1. Introduction

Finance Forge operates as a leading organization within the financial services sector which provides expert advisory services for mortgages along with savings and investment advice while managing its clients’ portfolios. Finance Forge helps private and corporate clients achieve their financial objectives through budgeting counseling and debt consolidation together with investment consulting services (Gupta et al., 2021). The company has opted to expand its operations as the customer base is growing with time. The upcoming organizational expansion has led Finance Forge to understand the essential requirement for updated computer system infrastructure to enhance staff operations and client performance.

The program infrastructure of Finance Forge consists of networked applications which every staff member accesses using their office computers. The system functions by handling fundamental operations which include preserving company and customer records and handling business procedures while loading current exchange rates along with market information to a centralized data warehouse. The company investigates migrating to a web-based platform because this deployment would boost accessibility together with scalability features and operational performance. An ideal system design must combine essential capabilities such as currency exchange processing alongside transaction history management and secure data storage with intuitive interfaces for clients alongside staff members (Akhtar et al., 2022).

This research investigates software development lifecycle (SDLC) methodologies which suit the creation of the new Finance Forge system. The analysis evaluates multiple SDLC frameworks for this project by taking into account Finance Forge’s exclusive requirements and limitations. Feasibility studies performed on large-scale software projects help ensure success by assessing technical, operational, financial factors according to the report. Moreover, the report analyzes how to conduct a complete software development lifecycle through stakeholder requirement identifications and project scope definitions as well as functional and non-functional requirement specifications and appropriate software analysis tool designs (Alami et al., 2022).

This report explores SDLC models for the Finance Forge project alongside software behavioral design approaches which includes finite state machines (FSM) and extended FSMs and analyzes their application suitability. This evaluation focuses on determining techniques that would strengthen both reliability and effectiveness of the proposed system. This report explains the investigation process and its effectiveness in improving software quality until the final solution matches project requirements together with user demands (Ali et al., 2024).

2. Activity 1: Research Paper on SDLC Models

2.1 Overview of Software Development Lifecycle Models

A lifecycle model selection determines all development procedures within software development. Every phase of program design to testing to support lifecycle is handled through standard protocols under Software Development Lifecycle (SDLC) models. Bajzek et al. (2021) evaluate the Finance Forge project through a combination of two iterative methodologies (Agile, Spiral) along with two sequential approaches (Waterfall and V-Model) while investigating development features and implementation phases as well as presenting advantages and disadvantages. Iterative SDLC models represented by Agile and Spiral enable developers to produce multiple development cycles that enhance project development through continuous enhancements. Software development models are optimal for projects requiring changing requirements since they combine consistent flexibility with system updates.

Iterative Models

Agile represents a highly adaptable framework for software development because the Finance Forge business environment functions dynamically. The Agile development process requires developers to divide projects into regular periods called “sprints” whose duration falls within two weeks and four weeks. The software output of development sprints undergoes stakeholder assessment before they receive feedback to enable development adjustments (Baumgartner et al., 2021). Software development teams at Finance Forge collaborate with stakeholders through Agile to develop solutions with full compliance to stakeholder requirements throughout all developmental stages.

The Agile model distinguishes itself through its strong ability to address system requirements changes. A key advantage of Agile modeling at Finance Forge enables the development team to react promptly to any system changes that occur during their web transition from a network application. Through Agile methodology, Finance Forge obtains working software early and repeatedly to shorten the market release duration. The model presents distinct obstacles in addition to its beneficial aspects. Continuous changes in project requirements create problems for clear timeline maintenance because scope creep becomes more likely (Cassel et al., 2018). Agile development heavily depends on sustainable team communication but resource exhaustion happens as the project staff size falls below requirements or stakeholders lack sufficient access.

The spiral model merges iterative procedures through processes which unite essential aspects of designing and prototyping systems. Risk management combined with continuous refinement enables this model to offer ongoing product improvement through its iterative approach. The model goes through successive “spiral” cycles which contain planning followed by risk analysis, engineering activities and culminate with evaluation steps. New risk analysis joins existing prior risk knowledge as the product development cycle completes successive iterations before finishing (Daraojimba et al., 2024). The new web-based system at Finance Forge achieves continuous testing of fundamental operational needs and technical capabilities to manage complicated major projects by utilizing this model.

The key advantage of using the Spiral model is the focus o risk assessment during application development. Early risk prevention strategies integrated into Finance Forge’s new web-based platform prevent the occurrence of expensive development errors throughout the project lifecycle. Each development stage of the Spiral model demands extensive resources because thorough analytical assessments increase both project time and financial commitments (Doğan et al., 2021). Project managers and developers with specialized skills are required for the Spiral model to analyze project risks effectively as they maintain its iterative development process.

Sequential Models

Sequential SDLC models such as Waterfall and V-model follow linear paths. Such development models function as rigid structures which force developers to finish each successive stage then proceed to the next step. These models offer excellent results in situations where requirements stay constant throughout development.

Software development practitioners have employed the Waterfall model as an early basic approach since its inception. The involves a step-by-step progression through distinct phases: The development process includes requirements gathering followed by system design, implementation, testing, deployment and maintenance (Doshi et al., 2021). The model ensures that every stage is completed before beginning the next stage and avoids both partial execution and continuous feedback cycles. A Waterfall model system upgrade implementation is suited for Finance Forge because requirements are clearly defined before implementation and development requirements remain consistent.

The Waterfall model provides a simple and clear structure which is easy to manage and plane. Finance Forge will benefit from Waterfall model by implementing a web-based application with minimal expected changes in requirements. The main challenge with waterfall model is the inability to adapt to changes. After completion of a phase ,the system becomes challenging to return to past development stages at reasonable costs (Dwivedi et al., 2022). The Waterfall model proves ineffective at handling unexpected changes including new regulatory requirements or shifting user requirements because it provides limited flexibility, so projects face delays with higher costs.

The V-Model extends waterfall model by integrating validation and verification within the framework. Under the V-Model, all development phases correspond to testing phases which enables ongoing verification of system requirements. The requirements gathering phase leads to a system testing phase which confirms that software matches its defined requirements. The V-Model specializes in projects demanding accuracy because testing runs throughout every development phase.

The main advantage of V-Model occurs from its disciplined testing methodology. The systematic execution process of the V-Model enables developers to detect errors early on thus reducing the possibility of ending up with faulty end products. The testing model at Finance Forge indicates potential success in validating functional capabilities together with maintaining security requirements according to Gupta et al. (2021). As a relative of the Waterfall model, the V-Model shows limited capability to adapt calmly to changes in requirements launched after development starts.

Comparison of Models

Project development requires various management approaches in models which differentiate their methods for handling requirements. Agile and Spiral iterative development approaches bring flexible structures that enable businesses to accept changing needs across the entire development phase. Project selection under this model occurs for systems needing constant changes because clients often modify requirements during time periods like the Finance Forge web-based system transition (Hassan et al., 2024). Two traditional development models follow linear parameters that differ from Agile and Spiral which use iterative cycles to fulfill various project requirements.

