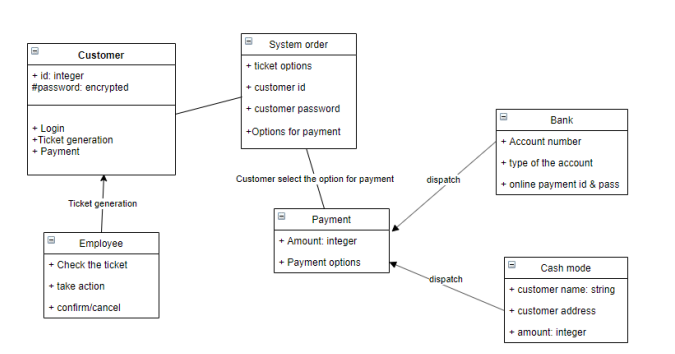

Domain diagram:

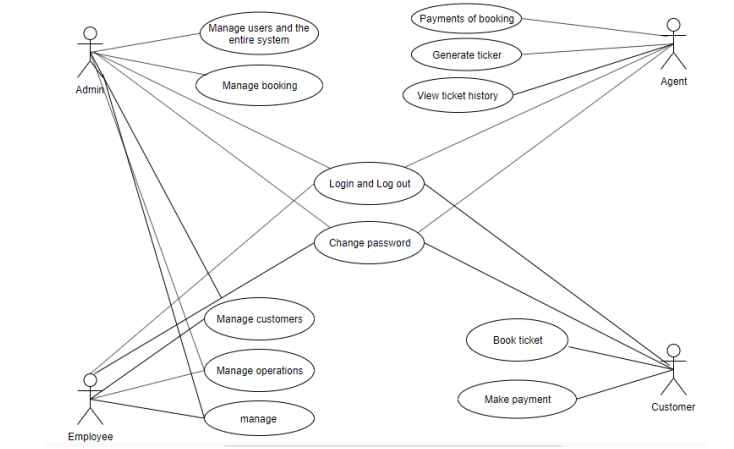

Use case diagram:

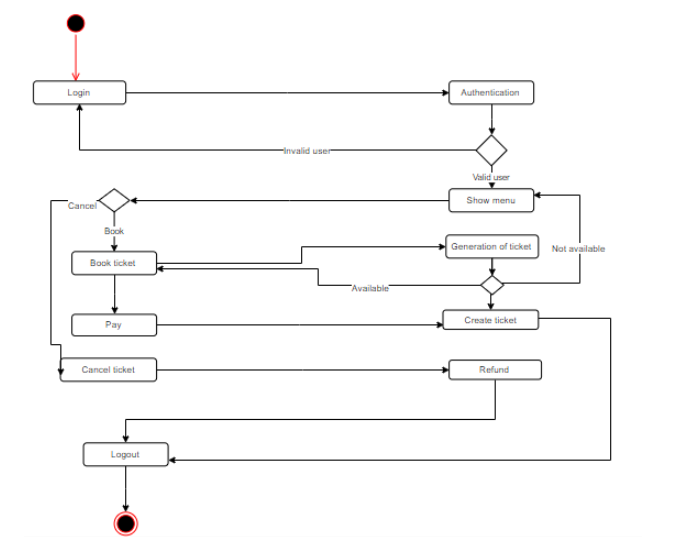

Activity diagram:

Accounting in society

Introduction:

For every company’s success stands on the ethical behavior of the company towards their customers. Harry Markham a pension investment advisor. Once in early 2012, he was in a dilemma about the state of pension fund while he was involved into preparation for the meeting along the board of trustees. Harry Markham completed his master of finance in the year 2004 from the B- school of USA, and he was found to be working for investment consulting associates (ICA) which had been involved into giving advice for funds related to pension. Markham could closely remain connected with the way the liabilities of pension funds were valued since Markham’s joining in the company. If Markham follows the principles which are guided in the MOF and CFA programmer, he got those numeric which were twice increased value compared to those reported for the funds. But he was not given permission to make any adjustment to the official numbers, inspire of the client members and the firm itself being least bothered in questioning them to make the board of trustees, the firm was unable to make any objection for the board who did not want the complain that the liabilities of the funds were much greater than number considered as per the government accounting standard rules (GASR) rules. Markham’s concern was with the loyalties with the firm, with the board of trustee, investors, investment expertise etc. Markham was in a dilemma whether or not to raise the issue of liability in the conference room to the board of the state pension fund. He knew that there was risk in the either side. But as he was bound with the ethical code of conduct, he was finding it difficult to hide the whole thing (Swanson & Frederick, 2016).

