Part 1: Expenditure Approach to Calculating GDP

Part a

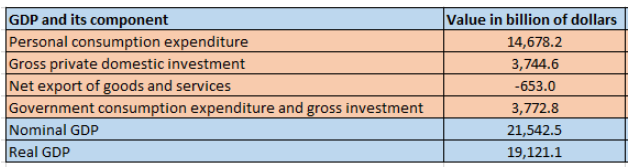

Table 1: Gross Domestic Product and its component

Part b

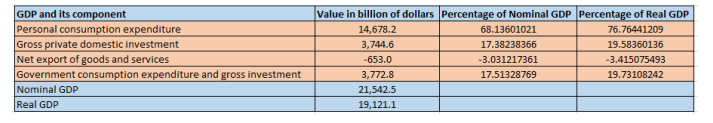

Table 2: Percentage share of different components in GDP

Report

Introduction

The report aims to discuss nominal and real GDP of United State with estimates made using expenditure approach. The discussion includes brief explanation of different components and its contribution to the economy.

Discussion

The accounted nominal GDP in the third quarter of 2019 was 21542.5 billion dollars. The estimated real GDP for the same period was 19121.1. Nominal GDP of a nation expresses value of produced goods and services of a nation in terms of prices in current year. Real GDP on the other hand expresses values of goods and services considering prices in a selected base year. Since, real GDP computes values of goods and service excluding the impact of inflation real GDP is general smaller than nominal GDP (Goodwin et al., 2015). US inflation rate in third quarter of 2019 was 2.1 percent which is higher than the previous quarter. Because of inflationary impact nominal GDP was larger than real GDP. Nominal GDP exceeded the real GDP by 2421.4 billion dollars.

The four components which make up GDP are “Personal consumption expenditure”, “Gross private domestic investment”, “Net exports of goods and services” and “Government consumption expenditure and gross investment” (Uribe & Schmitt-Grohe, 2017). Of the four components, “Personal consumption expenditure” makes up the largest portion of GDP with percentage of “Personal consumption expenditure” in nominal GDP ad real GDP being 68.13% and 76.76% respectively. The smaller portion of GDP is made up by Net export of goods and service with share of the component in nominal and real GDP being -3.03% and -3.41% respectively.

“Gross private domestic investment” is a representative measure that captures physical investment used in calculating GDP to measure aggregate economic activity of a nation. This is considered as a vital component in GDP estimation since is provides indication about future productive capacity of an economy (Heathfield, 2015). It measures fixed investment and changes in the private inventories. The fixed investment of a nation includes “non-residential”, “intellectual property products” and “residential investment”. Changes in private inventories include both farm and nonfarm inventories.

The “net export of goods and services” represents trade balance of a nation. It is computed as a difference between total export and total import. Net export of a nation becomes negative when import of the nation exceeds that of its export (Agenor & Montiel, 2015). For the accounting period, total value of goods and service exported was 2504.0 billion dollars. As against this total value of goods and service imported was 3166.7 billion dollars. Since import exceeded the export, net export is negative indicating a trade deficit.

As obtained from the data table, the speeding on national defense recorded in the last quarter was 849.3 billion dollars. The percentage of national defense in “Government consumption expenditures and gross investment” is computed as

The percentage of National defense out of GDP is

Real GDP in the third quarter increased by 2.1 percent. The increase in real GDP of the nation was mainly contributed from an increase in personal consumption expenditure, spending made by federal government, residential investment, expansion of export and spending by state and local government. The positive contribution of these components were somewhat offset because of negative contribution coming from fixed investment in nonresidential segment and investment in private inventory. Increase in import constituted another leakage offsetting positive impact of some components.

Conclusion

The data collected for the exercise gives necessary information related to nominal GDP and real GDP of United State. By providing information related to different components of GDP it helps to understand contribution made by different expenditure components in the nation’s GDP. It has been observed that the largest component of GDP of the nation is consumption expenditure while the smallest component is net export of goods and services. The data set not only contains information regarding GDP and aggregate expenditure of different components but also contains sub parts of different expenditure components. From the data set the information regarding spending on national defense is also obtained which is useful for understanding how much US spends on security of the nation. The original data set provides information on accounted GDP in the previous quarter helping to analyze direction of economic growth of the nation.

Part 2: Income Approach to Calculating GDP

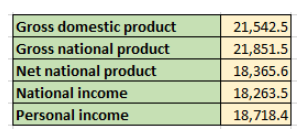

Table 3: GDP, GNP, NNP, National income and Personal income

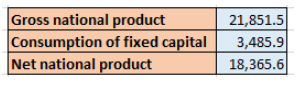

Table 4: Calculation of Net national product

Report

Introduction

This report discusses GDP estimates computed using income approach. Apart from GDP, the report includes discussion regarding other measures such as Gross National Product, Net National Product, National Income and Personal Income.

Discussion

“Gross Domestic Product” computes value of finished goods and services that are marketed in an accounting year within the national boundary. Gross National Product measures also measures value of all the products and services it however not bounded by national boundary (Heijdra, 2017). GNP in addition to GDP include “net property income from abroad”. One aspect following which GDP differs from GNP is that GDP includes income earned by foreign multinational while GNP excludes income of foreign multination when they sent profit to their own country.

In order to determine GNP from GDP, one must add income receipt from rest of the world to GDP while income payments made to rest of the world must be subtracted.

National income implies total amount of product and service that a nation produces within a given time. It actually measures monetary values of goods and services produced within the economy in the chosen accounting period (Coppock & Mateer, 2017). The level and growth in national income estimate is vital for measuring economic growth, changes in standard of living and changes in income distribution.

As obtained from the data table GNP is higher in this compared to NI. GNP is higher by 3588 billion dollars.

For determining NI from GNP, “consumption of fixed capital” and “statistical discrepancy” need to be subtracted from measured GNP.

National income is composed of different categories (Sadat, 2017). Of these categories, compensation of employees constitutes the largest portion of NI with accounted share being nearly 63 percent. Compensation of employees have two main categories such as wages and salaries and supplement to wage and salaries.

Conclusion

The data exercise includes data on different measures related to aggregate output and aggregate income of United State. Data on different estimates related to national aggregate help to understand the difference between different measures. The estimated GDP obtained using income approach is same as that obtained under expenditure approach supporting the assumption that GDP obtained using any of the available method gives identical result. Though both GDP and GNP measure total value of goods and services they differ in terms of measured items. The estimated GNP is higher than GDP suggesting net income from abroad is positive making positive contribution to the economy. National income include income earned by different factor of production is less than GNP since it is obtained after subtracting “consumption of fixed capital” and “statistical discrepancy” from GNP. The most significant component in the estimated NI is compensation of employees. The data set also includes data on personal income which reflects income of an average household. The data exercise thus is useful in understanding and interpreting different important measures related to national income estimates.

References

Agenor, P. R., & Montiel, P. J. (2015). Development macroeconomics. Princeton university press.

Coppock, L., & Mateer, D. (2017). Principles of macroeconomics. WW Norton.

Goodwin, N., Harris, J. M., Nelson, J. A., Roach, B., & Torras, M. (2015). Macroeconomics in context. Routledge.

Heathfield, D. F. (Ed.). (2015). Topics in applied macroeconomics. Macmillan International Higher Education.

Heijdra, B. J. (2017). Foundations of modern macroeconomics. Oxford university press.

Sadat, S. D. (2017). Rethinking Macroeconomics: An Introduction. International Journal of Economics, Management and Accounting, 25(3), 635-639.

Uribe, M., & Schmitt-Grohe, S. (2017). Open economy macroeconomics. Princeton University Press.