Question one

Introduction

Question one addresses the government auditing system in the USA. Under the government auditing system, the paper looks at the challenges, ways to improve blockchain and smart contracts, real-time auditing, automatic monitoring control, extract evidence from the source, format and standardise complicated data. Also, organising financial and non-financial data is discussed. This section also addresses most of the auditing issues faced by the US government in carrying out successful audits and corruption control. The section generally shows the latest systems of technology that is blockchain and smart contracts and how they generally affect the process of Auditing in the United States of America.

Government auditing system in the USA

An auditing system refers to a set of programs, information system and packages used in obtaining a good financial statement audit (Chia, 2015). In the US, the government adopted generally accepted auditing standards (GAAS). This was set by the Auditing Standards Board (AASB) for the American Institute of the Certified Public Accountants (AICPA). All public companies in USA are required to follow Generally Accepted Accounting Principal (GAAP) (Peters and Romi, 2015). According to Johnston (2019). All the financial statements must be prepared by the accountants of private companies by following GAAP. GAAP is generally known as the usual set of standards, procedures and principles given by Financial Accounting Standards Board (FASB). Generally Accepted Accounting Principal combines authoritative standards and the normally accepted ways of reporting and recording all accounting information. In the auditing system of US, GAAP has increased consistency, compatibility and clarity of financial information.

From the yellow book, the government employs generally accepted government auditing standards (GAGAS) (li,2018). GAGAS has guidance and requirements that deal with transparency independence, ethics, quality control, peer review, conducting engagement and reporting ad auditor’s professional judgement. In the US, GAGAS is mostly used by contract auditors, municipal auditors, supreme audit institutions, federal international agency, federal inspector general and certified public accounting firms. Generally accepted government auditing standards is applied to the engagements which pertain to government programs, entities, activities and functions and some other non-governmental organisations or non-profit entities that use the GAGAS voluntarily. The relationship of generally accepted government auditing standards generally requires, that independence between the auditor and the firm being audited should be strictly maintained. The government of USA uses generally accepted government auditing standards in preparing all the financial audits. It is mandatory for all public institutions to prepare their reports in line with generally accepted government auditing standards. This makes auditing very easy in all government agencies or entities. Generally accepted government auditing standards is also applied in attestation level examination (li,2018). The system is used in reviewing all the audit reports for the purposes of formulating an excellent and effective audit report. Generally accepted government auditing standards is mostly employed by the financial sector of US government in preparing performance audits.

Government auditing Challenges in the USA

Shortage of Government auditors. The government auditing section lacks a good number of auditors for carrying out successful audits. The government has very many projects that are beyond the available number of auditors (Xu,2016). The government is totally challenged as most of the projects are left unaudited due to inadequate number of auditors. There is no enough labour for reviewing the audit reports just in case there is something which is unsatisfactory (YU and nest, 1973). Most of the reports are based on assumptions especially for minor projects as much of the time is spent on Auditing big government projects and the small projects are not audited since the number of government auditors cannot fully exhaust the auditing process of all government projects (Woodrof and searchy, 2001). Most of the auditors are employed by private firms and the government is left without any option apart from using a few auditors it has. This has generally retarded auditing by the government of the US. Despite all the incentives that are given to the government auditors, the country still has a less number of the auditors who can exhaust all the government projects.

Untrustworthy digital records; The current digital records are not accurate and secure for reporting appropriate records. The digital records are liable to fraudulent changes which affect the audit reports (Varsaheheyi et al. 2015). The digital records are also liable to a lot of errors during the process of recording. Since the digital system is not strongly secure, the audit reports generated are not totally accurate and reliable. The government has found it difficult to access accurate records and generating the system which strongly violates data manipulation (Willamson, 1973). The auditors usually access the records that are given to them according to the desires of the accountants since there is a possibility of manipulating the records in the system before the auditor is involved (Varsaheheyi and Halpper 2004). Therefore, the primary objective of auditing by the government is generally rendered ineffective. This is because the government auditors usually access the manipulated financial records. Government auditing is generally hindered by inaccurate data and failure to have good error tracking information systems (Varsaheheyi and Halpper, 2002).

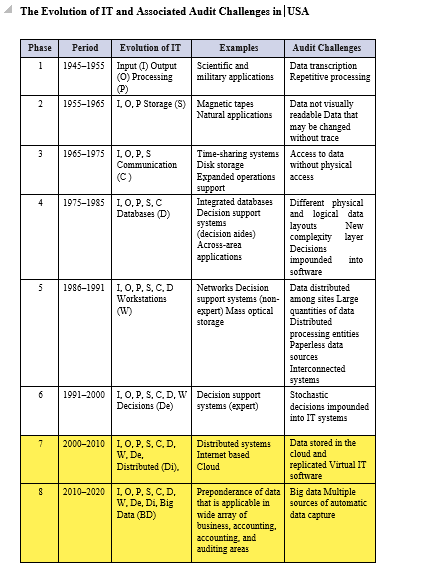

The chart below clarifies the challenges that are faced by auditing technology in the United states of America since 1945 to 2020. It shows that digital platforms have various audit challenges.

Complexity in gathering audit trails. An audit trail is a security relevant chronological record for showing a sequential evidence concerning a certain transaction or operation (Alles et al. 2018). In other words, an audit trail shows a list of steps in their chronological order starting from the beginning of the transaction to its end. Government auditors are tasked to collect trails from various sources. This is because the government has many entities which use different sources (Appelbaumet et al 2017). The audit trails have to be gathered from suppliers, government departments, IRS, carriers, third parties like banks and many more. The process of approaching various stakeholders is very lengthy. It takes a lot of time to track all the transactions by following all the necessary steps that were involved in carrying out a certain transaction (Appelbaumet et al 2015). This is generally a big challenge to government auditors since they are few and cannot get enough time to collect all the audit trails. Auditing is generally affected by poor systems for tracking all the steps involved in carrying out the transitions by government agencies. Since the process of collecting the audit trails is hectic and ineffective, government auditing is generally hindered (Bothernic an pennington, 2017). Most of the auditors fail to obtain all the audit trails thus causing inefficiency in auditing. The government has generally failed to enforce a good system that can easily aid the collection of audit trails by the government auditors. This has generally rendered government auditing ineffective (Bozdag, 2013).

Complexities in financial transactions; Generally, most of the government institutions have complicated data. They have developed a lot of complexities in the financial transactions. The systems used by government agencies in performing transactions are complicated. Complicated transactions and the related systems have greatly hindered government auditing. Government auditors find it so challenging to access the right information required in auditing since the systems are so complicated. Most of the government workers take advantage of taking part in complicated transactions and the related system with confidence that the auditors will not access the right information. Proper auditing requires accessing of the most meaningful information about the transaction. Since the data and the systems are complicated, it implies that government auditing is generally hindered (Chavez, 2015).

Challenges of government auditing and corruption control

a. Abuse of power and resources.

Abuse of power refers to the unlawful use of the office or misconduct of an officer (Chai, 2015). This generally affects the real performance of the official duties. Officials who indulge in abuse of power are those who generally involve themselves in corruption for personal gains. Abuse of power and resources generally hinders auditing and corruption control (Dai and Hashelyi, 2017). Government workers usually divert the would be public resources for their personal benefits, by taking advantage of their positons. Most of the leaders usually bribe the government auditors in order to shadow up the process of auditing. Therefore, government auditing and corruption control have generally been hindered by abuse of power. Government officials in the US take use of the loopholes in the accounting system of the US to hinder auditing (Florini, 1999). Leaders usually use their offices to promote bribery and corruption since there are chances of hiding the evidence. Evidence is hidden in a way that the leaders take part in complicated transactions. The confidence of taking part in complicated transactions comes from the fact that they have the full potential to corrupt the auditors.

Some government officials deliberately refuse to give all the records to government auditors. Some information is forcefully concealed by some government officials (Gaetane et al. 2017). This is normally done by the top management in case it is notices that there was an abuse of resources somehow somewhere. Abuse of power usually violates the principal of independence in auditing. If an auditor is not given enough independence, auditing is generally interfered. Abuse of power and resources generally creates a big room for fighting independence of an auditor. This negatively affects auditing and corruption control since the auditor is not given a clear environment of auditing.

