbs other technical skills. It is inclusive of some portions like software application, a database, and some associated processers. The possibility of blockchain technology is not restricted to bitcoin as it has increased much consideration in a diversity of businesses counting charities, monetary services, and e-commerce.

Use of Blockchain technology in business:-

This technology can be used for several internet-based and computerized applications. Smart Contracts are the one type of application that allows industries to spontaneously validate and implement agreements that purpose autonomously in a secure atmosphere (Sutton and Samavi 2017). Blockchain technology performs as a middleman for executing all business protocols, business transactions, and programmed interactions of evidence in smart contracts.

Some major enterprises are using blockchains for this particular purpose. The Shipping businesses have been rapid to understand that blockchain technologies are a usual explanation to continuing clear, updated records on the status. In specific, the blockchain is anticipating to be an effective means of handling paperwork, which presently suffers from clerical mistakes and fraud. Applying a blockchain in the small industry for the aim of tracking business histories might not necessitate this decentralized configuration (Angraal et al. 2017). As an alternative, a blockchain could assist as a thorough record of credits and debits, which would once again advantage from the assurance that the documents cannot be damaging with once it has arrived.

The companies could use blockchains in much the similar method as an influential tool for quality control. If a creation being traded by the business unable to fulfill the product quality standards, discovering the point of disaster could be as simple as arriving the product’s number and inspecting the transitional stages in its creation. Dealings in industries that need related synchronization might also advantage from capitalizing in a mutual blockchain. Keeping entire parties on a similar page can go a long way near avoiding problems that harmfully affect any business customers. The blockchain can help as a piece of unchallengeable evidence to hold the responsible parties.

Impact of blockchain in Audit profession:-

Blockchain technology has the possibility to impression all recordkeeping procedures, including the method dealings, are processed, initiated, recorded, authorized, and reported. Several industry houses and other non-financial companies have started concentrating on blockchain technology and initiated assessing active areas and the use of blockchain technology for their industry. Besides, inaugurated the documentation of consultants or vendors to apply the blockchain technology (Suzuki and Murai 2017). On the other side, accountants who are involved in the examination of said commercial houses will essential to start working towards improving their practical abilities, including capability in data analytical tools to be well prepared to appear and authorize the dealings on the network under block chain atmosphere.

The Audit procedure is usually an annual implementation, mostly for the reason of effort and time capitalized in it. Since Blockchain delivers distributed record, this technology may create it potential to conduct more regular audits on a periodical or even on a regular basis (Sikorski, Haughton and Kraft 2017). These increase the accountant’s understanding of the industry, as the arrangement is no lengthier a year-end snapshot. This opportunity can simplify the skill to spot developments or upcoming risks more aggressively.

Opportunities:-

Blockchain aids parties in business to create an argument without the existence of a third party. These expressively decrease third-party risk (Produit 2018). Furthermore, due to its decentralized network characteristics, the blockchain does not have any essential opinion of failure and is consequently capable of withstanding hateful attacks. With blockchain skills, each transaction, both previous and current, can be confirmed at any time for validity. Blockchain does not just deal with one person authentication; rather, a confirmation can occur instantaneously within a network lacking alteration fear. Blockchain technology profits not only crypto-currencies but also several different businesses that want to stock and operate substantial data amounts (Ahram et al. 2017). Blockchain technology has the prospective to backing the economic, social, and public services like asset management, educational facilities, land record management, energy management, taxations system, citizen registration structures, patient management, security, and confidentiality augmentation of mobile devices and related services.

Challenges:-

There are specific challenges linked with the blockchain networks. There is a massive storage requirement as the authentication process includes the entire blockchain (Kshetri and Voas 2018). Only specific dealing can be executed per second due to secure block size, which in turn reasons increased transaction interruptions and a huge transaction charge.

Furthermore, it is the potential to create false blocks by the network nodes or create communications that are reverse. The Quick blocks are probable by improved power depletion, resulting in genuine blocks being unable to get their stake of blockchain network possessions. One of the vital challenges of blockchain networks is the consumption of energy. These dealings consume a massive quantity of energy. It is assessed that every Bitcoin deal consumes 75,000 times additional energy as related to a card transaction.

