Introduction

Lithium also referred to as white petroleum” is a soft, silvery-white highly reactive and flammable alkali metal separated from other elements through electrolysis from a mixture of fused lithium chloride and potassium chloride at about 450 °C. US Geological Survey of 2018 estimated global lithium reserves to be about 16 million tons. It is, however, difficult to get an accurate estimate of world lithium reserves because most lithium classification schemes only account for solid ore deposits and not brine because of varying pumping effects and lithium concentrations.

Lithium and its derivative compounds have numerous industrial uses, including the production of heat resistant ceramics, lubricants and metal flux additives and lithium and lithium-ion batteries. Australia, Argentina and Chile are the top three lithium-producing countries in the world according to the report by the US Geological Survey.

South America hosts the biggest brine producers while the largest hard-rock mines are in Australia. Chile and Australia produce more than two-thirds of global lithium. Since Lithium Carbonate is the most significant and market valuable derivative of lithium, lithium products are converted into Lithium Carbonate Equivalents (LCE).

- What factors have driven the lithium boom?

Lithium trade has seen a tremendous increase in pricing after the 2007 financial crisis when leading suppliers such as Sociedad Química y Minera (SQM), lowered lithium carbonate prices by 20%. In 2012, competition between two major lithium processing companies, Rockwood, owned by Henry Kravis’s KKR & Co and Sociedad Química y Minera (SQM) controlled by billionaire Julio Ponce saw a dramatic increase in pricing and production making “FMC” a Philadelphia-based based company the biggest producer. Global consumption of lithium is projected to increase to about 300,000 metric tons by 2020 up from 150,000 tons in 2012.

The increase in price and production has been necessitated by two main factors, increasing the desire for lithium battery-powered devices mainly in China and the willingness to battery storage for solar and other renewable energy sources from Tesla. Demand for lithium batteries needed to power cell phones, electric vehicles and wind turbines has been rising at about 25% annually compared to the 5% overall annual gain in production of lithium. Production and marketing of electronic devices such as mobile phones and laptops have led to a dramatic rise in demand for lithium.

According to the European Commission, the amount of lithium in rechargeable batteries is expected to increase ten times between 2010 and 2020 and the tonnage of lithium in portable batteries reached over 80 % of the market share in 2017 compared to 0 % in 1991. Recently, lithium prices have doubled on the global market in the last two years about $16,500 per ton.

Demand for Lithium based batteries is projected to grow to about 67.6 billion dollars by 2022. In tandem, the price of Lithium has risen sharply from about 6,500 US dollars per ton in 2015 to over 20,000 US dollars in 2018.

Use of lithium in large electric and hybrid vehicle batteries is a crucial factor driving lithium boom. Major vehicle manufacturers such as BMW, Mercedes Benz, Volkswagen, Toyota, Mitsubishi and Audi had incorporated large lightweight lithium-ion batteries in their vehicles by the end of 2013. Fearing that demand for lithium may overtake supply, major manufacturers such as Toyota launched joint ventures with mining companies such as Orocobre Ltd an Australian based lithium mining company to secure a monopoly on their lithium deposits. The European Union acknowledges that while the establishment of electric vehicles reduces overreliance on fossil fuels, it also increases demand for electricity and other raw materials such as lithium.

China currently produces over 55 per cent of lithium-ion batteries used worldwide and plans to triple production annually until 2026. Additionally, in response to the need for clean energy, China intends to produce 5 million electric vehicles by the year 2020. Consequently, increased production of electric automobiles and energy storage solutions will make Lithium one of the most important global energy commodities.

Utility Storage Solutions are a less known but significant factor that could drive demand for Lithium. Many countries across the world are modernising their old fashioned electric grids using high-density Li-ion energy storage batteries because they are more efficient. Also, electricity utility companies now prefer storage energy in battery junction boxes during off-peak seasons and using it during peak time hence mitigating the high peak demand. It is expected that deployment of stored energy in utility, residential and nonresidential electric systems will increase more than ten times in three years leading to the growth of the energy storage market to more than 3 billion US dollars.

- As an investor in lithium, where would you choose to invest to extract the most value?