Some top government officials in the US, influence the subordinates especially in the accounting department to manipulate the records. Government officials do this in order to divert public resources for their personal gains. Auditing and corruption control have been limited by failure to access meaningful and accurate records as a result of abuse of power by some officials, who deliberately manipulate the records. The audit reports generated from the manipulated records usually lead to a poor audit report. A poor audit report generally depicts a weakness in government auditing and corruption control (Kivati, 2015).

According to Kivati (2015), in the United States of America, some government officials use their offices to ensure that auditing is un successful. Most of the government officials generally interfere with government auditing by violating all the principals of auditing, especially confidentiality and in dependence. They tend to know the government auditor before the day of auditing. The auditor is bribed before auditing and the entire process of auditing and corruption control becomes ineffective. Most of the information is not given to the government auditor. Government auditors also indulge in abuse of power and resources by accepting a bribe from other government officials before the day of auditing. Abuse of power is generally done by both government officials and government auditors. This is generally a great hindrance to successful and meaningful government auditing and corruption control.

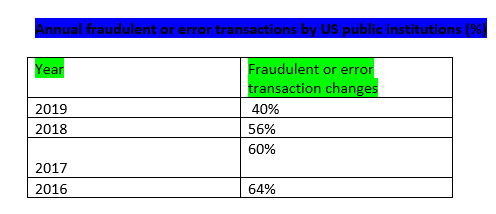

b Transactions changed fraudulently or by error

From the table above, it is generally observed that the percentage rate of the recorded transactions which are changed fraudulently or by error is reducing in public institutions. It can be seen that the percentage was at 64% in 2016, in 2017 it was recorded at 60%, in 2018 it was recorded at 56% and it 2019 it was recorded at 40%. The reduction is attributed to the continuous adoption of continuous auditing in most of the government institutions. This is because it reduces the chances of changing transactions fraudulently or by error as it contains features of automation and record keeping is done in digital manner (Jonstone, 2020).

Question one D

i How blockchain and smart contacts organise financial and non- financial data

Blockchain usually grows a list of records known as blocks. The financial data is stored in its block and the non-financial data is also kept in another block which is linked to the first block. The block of financial data and non-financial data are linked using cryptographic hash. Every block has a cryptographic hash of the previous block. Moreso, data about different subjects is stored in different blocks but if you access data in one block you can easily access data in another block (Tendermint Blockchain Consensus,2017).

ii How blockchain and smart contracts format and standardise complicated data.

With blockchain technology and smart contracts, once the data is registered in a block, there is no possibility of altering it retroactively. In order to alter the data, you must alter the subsequent blocks. This calls for consensus of network majority. In the processing of using a consensus network of majority the complicated data is formatted. Blockchain also standardises complicated data by denying room for data alteration ( Raiden Network,2017).

iii. How blockchain and smart contracts enable auditors to extract evidence from source.

In the ledgers of blockchain and smart contracts all the transactions that are valid are appended by using a time stamp. This generally helps the auditors in extracting evidence from the true source. This also helps to avoid counterfeits and theft. Blockchain and smart contracts reduce paper work and promote compliance. Therefore, auditors extract evidence from the source since blockchain and smart contracts are not associated with paper work. Smart contracts applied on the blockchain help the external auditor to develop the procedures which can help him to extract information from the right source. Smart contracts applied on the blockchain also work as a distributed open ledger for recording the transactions between the involved parts in a transaction in a verifiable, efficient and permanent way. Generally, blockchain serves as a source of the transaction reports. Therefore, with blockchain and smart contracts, auditors can obtain information from the source (Ethereum Blockchain Application Platform, 2015).

iv How blockchain and smart contracts improves automating error and data verification in real time.

Blockchain and smart contracts present data in a digital form. Therefore, data can be accessed by the holder of an account/account user. Data can be altered and verified in case it is important to automate some errors and verification is typically easy after alteration of the data. Blockchain and smart contracts use analytical tools emphasized by regulators and standard setters that have tools for automating errors. These tools involve oracles and smart audit procedures which critically detect the possible financial errors recorded and also facilitate verification of the data in the real time (Block Confirmation, 2016).

V How Blockcain and smart contracts improve monitoring control automatically on a more frequent basis/

Brockchain and smart contracts technology use smart internal control test and analytical procedures. These autonomously carry out the execution of the procedures on behalf of the auditing staff. The smart internal control tests are combined with the analytics to automatically monitor the risk activities in the public institutions of the US. The analytics ease the mode of understanding how the transactions are carried out in a smart way for the purposes of quick evaluation. The smart internal controls automatically detect errors and financial risks and automatically exercise control over them (Bigchain, D.B, 2017).

Vi How blockchain and smart contracts improve real time auditing

Real time auditing takes use of another cost containment approach and proactive quality especially in the public health institutions of the US. It usually happens when an auditor is available in the course of treating the patient (Blockgeeks,2017).

The smart contracts which are deployed on a blockchain which is invented by the external auditor facilitate real time auditing by executing audit procedures. The conceptualization of the smart contracts procedures is modified in the blockchains to enable the external auditors to come up with real time audits for various stakeholders like, audit inspectors, suppliers, investors, audit committee and the government institutions. This is because the brockchain gives a platform for executing smart audit procedures that enable real time auditing. The audit procedures enable the auditors to identify the higher risk procedures and compile an audit reports more quickly. The smart audit procedures are exercised on the participating nodes on the blockchain of the auditor on a good real time basis. This promotes transparency and enables real time auditing (DHS Awards Blockchain grant of Identity Management, 2016).

Conclusively, the government of USA uses generally accepted government auditing standards (GAGAS). This auditing standard is used by all the public institutions and non-profit entities and non-governmental organisations that use the system voluntarily. Literature shows that the top government auditing challenges in the USA involve, shortage of government auditors where government projects are more than the auditors, untrustworthy digital records, complexity in gathering audit trails and complexities in financial transactions that lead to complicated data which distorts auditing. Literature also shows, that government auditing and corruption control is basically affected by abuse of power and resources where both government officials and government auditors indulge in corruption thus distorting the entire process of auditing. Government auditing and corruption control is also affected by fraudulent changes in the recorded transactions. The study revealed that Blockchain and smart contracts generally have high options for improving, real-time auditing, monitoring control automatically on a more frequent basis, extract evidence from source, format and standardise complicated data and organising financial and non-financial data.

Question 2

Introduction

This question addressed the explanation of continuous auditing and how it is beneficial. It clearly unravels how continuous auditing is different from traditional auditing especially in terms of operations. This section also gave an overview of how continuous auditing has changed the nature of auditing and the recent literature about how continuous auditing is generally applied

A. Continuous Auditing

Continuous auditing refers to an internal process used in examining risk controls, accounting practices, information technology system, compliance, and the business procedures on the prevailing basis. Continuous auditing is basically driven by technology, and it is primarily used in real time data verification and automate error checking. A continuous audit system consists of alarm triggers which provide quick notice concerning the errors and anomalies detected by the system. Continuous auditing promotes quick and continual assessment of the controls’ effectiveness. Continuous auditing usually focusses on the current ongoing risk controls and accounting practices. Continuous auditing is usually employed in the US as there has been an implementation of the new procedures in tracking the effectiveness (Liang, 2017).

Most of the people use computers for continuous auditing and computer aided auditing, however both technologies are different form each other. Under computer aided auditing, the auditors are generally helped by technology like spreadsheets in completing the periodic audit. Computer aided auditing is generally driven by the auditor whereas continuous auditing is designed to run automatically at stipulated tight intervals. Continuous auditing is generally known as an automatic method that is used in in the performance of auditing activities, such as risk assessment and control by using technology. Technology is very vital in continuous auditing as it helps in automating the identification of anomalies or exceptions, analysing patterns which are in the key numeric fields. Continuous auditing is also crucial in testing controls and reviewing trends in the public intuitions of USA (Simoyana et al, 2017).