Discussion:

Harry Markham often said that ‘My role isn’t for deciding the liability value. As an investment advisor his role is to offer different ethical views. He was challenged both by ethically and practically. The central problem is an ethical issue for Harry Markham’s, CFA. His loyalty related to his firm, the board of trustees as well as the pension holders is at odds with his personal and professional standards.

As an investment advisor Markham need to identify the circumstances of the investors, like their background, their ability to take risk, the annual income, the budget for investment etc. to make the best investment advice. The CFA professionals said that one should not give advice without identifying the client’s circumstances. And the next is they got those funds which are grossly being shortage of money, but the accounting could not consider them to be as shortage of money. Before giving advice Markham let the firms know where they are starting. Therefore, the client will be knowing that got to start from a multi- billion dollar. On the other hand Markham was concerned about not getting what he could believe were in accurate figures, he also know that his clients are afraid of getting bad news. He was bothered about the fact that if he was to reflect issue related to liability then surely he and his business company would be fired.

Investment committees and staffs believe that their main motto is to earn, at least at the discounted rate given by the government. A sponsor told Markham that it could not be as per planning members’ interest to decrease the rate of discount as the liability increase would bring about shock to the taxpayers as well as to the state legislature that it would determine the support related to political for the plan’. The sponsors of the plan are least interested to know that they were low funded compared to the numbers those are showing and the messengers are blamed. On the other hand if it was officially elected they don’t desire a crisis as per their knowledge (Swanson & Frederick, 2016).

An advisor for investment is responsible to make good investment decisions, and have a knowledge in client’s financial condition to make sound investment decision. This sometimes involve those information which the clients are afraid of.

Generally, as a Chartered Financial Analyst, Markham need to attest the compliance with respect to the ethical code of conduct. He need to air those information which is ethical to do and are relevant to the firm and the client too. As an employee of the company, Markham need to be loyal, need to know all the code of conducts, need to be ethical.

Ethics mostly concern on that is right as well as that is wrong in behavior related to business judged as per the basis of the future standard of practice as per approval of the society. Business ethics is a code of conduct consisting of regulation of the business activities towards society as well as other business units. As well as business ethics defines the social, legal, cultural and economic limits within which business organization are expected to plan their activities. According to Markham’s dilemma relating to conflicting loyalties of a firm explained as the loyalty of boards of trustees including such peoples engaged in making investments decisions relating to public pension. Such person are hired by the firm as an investment expertise the code of ethics needs to maintain by such individual persons to conduct their performances effectively. The board of trustees will remain unaware for its dangers and will be happy related to the pension plan of state and will still have its own support with respect to political. His self as well as professional views related to ethics are violated. Moreover, the liabilities will deal as per the plan and the employees will not get benefits or taxpayers will require to pay more (Swanson & Frederick, 2016).

Conclusion:

It can be concluded from the above discussion that the ethical issue arises from Harry Markham is related to loyalty of firm, board of trustees as well as pensioners with personal standards. It can also be concluded that funds are shortage of money but accounting does fail to show them shortage of money. Further discussion reveals about responsibility of investment advisor to take good investment decisions. It can also be concluded that business ethics is a social, legal as well as cultural limits for which organization plan their activities accordingly. Hence, it can be concluded that as per Markham people engaged in making investments should be hired by firm as investment expertise being code of performance efficiently.

References:

Swanson, D. L., & Frederick, W. C. (2016). Denial and leadership in business ethics education. Business ethics: New challenges for business schools and corporate leaders, 222-240.

smartphone NFC Technology Security And Issues

ABSTRACT

The technology of internet adoption of things and its applications is changing every day. Near Field Communication for instance is internet of things technology that is vastly adopted because of its range frequencies since they are short hence making it good candidate to be applied in systems such as door and attendance system based to its access control. However, as a result of miniature size of Near Field Communication tags; since the text contents is much clear and insecure channel communication between tag reader database; the middle man that is Denial of Services among others are prone to security attacks in Near Field Communications technology. Any organization adopting the applications and technologies of NFC are impacted by the critical data that are leak by the users in these attacks. In this article, Near Field Communication vulnerability that are caused by privacy and security attacks are deeply studied. By focusing on data corruptions and Denial of Service (DOS) instance of attacks, the approach of Analytical Hierarchy (AHP) is used to evaluate the risk assessment that are existing. Also the best practice is presented that are used in mitigating these attacks