Other Technological Advancement:-

In modern times human technology is proliferating. For this reason, the blockchain technology also enhances their capability in very quickly. Modern technological tools have the probability of allowing the auditor to analyze and vast volumes of designed and formless data connected to a business’s financial evidence (CGMA 2018). This ability may permit auditors to check 100 percent of a business’s dealings as an alternative of only an example of the inhabitants.

The critical accounting companies have declared that the practice of these tools is increasing the audit by systematizing time-consuming jobs, which are more rote and manual. For instance, over the use of AI, robotic arrangements could interface with a consumer’s structures to compile and transfer data spontaneously, something earlier done by hand through a junior auditor.

The use of these technical tools and techniques increases specific challenges. For instance, the information being used must be dependable, comprehensive, and accurate. That is factual for overall ledger documents, other economic and functioning data, and documents from outside the business. Data quality and security control over these tools, whether established in-house or by retailers, are factors for companies to consider. It is also confirming the reliability of methodologies across group inspections may become problematic if such tools are not willingly accessible to, or used by, associate workplaces (Otete 2018). For these technical tools and techniques to help the relevancy and appropriateness of the audit, they need to be used to improve and distribute a more excellent quality audit to enhance the investor’s benefit.

Future of new technology for audit:-

Innovative technology creates it probable for auditors to analyze vast quantities of a business’s financial data and test 99.9% of a business’s transactions as an alternative to testing only a sample (Zheng et al. 2017). Modern technology allows auditors to make innovative analytics to improve a deeper understanding of the business’s operations. Technological developments might even move accountants near more continuous monitoring and auditing model because they’ll be capable of accessing appropriate customer data and identical format. Noticeably, progressive technologies offer the excessive potential to the audit. But it’s vital to remember that for all the possible AI, data conception, and robotic automation offer, these skills are only as decent as the audit team controlling them and analyzing the outcomes.

Conclusion:-

This assignment is describing the fundamental concept of blockchain technology and also deliver some nice idea about advantage and challenges of this technology in a financial organization. The critical part of this report is that some advance technology must increase any business financial model. With the help of modern technology, the organization is easily capable of recognizing and reviewing a consumer’s progressions and, using process mining, discover them efficiently. So the conclusion of this report state that recent technology was carrying the most effective audit method, which can enhance the organization’s financial status.

References:-

Ahram, T., Sargolzaei, A., Sargolzaei, S., Daniels, J. and Amaba, B., 2017, June. Blockchain technology innovations. In 2017 IEEE Technology & Engineering Management Conference (TEMSCON) (pp. 137-141). IEEE.

Angraal, S., Krumholz, H.M. and Schulz, W.L., 2017. Blockchain technology: applications in health care. Circulation: Cardiovascular Quality and Outcomes, 10(9), p.e003800.

CGMA, C., 2018. Blockchain augmented audit–Benefits and challenges for accounting professionals. The Journal of Theoretical Accounting Research, 14(1), pp.117-137.

Kokina, J., Mancha, R. and Pachamanova, D., 2017. Blockchain: Emergent industry adoption and implications for accounting. Journal of Emerging Technologies in Accounting, 14(2), pp.91-100.

Kshetri, N. and Voas, J., 2018. Blockchain-enabled e-voting. IEEE Software, 35(4), pp.95-99.

Otete, A.R., 2018. Audit market dynamics and auditors’ remuneration of listed companies in East Africa. European Journal of Accounting, Auditing and Finance Research, 6(6), pp.12-21.

Produit, B., 2018. Using blockchain technology in distributed storage systems.

Sahlin, E. and Levenby, R., 2018. Blockchain in audit trails: An investigation of how blockchain can help auditors to implement audit trails.

Sikorski, J.J., Haughton, J. and Kraft, M., 2017. Blockchain technology in the chemical industry: Machine-to-machine electricity ma

Sutton, A. and Samavi, R., 2017, October. Blockchain enabled privacy audit logs. In International Semantic Web Conference (pp. 645-660). Springer, Cham.