(Weighting: 70% of assignment mark)

Introduction

Currently, global demand for industrial grade Lithium already will outstrip production three times over. Electric Car producers target to produce over 20 million electric motor vehicles by 2025. It is estimated that 10kg of Lithium will be required by each car and therefore more than one million tonnes of Lithium annually would be required annually. Due to this continual demand for Lithium, Lithium prices are ever increasing; this makes this industry for individuals thinking of investing. Investment in Lithium industry can take two forms, direct investment in lithium or its derivative products such as batteries or ceramics and what is popularly known as pick and shovel investment which involves investment in indirect processes such as in the production of Carbon for the manufacture of Lithium Carbonate.

Currently, there are several options available in the marketplace to invest in the metal. While buying the physical stock of lithium is hardly possible, investors can purchase shares of companies engaged in lithium mining and producing. Also, investors can buy a dedicated lithium ETF offering exposure to a group of commodity producers.

Below are some of the most lucrative lithium industries for investors;

- Supplier of Electric Cars

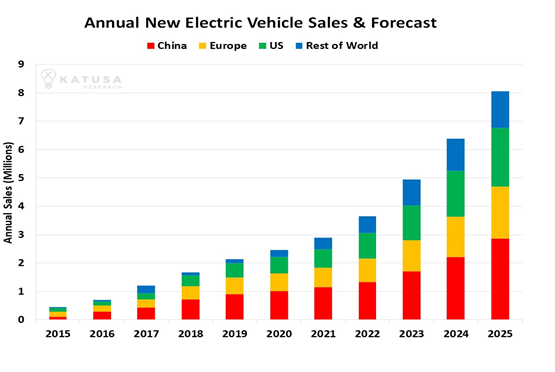

It is estimated that about 1.8 million new electric vehicles were sold in 2018 up from virtually no cars at all ten years earlier. The International Energy Agency projects that nearly 12.9 million electric vehicles will be available in main world markets by 2022 and about 90 million will be driven in 2040. Bloomberg’s New Energy Finance group targets that by 2025, more than 10 million electric vehicles will be sold annually.

Adopted from Katusa, 2018

There is a generational paradigm shift from gasoline-electric powered evidenced by unprecedented growth the U.S. electric car company Tesla to an equal market capital as motor vehicle giants such as Ford and General Motors.

- Supply of Electric vehicle batteries

There was a 40% increase in the number of new electrical vehicles sold globally from 2017 to 2018 with more than estimated 1.7 million cars sold that year, and Bloomberg projects that 8 million cars will be sold in 2025 and over 45 million by 2035. Thus there is enormous demand from major automotive technology leaders for electric vehicle batteries.

Common Electric car batteries used by major automotive industries such as Tesla and BYD are either composed of NMC (Lithium-Nickel Manganese-Cobalt) or NCA (Lithium-Nickel-Cobalt-Aluminum). Because the companies have made substantial investments in the design of the batteries and set up factories to produce them according to specifications, it is unlikely that they may change battery chemistry drastically. More promising is the fact that the Chinese government has legislated to subsidise long-range and more efficient batteries such as NCA. And NMC. Lithium-iron-phosphate batteries are much cheaper than NCA and NMC batteries, but they are being abandoned in favour of more superior energy saving and high-density alternatives.

- Lithium Carbonate Explainer

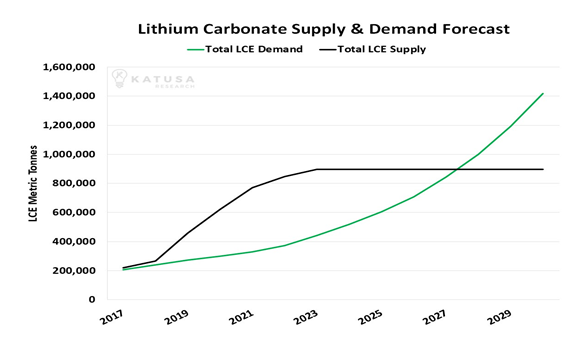

While lithium is the most critical element in lithium batteries, to ensure optimum energy density and efficiency, the lithium needs to be converted to lithium carbonate. One Kilogram of Lithium produces about 5 Kilograms of Lithium Carbonate and costs about $10 per pound up from about $3 in 2015 due to increased demand and supply. Production of Lithium carbonate is likely enhanced by over 250% by 2020 from 2016.

As such, the lithium carbonate market can be confidently be projected as favourable until 2025. It is hence a good venture for would-be investors.

Adopted from Katusa, 2018

- Buying Lithium stocks

Buying publicly advertised Lithium stocks is one of the most potentially profitable ways of investing in lithium. Future demand for green energy and coupled with increased media attention towards lithium all point to a promising future in this industry.