The combination of Agile and Spiral development methodologies brings tremendous advantages to the project by providing adaptable risk management systems to handle uncertainties that emerge during Finance Forge’s network-to-web platform transformation. The project benefits from this adaptive method but the approach creates scope expansion problems that require continuous dialogue with all stakeholders. Sequential models generate predictable results through structured methods but show restricted alterability which fits projects with set boundaries that oppose modifications (Imam et al., 2024).

2.2 Managing Risk in SDLC Models

Established risk management practices are essential to achieve project success because of the software development work that happens in complex dynamic environments at Finance Forge. SDLC generates different risks that emerge from technical unpredictability together with evolving specifications and constrained project resources (Khan, 2021). Detailed project risk assessment leads to sustainable development process that delivers products appropriate for business purposes and functionality expectations. SDLC models dedicate separate treatment to risk implementation through their processes for identifying risks and developing mitigation strategies in addition to risk management practices for Finance Forge’s web-based system migration.

Risk Management Approach in SDLC

The initial step of risk management in SDLC involves identifying potential risks which can affect the success of a project. The risks may include; technical issues and unpredictable changes in project size along with unclear specifications and external factors like regulation changes. The transition of Finance Forge from networked to web-based system introduce several vulnerabilities concerning technology adoption and data security, along with system integration and user acceptance (Kuhrmann et al., 2021). The development team should recognize project risks early, so they create plans which reduce or eliminate these potential threats.

The next step after risk identification involves determining how much impact these risks will have on the project. Project teams use two measures to group risks including likelihood and severity. Data security and system scalability have a more priority in Finance Forge because of the high sensitivity of financial data and expanding system requirements (Gupta et al., 2021). Integration risks against legacy systems should be given more priority because system incompatibilities could slow the project timeline.

Organizations should take proactive steps that reduce both the frequency of risks occurring and their impact. Additionally, the organizations should use more reliable technologies, robust testing methods, stakeholder commitment, and they should provide the team with necessary skills and resources (Kumar & Rashid, 2018). The implementation of Agile or Spiral iteration methodologies within Finance Forge would permit staff to discover problems quickly through continual execution and feedback cycles which allow for strategic modifications to project materials.

Risk management practices run continuously from the beginning until the end of all SDLC phases. Continuous risk surveillance helps to ensure that new risk are identified and existing risks are managed effectively (Gupta et al., 2021). The organization should conduct regular risk assessments to address any Unforeseen challenges that may arise. The approach can help Finance since changes in requirements and unanticipated technology challenges can emerge at any stage of development.

Risk in Iterative vs Sequential Models

Risk management performs differently in the SDLC models between iterative and sequential approaches. SDLC models that apply iterative patterns including Agile and Spiral maintain adaptable designs and execute continuous risk assessments but sequential patterns including Waterfall and V-Model restrict mid-project modification (Kyeremeh, 2021).

Progressive risk management occurs continuously through iterative life cycles in models featuring iterations. Each Agile sprint builds into a risk assessment phase where developers together with stakeholders review project progress to steer the direction toward new learning or client feedback. Additionally, this method enables early risk detection of technical obstacles and changes in user requirements while maintaining flexibility in managing potential risks before their escalation (Laplante & Kassab, 2022). Technology challenges during the web transition for Finance Forge could emerge because the existing infrastructure experiences compatibility issues with the new system. Through its iterative nature, Agile helps teams promptly discover such project risks allowing systematic and preventive action before later development phases begin.

The Spiral model applies explicit risk management techniques through continuous assessment in every iteration. Risk monitoring and mitigation persistence occurs continuously across the project timeline through multiple phases consisting of planning followed by risk analysis then engineering and evaluation stages. The spiral model emphasizes risk management which is important for the project Finance Forge (Martin, 2023). The model allows the teams to create streamlined solutions for dealing with scalability problems and legacy integration obstacles. Spiral model revisits risks throughout each developmental phase to enable the team to create measures that reduce their impact on both the project timeline and quality targets.

Sequential models such as Waterfall and V-Model lack the same adaptability for risk management operations. The risks are identified during the initial requirements phase in waterfall model, and there are no opportunities for reassessment in later stages. The developers may face difficulty when addressing risks in the design phase. The web-based systems in Finance forge may experience unexpected issues such as, performance, user interface, and security problems, which may not be seen until testing phase. The issues may result in delays in the projects and cost of the project may also increase.

2.3 Example of Lifecycle Model Selection

Project success depends heavily on selecting an appropriate Software Development Lifecycle (SDLC) model particularly when implementing large initiatives that require web system transitions such as at Finance Forge. The SDLC model choice should match project requirements across system complexity and scalability needs and user adaptation flexibility. The Agile methodology fits perfectly as the chosen iterative SDLC model to implement the web-based system at Finance Forge (Martínez-Fernández et al., 2022).

The ability of Agile to adapt flexibly to changing requirements makes it a preferred choice for Finance Forge. The project faces upcoming challenges since Finance Forge exchanges traditional networked systems for web-based ones throughout its development. Over the course of development, Finance Forge must address scalability concerns accompanying user experience requirements alongside security protocols and system integration points. Through its iterative development structure, Agile enables frequent redesign evaluation coupled with modifications to system functionality in its defined sprint cycles (Mishra, & Alzoubi, 2023). User feedback together with technical requirements may evolve throughout project lifecycle in Finance Forge.

The agile methodology performs exceptionally well on expansive large-scale projects because of its focus on team collaboration and communication. In Finance Forge, multiple teams must work together alongside back end developers who create server logic while designers model the user experience and security specialists ensure data protection. Agile methodology allows stakeholder teams and developers and testers to maintain continuous communication so as to ensure that all parts of the system deliver business requirements correctly (Najihi et al., 2022). Users get real-time feedback through this feedback mechanism which prevents confusion while guaranteeing that their needs will be met by the finished product.

Agile methodology is suitable for projects with uncertain or changing requirements. The web-based system in Finance Forge require sequential testing phases followed by developmental cycles to realize its best output. By basing priority decisions on user value Agile guides development teams to tackle essential components first which secures project progress no matter what unexpected obstacles emerge (Gupta et al., 2021).

2.4 Waterfall Model Assessment for Large Projects

Waterfall model is a traditional SDLC model that adopts a linear, step by step approach of software development. The model has been used widely in large-scale software projects, especially in environments with changing requirements like Finance forge. The model has shown both benefits and limitations in developing software.

The main advantage of waterfall model is that it has a structure and predictable process. The Waterfall model is suitable for complex products with specific requirements, and minimal expected changes. The completion of every phase at Finance Forge follows a sequential delivery approach that enables project managers to stay in control of budget and timeline requirements (Olorunshola, & Ogwueleka, 2022).