Suzuki, S. and Murai, J., 2017, July. Blockchain as an audit-able communication channel. In 2017 IEEE 41st Annual Computer Software and Applications Conference (COMPSAC) (Vol. 2, pp. 516-522). IEEE.

Yaga, D., Mell, P., Roby, N. and Scarfone, K., 2019. Blockchain technology overview. arXiv preprint arXiv:1906.11078.

Zheng, Z., Xie, S., Dai, H., Chen, X. and Wang, H., 2017, June. An overview of blockchain technology: Architecture, consensus, and future trends. In 2017 IEEE international congress on big data (BigData congress) (pp. 557-564). IEEE.

ACCT 5507 – Jan ’20 Final Exam

This test is worth 25% of your final grade. It includes four Sections. You have from 11am-3:30pm.

Section 1 (15 Marks)

Section 2 (20 Marks)

Section 3 (25 Marks)

Section 4 (25 Marks)

Section 1 – (15 Marks)

- (12 Marks) You are considering bidding on a project to make new cases for mobile phones. The project details include:

- Upfront costs of $350,000 for a new injection-moulding machine.

- 4 year life

- $30,000 in yearly pre-tax operating costs

- Initial investment of $50,000 in working capital

- Your company has a tax rate of 30%

- Your company’s required rate of return is 10%

- At the end of 4 years you can sell the equipment for $30,000

- There is no depreciation consideration for this equipment

- (6 marks) Complete the following table and calculate the net present value for the project costs.

- (3 marks)What is the projects Equivalent Annual Cost?

| Section 1 B | |

| Equivalent Annual Yield | r(NPV)/(1-(1+R)^-N) |

| R | 0.1 |

| NPV | -284938.8703 |

| N | 4 |

| EAA | $ -89,889.89 |

- (3 marks) If the contract requires you to make 25,000 cases, what is the minimum amount you would bid/case?

- (3 Marks) BikesAreBetter is now looking at an “Economy Version” of its top selling bicycle. The new version will not include all the same features as its top seller and hence will be offered at a lower price. What are some of the cash flow and market conditions it must consider when evaluating the project? Explain.

Section 2 – (20 Marks) – Show Your Work

- (3 marks) What is the present value of the following set of cash flows at an 8% discount rate?

| Year | 1 | 2 | 3 | 4 |

| Cash Flow | $2,000 | -$2,000 | $2,000 | -$2,000 |

- (3 marks) Brad earns 7% per year on a past investment of $100,000. He recently sold his investment for $450,000. How much sooner could Brad have sold the investment if he only wanted $350,000 for it?

- (3 marks) Your credit card company quotes you a rate of 22.5%. Interest is billed monthly. What is the actual rate of interest you are paying?

- (3 marks) You are able to contribute $50 a week to your retirement plan. Assume that you work for 20 years and that you earn 5% per year. How much will you have for retirement?

- (3 marks) Humber College recently purchased some fixed assets that belong in a 20% CCA class. The assets cost $550,000. What is the amount of the depreciation expense in the third year?

- (5 marks) Would you be willing to pay $1000 today in exchange for $10,000 in 20 years? What would you consider in answering yes or no to above?

Section 3 – (25 Marks)

Andrew David is thinking of buying some new equipment for his family business. The equipment costs $300,000 and last for 5 years. It is expected that the new equipment will generate after-tax cash flows of $50,000 in the 1st year and increase by $20,000 each year until it reaches $130,000 in year 5. After the project they will sell the equipment for $50,000, making the total cash flow in year 5 $180,000. Complete the following table. The companies required return is 15%.

| Calculate Project’s | Accept or Reject Project? Why? |

| Payback? (Benchmark <4years) | |

| Discounted Payback? (Benchmark <4years) | |

| NPV? | |

| Profitability Index? | |

| IRR? |

Section 4 – (25 Marks)

- (20 Marks)

- (16 Marks) Based on the following projections complete both the cash flow tables. Use 2 decimal places for all values.