INTRODUCTION

The Near Field Communication is the technology of wireless communication that is simply an extension from RFID technology operating in short range communication. The RFID mainly is used in transmitting, identifying and tracking of the radio waves [8]. Near Field Communication can operates on a frequency that has a range is low as 13.56 MHz covering a that is between 4cm to 10 cm with a maximum data rate of about 424 kbps. Near Field Communication applications can be groups such as touch and explore, touch and connect, touch and confirm, and touch and go. The application of NFC in real life usage doesn’t really ensures application security. Therefore, the technology of NFC has its challenges to face for instances, the security treats of RFID can be applicable to Near Field Communications, since NFC is a colleague of RFID and all Near Field Communication devices act as writers or readers that can create threats that different [7].

Due to lack of a Near Field Communication that covers all the countermeasures of x.800 security services for example access control and authentication is another leading factor security vulnerability in Near Field Communication. The current specification guideline of NFC developers. The current specification that are provided are guideline for Near Field Communications developers for applications that secure data as well as communications within Near Field Communication devices. The next of privacy issues arises while using Near Field Communication likes users’ personal information stored in the devices of NFC then could be disclosed to malicious attacks [12]. For example, user using Near Field communication like a digital wallet for storing there information about their bank account then are prone to attack of data privacy while information in that wallet can be captured at anywhere and anytime by attackers without any user concept since Near Field Communication technology faces security challenges as concern in rising of an environment that is secure. There are a number of Near Field Communication applications that are developed with payment application that is contactless and works in two ways that is touch and go, and touch and confirm application. Google Wallet as well as Pairwave are examples of payment application that are contactless [12].

The Google Wallet is a touch and confirm application of NFC that need a PIN code confirmation to undertake any transaction. On the other hand, Visa paywave is a touch and go application type of NFC that allows the visa card holders to just wave their card or Near Field Communication allows smartphone with contactless payment terminal to process payment with no confirmation of that payment. The vulnerability have been identified on previous research that of contactless payment, in Visa card that is contactless, the card doesn’t recognize foreign currency that are from outside United Kingdom thus lead to fraudster in transaction of the contactless. Hence, security becomes a concern in payment that are contactless in particular touch and go application of NFC since they perform payment with no confirmation while process the transaction.

Research Questions

- Is there security concerns with the NFC technology of payment?

- If so, what are measures which can be put in place to overcome the security issues?

- Who is to be answerable to the attacks associated with electronic payment?

- Reason why the electronic payment is not majorly used around the world.

- Why is it that money is getting lost from peoples NFC accounts?

Literature review

The scholarly writing survey in any zone of research is fundamental work since it gives inquire about structures, commitments, scientific categorization, and open research zones meaning, and headings of future research. Such work of NFC inquire about territory was not performed so far in a thorough and control way. So as to have writing survey of NFC look into, related essential audits contemplates – electronic trade, data frameworks, RFID and versatile business must be inspected in detail. In understanding to Borchert and Günther [1] proposed the distinction of plan science inquire about and that of conduct science. Plan science is basically a procedure of tackling an issue that makes just as assesses Information Technology, expected in taking care of featured authoritative issues. They generally centers in the significance of science configuration in research territories of data frameworks just as makes look into system that keeps up the thorough and the pertinence of the examination. All together for the scientists accomplish a viable science configuration inquire about in the data frameworks, seven basic rules are given.

These days, accomplishing a viable and complete NFC science plan is a vital issue just as essential. Today a large portion of this NFC scholarly writing in some cases can be considered as a science plan rather than a social science. Another related just as an exploration region more extensive is online business (electronic trade) because of its oddity just as development increment. One can find a few audit investigations of electronic trade in points of view that are not the same as various occasions Kim [5]. These days, we see that electronic business has one of the extraordinary secured territory as a result of developing enthusiasm for it.