The Waterfall model fails to deliver adequate outcomes on extensive projects like the web-based system at Finance Forge. The model has a rigid structure which cannot adapt to changes which occur throughout development periods. The completion of one phase causes major challenges for projects to return to previous development stages at a reasonable cost. The project faces considerable delays whenever new requirements or issues surface because adjustments must be made during development to prevent delay. The Waterfall model frequently identifies crucial problems too late because testing happens after the development phase leading to high costs and delayed completion (Pinheiro, et al., 2018).

3. Activity 2: Evaluative Report on Feasibility Studies

3.1 Purpose of a Feasibility Study

A feasibility study is an essential initial process for software development projects including complex ones like Finance Forge’s planned web-based system. A feasibility study aims to determine project viability before organizations dedicate extensive time and financial resources to their projects. A complete feasibility study helps organizations to identify project risks, resource needs and obstacles throughout the early stages of development. The feasibility study in Finance Forge helps to assess the viability of migrating to web-based technology, and review project duration and budgetary constraints (Pothukuchi et al., 2023).

The stakeholders and project managers can use feasibility study as a blueprint to assess different solutions. The feasibility study is essential in the transition of Finance Forge from networked application to web-based platform. Organizations use feasibility studies to examine technical alternatives along with cost estimates and potential challenges to determine overall project effectiveness. The project success and potential risks become uncertain when basic analysis is omitted because major errors would occur at an early project phase (Rasheed et al., 2021).

3.2 Components of a Feasibility Study

A thorough feasibility study consists of several key components: The success of project development requires evaluation through four essential areas: technical feasibility, economic feasibility, operational feasibility, and schedule feasibility. The distinct project components within a feasibility study examine multiple initiative aspects to determine potential obstacles ahead of program implementation.

Technical Feasibility is the most essential component within a feasibility study, especially in projects like the transition of legacy system to a web-based solution in Finance forge. Technical feasibility investigates how much progress the proposed system can achieve using available technology and expertise from current infrastructures. Finance Forge must verify its present hardware along with the software infrastructure versatility for the new web-based system alongside assessing internal personnel technical capabilities for implementing the platform (Rindell et al., 2021). The study also examines the ability of the web-based platform to adapt to higher operational requirements of a growing client base. The study examines all technical risks while exploring system integration limitations with established applications and database platforms.

The evaluation of financial project components through Economic Feasibility determines whether anticipated rewards match project expenditures. The development costs consisting of personnel expenses together with infrastructure provisions and licensing fees and maintenance charges would be assessed by Finance Forge against expected financial advantages. A ROI assessment of Finance Forge will determine if planned financial returns together with operational savings match the project investment costs. The evaluation of economic feasibility monitors how budgets perform during projects while identifying new costs that potentially arise over time (Saeed et al., 2025).

Operational Feasibility investigates both the system’s compatibility with organizational structures along with how well it meets user demands. This component for Finance Forge examines if the new web-based system matches the company’s ongoing business workflows while providing effective help to staff members alongside clients. The evaluation ensures both user interface simplicity and system capability to perform essential business operations including currency conversion, and quote generation and client data management (Senarath, 2021). The assessment of operational feasibility determines both the effects of system implementation on employees at Finance Forge alongside client management requirements. The analysis evaluates staff adaptability to the new platform while determining system efficiency regarding existing operation levels to prevent excessive complexity and interruptions. The evaluation would assess how well the system fulfills legal demands and regulatory necessities related to financial sector privacy protection protocols (Shafiq et al., 2021).

The Schedule Feasibility component ensures projects will finish on time. Finance Forge needs to verify new system development timeline because the company desires to implement the system for their expanding operations. The company should estimate the duration of each development phase from the start to the end of the project. The project feasibility analysis includes evaluation of available resources including staff and infrastructure and their potential to effectively fulfill project deadlines. The schedule feasibility helps that enough time is used to fulfill project goals, which reduces delays that may impact business operations (Shylesh, 2017).

The feasibility study allows Finance Forge to determine the viability of the proposed project. The analysis allows Finance Forge to decide whether to proceed with the project or to avoid the project if the cost is high. The feasibility study is an essential tool which helps Finance Forge achieve project success during decision-making procedures at Horizon Peak Digital.

3.3 Comparing Technical Solutions

All software development feasibility studies require basic steps for technical solution assessment and evaluation. The evaluation methodology works to find the optimal technology stack with design approach and system architecture that addresses project specifications (Soni et al., 2023). Technical feasibility assessment of the Finance Forge project determines whether the web-based solution aligns with business targets and the current organizational foundation. The technical solution assessment requires a structured evaluation of scalability potential with user results and security features integration strength together with skills available within the resource team.

The first essential step in technical solution comparison process involves clearly defining project requirements. Financial Forge’s requirements dictate the need to build a web-based system enabling real-time currency conversion capabilities as well as investment quote computation and secure client record management. The system needs to provide versatile functions to support expanding user traffic so it achieves optimal speed together with demanding security standards for protecting essential financial data (Sudarmaningtyas, & Mohamed, 2021). The solution needs to function with present databases and legacy operational systems in order to generate efficient data exchange while maintaining continuous business operations.

The evaluation process moves to assess different alternate solutions by examining various technical architectures and platform selections. The development of customized web applications with combination of MySQL or PostgreSQL relational database and PHP or Java server-side traditional technology could solve Finance Forge’s requirements. The implemented solution uses server infrastructure to execute business logic and process requests and handle data storage on a central server. The customization features of this methodology allow Finance Forge to adapt the application specifically for their needs. This custom-built platform provides high customization but poses scalability problems which may create performance bottlenecks as the system’s user base expands substantially (Yahya, & Maidin, 2022).

Another alternative include a cloud-based strategy that utilizes platforms from Microsoft Azure or Amazon Web Services. Cloud computing provides multiple benefits such as automatic resource scaling based on demand together with robust defense systems that protect sensitive information. A cloud-based solution represents an attractive option for Finance Forge because it does away with extensive in-house infrastructure expenses while allowing flexible resource organization. Through cloud infrastructure, Finance Forge could quickly connect third-party currency exchange rate providers and enable the adoption of current software development practices involving continuous integration and deployment (Yahya, & Maidin, 2022).

The implementation of a hybrid solution which merges conventional server-side methods with cloud systems represents another potential design alternative. As a part of its transition, Finance Forge will maintain its current on-premise data storage but move its application frontend and business logic components to a cloud platform. The company can leverage cloud advantages for scale and flexibility so it does not need to leave behind its present infrastructure framework. The implementation of a hybrid system may introduce complexity as well as other additional costs (Yahya, & Maidin, 2022).

The assessment of these technical solutions requires thorough evaluation of their prospective scalability. The new system needs to support growing traffic loads together with expanding data processing requirements as Finance Forge continues its development. Cloud-based solutions demonstrate better scalability than traditional on-premise systems since they allow instant modifications of resources according to usage data (Gupta et al., 2021). A growing organization such as Finance Forge crucially needs this feature to ensure its system can grow with expansion while avoiding extensive system replacements.