Continuous auditing is also known as the real time or near real time ability of checking and sharing financial information. Under continuous auditing, information integrity is easily evaluated at a particular time. More so, information can continually be checked for fraud, inefficiencies and errors automatically. In the US, banks and telecommunication companies use continuous auditing technology. Most of them at least have SAP system to assist them in managing all the operations properly. The US has been facing a problem of shortage of auditors. Therefore, both private and public organisations have adopted continuous auditing since it is automatic and does not require manual intervention. Continuous auditing is regarded to as a conceptualisation of auditing in the US as it is believed to provide third party attestation. It also assists in monitoring processes, transactions, and future controls. The US has put much emphasis on adopting Continuous auditing in almost all the government institutions as it is efficient in the mode of operation (Mitshedit, 2016).

Generally, continuous auditing is regarded to as the transforming the external and internal auditing by applying modern information technology. The ethnology used is automatic in the mode of operation thus it is not aided by the auditor. The audit reports can be formed and reviewed on a daily basis, weekly, monthly, quarterly or annual basis since it is easy to check the system as auditing is totally automatic.

Continuous auditing usually comprises of seven steps as seen in the chart below

The firs first step is about establishing apriority area that is, the area which requires auditing. The second step involves defining and identifying audit rules, determining process frequency, configuring parameters and execution, managing results and follow up, report results and assessing emerging risk and adding to register respectively (Aldemen, 2011).

B. Difference between continuous auditing and tradition al auditing.

Traditional auditing focuses on the transactions that produce financial reports like balance sheets. Traditional auditing is manual in the mode of operation. Continuous auditing is better than traditional auditing since it is automatic in the mode of operation. Continuous auditing entails thorough use of technology in compiling the audit reports yet traditional auditing is not technology driven. Continuous auditing is associated with few errors compared to traditional auditing since it is automatic in the system (Chia,2015). Continuous audit reports are more reliable compared to traditional audit reports since the degree of errors in the continuous reports are minimal compared to the degree of errors the. Continuous audit reports can be compiled and viewed on a daily basis yet traditional audit reports cannot be compiled and reviewed on a daily basis. It requires a lot of time to prepare traditional audit reports compared to continuous audit reports. Traditional auditing uses accounting systems which are paper-based and it is carried out usually at the end of the year or quarterly. On the other hand, under continuous auditing, there is less or no use of paperwork in the accounting systems used (Peters and Romi, 2015).

Traditional audit programs are usually designed to give an assurance to the organisation that internal controls exist to control fraud, continuous auditing programs strictly detect fraud and make an alarm in the system. Therefore, continuous auditing is more effective compared to traditional auditing. Traditional auditing uses sampling of data, while continuous auditing examines all the data. Sampling of the data has its problems like choosing a wrong sample size. This affects the general auditing report formed. sampling of data is generally unreliable compared to examining all the data. Therefore, it is very crucial to employ continuous auditing. other than using traditional auditing. There is continuous monitoring of the records and provision of the reply under continuous auditing, yet there is no automation under traditional auditing (Labelle et al.2010).

Traditional auditing majorly handles financial information only, while continuous auditing handles both financial and non-financial information. Most of the public organisations engage in non-financial dealings. In the past the use of traditional auditing could only cater for financial information and leave the non-financial information, yet big non-financial deals define the role of government institutions especially in offering the services. Audit reports generated by traditional auditing are biased since they exclude non-financial information. Therefore, in order to come up with meaningful and effectual audit reports, both the private and government institutions should generally adopt continuous auditing ( Ademen, 2011).

Traditional auditing uses past records or historical data to generate an audit report while continuous auditing generates the most current reports since the system automatically runs an audit report every time a transaction is carried out. For efficiency in auditing and decision making by the government institutions, it is relevant to use continuous auditing other than traditional auditing. The costs and time involved in traditional auditing are very high compared to traditional auditing.

Question 2c

Explain the continuous Auditing benefits.

Continuous auditing involves the process that is internal for examining the practices of accounting, the compliance systems of information technology, risk controls as well as the procedures of business. Continuous auditing is driven by the technology and designed to automate the checking for errors and verifying the data in the real- time. Continuous auditing ensures immediate detection of fraud and errors. This due to the fact that at regular intervals, the auditor is required to perform accounts checking in a detailed manner. Equally the same, the opportunities for frauds that are complicated are reduced since they can be detected before such frauds attain very large proportions in the accounting system. There is also easy rectification due to the early detection of the fraud within the system since the detection of the error is followed by immediate rectification in the system ( Labelle et al.2010).

Under the system of continuous auditing, there is detailed accounts examination which enhances the checking that is deep to the system of accounting. This avails the auditors with an opportunity to purposely finish a given financial year. More still, the continuous audit ensures proper planning of the work associated with auditing. The auditor can systematically plan for the work of auditing. This can even spread throughout the year which improves the audit work efficiency. Continuous auditing also ensures quick interim accounts preparations. This is an activity performed by several countries who provide interim dividend. In this scenario, Continuous auditing tends to offer great help due to the interim accounts that are always prepared without delay. It is accompanied by immediate finalization of the accounts of auditing. This is due to the fact that complete and quick accounts are sooner presented by the auditors (Peters and Romi, 2015).

Valuable suggestions are as a result of continuous auditing since the auditors tend to stay more in touch with the accounts of the business. Therefore, the auditor is able to understand the details which are technical about auditing. This helps the clients to provide suggestions that are valuable to the system of accounting. Updated accounts can also be due to the continuous auditing which causes efficiency of the staff accounts of the departments (Ongaro and Ousterhout, 2014).

Continuous auditing keeps the staff of auditors busy. This ensures provision of ready information due to the proprietor concern from the desired information and verified without difficulty at any time. Therefore, continuous auditing ensures greater moral checking. This is as a result of surprising frequent visits provided by the auditors to the accounts of the business. This is accompanied by up to date recording by the auditing staff. This offers proper moral checking regarding the dishonest practices detected from the uncertain clerks of intervals. Since the staff are not aware of the time the auditors attend to their performance (Cosmos Whitepaper,2017).

D How continuous auditing changes the nature of the audit.

Continuous auditing has simply eased auditing and the audit reports’ quality is generally reliable compared to other types of auditing. Continuous auditing has very good processes which managers use to ensure that, procedures policies and the processes of the entity are operating smoothly. It has a provision that allows the mangers or top officials’ effectiveness and adequacy of controls. Continuous auditing enables identification of assurance assertions and control objectives to establish automated tests (Liang, 2017). This helps in giving highlights concerning the transactions and activities which do not comply. Continuous auditing enables daily monitoring of the internal control activities since the reports are generated on a daily basis. Managers can track the data about the transactions and make the relevant assertions on a daily, weekly or monthly basis. Yet, in the traditional auditing system, the internal control system effectiveness used to be hindered by a delay in the audit reports as most of the reports were give on the quarterly or annual basis (Chia, 2015). Continuous auditing has generally improved the control environment and overall monitoring of the activities in the organisation. In case there is an error or fraud detected, the managers can quickly understand and make proper evaluation under continuous auditing. Continuous auditing generally has reduced the errors in record keeping due to its advanced features that alert the concerned people to handle the issue (Hyperledger, 2016).

Continuous control enables the managers to know the most critical control points, rules and exceptions quickly compared to performing manual internal control system and substantive detailed testing periodically. Mangers are capable of making assertions, perform critical control and assessment of risks in the real time or near real time because of the automated analysis of data. Mangers have been changed to adopt the system of being data driven in handling all the control procedures as the system generates new reports specifically on a daily basis. Generally continuous auditing has improved the internal control system of both government institutions and non-government institutions to daily review instead of periodical review (Labelle et al.2010).

Mangers have revealed that continuous auditing has reduced the efforts in the implementation of the internal control system as seen in the figure below.

- Examples of applying continuous auditing methodology from recent research.

