Part A:

One of the most widely used measurements for risk assessment and risk management in investment portfolio is Value at Risk (VaR). In order to identify and understand the exposure to risk VaR is extremely useful and effective. The normal distribution of past losses are shown using VaR and used in investment portfolio to determine confidence interval in such investment portfolio. In simple terms probability based minimum loss in dollar terms in an investment portfolio is estimated using VaR.

Here the investor has invested in 20,000 shares of National Australia Bank and in 5000 shares of Rio Tinto. Estimating value at risk of the stock portfolio will enable the investor to evaluate the expected performance of the portfolio. The details of investment is provided below.

| Investment | Amount ($) |

| 20,000 NAB shares on February 6, 2020 @25.61 per share | 512,200.00 |

| 5,000 Rio Tinto shares on February 6, 2020 @55.68 per share | 278,400.00 |

| Total investment | 790,600.00 |

It is important to note that since it was mentioned that the shares were acquired before trading opened on February 6, 2020 hence, the closing price of the shares on 5th February, 2020 have been considered to calculate the cost of investment.

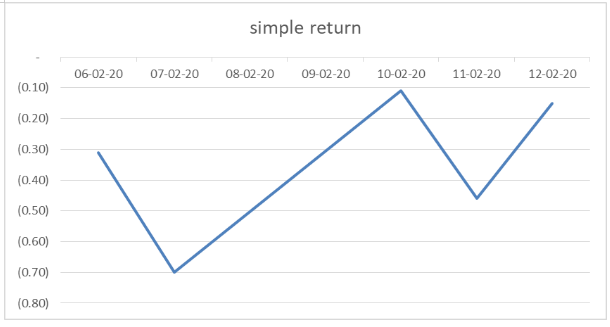

The share price movement of RIO is provided below on the basis of which simple return has been calculated for next 5 trading days for the share, i.e. till February 12, 2020.

| RIO | |||||

| Date | Open | High | Low | Close | simple return |

| 06-02-20 | 55.689999 | 55.79 | 55.220001 | 55.38 | (0.31) |

| 07-02-20 | 54.43 | 54.64 | 53.689999 | 53.73 | (0.70) |

| 10-02-20 | 53.540001 | 53.61 | 53.080002 | 53.43 | (0.11) |

| 11-02-20 | 54.310001 | 54.35 | 53.599998 | 53.85 | (0.46) |

| 12-02-20 | 55.43 | 55.51 | 54.959999 | 55.28 | (0.15) |

| Risk measure | 0.22 |

| Covariance | 0.01 |

| Average return | (0.35) |

| Standard deviation | 0.2162036 |

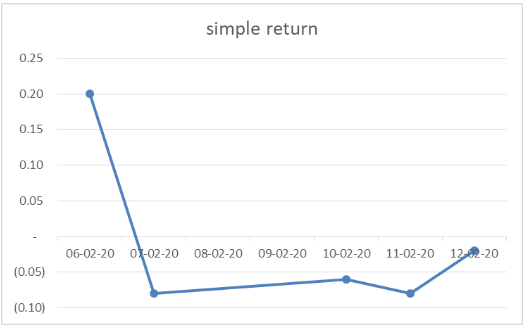

The share price movement of NAB is provided below on the basis of which simple return has been calculated for next 5 trading days for the share, i.e. till February 12, 2020.

| NAB | |||||

| Date | Open | High | Low | Close | simple return |

| 06-02-20 | 25.75 | 26.035 | 25.72 | 25.95 | 0.20 |

| 07-02-20 | 26 | 26 | 25.68 | 25.92 | (0.08) |

| 10-02-20 | 25.84 | 25.905 | 25.71 | 25.78 | (0.06) |

| 11-02-20 | 25.98 | 26.06 | 25.805 | 25.9 | (0.08) |

| 12-02-20 | 26.15 | 26.28 | 26.05 | 26.13 | (0.02) |

| Risk measure | 0.11 |

| Covariance | (0.01) |

| Average return | (0.01) |

| Standard deviation | 0.106282958 |

| Amount of investment (Exposure) | 790600 |

| Standard deviation | 0.1774964 |

| Time horizon | 5 |

| Confidence level | 99% |

| VaR | 56641.44 |

| (790,600.00 * 0.1800 * 5.000.5 * 0.18) |

VaR on the basis of historical return is calculated below is $56,641.44 thus, the minimum amount of loss that the investor can suffer is $56,641.44 over the concerned period as per VaR.

Annualized return method:

| VaR | |

| Amount of investment (Exposure) | 790600 |

| Standard deviation | 41.2204258 |

| Time horizon | 5 days |

| Confidence level | 99% |

| VaR | 686565.12 |

| (790,600.00 * 0.1800 * 0.010.5 * 41.22) |

As per annualized rate of return VaR is 686,565.12 indicating significantly higher amount of minimum loss due to decline in share prices.

The variance- covariance method:

The variance covariance method is used below to calculate VaR.

| VaR | |

| Expected weighted return of the portfolio | (51.96) |

| Z score confidence level | 99% |

| standard deviation | 41.2204258 |

| Portfolio value | 790600 |

| VaR | (73,343,094.71) |

The amount of VaR using variance-covariance method is clearly unrealistic and impractical at $73,343,094.71 considering that the cost of investment is only $790,600.

From the above results it is clear that Historical method provides best measurements to analyse the performance of the portfolio. The fact that history repeat itself though not always true but in this case the results under this method is most appropriate considering the movement in share prices.

Part B:

Reflecting on approach of learning:

The approach of my learning is dependent on the subject mainly. In subjects and areas of learning where it is good to conduct group study such at the time of trying to a master a new or trying to prepare for exams by taking self-assessment tests. Thus, in these specific areas I like to work with others to not only learn but also to assess myself against others. Generally, in learning I try to avoid activities that require too much energy. Anything properly explained by the professor and faculty with practical examples is very attractive way of learning and I find it very to grasp even most difficult learning curriculums by use of practical examples. In case I find something difficult to understand than I generally ask the teachers to help me out in understanding the matter clearly. Considering the huge reach of internet and huge variety of resources available online I refer to these resources as and when necessary to approach new and complex ideas differently. Generally efficient utilization of time to learn properly is my approach to learning and till now it has paid me huge dividend.

Reflecting on learning in EFB344:

Sub part 1:

Concentrating on finding credible and genuine data about the particular companies of whose shares the investors have purchased helped me immensely to carry out appropriate calculations on these data to correctly determine VaR of the portfolio. The reason that I think it has helped me learning by making a difference is because I think now I understand the implications of different data better.

Sub part 2:

Conducting more research on VaR and various methods used ot calculate VaR would have been very helpful to me to learn various aspects of VaR more effectively and efficiently. The reason researching has been selected is because availability of resources in internet and online platforms have improved the ability of the students to learn many new things without need to wait for the responses of professors and colleagues always.

Sub part 3:

The approach to my future study would obviously improve significantly as more in-depth research shall be carried out on the subject before proceeding to formulate the answers for a given problem. By doing this I will be able to learn better by undertaking appropriate level of research. In future thus, majority of time shall be invested firstly to conduct detailed research on a subject matter before proceeding to discuss and solve the issues in relation to the subject matter.