Another important factor is performance. The future system of Finance Forge requires quick response speeds from users who work with timely financial data including currency fluctuations and investments computations. Organizations can gain better performance optimization through lower latency and access improved options due to cloud systems which distribute data across global facilities compared to conventional server-based systems that need proper scaling for optimal performance (Soni et al., 2023).

The security of sensitive information is an essential factor that demands special attention because Finance Forge operates as a financial services company. Financial services providers like Finance Forge need to maintain complete security for both transaction records and personal customer data (Khan, 2021). Cloud-based systems deliver strong security capabilities through multiple encryption protocols and require multi-factor access verification and automatic system patches. Server-side technologies would force Finance Forge to create and sustain its security fundamentals independently at greater expenses while potentially introducing new cyber threats.

The availability of skilled resources should also be considered. The selection of server-side custom solutions by Finance Forge demands developers whose expertise extends to particular programming languages and database management systems (Khan, 2021). Cloud solutions need workers who understand cloud services and infrastructure management frameworks which are becoming standard due to the growing popularity of cloud technologies across the market.

Finance Forge should choose an optimal solution that combines reasonable costs and performance along with safe implementation and scalability requirements. The feasibility study gives Finance Forge a comprehensive view of solution trade-offs, so they can pick an option that establishes success for their web-based system.

3.4 Impact of Feasibility Study on Finance Forge

The feasibility study helps Finance Forge to evaluate project viability especially when managing a substantial system transformation such as the one at Finance Forge. A meticulous feasibility study creates significant impacts by verifying the project’s technical feasibility as well as its compatibility with financial goals and operational requirements. The new web-based platform at Finance Forge requires three crucial feasibility assessment criteria to guide decisions while leading to platform success: Cost, Schedule and Technical Fit (Shylesh, 2017).

The cost evaluation represents the top priority for feasibility studies because it directly affects project success. The cost feasibility assessment analyzes whether existing financial restrictions allow for the project solution implementation at Finance Forge. The cost assessment for Finance Forge extends through development phases alongside implementation work and future maintenance requirements. The assessment includes an evaluation of constructing an in-house system against choosing premade cloud solutions or ready-to-use products. Cloud-based solutions help companies save finances by providing subscription packaging and enabling them to avoid substantial hardware capital expenditures which custom development typically requires more skilled resources and building infrastructure (Saeed et al., 2025).

Finance Forge would face considerable initial expenditures for traditional server-side solutions because they need to purchase specialized hardware and servers and maintain dedicated staff for system administration. Finance Forge stands to achieve substantial capital savings through selecting cloud-base options such as Amazon Web Services (AWS) or Microsoft Azure which implement pay-as-you-go pricing models. Through the feasibility study, Finance Forge will select the least expensive solution which meets their requirements without exposing excessive financial vulnerability. The evaluation will help to understand long-term financial implications including the costs of scaling and maintaining the infrastructure (Senarath, 2021).

Project schedule becomes the second feasibility factor which determines the feasibility of finishing the work according to planned deadlines. The new system rollout timing stands as a priority for Finance Forge since system delays can degrade customer satisfaction while damaging business operations and causing reputation loss.

The Finance Forge project faces major scheduling problems because of the need to integrate its new web-based platform with existing legacy systems. Legacy systems that use outdated technologies avoid both changes and technological updates. The feasibility study will determine the required integration time to ensure the timing plan remains practical. The study reveals that system integration exceeds its planned timeline so Finance Forge must determine whether they need to extend their project schedule or add new functional processes. Financial Forge will conduct an evaluation to examine external requirements from both market needs and regulatory concerns which may affect the planned schedule. Defined preparation methods enable Finance Forge to achieve delivery targets during system implementation (Rindell et al., 2021).

The assessment process requires the new solution to be tested for compatibility with existing Finance Forge technology while demonstrating ability to match future expansion projections. Technical feasibility analysis examines both system compatibility with existing organizational technology and software and hardware purchases which sustain long-term business expansion. Finance Forge requires assessment of seamless connections between their current client and financial record systems and their currency conversion tools (Rindell et al., 2021).

A feasibility study for cloud-based solutions must determine if existing IT infrastructure supports cloud implementation together with confirming the technical skills needed for managing cloud-based systems. The study evaluates how well the new system accepts anticipated modifications such as mobile applications and advanced financial tools (Khan, 2021). Security stands as a main priority for Finance Forge before implementing its solution because the system must protect sensitive financial information requiring advanced encryption methods along with multi-factor authentication and compliance with GDPR or PCI-DSS standards.

Technical fit in software development practices runs through the complete processes carried out by the company. A study of Finance Forge’s agile development team capabilities would enable the feasibility study to produce an iterative SDLC recommendation that provides quick adjustment capacity to shifting requirements. A team who works in traditional development methods will benefit from the waterfall approach. However, a team familiar with modern techniques may use an iterative SDLC model. The project selection phase selects a model by matching operational strengths within the company ensuring that chosen techniques align with project achievements (Rindell et al., 2021).

The analysis from the feasibility study reaches up to senior organizational decision-makers because it directly shapes their strategic choices. The feasibility assessment aids Finance Forge leadership teams to realize optimal resource distribution so they can select vendors and establish their overall project direction (Khan, 2021). Finance Forge can identify potential risks during the feasibility study, so they can establish strategic mitigation approaches that helps prevent project failure and major setbacks.

External research literature establishes the fundamental value of conducting feasibility assessments throughout software development cycles. The Project Management Institute (PMI) showed that 60 percent of software development projects fail because of ineffective planning and mismatched project expectations. A detailed feasibility study acts as a fundamental tool for setting attainable targets which match the company’s potential and market conditions. The new web-based platform from Finance Forge achieves technical feasibility through solution comparison along with risk evaluation and cost projections which demonstrate financial viability and potential user advantage (Rindell et al., 2021).

Activity 3: Software Development Lifecycle Investigation

4.1 Identifying Stakeholder Requirements

The success of software development success depends on stakeholder requirement identification because this produces systems which address user and organizational expectations. The successful implementation and development of Finance Forge’s new web-based platform depends on properly understanding and addressing the requirements of key stakeholders who include management alongside users and technical staff (Khan, 2021).

Initial stakeholders within the Finance Forge project consist of the management team. The project must support company strategic objectives which focus on customer satisfaction improvements together with operational efficiency. The new platform requires significant attention from Finance Forge’s management to ensure it has scalability alongside security standards which will support business growth in the future. Finance professionals need complete information about all project expense estimates together with duration assessments and profitability predictions (ROI) estimates. Security is a top priority for the management team who wants to make sure the new system follows rules and protects sensitive financial information at its highest level (Pinheiro, 2018). System architecture decisions together with third-party vendor choices and project direction emerge from these requirements.