Lithium is much cheaper compared to other metals such as gold and diamond chiefly due to its abundance. As such, companies involved in lithium mining also called “lithium stocks” are also involved in either mining or manufacture of other chemicals or metals. Because these companies are not pure-play companies, the cost is reduced significantly, and their stocks are therefore relatively stable.

For investors who want to avoid single-stock risk arising from picking stock from lithium producers, exchange-traded fund is the best option. Started in 2010, Global X Lithium ETF was established to expose investors to many lithium-related companies. Other investors may want to invest in an ETF that tracks countries with plenty of reserves of lithium such as United States, China, Australia and Chile.

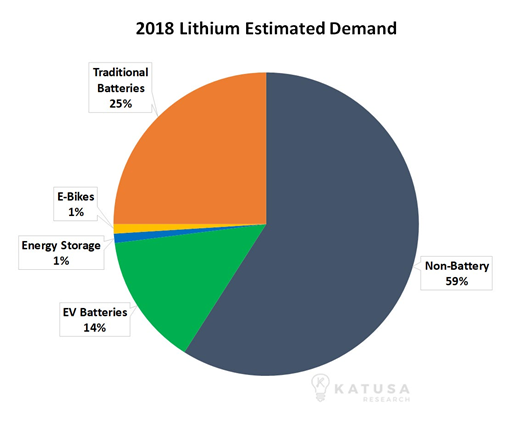

Adopted from Katusa, 2018

It is expected that electric vehicles constitute makeup 54% of the total lithium demand by 2025 making Lithium the only metal on the global market with a clear demand-growth projection. It is also projected that Non-battery applications will make up only 22% in 2025 of total lithium production down from demand, which 60% in 2015, thanks to electric vehicles.

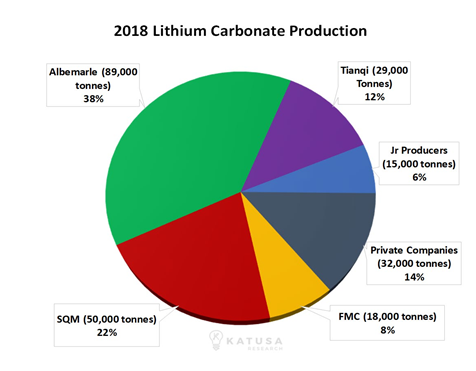

- Invest in “The Big Four” Lithium Monopoly

Four companies popularly referred to as the Big Four; Albemarle, Tianqi, SQM and FMC control over 80% of all lithium produced worldwide.

Adopted from Katusa, 2018

High lithium prices have led to the establishment of numerous new lithium production projects and or reopening of previously uneconomic mines. The Big Four companies are the front runners in this adventure thanks to economy of scale and have since created an oligopoly in this industry albeit with different market characteristics.

Because companies have a market cap of over USD$5 billion, they can buy large volumes of high-grade lithium deposits compared to junior companies. In the end, due to the inherent nature of oligopolies, it is possible that increased production of lithium by the Big Four will result in reduced prices of battery-based lithium, enabling them to buy out junior companies that own the most lucrative lithium deposits.

Because of the electric motor vehicle revolution and the resultant demand for Lithium battery, lithium trade has become a very lucrative sector. This is evidenced by capital share value and profit margins recorded by significant players. Albemarle has grown by over 150% since 2015; SQM is up by nearly 180% since 2016 while Lithium X, a small upcoming lithium company, was bought for more than $250 million only two years after launching.

- Invest in Ceramics and glass production

Lithium oxide is used in silica processing, reduce viscosity and melting point of silica resulting in glazes of high physical properties. This industry is lucrative and stable due to regular demand and stable market price.

Conclusion

Lithium has become one of the essential metals in the global market due to the green energy revolution which has increased its demand and price drastically. Consequently, there is increased interest in this industry mainly by investors. It is of utmost importance for investors to analyse and identify possibilities available in the industry and isolate available opportunities where they would invest to and extract the most value. It is also essential to determine the mode of investment whether directly or indirectly.

References

Kalevi, R. et al., 2018. Quantitative Assessment of Undiscovered Resources in Lithium–Caesium–Tantalum Pegmatite Hosted Deposits in Finland. Espoo, Finland, Geological Survey of Finland.

Martin, G., Rentsch, L., Hoeck, M. & Bertau, M., 2017. Lithium market research–global supply, future demand and price development. Energy Storage Mater., Volume 6, p. 171–179.