| Cash Collections & Disbursements ($’000s) | ||||

| Q1 | Q2 | Q3 | Q4 | |

| Cash Collections | ||||

| Beginning A/R | ||||

| Sales | ||||

| Cash Collections | ||||

| Ending A/R | ||||

| Cash Disbursements | ||||

| Beginning A/P | ||||

| Purchases | ||||

| Payment A/P | ||||

| Ending A/P | ||||

| Total Cash Outflows | ||||

| Beginning A/P | ||||

| Operating Expenses | ||||

| Capital Investments | ||||

| Interest & dividends | ||||

| Total cash disbursements |

| Cash Budget (‘000s) | ||||

| Q1 | Q2 | Q3 | Q4 | |

| Total Cash Collections | ||||

| Total Cash Disbursements | ||||

| Net Cash Inflow | ||||

| Beginning cash balance | ||||

| Ending cash balance | ||||

| Minimum cash balance | ||||

| Cumulative surplus (deficit) |

- (4 Marks) Based on both tables above, what can you say about this projects viability? What plans might the company have to make?

- (5 Marks) Complete the following Short Term Financing Plan. Interest on new short-term borrowing is 2% per quarter. Note: This is a separate question to above.

| Short-Term Financing Plan ($‘000s) | ||||

| Q1 | Q2 | Q3 | Q4 | |

| Beginning cash balance | 100.00 | |||

| Net cash inflow | 25.00 | -50.00 | -25.00 | 125.00 |

| Ending Cash Balance (before borrowing) | ||||

| Interest on short-term borrowing | ||||

| New short-term borrowing | ||||

| Short-term borrowing repaid | ||||

| Ending cash balance (after borrowing) | ||||

| Minimum cash balance | 100.00 | 100.00 | 100.00 | 100.00 |

| Cumulative surplus (deficit) | ||||

| Beginning short-term debt | ||||

| Change in short-term debt | ||||

| Ending short-term debt |

Financial Planning Article

Introduction

The advancements in the medical field have brought about changes in the health of the individuals which has increased their overall capability to work harder and to be independent for a long period of time (Ageing.ox.uk 2020). However, over the past few years, the state pension age has remained stagnant to 60s and according to Jones (2016), this may be too early for the different individuals and hence, an individual who is completely capable of working and earning for themselves may find themselves unemployed to a great extent. Hence, the report is primarily focused on analyzing the proposal of increasing the State Pension Age to 75 by the year 2035. The society has failed to grasp and respond to the different needs of the ageing workforce. Additionally, the working longer has a considerate potential to improve the health as well as the overall wellbeing of the individual and gives them an opportunity to increase their retirement savings and undertake the full functioning of the public services. Hence, the report will outline the different issues of the Ageing workforce in the United Kingdom and provide financial advice in consideration of the same. Hence, certain recommendations to improve the scenario and

Provide a self-dependent scenario for the ageing workforce will be provided accordingly.

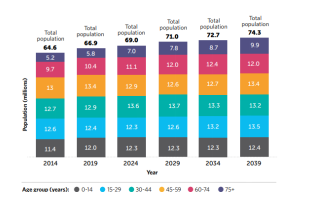

Figure 1: The Pension age in UK

(Source: Ageing.ox.uk 2020).

Issues of the ageing workforce in the United Kingdom

Various individuals in the United Kingdom are living longer than before due to the achievement of the modern science as well as improved healthcare. Other individuals mention that the older people form a considerate proportion of the population and hence, their contribution to the society is much higher. The individuals are workers, volunteers, tax payers as well as the careers. However, according to Ageing.ox.uk (2020), the United Kingdom is not making most of the various opportunities which can be afforded by the ageing population. The individuals are forced out in the later life by the unwelcoming attitude at the workplace. Additionally, very few individuals do not have to access the training and are not being able to adapt to the changing labor market. The ageing model also challenges the United Kingdom`s model of the service provision and if there exists an older population, the demand for the public services increase but questions can be raised about the sustainability of the current models of the working health, pension and provision (Shipway et al. 2015). Additionally, the political issues in regard to the situation can be referred to be the fact that, the government does not have adequate policies at place in regards to the overall management and consideration which is generally required in the case of an aged population (Telegraph.co.uk 2020). The pensions are given to the employees up to a certain age limit however, the particular population is now fit enough to work for a longer time frame and hence, the pension policy is beginning to collapse.