Internal customer service representatives and financial analysts join external clients who utilize the web platform as important stakeholders within this system. The company requires specific features in its system design which must deliver user-friendly navigation functions as well as analytical financial tools for internal employees to efficiently support customers. Users need access to real-time information together with intuitive interfaces and efficient workflows in the system (Pinheiro, 2018). External stakeholders focus on how easily they can use the platform together with its accessibility features. The system demands ease of use together with response capabilities as well as secure banking functions for users to access financial data alongside account records and transaction registers. The users prioritize a system that allows seamless execution of currency conversions and portfolio handling operations and effortless team support interaction.

The technical staff at Finance Forge leads development and maintenance together with implementation tasks for the new platform. The team at Finance Forge defines technical specifications to evaluate system architecture alongside performance capability and ease of combining existing systems. The technical staff requires an IT platform which utilizes contemporary technology standards to serve both present and future company operational requirements along with target systems architecture (Pinheiro, 2018). A system must include detailed documentation and a solid security framework while offering both strong troubleshooting support and clear documentation. The established requirements will help guide decisions regarding development frameworks as well as database management systems and system security approach. Finance Forge should involve all key stakeholders in order to ensure that their developed system meets all requirements resulting in an acceptance of the final platform.

4.2 Planning and Scope of the Project

The scope of Finance Forge system defines the exact project limitations while specifying all crucial components which will feature in the new platform. This fundamental planning stage establishes meaningful boundaries which help stakeholders view all system features and verifies that the system satisfies business needs along with technical capabilities. The Finance Forge system identifies two main user groups while developing essential elements that comprise currency conversion functionality as well as savings and investment quotation capabilities along with user administration tools to manage accounts and integrate financial data pools (Pinheiro, 2018). The designed features will incorporate future growth expectations to meet rising market requirements while being built with security and scalability principles in mind.

A critical part of this system consists of multiple essential packages starting with a currency conversion framework which allows users to compute foreign exchange costs for GBP, USD, EUR and JPY currencies. This system obtains current market exchange rates and executes automatic currency conversions whenever end-users submit their data through the interface. Clients will find a savings and investment plans module in the system that delivers quotes about potential earnings based on their investment selection (Pothukuchi et al., 2023). User account management within this system enables clients to maintain personal information while reviewing their transaction records and keeping their quote data for future use. The platform includes a data security module featuring security protocols to protect user-sensitive information which fulfills data privacy laws and regulatory standards for data protection.

The system offers multiple interfaces to handle data input together with responses and operational procedures that drive its essential processing. User data comprised of personal information and financial details and currency amounts entering the system functions as inputs. Real-time information about currency exchange rates and investment choices will be processed by the platform. Direct output displays present calculated conversion figures together with financial data graphics along with investment and savings rate proposals for users to view (Pothukuchi et al., 2023). The system will automatically create user-oriented reports that provide transaction history summaries and financial metrics about portfolio performances with the additional capability to create reports for financial advisors. The system performs functions consisting of data verification and real-time information retrieval from exchange rate APIs and financial computation with additional user verification aspects.

Project boundaries need specific attention when defining the scope but also require assessment of possible constraints that can affect implementation. The implementation of ERP meets various barriers including minimal funding and restricted time as well as limitations from the present technology system at Finance Forge. A web-based solution that enters a client-server infrastructure will need substantial modifications to maintain seamless data exchange capabilities (Pothukuchi et al., 2023). Because financial data is sensitive, the system requires compliance with regulations to ensure secure data processing. The implementation timeline for the system needs to consider both the detailed features of individual modules along with required integration periods to produce a unified solution.

The analysis of diverse system options during the planning period helps Finance Forge identify their most suitable choice. A possible alternative to custom-built systems would be an off-the-shelf software solution adoption. The off-the-shelf software packages may reduce development expenses and timelines, but do not adapt effectively to the specific needs of Finance Forge regarding customization options and expansion capabilities (Pothukuchi et al., 2023). Such alternative solutions often struggle to integrate effectively with Finance Forge’s current technical structure.

The hybrid alternative combines internal development of currency conversion and investment quotes modules with external usage of current software platforms for managing user accounts. This solution helps minimize expenses and accelerates work but might face issues when keeping modules structurally consistent at a user level (Pothukuchi et al., 2023). The implementation choice would require evaluating the return on investment in order to decide between long-term sustainability needs and the need for smooth integration.

The system demands top priority security features because it processes highly confidential financial data. Data protection must be a fundamental component of system development through encryption which protects information both in transit and when it is at rest. User authentication through multi-factor authentication (MFA) techniques is necessary to guarantee authorized personnel access to protected information (Pothukuchi et al., 2023). Client personal information requirements under General Data Protection Regulation (GDPR) and other relevant privacy regulations need to be met through the Finance Forge system while users retain control of their personal data and all stored data must remain secure.

Firewalls together with intrusion detection systems combined with regular security audits are essential elements for protecting the platform against outside attacks. A proper implementation must include role-based access control (RBAC) which allows users to see only relevant data features based on their assigned roles. The financial system requires a comprehensive approach for safeguarding data integrity because it needs defense against unauthorized modifications as well as loss events. Security needs demand solid implementation of secure development practices such as code analysis and security vulnerability tests to run through every development phase (Pothukuchi et al., 2023). The planning scope of the Finance Forge system are shaped by all features, modules, inputs, outputs, processes, security considerations, and design constraints specified in this report.

4.3 Functional and Non-Functional Requirements

Functional Requirements

The functional requirements at Finance Forge system establish essential user activities and services which directly reflect Finance Forge’s business needs alongside those of its clients. The system requirements detail functional elements including enabling behaviors and operational abilities. The currency conversion feature is the primary functional requirement, because users need an interface to input their transaction amounts in various currencies before receiving their chosen currency value (Olorunshola, & Ogwueleka, 2022). The system needs to retrieve real-time exchange rates from secured external application programming interfaces for delivering precise currency conversions. The system presents results immediately to show exact conversion rates together with proper mathematical computations. The system provides essential functionality to clients who work with international deals by enabling real-time foreign currency exchange management.

The transaction record management system is a major functional requirement because it maintains records on how users conduct currency exchanges and access investment quotes and create savings plans. A system should store complete transaction records that include transaction values alongside dates and user information and type of processed activities. The system serves essential functions to enable Finance Forge staff together with users to maintain precise financial documentation (Khan, 2021). Users should be able to retrieve their transaction records from their accounts but Finance Forge team members will depend on this information for financial reports and audit requirements along with compliance needs.

The Finance Forge system requires an integral tool which generates investment quotes as part of its operations. Users can input financial planning data through this interface which the system transforms into return estimates using pre-defined criteria and market information. Users receiving output should easily understand expected investment performance projections and investment quotes that the system generates (Kyeremeh, 2021). The system requires an account management element that lets users create new accounts and make changes to them, also allowing deletion of accounts and secure data storage for personal information and financial tracking. A secure login features allow users to log in to the system using either username and password or multiple verification authentication.