In understanding to Francis, Hancke, Mayes and Markantonakis [2] just as Geon Pak, Ram Lee and Suk Lee [7] who are some the online business writing audits analysts, they by and large express electronic trade look into scientific classification in various four measurements that is innovation, applications, support just as execution, and different issues, investigations similar has an extraordinary effect to the assurance of the issues just as research zones for future. The for the most part impressive recommendation have been made on the advancement of “thorough research strategies for articles and further observational examinations” That are additionally a rule for science configuration looks into [3]. Subsequently, thorough of Near Field Communication writing as a recently developing innovation just as are of research that needs to inspected. A similar case to M-business that is versatile trade, there writing surveys are great sources that can be utilized while making an appropriate Near Field Communication scientific classification.

The distinguishing proof of the holes among the hypothesis, practice just as heading of things to come examine for portable trade papers are plainly all around organized with grouping system just as examinations is according to [4].

In actuality, RFID explore zone’s additional examination which was likewise proposed in there carefully. At the point when the examination regions are limited Near Field Communication writing, Radio Frequency Identification look into territory has related innovation to that of NFC, which is a piece of electronic trade just as portable business world.

ANALYSIS

Risk Assessment & Multi-Criteria Decision Techniques

The multi – Criteria Decision Techniques as well as risk assessment are discussed under this section. The comparison of multi-criteria decision making to that of risk assessment are thoroughly done.

Risk Assessment Methods

The technological scientific process base that is consisting steps of risk analysis, identification of the risk as well as risk evaluation is refers to as Risk assessment.

Accordingly, CVSS stand as the best option for risk assessment due to the fact of its capability which is focused in calculating various different types of scores such as temporal, base and environment.

This is applicable to be adopted as a risk assessment for a technology based applications such as NFC. Meanwhile, OCTAVE only focuses on organizational risk as it is designed for organizations instead of technological risk and, it is hard to implement because there are many practices that need to implement. Although, CVSS does not reduce the number of attack, it evaluates the attacks with rating score [13].

Multi Criteria Decision Making (MCDM) Methods

This is a decision making algorithm which is utilized in making best decisions in the alternative decisions. Its main aim is to determine and rate the alternative decisions in terms of there priorities. This technique has been used for many assessments. From the study, MACBETH and the AHP are used in supporting the pairwise comparisons. TOPSIS is utilized when the ideal as well as the anti ideal options are needed. ELECTRE and VIKOR, all the two are based on the same principles on the concordance analysis like considering some global measures as well as other criteria which are [13]. SMAA makes determination if the information of the decision is correct and accurate which in-turn helps in preventing making of wrong decisions because of inadequate information. The MCDM method gives a description that those AHP applications, have powerful and highly flexible guidance method to the techniques used for decision making.

Possibility and Impact Estimation of Vulnerabilities using CVSS

Calculation of possibility is done by the use of metrics group as well as temporal group metrics of the CVSS. Calculation of Impact estimation is done by use of base group metrics as well as environment group metrics of the CVSS [9]. There results are taken from the survey data which needs respondents for evaluation. The survey data is categorized into discrete probability distribution which is used in assigning the probabilities for every outcome of each and every rating group as low, medium as well as high for the CVSS. The scores in this case segregated into a probability distribution because the participants had different values for each and every CVSS metric. The calculation of probability is given by the formula below;

SMAA-TRI method is used in calculation and production of category indices which are acceptable for each and every pairs of the categories and alternatives. The JSMAA is used for simulation of the SMAA-TRI [9].

FINDINGS

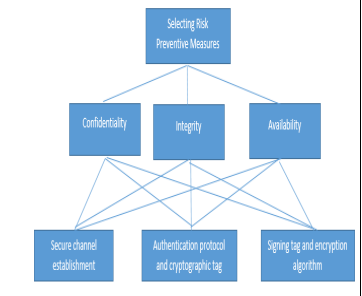

Dos Attack & Data Corruption Attack Countermeasures & Selection Using Mcdm

The Dos attacks takes place when the NFC devices gets in touch of the empty or rather NFC tags which are corrupted, error messages will take the NFC devices until such a time when the devices are suspended. This also takes place in smartphone which NFC enabled. Corruption od data involves the processes whereby the attackers manipulate data as a results the NFC transmission is disturbed by the NFC interfaces and the devices. Now that data has been corrupted, it will be unreadable to the devices which are operating under the NFC [10]. In order to prevent corruption of data, then NFC devices have to observe and check the radio frequencies when data is being transmitted. Detection of this particular data corruption attacks can be done due to the fact that higher power is required in the corruption of data as compared to sending of data, therefore, NFC is in a position of detecting sending data session which utilizes more power during transmission of data. This measures which are to be used in minimizing the risks of corruption of data as well as the Dos attacks is done by signing tags which encryption techniques by the use of cryptographic tag authentication protocols as well as establishment of a secure channel which has to exist between the NFC devices. It is the best option to secure the NFC communication as well as defending all types of data attacks when communication or data transfer is taking place [10].

