According to President Trump’s tweet, the US steel industry had hit the global headlines and according to Trump, it was giving new life and seemed to be thriving (Steil & Rocca, 2019). However, it is after a year following slapping of tariffs by Trump on the imported steel that has led to the poor performance of the steel industry. The steel industry has been reeling as the steel prices have declined and currently are at pre-tariff levels. Employment has also become stagnant a clear indication that the tariffs are not effective. However, if the policies adopted by Trump’s administration were working as scheduled, then the steel industry was anticipated to outdo the other segments.

The proponents of Trump’s tariffs, for instance, the Alliance for American Manufacturing postulated that more than 12,000 well-paying occupations had been developed or maintained in both steel and aluminum factories following the implementation of the president’s policy in the first quarter of 2018. They also asserted that vast amounts of investment in the metal mills could benefit the US in future with the inclusion of the $1 billion that was announced at a US steel plant at the outskirt of Pittsburgh.

Toyota

According to the head of Toyota in North America, he expressed his concerns and worries following the imposition of tariffs by Trump on foreign vehicles as this would make it hard for Toyota to follow through the added $750 million needed in the US investments (Lobosco, 2019). The head of Toyota went further to assert that it would be challenging as it would impact the industry in general.

Toyota workers

The president of Toyota remarked that Trump’s latest move with regards to the administration of global trade war was a significant drawback for the American consumers and this was a clear indicator that Toyota’s investment was not welcomed in the US and also that the contributions originating from the American employees are not recognized (Long, 2019). The directive that was issued by the president, however, was providing Japan and the European Union a window period to have their trade deals renegotiated with the US and this will ensure that the American automobile industry together with its workforce are protected which means jobs will not be lost.

Harley Davidson

Trump used tariffs to attack Harley last year when the company announced that it was planning to shift some of its production located in the US overseas as a strategy to sidestep the levies by the EU (Bloomberg, 2019). However, Harley Davidson has more than tariffs to blame for its poor performance. The company seems to struggle on how to attract young bike riders and instead is planning to provide cheap bikes and sell more of the clothing.

Harley Davidson workers

Harley Davidsons sells motorcycles in the US, and these bikes are manufactured in the US; however, the units are sold globally with a mix of origins and assembly (Pauly, 2015). With the EU-associated manufacturing transfer, this will lead to some of the US jobs being lost though the company never confirmed it. Also, the loss of sales in the EU translates to some workers losing their positions.

Question 2

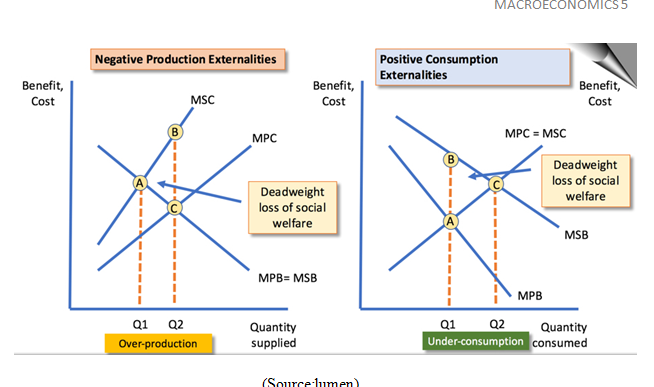

` The BP drills could have both positive and negative externalities. Starting with the positive externalities, both the consumers and the consumers would benefit as the consumers would have more access to supply of oil and the producers on the other side will obtain revenues from the oil exploration (Riley, 2018). The negative externality is that the BP drills would disrupt the sea species and the marine ecosystem, mainly through the catastrophic effects of oil spills. According to course theorem, it states that marginal social benefits and the marginal social costs should be evaluated. In this case, if the MSC is higher, then the viability associated with resource allocation for such an exchange gets lost.

On the other hand, if MSB is greater than MSC, then this leads to efficiency in resource allocation. In this case, the MSB associated with drilling activities is greater, making it optimal to continue with oil exploration. However, there will be adverse impacts related to oil drilling, and government regulations would have a significant effect as they would create countrywide awareness.