Non-functional requirements

Non-functional system requirements establish operational characteristics which uphold performance and effectiveness together. The system requirements focus on attributes like scalability and security and usability that determine user experience while remaining independent from core functionality.

Scalability is a critical non-functional requirement for implementing the system. The expanded services along with increased user base at Finance Forge necessitate a system architecture that supports rising traffic together with expanding transaction volumes. The platform achieves continued operation efficiency through its ability to scale its services and accommodate greater client volumes and transactional workloads. The system requires cloud-based infrastructure together with load balancing and database optimization to efficiently manage future demand (Kyeremeh, 2021).

Another essential non-functional requirement is the usability. A simple user-friendly interface (UI section) in the system needs to serve clients of all financial literacy levels who need to easily operate throughout the platform. A user-friendly design must have simple layouts along with easy-to-follow traffic patterns and obvious system functionality. The design should consider accessible needs when supporting multiple devices including desktops as well as tablets and smartphones and must follow accessibility requirements for people with disabilities (Kyeremeh, 2021).

Financial transactions demand maximum security because it remains the top non-functional demand. A system requires comprehensive security protocols to safeguard all user data together with financial information. Data protection is maintained with encryption techniques alongside secure user identity management and defense against cyberattacks including hacking and phishing intrusions (Kyeremeh, 2021). The system needs to conduct ongoing security audits as well as vulnerability assessments to detect potential risks which need to be resolved before they become issues. All user and financial data needs protection through obeying data privacy rules which also include international standards like the General Data Protection Regulation (GDPR) for proper handling of personal information.

Performance is an essential non-functional requirement which enhances system operation. The system needs to execute its essential functions with rapid speeds while maintaining consistent reliability throughout operations. Users expect their currency conversions and investment quote outputs to arrive instantaneously since excessive processing time leads to dissatisfied users (Kyeremeh, 2021). The platform needs continuous performance monitoring to discover problems while maximizing system operations regarding speed and efficiency.

The last essential non-functional requirement is system availability. A system must have high availability which guarantees users experience and minimal interruption. Any interruptions to the system on a financial service platform could result in revenue loss, and affect user trust. The system infrastructure should contain redundant backup systems and failover mechanics which defend continuous user accessibility.

4.4 Design and Solution

Different system design approaches must be applied when developing Finance Forge to create an efficient and scalable solution which delivers solutions for currency exchange operations alongside investment planning and user account management. System design that includes comprehensive planning must solve technical and business obstacles regardless of its usability and security features (Kyeremeh, 2021).

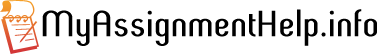

Algorithmic design elements are essential because they enable key operational procedures such as currency conversion, transaction recording and investment quotation calculation. The Finance Forge system contains currency conversion as the basic operational process. The flowchart demonstrates how user form entries related to conversion parameters activate system inquiries (Kyeremeh, 2021). The outline map details the workflow from source to destination, starting with outside APIs which pull current exchange values to generate calculated results for user display. The pseudocode for this process could look like this:

Start

Input: Amount, SourceCurrency, TargetCurrency

Get ExchangeRate from API (SourceCurrency, TargetCurrency)

ConvertedAmount = Amount * ExchangeRate

Display ConvertedAmount

End

The pseudocode simplifies currency conversion while remaining adaptable for implementing components including investment price computation. A flowchart illustrating the transaction recording system shows exactly how users’ processes (transaction completion) affect the system database through entry of transaction details (such as date, amount, and user information).

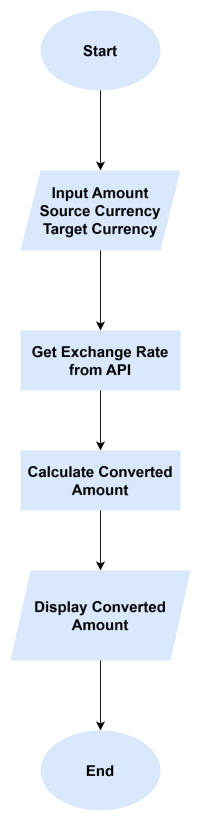

A Finite State Machine (FSM) design for the system begins with examining the states which affect different components involved in user processes and system dynamics. An FSM design depicts system stage evolution by revealing the process steps and state transit events prompted by user actions or system situations. The Finite State Machine design establishes “logged out” and “logged in” and “session expired” stages when managing user accounts. The system would trigger transitions when users successfully authenticate and complete actions as well as when inactivity ends the session. The FSM allows designers to visually control and model the system’s user interaction flow patterns.

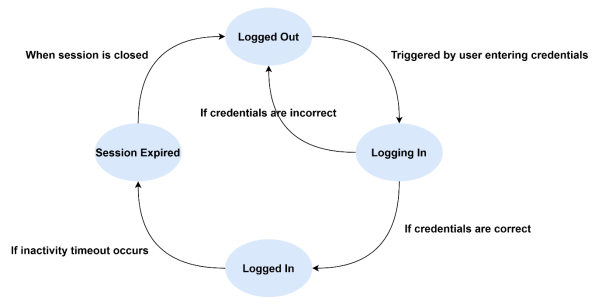

Extended Finite State Machines serve as an advanced evolution of Finite State Machines by integrating conditions with data elements into transition management. User authentication requires system evaluation of account status and password verification with additional verification for two-factor authentication. In this scenario, the FSM functions beyond basic “enum” states to incorporate data-driven elements such as “valid password” and “invalid password” which expand system decision making capabilities. The Finance Forge platform requires this expanded model as part of its secure authentication management system which handles multiple user verification steps.

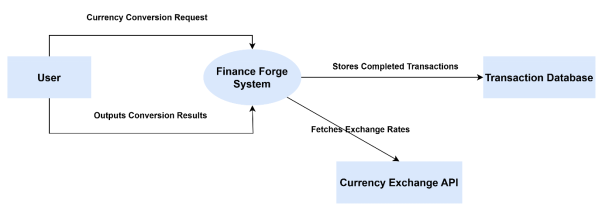

Data design plays an equivalent role within systems by determining how data will be organized for storage within structures that support each functional requirement. A Data Flow Diagram (DFD) serves as a representation tool to monitor data movement across system areas. The Level 0 DFD demonstrates the Finance Forge system operating as a central process which connects to user data as well as external APIs for exchange rate access alongside external transaction service utilization. DFD diagram allow all stakeholders to understand how data travels between the different system components.