Continuous auditing has been used by government auditors to monitor the performance of commercial banks. Several researchers revealed that continuous auditing helps the managers of the banking institutions to monitor the activities of the bank on a daily basis. Government auditors take more use of continuous auditing to manage the operations of other businesses (Chaia, (2015), Aldemen (2011) and Calderin and wang (2012))

Continuous auditing has improved efficiency of audit reports in the government institutions. Continuous auditing has been applied by following all the steps in evaluating the school activities and the money received from the states. The findings show that the audit reports generated by government auditors have generally been vital compared to the traditional auditing (Aldemen 2011 and Calderin and wang 2012)

The telecom companies in the US have delighted in the use of SAP. This has been adopted by almost 80% of the telecom companies in America. Recent research shows that continuous auditing has eased the mode of operation of the telecom companies. The mangers visit daily records to make new control policies and the risk assessment procedures ((Chia (2015), Johnston (2019), Aldemen 2011 and Labelle et al. (2010)

According to Johnston (2019) 50% of the companies in the United States of America use continuous auditing, whereas 31% are in the road map to using the continuous auditing. It is clear that companies that employ continuous auditing have been capable of changing their mode of operation in the shortest time possible compared to those that are still using traditional auditing. Continuous auditing has become the secret of business success in the US. The researcher reviews that companies that use continuous auditing do fall into fraud scandals and fraudulent errors are minimal

Conclusively, continuous auditing is very vital in both private and government institutions. It has an information system used in automatic auditing. The system has features of automation which eases the entire process of report compilation. The audit reports are formed on a daily basis and they are more accurate and reliable since the system is bound to making minimal errors. It was revealed that continuous auditing is more different from traditional auditing in terms of operation. Continuous auditing is technology based while traditional auditing uses manual means of auditing. Continuous auditing is more beneficial in a way that it improves the internal control system and the entire operation of the entity as reports are generated on daily basis. The study also revealed that continuous auditing has generally changed the nature of auditing from manual internal control to technology driven internal control system. The literature shows that most of the of the government institutions and private entities especially banks and telecommunication companies in the US use continuous auditing

Question 3

Introduction

This section presents meaning of the technology of blockchain. It further explains an overview of the blockchain technology, how to apply the technology in the government agencies, the benefits of the technology and the relevant examples regarding its application (Tapscott, 2016). The topic also demonstrates the limitations of the technology of blockchain which provides the general conclusion about the implementation of the technology in the government or public sector.

An overview of blockchain technology in government/ public sectors

A blockchain is used by the government sector to model the individuals and the businesses of the public sector. It is also applied in this sector in form of sharing the resources for the secured ledger distributed through the use of the cryptography. The structure of the blockchain eliminates a single failure point as well as protecting the citizens that are so sensitive to the data of the government. A digitalized blockchain protects the data, fraud can also be reduced, processes of streamline, abuse and waste. This tends to increase trust as well as improving the accountability. Using the blockchain by the government enables the individuals or the citizens to use the resources of the government of its businesses. The government based on the blockchain tends to reduce the processes of labor intensive. It further reduces the costs of accountability management, abuse and corruption as well (Vasarhelyi et al, 215).

There can be support provided by the distribution of the format of the ledger which enhances the applications of the sector. This includes the payments or currency in the digital format, digitalized registration of the land, supply chain, management of the identity, care in terms of health, corporate registration, management of the legal entities, voting as well as the taxation system of the government (Vaziri, 2016).

Currently, the US government applies the blockchain to join the legislation regulation race and start the projects of the pilot based on the technology of the blockchain. The government offers cybersecurity, optimization of the process as well as integrating the services that are hyper connected to the services bolstering accompanied by accountability.

How to use blockchain to improve data management in the public sector

The technology of blockchain simplifies the managing of the information trusted by the government. This makes it easy to obtain the application of the critical data of the public sector that maintains the information security in this sector (Yan, 2017). The blockchain consists of the digital ledger encoded and stored on the several computers of the network of public and private sector. It has blocks called the data records collected in a chain. However, these blocks cannot be deleted and changed by any actor (Yoon, 2016). There is an application of the government shared protocols which are so automatic to the programs of the system of the government.

It is noticed that, the banks have adopted the blockchain technology through the payment services of the providers which implies a great level of impact as well as high investment level of the technology of the blockchain. The US government has also deployed the blockchain technology through enabling the strategic pilot projects. The blockchain digitalizes the records existing on the agencies of the government and allows transformation of the records into smarter formats. The government can be in position to formulate algorithms as well as rules to allow automatic sharing of the data through the blockchain. In the long run, the blockchain technology will be in position to avail the individuals a chance to get access to the data and information there by, having control over it (Yermack, 2017).

The agencies of the government can use very many technologies and tools of the technology of block chain to implement and protect the data and information critical to the public and the government. This improves the management of the records of the self- owned property as well as the property to the corporation. More so, the technology of the blockchain protects the critical data through the efforts best for protecting the systems of the agencies since it eliminates the criminals that can access the databases of the government with the aim of stealing and manipulating the records.

Examples of applying the blockchain in government/ public sectors from the recent research

The hackers got access to the personal data and details of the United States government in 2015. The details included the fingerprints, history about the employment of the citizens, numbers of the social security as well as the information related to finance of over twenty million citizens. These citizens had been checked by the government of the United States (PCW, 2016). The methods of encryption may be safe at one hundred percent; however, breaches can be performed by the technology of blockchain which makes it difficult for the hackers to achieve these related encryptions.

The Estonia nation is trying to roll out the Keyless Signature Infrastructure (KSI) technology. This is done to ensure safeguarding of all the data of the public sector. This technology is composed of values that are hash and tend to represent the large data amounts uniquely like the numeric value which are smaller. The values (hash ones) can obtain the records; however, they cannot manage reconstruction of the filed information (Romero et al, 2012). The values are kept within the blockchain and are ever distributed via the private network for the computers of the government. The new value (harsh) is connected to the chain whenever there are changes to the underlying file. This makes sure that there is more change towards the information. Each record’s history is transparent fully and any unauthorized access is easily detected for prevention (Rozario and Thomas, 2017). The changes associated with the database of the officials of the government are monitored by the Keyless Signature Infrastructure. The technology changes the implemented records, and where they are made. It is now known that the records of health regarding the citizens of Estonian are controlled and managed through the application of the available technology of KSI. The country further plans to ensure availability of this system to all the agencies of the government and the sector of the private companies as well.

The transfer and owning process of the assets that is, financial instruments with the physical property consists of the interactions that are multiple and long in terms of a trail paper. The agencies of the government need to reduce the digitizing of the information regarding the ownership of the asset and use the registers of the blockchain to store it. This can be evidenced by the government of Swadesh’s application of the technology of blockchain. The case of the transactions of real estate in Sweden, there are high stakes. The country has over elven trillion Swedish Krona in terms of the properties accumulated in the country. This is three times more than the Gross Domestic Product of the country of Sweden. This is accompanied by onerous tasks regarding the properties transfer and registration in the country of Sweden. The authority of the land registry about the land is enhancing ways of digitizing the process. This is done through the application that is mobile based to provide space for the transaction of the buyers and sellers as well as the agents of the banks and real estates in the country. The technology of blockchain can adequately provide the real estate with information that is detailed regarding the sold properties and every transaction step (Stewart, 2015).

The benefits of using blockchain as database in the government sector

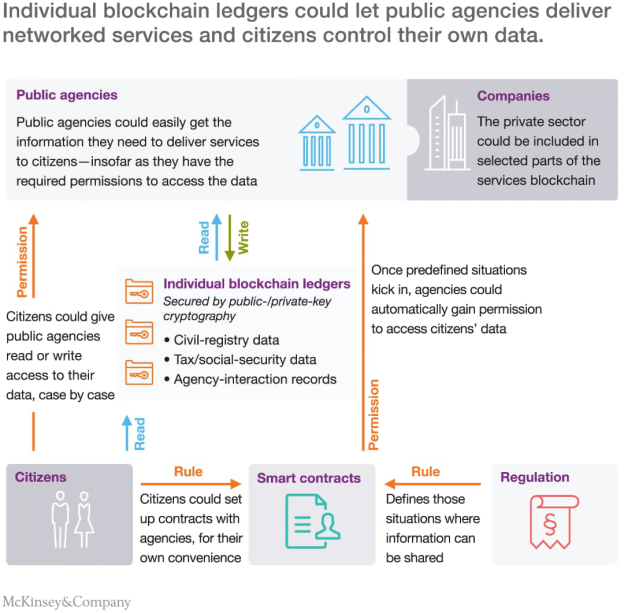

The US government gets gathered and safe guarded information from of thse citizens from block chain. The agencies of the public sector tend to provide and extend the social services to the citizens without enough information relating to the interactions. Equally important, the process of collecting the related information may require effort that is painstaking to the agency due to lots of time involved and the legwork. There is no requirement for the keeping of the data in silos thus, calling for the help of the blockchain technology. Therefore, the technology is graded at a rank of managing the construction of networked services of the public (Swan, 2015).