The case of a neighbor having a loud party translates to the neighbor enjoying the music, thus gaining satisfaction from it, and this would be his MSB. However, this only adds stress and disturbance to the surrounding neighbors who may be experiencing stress from the loud party music, and this is the negative externality. The optimality will arise when the neighbor reduces the loud music to acceptable limits considered by society. In this case, the coarse theorem can be utilized to fathom the inefficiency resulting from such resource allocations.

The case of a car that has got safety features leads to MSB being greater than MSC since the benefits from the usage of the vehicle are more tangible though the costs here are lesser compared to the benefits associated with safe driving and the safety of passengers. Thus, the coarse theorem can be used, and the optimality of the allocated be fathomed. In such a case, it is imperative for government regulation and intervention to be prioritized since its effect is enormous on society.

(Source:lumen)

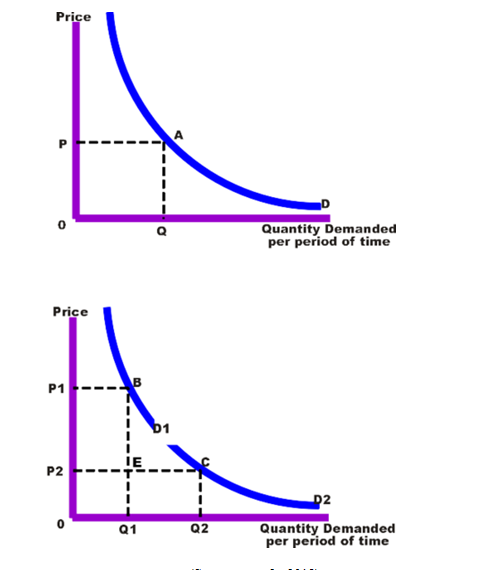

Price discrimination

The ongoing debate is gaining momentum where large insurers are favoring the cover of drug prescriptions where they will bargain the prices charged for a drug that vary based on how well it functions for some group of insured patients (Loftus, 2015). This matter occurs when exorbitant cancer drugs that may assist with several types of cancers but works better for one in specific (Pauly, 2015). This will work well in price discrimination as there will be a difference in elasticity where the pharmaceutical companies will charge based on the elasticity of demand, low price will be charged for Tarceva for the lung cancer where demand is an elastic and high price for pancreatic cancer patients where the demand is inelastic. However, according to benefits manager from Express Scripts, it would be imperative if the insurers pay less for a Tarceva among pancreatic cancer patients compared to lung cancer patients. Since there is substantial evidence from the clinical trials that show that though the drug extends survival in both cases, the increase is for lung cancer compared to those with pancreatic cancer. However, the reason why the price discrimination may not work for different cancer patients is the insurers failing to provide the sellers of the drug the access to information based on the characteristics of such patients, for instance, the type of cancer. Also, they need the guarantee that a drug sold at an affordable low price for a patient of pancreatic cancer will not be applied for a patient of lung cancer. However, it is thus evident that the insurer is better positioned to maintain the markets distinct in a manner that the seller may not be able to isolate such markets.

(Source: tutor2u 2018)

Economic intuition

The additional revenue for drug frims will be more substantial compared to the cost of manufacturing additional doses of the drug and may transcend the additional health benefits. The stockholders who are the most Americans will have taken into account the disproportionate segment of the benefits to society. Thus, a maker of a drug possessing patent could peg the price for all buyers slightly lower to benefit the buyers and primarily all the gains associated with an emerging product introduced in the market will all be enjoyed by the seller and the buyers will be less valued compared to if the drug was never discovered.