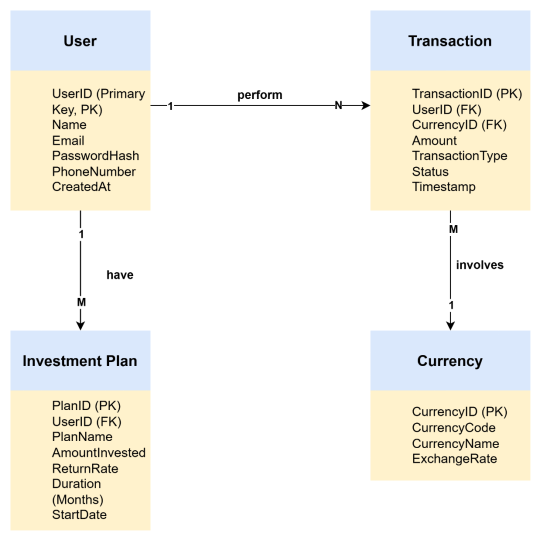

Entity-Relationship Diagram (ERD) can help to expand on the system’s database structure by identifying key entities such as; User, Transaction and Currency, investment plan and their relationships. The diagram shows how Users connect to Transactions, as they can execute various Transactions. Each individual Transaction is related to the Currency entity in order to track the currency pairs related to an exchange. ERD allows the system to establish normalized databases which enable efficient accessing and generation of reports.

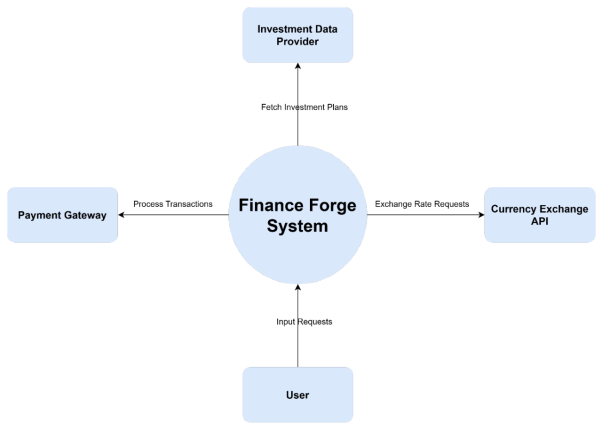

The context diagram is an advanced abstraction tool which defines high-level graphical relationships between system components and external elements. The diagram shows the system at the center, which is surrounded by the User, Payment Gateway, Currency Exchange API and Investment Data Provider. This diagram shows the system boundaries, and it defines what falls inside the scope and what remains outside.

The evaluation of business and technical system options requires systems to demonstrate their capacity for scalable growth together with adequate security standards and future expansion capabilities. The deliberate choice of a cloud-based system infrastructure aligns perfectly with Finance Forge’s requirement of handling user demand growth and unstable usage patterns. The database management and serverless computing along with automated scaling abilities of Amazon Web Services (AWS) and Microsoft Azure allow systems to handle rising user traffic and data processing tasks without sacrifice to performance output. Microservices offer a technical solution that divides the system into independent modules representing features like user management and currency conversion alongside transaction processing. The modular structure simplifies development of new features because system maintenance does not affect the entire platform (Kumar, & Rashid, 2018).

From a business perspective, Finance Forge needs a system which supports easy use and intuitive interfaces to attract individuals including small business owners and investors. The essential elements such as; usability and performance will help to achieve business goals. The system must fulfill financial regulatory requirements alongside data protection standards which include GDPR standards as well as applicable laws governing financial services. The approach to business cost-effectiveness demands flexible cloud-based solutions which enable demand-driven scalability to reduce initial capital outlays and maximize operational spending efficiency.

4.5 Improving Software Quality

Software quality must be improved by implementing essential strategies. The developers can improve software quality by using methodologies such as automated testing and continuous integration practices. These approaches allows developers to identify and address issues early, enhance reliability of the system, and streamline the development process (Kumar, & Rashid, 2018).

Tools for automated testing can assess system performance by performing preset tests automatically any time developers modify or insert source code into the system. The core processes of currency conversion along with transaction recording and user authentication need to utilize automated testing as a critical validation method for Finance Forge. This automated method allows for frequent testing without human involvement which helps to identify bugs early (Kumar, & Rashid, 2018). The development team can maintain the system stability and correct functionality across environments by developing automated tests designed for different levels including units, integrations and systems which verify individual component accuracy and component-to-component interconnection and overall system operation. This method results in better quality software with enhanced user satisfaction.

Continuous integration (CI) is another essential approach for enhancing software quality. Software developers implement continuous integration by pushing their amendments regularly into centralized storage then test automatically to confirm their changes have not brought flawed results (Kumar, & Rashid, 2018). The continuous integration process at Finance Forge prevents systemwide interruption when developers deploy system updates which include currency exchange API modifications or user management enhancements. The feedback cycle enabled by CI helps developers identify integration problems instantly so they can solve issues before they become complex later during development. CI allows developers to maintain better collaboration because they can work simultaneously on different system areas without risking their changes to interfere with each other.

Software requirements traceability is an essential process throughout the complete system development time. The process guarantees complete consideration of all functional and non-functional requirements throughout design phases and testing phases until system deployment. The requirements tracing solutions for Finance Forge consist of linking each system feature and user story with identified requirements determined during planning activities (Kumar, & Rashid, 2018). The tracking capabilities generate a direct line which connects specification activities with the development of the implemented system. Requirements tracing enables the development team to monitor changes while assessing modification effects which validates systems, maintain alignment with business needs and user expectations.

Conclusion

The study of software development lifecycle (SDLC) models alongside feasibility studies and behavioral design techniques identified essential guidelines for a successful Finance Forge project. The study investigated the application of sequential and iterative SDLC models throughout this report to determine their capabilities when implementing the project’s requirements (Kumar, & Rashid, 2018). The iterative models featuring Agile and Spiral excel at delivering flexibility, adaptivity and both models are essential in Finance Forge due to its platform dynamism. Waterfall and V-Model together with their sequential structure offer developers a systematic framework that ensures requirements are completed properly but provide less adaptable workflows than iterative SDLC models. According to the assessment, the iterative approach such as Agile best suited Finance Forge because of its complex and continuously changing demands.

The project viability assessment emphasized four core elements including technical features and economic viability and operational requirements and schedule timings. Each component proved essential for project feasibility determination. The investigation revealed that pre-project assessments of fundamental factors are essential because they let teams plan appropriately while anticipating future developmental challenges (Khan, 2021). The analysis of technical solutions in the feasibility study demonstrated that implementation of data-oriented approaches with contemporary technology was essential to achieve reliable and scalable system operations.

For optimal results, Finance Forge should implement an Agile protocol in the Software Development Life Cycle, so developers can perform constant evaluation and successive enhancement of the system. Behavioral design techniques with FSM and extended FSM enable managers to handle system states and transitions and ensure predictable responses across different operating conditions (Khan, 2021). The implementation of data-driven design promotes better adaptation across the system while enabling increased responsiveness to changes thus resulting in higher system reliability.

Software development requires extensive investigation alongside detailed planning because both aspects are essential to project success. The combination of SDLC model evaluation with feasibility assessments together with appropriate design approaches creates development processes which deliver high efficiency (Khan, 2021). This process aligns Finance Forge to develop a robust user-friendly platform which satisfies business requirements and user prediction.