The social issues which are being faced in consideration are that there are no adequate activities which can be applied and may be suitable for the ageing workforce and the options available to the different individuals are rather limited (Kanabar 2015). In line with this, the increasing ageing population has a negative influence on the economic status of the country whereby although this population has the ability to work and forms an integral part of the society, however, they are not contributing adequately. Hence, as the issues have propped up, the proposal of increasing the State Pension Age to 75 by the year 2035 seems appropriate (Jones 2016).

Advantages of employing people beyond the Current State Pension Age

- Experience: The primary advantage of employing the different individuals beyond the current state pension age can be understood to be the fact that it will help the enterprise in performing well as these individuals have prior experience in the field.

- Knowledge: The individuals have prior knowledge as well and concerning this, they will be able to contribute effectively to the overall goals of the enterprise.

- Good image: Hiring of these employees will thereby assist in ensuring that the firm can enjoy a good image in the eyes of the investors as it encourages inclusion.

Disadvantages of employing people beyond the Current State Pension Age

- Health issues: These individuals experience considerate health issues which may impact their work (Berry 2016).

- Age group difference: The aged individuals may not necessarily be able to gel with the existing employees due to the age difference.

- Working style: The working style of these individuals may not be as proactive as required and this may lead to a poor workplace culture and related conflicts.

Figure 2: The increasing ageing population

(Source: Ageuk.org.uk 2020)

Government initiatives taken

The government has taken several initiatives in this domain so as to ensure that the individuals who are retiring from the workplace are being able to utilize their time accordingly. Working for a longer time period tends to improve the health benefits and hence, the government has undertaken various plans so that these individuals are successfully being able to manage the operations accordingly and in association with this, they are being able to come up with policies with respect to Health care so that the age group can be managed (Telegraph.co.uk 2020). In association with this, the government has planned certain employment programs which would help the individuals to pass their time accordingly.

Fairness of raising State Pension Age over such a short period of time

Vincent, Patterson and Wale (2017), states that although the proposal to increase the State Pension Age by 2035 seems to be amicable, various experts and related critiques may feel that the time period is to short. However, to justify this, it can be essentially mentioned that this increasing fitness with age is a phenomenon which has been taking place since a long period of time and hence, the 15 years proposed time is rather applicable in consideration to the fact that it is time to bring about this change and ensure that the population is being allowed to work until a longer age (Foster 2018).

Possible alternatives to the proposal

These individuals can be involved in another scheme which shall ensure that the population is successfully being able to manage their finances well and are still being able to employ themselves in a manner such that they are able to remain healthy by working for a longer time frame and additionally are also being able allow a regular flow of income for themselves.

Factors beyond retirement planning that this issue might impact

The issue pertaining to extending the Pension Age Limit affects domains like Organizational structure and the Healthcare planning as well (Telegraph.co.uk 2020). As increasing this age limit will assist in ensuring that the enterprises will be required to manage the organizational culture accordingly to see to it that they are being able to gel well with the younger population. Additionally, are being able to ensure that, the workplace queries can be resolved accordingly. In consideration with this, the issues relating to Personal finance planning and the Healthcare planning will also be affected accordingly. Ageuk.org.uk (2020) states that, the healthcare planning is affected because the issues related to ageing may be altered and additionally, personal finances of the ageing group also have to be planned accordingly.

Figure 3: The increasing ageing population

(Source: Telegraph.co.uk 2020).

Importance or otherwise of personal financial planning in finding a solution

According to Shipway et al. (2015), the personal financial planning has a key role to play in finding a viable solution because it will assist in devising a strategy which shall be useful for the ageing population to ensure that they are being able to remain independent and that they are being able to come up with a strategy with the help of which, their overall livelihood and quality of life improves. Once the personal finances of the population are in place, they will be able to perform well and undertake initiatives to improve their lifestyle (Foster 2018).