MCDM Analysis is AHP Approach

This AHP method of approach utilizes the selection of the NFC risk countermeasures which have the highest priority. This method is utilized in creation of the priorities the alternatives and its criteria is utilized in decision making as well as judgmental for the alternative decisions made. The AHP method comprise of the following steps [11];

- Step 1

Development of criteria weights for the creation of single pairwise comparison matrix for that [articular criteria.

- Step 2

Development of the ratings for every decision alternative made for every criterion by development of the pairwise comparison matrix

- Step 3

Calculation of the average weighted rating for each and every decision alternative. The decision alternative which has the highest score is chosen.

In the AHP method, the pairwise comparisons are utilized in establishment of the relative priority for every criterion which is against another criteria or that is against the decision alternatives. The table below shows the AHP scale which utilizes the ratings from the equal importance to the extreme importance.

| Scale of Importance | Explanation |

| 1 | All with same importance |

| 3 | One is slightly important compared to another |

| 5 | One is just important to another |

| 7 | One is very important compared to another |

| 9 | One is completely important compared to another |

| 8,6,4,2 | When compromise is required |

From the table above, a hierarchy of decision is designed for the purpose of making decision on the highest priority countermeasures of the NFC. On comparison in order to know give the confidentiality, establishment of the secure channels is considered as very crucial as compared to use of the authentication protocol or the cryptography. On the other hand, the use of the protocol is considered to be more important as compared to use of encryption. From the comparison above, the establishment of the secure channel as a priority of 0.7611, utilization of the protocol has a priority of 0.1663 and the use of the tags containing the encryption has a priority of around 0.0726 [11].

On the comparison for provision of integrity, it is seen that establishment of secure channel is regarded as more important as compared to the cryptography as well as the authentication protocol. As compared to the protocol, the establishment of the secure channels is also considered more important. However, utilization of the protocols is slightly important as compared to signing of the tag using the encryption. The establishment of a secure channel is prioritized at 0.7503, the utilization of the protocols is prioritized at 0.1714, as finally the use of the signing tags in encryption is prioritized at 0.0782 [11].

When comparing priorities in terms of availability provision, it is noted that the establishment of a secure channel is regarded as more important as compared to the use of authentication protocol as well s the cryptography. The establishment of a secure channel is also regarded as more important as compared to the use of protocol. However, the use of protocol is noted to be slightly important as compared to the use of signing tag with the use of encryption. The establishment of secure channel is prioritized at 0.7172, the utilization of the protocol is prioritized at 0.1947 and the utilization of signing tag by the use of encryption is prioritized at 0.0881 [11].

TABLE 6 HERE

| Alternatives | Integrity | Confidentiality | Availability | Priority |

| Priority 1 | 0.7503 | 0.7611 | 0.7172 | 0.7429 |

| Priority 2 | 0.1663 | 0.1714 | 0.1947 | 0.1775 |

| Priority 3 | 0.0726 | 0.0782 | 0.0881 | 0.0796 |

The overall priority of the AHP for every alternative as shown in the able above is calculated using all the pairwise comparison of alternatives in accordance to CIA.

The highest priority which is obtained by the calculations of the AHP is aimed to establish a secure channel which is having a priority of 0.7429 that when converted to percentage, it comes to 74.29%. Measures of prevention like the use of cryptography as well as the authentication protocol is also prioritized at 0.1775 which is equivalent to 17.75 %. The signing tag using the encryption algorithm is prioritized at 0.0796 which is equivalent to 7.96%. Therefore, it is worthy noting that the establishment of the secure channel is having an overall priority of 74.29% which in return makes the best risk countermeasure solution for the prevention of data corruption as well as Dos attacks in the NFC[11]. From the analysis therefore the best solution for the dos attacks and data corruption prevention is the establishment of the secure channels which according to the analysis, it has a priority of 74.29%. All type of attacks in the NFC communication such as the eavesdropping, and many others are able to be prevented by the solution. The protocol which could be utilized in the establishment of the secure channel in the NCF is the Diffie-Hellman which is based on the RSA or the Elliptic Curves Cryptography. As from the data which was collected from interviews, the participants made an overall suggestion that 3DES to be used for shorter transaction which requires shorter time of response and RSA to be used for longer response time for transactions.