References

Akhtar, A., Bakhtawar, B., & Akhtar, S. (2022). Extreme programming vs scrum: A comparison of agile models. International Journal of Technology, Innovation and Management (IJTIM), 2(2), 80-96.

Alami, A., Krancher, O., & Paasivaara, M. (2022). The journey to technical excellence in agile software development. Information and Software Technology, 150, 106959.

Ali, R., & Bahrami, M. R. (2024, October). Integrating Optimization Techniques in Software Development Life Cycle-SLR. In 2024 International Conference on Electrical, Communication and Computer Engineering (ICECCE) (pp. 1-8). IEEE.

Bajzek, M., Fritz, J., & Hick, H. (2021). Systems engineering principles. Systems engineering for automotive powertrain development, 149-194.

Baumgartner, M., Klonk, M., Pichler, H., Seidl, R., & Tanczos, S. (2021). Agile Testing. Springer International Publishing.

Cassel, S., Howar, F., Jonsson, B., & Steffen, B. (2018). Extending automata learning to extended finite state machines. In Machine Learning for Dynamic Software Analysis: Potentials and Limits: International Dagstuhl Seminar 16172, Dagstuhl Castle, Germany, April 24-27, 2016, Revised Papers (pp. 149-177). Springer International Publishing.

Daraojimba, E. C., Nwasike, C. N., Adegbite, A. O., Ezeigweneme, C. A., & Gidiagba, J. O. (2024). Comprehensive review of agile methodologies in project management. Computer Science & IT Research Journal, 5(1), 190-218.

Doğan, O., Bitim, S., & Hızıroğlu, K. (2021). A v-model software development application for sustainable and smart campus analytics domain. Sakarya University Journal of Computer and Information Sciences, 4(1), 111-119.

Doshi, D., Jain, L., & Gala, K. (2021). Review of the spiral model and its applications. Int. J. Eng. Appl. Sci. Technol, 5, 311-316.

Dwivedi, N., Katiyar, D., & Goel, G. (2022). A Comparative Study of Various Software Development Life Cycle (SDLC) Models. International Journal of Research in Engineering, Science and Management, 5(3), 141-144.

Gupta, A., Rawal, A., & Barge, Y. (2021). Comparative Study of Different SDLC Models. Int. J. Res. Appl. Sci. Eng. Technol, 9(11), 73-80.

Hassan, F. M. A., Das, S. R., & Hussain, M. (2024). Importance of Secure Software Development for the Software Development at Different SDLC Phases. Authorea Preprints.

Imam, A. (2024). INTEGRATING AI INTO SOFTWARE DEVELOPMENT LIFE CYCLE.

Khan, N. A. (2021). Research on various software development lifecycle models. In Proceedings of the Future Technologies Conference (FTC) 2020, Volume 3 (pp. 357-364). Springer International Publishing.

Kuhrmann, M., Tell, P., Hebig, R., Klünder, J., Münch, J., Linssen, O., … & Richardson, I. (2021). What makes agile software development agile?. IEEE transactions on software engineering, 48(9), 3523-3539.

Kumar, M., & Rashid, E. (2018). An efficient software development life cycle model for developing software project. International Journal of Education and Management Engineering, 8(6), 59-68.

Kyeremeh, K. (2021). Overview of system development life cycle models. Journal of Management and Science, 11(1), 12-22.

Laplante, P. A., & Kassab, M. (2022). Requirements engineering for software and systems. Auerbach Publications.

Martin, M. (2023). Software Development Life Cycle (SDLC) Phases & Models.

Martínez-Fernández, S., Bogner, J., Franch, X., Oriol, M., Siebert, J., Trendowicz, A., … & Wagner, S. (2022). Software engineering for AI-based systems: a survey. ACM Transactions on Software Engineering and Methodology (TOSEM), 31(2), 1-59.

Mishra, A., & Alzoubi, Y. I. (2023). Structured software development versus agile software development: a comparative analysis. International Journal of System Assurance Engineering and Management, 14(4), 1504-1522.

Najihi, S., Elhadi, S., Abdelouahid, R. A., & Marzak, A. (2022). Software Testing from an Agile and Traditional view. Procedia Computer Science, 203, 775-782.

Olorunshola, O. E., & Ogwueleka, F. N. (2022). Review of system development life cycle (SDLC) models for effective application delivery. In Information and Communication Technology for Competitive Strategies (ICTCS 2020) ICT: Applications and Social Interfaces (pp. 281-289). Springer Singapore.

Olorunshola, O. E., & Ogwueleka, F. N. (2022). Review of system development life cycle (SDLC) models for effective application delivery. In Information and Communication Technology for Competitive Strategies (ICTCS 2020) ICT: Applications and Social Interfaces (pp. 281-289). Springer Singapore.

Pinheiro, J. (2018). Software development life cycle (sdlc) phases. URL: https://medium. com/@ jilvanpinheiro/software-development-lifecyclesdlc-phases-40d46afbe384.

Pothukuchi, A. S., Kota, L. V., & Mallikarjunaradhya, V. (2023). Impact of generative ai on the software development lifecycle (sdlc). International Journal of Creative Research Thoughts, 11(8).

Rasheed, A., Zafar, B., Shehryar, T., Aslam, N. A., Sajid, M., Ali, N., … & Khalid, S. (2021). Requirement engineering challenges in agile software development. Mathematical Problems in Engineering, 2021(1), 6696695.

Rindell, K., Ruohonen, J., Holvitie, J., Hyrynsalmi, S., & Leppänen, V. (2021). Security in agile software development: A practitioner survey. Information and Software Technology, 131, 106488.

Saeed, H., Shafi, I., Ahmad, J., Khan, A. A., Khurshaid, T., & Ashraf, I. (2025). Review of Techniques for Integrating Security in Software Development Lifecycle. Computers, Materials & Continua, 82(1).

Senarath, U. S. (2021). Waterfall methodology, prototyping and agile development. Tech. Rep., 1-16.

Shafiq, S., Mashkoor, A., Mayr-Dorn, C., & Egyed, A. (2021). A literature review of using machine learning in software development life cycle stages. IEEE Access, 9, 140896-140920.

Shylesh, S. (2017, April). A study of software development life cycle process models. In National Conference on Reinventing Opportunities in Management, IT, and Social Sciences (pp. 534-541).

Soni, A., Kumar, A., Arora, R., & Garine, R. (2023). Integrating AI into the Software Development Life Cycle: Best Practices, Tools, and Impact Analysis. Tools, and Impact Analysis (June 10, 2023).

Sudarmaningtyas, P., & Mohamed, R. (2021). A review article on software effort estimation in agile methodology. Pertanika Journal of Science & Technology, 29(2), 837-861.

Yahya, N., & Maidin, S. S. (2022, September). The Waterfall Model with Agile Scrum as the Hybrid Agile Model for the Software Engineering Team. In 2022 10th International Conference on Cyber and IT Service Management (CITSM) (pp. 1-5). IEEE.