Relevancy to individual`s personal finances

The State pension age limit needs to be increased accordingly so as to see to it that the personal finances of the elderly can be managed well (Ageuk.org.uk 2020). This simply means that currently since the Elderly are being forced to retire and are being given the pension at an early age, these individuals are not being able to utilize the physical initiative and along with this, their mental ability as well. In regards to this, their expenses are at a high, however, the personal finances often fall short. In consideration of this, increasing this limit will have a positive influence on their lifestyle.

Professional Bodies Involved

The professional bodies such as CII and CISI are under the belief that considerate initiatives and new schemes need to be planned accordingly so as to ensure better entrepreneurial performance and to see to it that the different employees and individuals who are under the ageing workforce category are being able to perform well, contribute to the business dynamics and that their needs can be met with (Telegraph.co.uk 2020). This will ensure a better contribution to the society in terms of economic incentives and additionally, improve the health and overall wellbeing of the individuals as well which will thereby ensure full functioning of public services for all.

References

Ageing.ox.uk 2020. Ageing report [online]. Available at: https://www.ageing.ox.ac.uk/files/Future_of_Ageing_Report.pdf (Retrieved on: 10 Feb. 2020).

Ageuk.org.uk 2020. Age Uk [online]. Available at: https://www.ageuk.org.uk/globalassets/age-uk/documents/reports-and-publications/later_life_uk_factsheet.pdf(Retrieved on: 10 Feb. 2020).

Berry, C., 2016. Austerity, ageing and the financialisation of pensions policy in the UK. British Politics, 11(1), pp.2-25.

Foster, L., 2018. Active ageing, pensions and retirement in the UK. Journal of population ageing, 11(2), pp.117-132.

Jones, R., 2016. The unprecedented growth in medical admissions in the UK: the ageing population or a possible infectious/immune aetiology. Epidemiology (sunnyvale), 6(1), p.1000219.

Kanabar, R., 2015. Post-retirement labour supply in England. The Journal of the Economics of Ageing, 6, pp.123-132.

Shipway, D.J.H., Partridge, J.S.L., Foxton, C.R., Modarai, B., Gossage, J.A., Challacombe, B.J., Marx, C. and Dhesi, J.K., 2015. Do surgical trainees believe they are adequately trained to manage the ageing population? A UK survey of knowledge and beliefs in surgical trainees. Journal of surgical education, 72(4), pp.641-647.

Telegraph.co.uk 2020. Article. [Online]. Available at: https://www.telegraph.co.uk/news/2019/10/21/number-85s-uk-double-25-years-amid-fears-social-care-crisis/ (Retrieved on: 10 Feb. 2020).

Vincent, J.A., Patterson, G. and Wale, K., 2017. Politics and Old Age: Older Citizens and Political Processes in Britain: Older Citizens and Political Processes in Britain. Routledge.

Determining the factors affecting the price of branded apparel items worldwide from manufacturing facilities to in-store or online sales in various regions across the globe to provide useful information to customer making them save money where ever possible.

There are many factors in price rising. One of them is keystone discounts. It is a technique that multiplies the cost base by a factor of 2, to determine the price for next value chain. It was originated of consistent labelling products to a competitive level around the retailer and the idea is to maximize the price of each commodity so that the retailer profitability was more of a functional in sold units.

The use of secondary data is a highly ethical practice in itself: it maximizes the interest of any (public) expenditure in data collection, decreases the burden on respondents, guarantees the replicability of study results and thus greater consistency of research procedures and the quality of research work. But the importance of secondary data is only fully understood when these advantages outweigh the costs, especially in terms of individual re-identification and disclosure of sensitive information.

The consumer-fashion sector is divided into two complementary brand and distribution divisions in order to better serve the market place. Marks concentrate on the design, manufacture and distribution of quality goods for their demographic objectives. Retailers seek to optimize the product / markt suits for every retail site and properties, their brand selection, their inventory quantities and their demand generation ..

.