Answer to Question 1

When both of the players select strategy C, the best possible outcome is attained, with each of them getting a 2.5 payoff. This payoff is the maximum which these players can get without having to cooperate to each other.

The pure-strategy Nash equilibria are (A, A), (B, B), (C, C), and (D, D).

Since there does not exist any incentives for participants to move away from their strategies, cooperation can be challenging to attain in the context of this game. If the players play a couple of times, then as well the cooperation is discouraged by the dominant strategies.

In this game there are no gains from the renegotiation. Hence, renegotiation is highly unlikely in the context of this game. Each participant’s approach is optimum considering the strategy of the opposing player, additionally any straying from the strategy that was chosen is going to result to a reduction in payoff for both of them.

Answer to Question 2

| WB – Advertise (A) | WB – Not Advertise (NA) | |

| Disney – Advertise (A) | (2, 2) | (7, 0) |

| Disney – Not Advertise (NA) | (0, 7) | (5, 5) |

The Nash equilibrium for this scenario is no longer a dominant strategy equilibrium. In this scenario with advertising costs, the game has no unique Nash equilibrium. There are multiple possibilities depending on each company’s perception of the other’s strategy. It could lead to:

An Advertising war (A, A): Both companies advertise, splitting the market after incurring advertising costs (resulting in a lower profit compared to not advertising).

A situation where neither advertises (NA, NA): Both companies save on advertising costs but capture only half the market share.

A scenario where one company advertises and the other does not: This depends on who anticipates the other’s choice correctly, leading to a potential advantage for the advertiser.

In a 5-year game, advertising becomes less appealing due to future costs, leading to a subgame-perfect equilibrium where companies may not advertise in later periods, potentially encouraging mutual cooperation for profit maximization.

There exists a subgame-perfect equilibrium with higher equilibrium pay-off by strategically cooperating in later periods, not advertising, and discounting future profits. This strategy maximizes immediate profits by encouraging cooperation and not advertising in later periods, resulting in higher equilibrium payoff.

Answer to Question 3

In this equilibrium, society would believe:

College degree & Passed test: Middle productivity (only group to get a degree)

College degree & Failed test: Impossible (middle productivity would not waste money failing the test)

No degree & Passed test: High productivity (cannot be middle or low due to test and no degree)

No degree & Failed test: Ambiguous (could be high or low productivity)

| Obtain Degree | Do Not Obtain Degree | |

| High Prod. | 120 | 120 |

| Middle Prod. | 90 | 90 |

| Low Prod. | -80 | 0 |

Only middle productive types find it beneficial to obtain a degree, leading to an equilibrium where only they choose to signal their productivity through education.

| Obtain Degree | Do Not Obtain Degree | |

| High Prod. | 120 | 120 |

| Middle Prod. | 90 | 90 |

| Low Prod. | -200 | 0 |

High productive types prefer not to obtain a degree due to the cost, but with the belief that non-degree holders passing the test are middle productive, they choose to obtain a degree to signal their higher productivity.

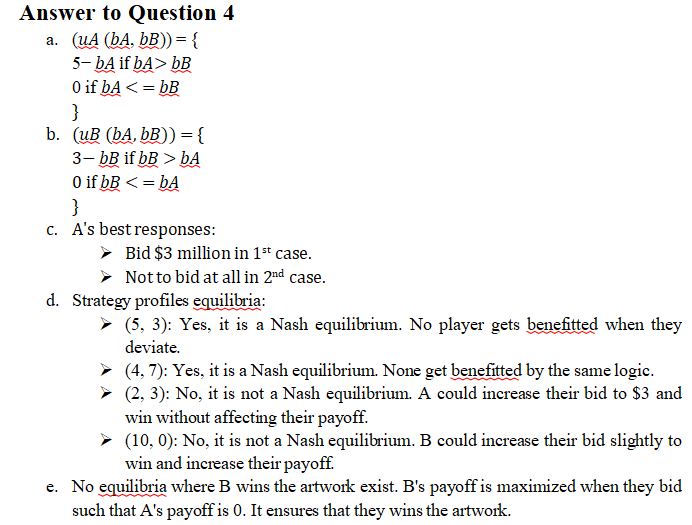

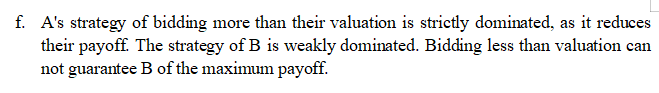

Answer to Question 4