CONCLUSION

From the analysis and evaluation, it is noted that, in this research, there are two contributions which have been made, using the MIDAS system, a guideline solution is proposed in order to put security to the NFC application. As from the analysis, the ECC as well as the AES are considered to be the best techniques for the establishment of the secure channel in the NFC and also in the prevention of the data corruption and the DOS attacks in the NFC [13]. It is found out that the results, findings as well as the cryptographic techniques are all similar and they correlate to each other as the standards for the mechanism of NFC. On the basis of the research significance, and methods, the possibility of the NFC security risk as been determined by evaluation of the risk by the use of risk assessment methods whereby the highest risk which are determined was data corruption and dos attacks. The impediment of this exploration includes the quantity of members that take an interest in online review and the quantity of NFC specialists. The result results from hazard evaluation procedure is associated to the quantity of testing size. Diverse examining size or gathering can have affected the result results. For further research, distinctive hazard appraisal technique can be utilized to assess the security chances in NFC. Other MCDM strategies can be considered to actualize in this examination as to choose the best answer for counteract security assaults. Other than sensitive use of NFC, other NFC application can be tried as to decide the probability of its security dangers.

References

[1]B. Borchert and M. Günther, “Indirect NFC-Login on a Non-NFC Device using an NFC-Smartphone”, International Journal of Intelligent Computing Research, vol. 4, no. 4, pp. 358-364, 2013. Available: 10.20533/ijicr.2042.4655.2013.0047.

[2]L. Francis, G. Hancke, K. Mayes and K. Markantonakis, “On the security issues of NFC enabled mobile phones”, International Journal of Internet Technology and Secured Transactions, vol. 2, no. 34, p. 336, 2010. Available: 10.1504/ijitst.2010.037408.

[3]K. Grassie, “Easy handling and security make NFC a success”, Card Technology Today, vol. 19, no. 10, pp. 12-13, 2015. Available: 10.1016/s0965-2590(08)70134-8.

[4]Y. Jang, S. Chang and Y. Tsai, “Smartphone security: understanding smartphone users’ trust in information security management”, Security and Communication Networks, vol. 7, no. 9, pp. 1313-1321, 2013. Available: 10.1002/sec.787.

[5]H. Kim, “Investigation on NFC-based Security System for Smart Work”, Journal of Security Engineering, vol. 11, no. 3, pp. 263-272, 2014. Available: 10.14257/jse.2014.06.06.

[6]A. Mylonas, A. Kastania and D. Gritzalis, “Delegate the smartphone user? Security awareness in smartphone platforms”, Computers & Security, vol. 34, pp. 47-66, 2013. Available: 10.1016/j.cose.2012.11.004.

[7]J. Geon Pak, B. Ram Lee and M. Suk Lee, “Implementation of Mobile Smart Key System using the NFC Function of the Smartphone”, International Journal of Engineering & Technology, vol. 7, no. 44, p. 1, 2018. Available: 10.14419/ijet.v7i4.4.19589.

[8]S. Poddar, “Central Locker System for shopping mall using NFC Based Smartphone”, Transactions on Networks and Communications, vol. 2, no. 5, 2014. Available: 10.14738/tnc.25.520.

[9]”NFC Phones Raise Opportunities, Privacy And Security Issues”. [Online]. Available: https://cdt.org/blog/nfc-phones-raise-opportunities-privacy-and-security-issues/. [Accessed: 2019].

[10]”Security Risks of Near Field Communication Technology”. [Online]. Available: http://nearfieldcommunication.org/nfc-security-risks.html. [Accessed: 2019].

[11]”Security Issues in Mobile NFC Devices | Request PDF”. [Online]. Available: https://www.researchgate.net/publication/266557612_Security_Issues_in_Mobile_NFC_Devices. [Accessed: 2019].

[12]”Concerns Related to NFC Technology for Payments [Updated 2019]”. [Online]. Available: https://resources.infosecinstitute.com/nfc-technology-payments-concerns/. [Accessed: 2019].

[13]”Mobile Payments: Risk, Security and Assurance Issues”. [Online]. Available: https://www.isaca.org/Groups/Professional-English/pci-compliance/GroupDocuments/MobilePaymentsWP.pdf. [Accessed: 2019].