Source: (Dai and Vasarhelyi, 2017).

The limitations of using blockchain as database in the government sector

The departments of the government that need to apply the solutions of the blockchain towards the improved databases of the agency need to use the quick evolving industry. The blockchain technology requires over $1.2 billion as capital for the investment in the technology. Such decisions are so challenging towards the decision takers of the government in terms of faster growth that is needed by the departments (Aicpa, 2017).

Since the providers of the blockchain technology are small in terms of their start-ups, it seems to be impossible for the departments of procurement and information technology in the government sector to be the best partners with enough capabilities and power. The companies can even provide products that are cutting- edge. In addition to that, there are risks associated with the privacy that need critical attention. The government’s deployment of the blockchains that offer sharing of data via the networks of the public will leave it with a duty of finding encryption methods to enable privacy throughout the system (Appelbaum et al, 2017).

Conclusion

Since the blockchain technology is associated with a lot of benefits towards the improvement in the data quality management, the government sectors need to take into consideration of the pace that is rapid in innovation terms. It cannot forego the implementation of the blockchain thus, the challenges and risks can be approached (Badertsher et al, 2017). The government needs to adopt the approach to change incubator to enable scanning through the small team to enable prioritizing of opportunities for the pilots of the blockchain. This will be through selection of the right partners to implement the technology into the system. This can be the office that is central for the government’s digitization.

Question 4

Introduction

The technology of blockchain avails new drastic kinds of processing, recording and storing of the transactions and information of the financial sector. It has a great impact and potential towards the landscape change of the profession of accounting to reshape the ecosystem of the business. This article presents the improvement of the government audit by the blockchain and smart contracts with examples of application of smart contracts in the government sector (Bartoletti and Pompianu, 2017). It also explains the benefits of blockchain based on smart contracts in the government auditing and the ways the government auditors can apply the technology in the auditing of the government procurement.

In what ways could blockchain and smart contracts improve government audit?

The blockchain and smart contracts involve programs of the computer in form of a protocol of transaction with an intention of execution that is automatic to the system of the financial sector. They legally control the actions of the negotiation of the agreement. The technology of blockchain offers the possibility of reconciling the cash flow recording by the accountants (Buterin, 2014).

The blockchain and smart contracts avail the auditors and accountants with the ability to view the trials of the paper to solve for the problems of book keeping in the government sector. They offer the accountants of the government with the opportunity through the CPA that is, transparent to record the data of the citizens with the aim of ensuring accurate and truthful data and information to the agency of the government (Kuenkaikaew and Vasarhelyi, 2013).

First and foremost, the reduced fraud through the blockchain and smart contracts improves the accountang system of the government that seems to be more traditional. This is due to the fact that while applying such technologies in the system of the government, it is very difficult to perform any fraud accounting practice since in their nature, the systems are immutable. It is so difficult to modify any record of the systems by any actor since the copies of ledger are distributed simultaneously by the system (Dai and Vasarhelyi, 2017).

Auditing is totally reduced as the accountants expect less audits in the future. The auditors tend to automate the functions that are mostly involved in the auditing practice. This is by the greatest power and influence of the smart contracts. Therefore, the auditors and accountants of the government’ financial sector get excited about the blockchain technology. Special gratitude should go to the blockchain technology from the auditing department of the government sector. This is due to the fast auditing process from such systems regarding the records on the blockchain which tend to reduce time of the auditors as well as their need to check the books of accounting (Kuhn and Sutton, 2010).

The systems of blockchain and smart contracts improve the regulatory compliance of the government sector. The enhanced system of blockchain enables the agencies of the government to go through the satisfaction of the regulatory demands and needs. Due to the embracement of the smart contracts and the blockchains, the sectors such as authorities of regulatory can be embraced by the technology (Kogan et al, 2013).

The accountants can even start applying the automatic and smart contracts to ensure that the tasks are reconcilliated. In addition to that, the blockchain facilitates the field of entering data. This is due to the reduced errors due to the human nature associated with the technology which is automatic to the Information system.

The smart contracts and the blockchain technology improve the efficiency of the entered data of the system. This is among the considered legacy of the accountants which seems to be challenging. However, the blockchain facilitates everything easier and faster by the use of the robust database.

Finally, the technology of smart contracts and blockchain reduces the costs. Despite the fact that, the reduced costs, increased efficiency of the system greatly reduce the costs of operation, the accountants expect more reduction in the costs through the shift from one technology to another. This is provided by the systems of blockchain since it is cost saving to the government sector.

Examples of applying smart contracts in government / public sectors from the recent research

There is programming associated with the smart contracts with the aim of managing the applications granted by the government. The terms and conditions associated with track compliance, dispense loans are also automated with the aim of ensuring the tracked performance towards the data of the real- time are also among the operations of the smart contracts. It is accompanied by increased security to the citizens of the government, transparency and compliance (Kiviat, 2015).

The smart contracts can be applied in the E- Government regarding the performance of the government. The Electronic Government involves the application of the Information Technology with the aim of providing the government with different ways of interacting with its citizens, managing its businesses through effective communication in form of the information shared with the several stakeholders. It can also be through the delivering of the goods and services in the state. The government is utilizing the World Wide Web with the major goal of impacting efficiency within the portal services simplified by the Web. The evolution that is technological shapes the use Information Technology of the Web. The examples of the Information Technology are in the form of the ledger that is distributed (DLT), the AI, the WWVW (World Wide Virtual Web) and the Semantic Web (Louwers et al, 2013).

The technology which is disruptive and promising is the Artificial Intelligence. The ability of the AI’s technology can equip machines that have capabilities that infer and adapt the data consumed and reinforce through the production of devices that are smart. This is through the applications of the web and the social media. The data associated with the projects of Artificial Intelligence is managed and controlled centrally; however, the data can be tampered with. The project of Artificial Intelligence Twitter- based is an example of the overwhelmed projects that involved racist results and caused repetition to the side of the users (Mainelli and Smith, 2015).

The Smart Contracts in form of Artificial Intelligence is one of the ongoing arguments considered to break the obstacles associated with government or the public sector. It involves the practices such as allocation of the government resources, managing the data sets that seem to be very large and shortage of experts. It also involves scenarios of prediction, tasks that are repetitive, aggregation of the diverse data and summarizing (Jarvenpaa and Teigland, 2017).

The centralization needs analysis that is crucial as well as the problems of authenticity and provenance. The Smart contracts of Artificial Intelligence can concentrate and clear the centralization related problems through the provision of a way to optimize the resources of the personal data of the public and finally to the owners through decentralization. Therefore, the Smart contracts tend to improve data management and other performances related to the government or the public sector. This is most especially witnessed by the Electronic Governance of Artificial Intelligence.

The benefits of using blockchain based smart contracts in government auditing

The blockchain enables the auditors to review specific transactions as well as verifying the digital assets existing in the financial sector of the government. This approves consistency between the physical world and the information of the blockchain. This is so challenging if the authorities do not possess centralization on the technology of the blockchain. The expertizing of the blockchain technology by the auditors invests more methods to complete the ownership verification. The technology of blockchain can change the process of auditing through the transaction record that is stored on the blockchain. Auditors have no need of requesting and waiting for the provision of documents as well as data and information in the government sector. More so, the blockchain is trying its level best to surpass the auditing process that is traditional in terms of the process of sampling (Issa and Kogan, 2014). It also allows audits that are continuous on the transactions of the chain within a stated period.

The blockchain provides shifting to testing of the controls from the transaction testing. The blockchain technology mentions the gain of efficiency by the auditors of the government sector but the record of transaction that is stored on the technology of blockchain may not assure that financial reports of the government sector are reliable. Take an instance of the transaction of the on chain. This can be executed between the parties related and joined to some of the agreement that is not easily observed by the fraudulent. Thus, effectiveness of the blockchain is so critical whenever the auditors tend to find controls of internal auditing encountering a certain blockchain. Furthermore, effectiveness is also required with the identification of the code of the blockchain, changes of the protocol, incentives of the individuals as well as allocation of the power among different peer groups. The auditors will not directly test the transactions but they will apply the protocols with the view of obtaining the exact and correct assurance regarding the hosting of the transactions of the accurate blockchain (Iaasb, 2017).