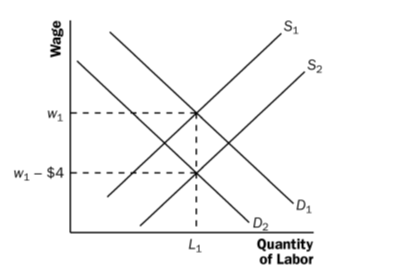

It is crucial to understand the nexus between costs associated with health insurance and the labor markets as such understanding is of great importance to policymakers. The magnitude of the impacts of such a policy requiring employers to pay 100% of the health insurance would cost employment, wages, and the coverage of such health insurance. This depends on the elasticities associated with labor supply and demand, institutional limitations on wages and compensation packages, and the extent to which employees prioritize the increase in health insurance. Since employers provide such coverages voluntarily, employees who value such benefits bear the cost of the increase in reduces wages with no following change in employment and employment costs. Thus, in this context, where employees prioritize the insurance policy at their cost increase in the cost of benefits will be fully offset by reduced wages. Therefore, following the law stipulating all employers to accord workers 100% health insurance, which is a benefit would raise the cost of employee say maybe by $ 4 for every hour. If companies were not initially providing such benefits before the policy, the curve demonstrating the demand for labor would shift down by the same proportion of $4 based on each quantity of labor. This follows the logic that the companies will be unwilling to reward their workers with a high wage given the move by the government to increase the cost of the benefits.

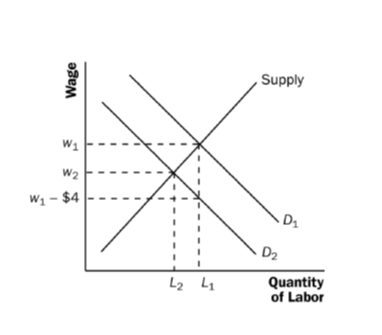

If the workers value the benefit by exactly $4 hourly, it means they would be ready to work the same amount for a wage that is $ 4 less, and this will make the supply curve of labor to shift down by $4. Figure 2 demonstrates the equilibrium in the labor market. Since both the demand and supply curves of labor shift down by $4, the equilibrium quantity associated with labor remains unchanged and the rate of wage declines by $ 4 and employers and employees are well off as before. However, if the workers fail to value the stipulated benefit, the labor supply curve will not shift down and this will lead to a decline in the wage rate by less than $ 4.This will make the equilibrium quantity of labor to decline as demonstrated in figure 4.The employers are worse off since they will now pay higher total wage plus the benefits for the few employees. Employees are also worse off since they will be entitled to a lower wage, and few will be employed.

Figure 2

Figure 4

References

Bloomberg, 2019. Harley-Davidson Profit Wiped Out

by Trump Tariffs. [Online]

Available at: http://fortune.com/2019/01/29/harley-davidson-profit-wiped-trump-tariffs/

[Accessed 13 June 2019].

Lobosco, K., 2019. Toyota chief warns that new tariffs

could threaten US investment. [Online]

Available at: https://edition.cnn.com/2019/03/15/business/toyota-tariffs-event/index.html

[Accessed 13 March 2019].

Loftus, P., 2015. New Push Ties Cost of Drugs to How

Well They Work. [Online]

Available at: https://www.wsj.com/articles/new-push-ties-cost-of-drugs-to-how-well-they-work-1432684755

[Accessed 13 June 2019].

Long, H., 2019. Trump’s steel tariffs cost U.S.

consumers $900,000 for every job created, experts say. [Online]

Available at: https://www.washingtonpost.com/business/2019/05/07/trumps-steel-tariffs-cost-us-consumers-every-job-created-experts-say/?noredirect=on&utm_term=.a3c586098044

[Accessed 13 June 2019].

Pauly, M. V., 2015. Pay-for-Performance Is No Miracle

Cure. [Online]

Available at: https://ldi.upenn.edu/pay-performance-no-miracle-cure

[Accessed 13 June 2019].

Riley, G., 2018. Externalities – the 4 Key Diagrams. [Online]

Available at: https://www.tutor2u.net/economics/reference/4-key-diagrams-on-externalities

[Accessed 13 June 2019].

Steil, B. & Rocca, B. D., 2019. Trump’s Tariffs Are

Killing American Steel. [Online]

Available at: https://www.cfr.org/blog/trumps-tariffs-are-killing-american-steel

[Accessed 13 June 2019].