How could the government auditors apply continuous auditing method using smart contracts?

The auditing through the security of the Smart Contracts can be through the analysis of the blockchain related to the application of the Smart contracts. For the government auditors to solve design- related issues, coding errors as well as vulnerabilities involved in security, such analysis is relevant. An agreement on the specification, tests to be run by the system, tools for execution of the symbols of automated running, analysis of the manual coding and the report creation are the typical steps the auditors must follow with leading company of security auditing to apply the Smart Contracts within the system of the government (Moon, 2016).

The government is using various and numerous kinds of technologies in form of smart sensors. the auditors can use the tools of smart contracts to improve the accounting sector of the government. The auditors have the main objective of acquiring the auditing based on the real- time as well as monitoring to obtain a new generation. The study determines and summarizes that the blockchain and the smart contracts implement auditing (Iaasb, 2016).

The rapid growth of the blockchain technology provides various opportunities that benefit the auditors of the government or public sector. The auditors are moving towards continuous auditing; the applications of the blockchain make it possible for continuous process of auditing that is due to the real- time in acquisition of the records of the transaction.

There is evidence towards the growth and development of the advisory function through the freed resources from the testing and collection of the traditional transactions. The auditors tend to apply the analytics of data that is appropriate in the technology of the blockchain. This expands the services that are advisory to the citizens such as the designing controls, changing of the management as well as the governance of the blockchain technology in the sector of the government especially the financing department of the public (No and Vasarhelyi, 2017).

How continuous auditing can be implemented by the government auditors using smart contracts in auditing government procurements? Use the Generally Accepted Government Auditing Standards (GAGAS).

The recent researches explain it clearly that there should be increment and adoption of the procurement systems based on the blockchain. The blockchain provides recording decentralized ledger, immutable and shared processes for the transactions in the network. The assets of the government can be tangible such as buildings, land, machineries and vehicles whereas the intangible assets are composed of patents, intellectual kinds of properties and copyrights. Recording, trading and tracking can be simplified while using the network of blockchain (IBM, 2017).

The smart contracts are so transparent as well as efficient when recording the relevant stakeholders’ transactions basing on the concept of trusting the renders, decentralization and immutability. This is due to the quality level of and accessed process of tracking. Security is ensured and provided through anonymity that enhances the integrity of data transactions minus the need for the third party. More so, a time stamp is available for the data stored within the blockchain for validating and creating of the chain of blocks in the system.

To address and resolve the problem of corruption during the procurement services of the government which results from the interoperability absence to simplify the current processes of procurement, the framework proposed can enhance the application of the blockchain network. This improves the automation of the processes in form of reduced corruption entailed within the procurement department of the government (PCAOB, 2017).

Secondly, the technology can be used to involve the stakeholders in the processes of procurement to establish the communication clear in terms of the channels connecting the citizens with the government sector. The technology provides the citizens to participate in the services of eliciting the requirements before the submission of a particular proposal of the government. This implies that the stakeholders are part of the legislation of the process of procurement.

Finally, the effectiveness of the procurement process can also be addressed by the system of procurement in form of the processes and completed duties and projects of the government sector. The technology is so capable of monitoring, tracking the executed projects of the procurement department. It further improves openness and transparency of the processes of procurement through the provision of the avenue regarding the mechanics of feedback of the projects executed by the government through the auditing activities of the procurement programs. There by, promoting its efficiency in the long run.

The blockchain of the smart contracts can limit the actions of the participants in form of the permitted restrictions of the technology. Only the participants of the procurement sector are in opposition to participate in the network of blockchain. This ensures privacy of the data and information of the shared processes of the procurement of the government or private sector (Forbes, 2016)

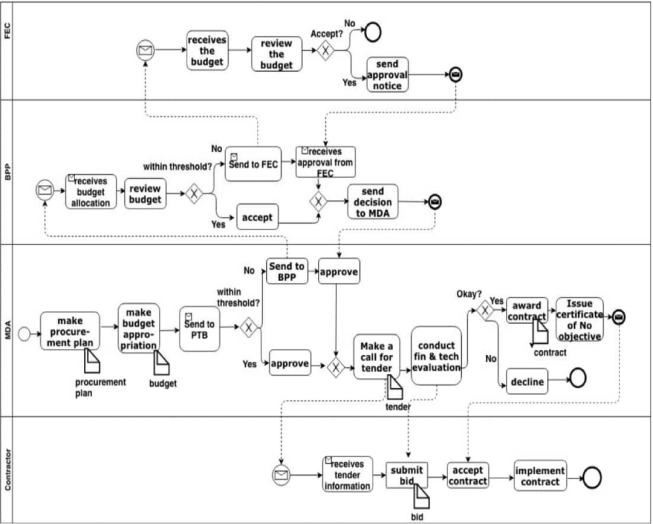

The procurement process of planning begins with the MDA assertion on the project and current infrastructure which requires being filled and be provided for. Then, there is specification of the budget to be sent for appropriation to the National Assembly. The unnecessary projects can be cancelled after the passing of the budget and signing by the executive into the law which eventually need executed. The parastatals (PTB) are then sent the budget or to the MTB (Ministerial Tenders Board) in order to check and approve it. It also looks at the price whether it’s under the approved thresholds.

After the approval, the tender is called for placing in the dailies of news to ensure potential contractors. Thus, the Bureau of Public Procurement is sent the budget and eventually they perform the reviews after receiving the budget (Fanning and Centers, 2016). They also review the budget and approve the limits of the budget. Then, the proposal must be sent for further approval and considerations by the Federal Executive Council.

Source: IAASB. (2017).

After approving for the executed project, there is a tender called for issuing of the project to the budget that is, national dailies thus, the contractors are expected of submitting of their bids. It must be conducted technically and financially in terms of analysis. After submitting the bids, a conduction of a financial evaluation is performed by the bidder with a certificate issued for no objection of the system in the government procurement programs. If there are irregularities during the financial and technical stages, the biding can even be declined by the procurement auditors of the government sector. Therefore, the process of implementing the system is finally concentrated on if the flow of the entire process is accomplished by the government sector.

Conclusion

The technology of blockchain is accompanied by challenges tangible to the industry of auditing. This requires the transformation that is strategic towards the auditing area. The knowledge comprehensive to the operations of the businesses and to the will of the position of the government by the auditing firms is critical to the advisors of the ministries of the government while approaching the technology that is new to the system. Therefore, the preparations towards these changes of the technology that is disruptive and accompanied by professionals of auditing require adjustments and elevation of the qualified personnel towards the strategic partner role. To adapt the new environment, the auditors need to acquire competence in the blockchain governance and participate actively towards the development of the blockchain and controlling of the related risks in the system technology of the government or public sector (Decovry, 2015).

References

Alles, M., Brennan, G., Kogan, A., & Vasarhelyi, M. A. (2018). Continuous monitoring of business process controls: A pilot implementation of a continuous auditing system at Siemens Continuous Auditing: Theory and Application (pp. 219-246): Emerald Publishing Limited.

Appelbaum, D., Kogan, A., & Vasarhelyi, M. A. (2017). Big Data and analytics in the modern audit engagement: Research needs. Auditing: A Journal of Practice & Theory, 36(4), 1-27.

Appelbaum, D., Showalter, D., Sun, T., & Vasarhelyi, M. (2015). Analytics knowledge required of a modern CPA in this real-time economy: A normative position. Paper presented at the Proceedings of the Accounting Information Systems Educator Conference, Colorado Springs, CO, June.

Borthick, A. F., & Pennington, R. R. (2017). When Data Become Ubiquitous, What Becomes of Accounting and Assurance? Journal of Information Systems, 31(3), 1-4.

Bozdag, E. (2013). Bias in algorithmic filtering and personalization. Ethics and information technology, 15(3), 209-227.

Chavez-Dreyfuss, G. (2015). Honduras to build land title registry using bitcoin technology. Reuters, available at: http://in. reuters. com/article/2015/05/15/usa-honduras-technology-idINKBN0O01V720150515 (accessed 21 November 2015).[Google Scholar].

Dai, J. (2017). Three essays on audit technology: audit 4.0, blockchain, and audit app. Rutgers University-Graduate School-Newark.

Dai, J., & Vasarhelyi, M. A. (2017). Toward Blockchain-Based Accounting and Assurance. Journal of Information Systems, 31(3), 5-21.

Florini, A. M. (1999). Does the invisible hand need a transparent glove? The politics of transparency. Paper presented at the Annual World Bank Conference on Development Economics.

Gaetani, E., Aniello, L., Baldoni, R., Lombardi, F., Margheri, A., & Sassone, V. (2017). Blockchain-based database to ensure data integrity in cloud computing environments.

Kiviat, T. I. (2015). Beyond bitcoin: Issues in regulating blockchain tranactions. Duke LJ, 65, 569.

Lemieux, V. L. (2016). Trusting records: is Blockchain technology the answer? Records Management Journal, 26(2), 110-139.

Li, H., Dai, J., Gershberg, T., & Vasarhelyi, M. A. (2018). Understanding usage and value of audit analytics for internal auditors: An organizational approach. International Journal of Accounting Information Systems, 28, 59-76.

Liang, X., Shetty, S., Tosh, D., Kamhoua, C., Kwiat, K., & Njilla, L. (2017). Provchain: A blockchain-based data provenance architecture in cloud environment with enhanced privacy and availability. Paper presented at the Proceedings of the 17th IEEE/ACM international symposium on cluster, cloud and grid computing.

Mittelstadt, B. (2016). Automation, algorithms, and politics| Auditing for transparency in content personalization systems. International Journal of Communication, 10, 12.

Simoyama, F. D. O., Grigg, I., Bueno, R. L. P., & Oliveira, L. C. D. (2017). Triple entry ledgers with blockchain for auditing. International Journal of Auditing Technology, 3(3), 163-183.

Vasarhelyi, M. A., Kogan, A., & Tuttle, B. M. (2015). Big Data in accounting: An overview. Accounting Horizons, 29(2), 381-396.

Vasarhelyi, M. A., Alles, M. G., & Kogan, A. (2004). Principles of analytic monitoring for continuous assurance. Journal of emerging technologies in accounting, 1(1), 1-21.

Vasarhelyi, M., & Greenstein, M. (2003). Underlying principles of the electronization of business: A research agenda. International Journal of Accounting Information Systems, 4(1),1-25.

Vasarhelyi, M. A., & Halper, F. B. (1991). The continuous audit of online systems. In Auditing: A Journal of Practice and Theory.

Vasarhelyi, M. A., & Halper, F. B. (2002). Concepts in continuous assurance. Researching accounting as an information systems discipline, 257-271.

Williamson, A. L. (1997). The implications of electronic evidence. Journal of Accountancy, 183(2), 69.

Woodroof, J., & Searcy, D. (2001, January). Continuous audit implications of Internet technology: Triggering agents over the Web in the domain of debt covenant compliance. In System Sciences, 2001. Proceedings of the 34th Annual Hawaii International Conference on (pp. 8-pp). IEEE.

Yu S. and Neter J. (1973), “A Stochastic Model of the Internal Control System”, Journal of Accounting Research, Vol. 11, No. 2, pp. 273-295.

Xu, J. J. (2016). Are blockchains immune to all malicious attacks? Financial Innovation, 2(1), 25.

Bigchain, D.B. (2017). Retrieved from BigchainDB: https://www.bigchaindb.com/

Block Confirmation. (2016). Retrieved from Bitcoin Wiki: https://en.bitcoin.it/wiki/Confirmation

blockchain apps for healthcare. (n.d.). Retrieved from CIO: https://www.cio.com/article/3042603/innovation/blockchain-applications-forhealthcare.html

Blockgeeks. (2017). Retrieved from Blockgeeks: https://blockgeeks.com/

Build a better credit bureau. (2016). Retrieved 2017, from American Banker: https://www.americanbanker.com/news/can-blockchain-be-used-to-build-a-better-creditbureau

Byzantine Fault Tolerance. (2017). Retrieved from Wikipedia:https://en.wikipedia.org/wiki/Byzantine_fault_tolerance

Cosmos Whitepaper. (2017). Retrieved from Cosmos: https://cosmos.network/whitepaper

Decentralized Access Control. (n.d.). Retrieved from HYPR Corp: https://www.hypr.com/decentralized-authentication/

Deterministic System. (2017). Retrieved from Wikipedia: https://en.wikipedia.org/wiki/Deterministic_system

DHS awards blockchain grant. (n.d.). Retrieved from Nasdaq: http://www.nasdaq.com/article/department-of-homeland-security-awards-blockchaintech-development-grants-for-identity-management-and-privacy-protection-cm667365

DHS Awards Blockchain grant of Identity Managment. (2016). Retrieved from Nasdaq:http://www.nasdaq.com/article/department-of-homeland-security-awards-blockchaintech-development-grants-for-identity-management-and-privacy-protection-cm667365

Ethereum Blockchain Application Platform. (2015). Retrieved from Ethereum :https://www.ethereum.org/

healthcare information tech. (n.d.). Retrieved from Becker Hospital Review: https://www.beckershospitalreview.com/healthcare-information-technology/9-things-toknow-about-blockchain-in-healthcare.html

Hyperledger Fabric. (2016). Retrieved from Hyperledger Fabric: https://www.hyperledger.org/projects/fabric

IEEE: Do you need a blockchain. (n.d.). Retrieved from IEEE Spectrum: https://spectrum.ieee.org/computing/networks/do-you-need-a-blockchain

Introduction to Tendermint. (2016). Retrieved from Tendermint: https://tendermint.readthedocs.io/en/master/introduction.html

IPFS Distributed Web. (2016). Retrieved from IPFS: https://ipfs.io/

Members. (n.d.). Retrieved from Enterprise Ethereum Alliance: https://entethalliance.org/

Merkle Tree. (2017). Retrieved from Wikipedia: https://en.wikipedia.org/wiki/Merkle_tree

Non-interactive zero-knowledge proof. (2017). Retrieved from Wikipedia:https://en.wikipedia.org/wiki/Non-interactive_zero-knowledge_proof

Ongaro, D., & Ousterhout, J. (2014). In Search of an Understandable Consensus Algorithm.

Pentagon has the world largest logistic problem. (n.d.). Retrieved from Defense One: http://www.defenseone.com/ideas/2017/10/pentagon-has-worlds-largest-logisticsproblem-blockchain-can-help/141500/

Polkadot. (2017). Retrieved from Polkadot: https://polkadot.io/

Quorum. (2016). Retrieved from JP Morgan: https://www.jpmorgan.com/country/US/en/Quorum

Quorum Overview. (n.d.). Retrieved from Github: https://github.com/jpmorganchase/quorum/wiki/Quorum-Overview

Raiden Network. (2017). Retrieved from Raiden: https://raiden.network/

Reitwiessner, C. (n.d.). zkSNARKS in a nutshell. Retrieved from Ethereum Blog: https://blog.ethereum.org/2016/12/05/zksnarks-in-a-nutshell/

Tech Insight: Blockchain. (n.d.). Retrieved from VA: Office of Information Technology:

Tendermint Blockchain Consensus. (2017). Retrieved from Tendermint: https://tendermint.com/

What are State Channels. (2016). Retrieved from State Channels:https://blog.stephantual.com/what-are-state-channels-32a81f7accab

Aldamen H., Duncan K., Kelly S., McNamara R., Nagel S. (2011). Audit committee characteristics and firm performance during the global financial crisis. Accounting and Finance, 971-1000. Bedard J.C.,

Johnstone K.M., Smith E.F. (2019). Audit Quality Indicators: A Status Update on Possible Public Disclosures and Insights from Audit Practice. American

Labelle R., Gargouri R.M., Francoeur C. (2010). Ethics, Diversity Management and Financial Reporting Quality. Journal of Business Ethics, 335-353.

Chia Yan Y. (2015). Disclosing material weakness in internal controls: Does the gender of audit committee members matter? Asia-Pacific Journal of Accounting & Economics.

Peters G.F., Romi A.M. (2015). The Association between Sustainability Governance Characteristics and the Assurance of Corporate Sustainability Reports. Auditing: A Journal of Practice & Theory, 163-198.

Calderon T.G., Wang L., Conrad E.J. (2012). Material Internal Control Weakness Reporting Since the Sarbanes-Oxley Act. The CPA Journal.

AICPA. (2017). Rutgers AICPA Data Analytics Research Initiative. https://

www.aicpa.org/interestareas/frc/assuranceadvisoryservices/radarprojects.html Rozario & Vasarhelyi Auditing with Smart Contracts 23

Appelbaum, D.; Kogan, A.; Vasarhelyi, M. A. (2017). “Big Data And

Analytics In The Modern Audit Engagement: Research Needs”, Auditing: A Journal

Of Practice And Theory: November 2017, Vol. 36, N. 4: 1-27. Https://Doi.

Org/10.2308/Ajpt-51684

Badertscher, B. A.; Kim, J.; Kinney W.; Owens, E. L. (2017). “Audit

Procedures And Financial Statement Quality: The Positive Effects Of Negative

Assurance”, Working Paper.

Bartoletti, M.; Pompianu, L. (2017). “An Empirical Analysis Of Smart

Contracts: Platforms, Applications, And Design Patterns”. Https://Arxiv.Org/Pdf/

1703.06322.Pdf. Https://Doi.Org/10.1007/978-3-319-70278-0_31

Buterin, V. (2014). “A Next-Generation Smart Contract And Decentralized

Application Platform”, White Paper.

Dai, J.; Vasarhelyi, M. A. (2017). “Towards Blockchain-Based Accounting

And Assurance”, Journal Of Information Systems: Fall 2017, Vol. 31, N. 3: 5-21.

Decovny, S. (2015). “Chips Off The Old Blockchain”, Cfa Institute Magazine,

Vol. 26, N. 6: 24-25. Https://Doi.Org/10.2469/Cfm.V26.N6.8

Fanning, K.; Centers, D. P. (2016). “Blockchain And Its Coming Impact Onfinancial Services”, Journal Of Corporate Accounting & Finance, Vol. 27, N. 5: 5357.Onlinelibrary.Wiley.Com/Doi/10.1002/Jcaf.22179/Pdf

Forbes. (2016). “Thirteen Companies That Use Deep Learning To Produceactionable Results”. Https://Www.Forbes.Com/Sites/Kevinmurnane/2016/04/01/Thirteen-Companies-That-Use-Deep-Learning-To-Produce-Actionable-Results/#59f0590633b824. The International Journal Of Digital Accounting Research Vol. 18

Ibm. (2017). “Implementing Blockchain For Cognitive Iot Applications”.Https://Www.Ibm.Com/Developerworks/Cloud/Library/Cl-Blockchain-For-Cognitiveiot-Apps-Trs/Cl-Blockchain-For-Cognitive-Iot-Apps-Trs-Pdf.Pdf

Iaasb. (2016). Exploring The Growing Use Of Technology In The Audit, With Afocus On Data Analytics. New York, Ny: Ifac.

Iaasb. (2017). Data Analytics. Http://Www.Iaasb.Org/Projects/Data-Analytics

Issa, H.; Kogan, A. (2014). “A Predictive Ordered Logistic Regression Model As

A Tool For Quality Review Of Control Risk Assessments”, Journal Of Information

Systems, Vol. 28, N. 2: 209-229. Https://Doi.Org/10.2308/Isys-50808

Jarvenpaa, S.; Teigland, R. (2017). “Introduction To Trust, Identity, And

Trusted Systems In Digital Environments Mini Track”, In Proceedings Of The 50thhawaii International Conference On System Sciences.

Kiviat, T. I. (2015). “Beyond Bitcoin: Issues In Regulating Blockchaintransactions”, Duke Law Journal, Vol. 65: 569-569.

Kogan, A.; Alles, M. G.; Vasarhelyi, M. A.; Wu, J. (2014). “Designand Evaluation Of A Continuous Data Level Auditing System”, Auditing: A Journal Ofpractice & Theory, Vol. 33, N.4: 221-245. Https://Doi.Org/10.2308/Ajpt-50844

Kuenkaikaew, S.; Vasarhelyi, M. A. (2013). “The Predictive Auditframe Work.” \The International Journal Of Digital Accounting Research, Vol. 13, N.2: 37-71. Https://Doi.Org/10.4192/1577-8517-V13_2

Kuhn, J. R.; Sutton, S. G. (2010). “Continuous Auditing In Erp Systemenvironments: The Current State And Future Directions”, Journal Of Informationsystems, Vol. 24, N. 1: 91-112. Https://Doi.Org/10.2308/Jis.2010.24.1.91

Louwers, T. J.; Ramsay, R. J.; Sinason, D. H.; Strawser, J. R.;

Thibodeau, J. C. (2013). Auditing And Assurance Services: Mcgraw-Hill/Irwin

New York, Ny. Auditing With Smart Contracts 25

Mainelli, M.; Smith, M. (2015). “Sharing Ledgers For Sharing Economies: An

Exploration Of Mutual Distributed Ledgers (Aka Blockchain Technology)”, The

Journal Of Financial Perspectives, Vol. 3, N.3: 38-69.

Moon, D. (2016): Continuous Risk Monitoring And Assessment: Crma. Doctoral

Dissertation, Rutgers University-Graduate School-Newark.

No, W. G.; Vasarhelyi, M. A. (2017). “Cybersecurity And Continuous

Assurance”, Journal Of Emerging Technologies In Accounting, Vol. 14, N. 1: 1-12.

Public Company Accounting Oversight Board. (2017). Pcaobadopts New Standard To Enhance The Relevance And Usefulness Of The Auditor’sreport With Additional Information For Investors. Washington, D.C: Pcaob. Https://Pcaobus.Org/News/Releases/Pages/Auditors-Report-Standard-Adop Tion-6-117.Aspx

Public Company Accounting Oversight Board (2017). Staff Inspection Brief. Https://Pcaobus.Org/News/Releases/Pages/Staff-Inspection-Brief2017-Issuers-8-30-17.Aspx 26 The International Journal Of Digital Accounting Research Vol. 18

Pwc. (2016). How Smart Contracts Automate Digital Business.Http://Usblogs.Pwc.Com/Emerging-Technology/How-Smart-Contracts-Automate-Digit

Al-Business/

Romero, S.; Gal, G.; Mock, T. J.; Vasarhelyi, M. A. (2012). “A

Measurement Theory Perspective On Business Measurement”, Journal Of Emerging

Technologies In Accounting, Vol. 9, N. 1: 1-24. Https://Doi.Org/10.2308/Jeta-50396

Rozario, A.; Thomas, C. (2017). “Reshaping The Audit With Blockchain And

Artificial Intelligence: An External Auditor Blockchain For Close To Real-Time

Audit Reporting”, Rutgers University Working Paper.

Stewart, T. (2015). Data Analytics For Financial-Statement Audits, Chapter 5 In

Aicpa, Audit Analytics And Continuous Audit: Looking Toward The Future,

American Institute Of Certified Public Accountants. New York, Ny 2015

Swan, M. (2015). Blockchain: Blueprint For A New Economy. O’reilly Media,Inc.

Tapscott, D.; Tapscott, A. (2016). “Blockchain Revolution”, 1st Ed. New

York: Portfolio-Penguin.

Vasarhelyi, M. A.; Kogan, A.; Tuttle, B. M. (2015). “Big Data In

Accounting: An Overview”, Accounting Horizons, Vol. 29, N. 2: 381-396.Https://Doi.Org/10.2308/Acch-51071 Rozario & Vasarhelyi Auditing With Smart Contracts 27

Vaziri, A. (2016). “Smart Bol – Reducing Contractual Enforcement Costs”.

Yan, Z. (2017). “Automate Contract Analysis In Auditing”, Rutgers University

Working Paper.

Yoon, K. (2016). “Weather Variables As Audit Evidence”, Doctoral Dissertation

.Chapter 4, Rutgers University-Graduate School-Newark.

Yermack, D. (2017). “Corporate Governance And Blockchains”, Review Of

Finance, Vol. 21, N. 1: 7-31. Https://Doi.Org/10.1093/Rof/Rfw074