Martin, G., Rentsch, L., Hoeck, M. & Bertau, M., 2017. Lithium market research–global supply, future demand and price development. Energy Storage Mater, Volume 6, p. 71–79.

Mohr, S., Mudd, G. & Giurco, D., 2018, Lithium resources and production: Critical assessment and global projections.. Minerals, p. 165–184. .

Oliveira, L. et al., 2015. Critical issues of lithium-ion batteries–from resource depletion to environmental performance indicators.. J. Clean. Prod., Volume 108, p. 354–362.

Simon, B., Ziemann, S. & Weil, M., 2018. Potential metal requirement of active materials in lithium-ion battery cells. Focus on Europe. Resour. Conserv. Recycle., p. 300–310.

Phyto Partners and Segment Analysis

Introduction:

The usage of Cannabis or Marijuana has been illegal in the country America for a very long time. Under the Federal law, the possession of Cannabis is illegal and punishable, as propounded by the Controlled Substance Act of 1970. According to this act, even the medical use of the same, in spite of containing high potential use, was banned in the country. However, in the past few years, the legalization of Marijuana, in various parts of the world, especially, the legalization of Cannabis in Canada, has influenced the legal structure of the country. Therefore, although the medical and recreational use of the Cannabis is banned, but at the state level, the use policies, regarding the usage of Cannabis, for both Medical and recreational purpose, vary greatly. The medial use of the Cannabis is legalised across 33states of the country including Columbia, and the recreational use of the same is legalised over 10 states, including Colorado, Vermont and Washington. Further, the policy is observing a rapid expansion. Recently, the state of Oklahoma, which was primarily known for its conservative nature, saw the legalization of the medical usage of Marijuana, in the year 2018 (Grant. 2016). There are three factors that explain the legalization of Marijuana.

New Adoptions Add to the Legitimacy of Marijuana Reforms:

The changes in the adoption of the policies regarding the usage of marijuana and the restrictions on the practice of the same, varies greatly from state to state. The US government has viewed that the negative outcomes of the legalization of the, marijuana law, has got lessened with time and with liberalization of the laws. Therefore, the state governments of the country is observed to have been legalising the medical laws to practice a proper care treatment for the people of the nation, and has observed that the legal changes of such kind has appeared to be more palatable and less extreme to the inhabitants of the states, which has further made conservative countries like Oklahoma, made the practice legal (Parker. 2018).

Changes over Time:

Not all medical laws’, followed by then sates of the country are similar in the manner. While, some of them have legalized the availability of the substance in the dispensaries, others have made it leak to grow them, at the home yard for the same purpose. Therefore, over time it is seen that the laws have become more restricted in some ways and less restricted in other ways (Parker. 2018). This shows that the practiced of the usage of the substance can be continued in many ways, which has furthered the adoption of the marijuana laws in many of the states of the country.

State Adoptions Lead to Pressure to Change Federal Policies

The researches on policy jurisdiction, has shown that the incorporation of the marijuana law in one jurisdiction, has influenced the changes in the policies and the adoption of the same, in the other countries as well (Parker. 2018). Therefore, the continuous adoption of the same and the changes in the state policies or the laws, have put a pressure on the federation law of the country and t5he country is seen tri have made changes in its federation law, regarding the same.

Therefore, all these have led to the expansion of the usage of the substance across the country many organizations have seen to have been marketing the products and gain extreme profits. Therefore, in the following essay, the company, Casa Verde, a start- up company, of the country America, with specialization on Cannabis industry, is reviewed and analysed and further, a Segment Analysis on the same company has been presented.

Casa Verde Capital:

Casa Verde Capital is one of the dominant capital firm in the country, with its pivotal focus on the Cannabis industry. However, along with this, the firm is also focusing upon the other related business ventures. It is a start- up company which is specialised in the Cannabis industry, and now expanding in the fields of growth capital, investments and seeds. The expansion of the industry is supported by its investments in the fields of legal “pick and shovels”. The company has also invested into the media industry, communication industry and in the technology industry, with its prime focus on content and publications. The company is also focusing upon the agricultural sector of the country, by the production and sales of raw materials. It has included a sustainable approach for this particular sector, by the production of fresh crops, which are enriched with nutrients (Grant. 2016). Casa Verde has also set its feet into the software and hardware industries and in the big data analytics. It has also expanded a lifestyle section, in various parts of the country. Further, with its focus on the health and wellness of the people of the country, the company is thriving, gaining a niche in the market. It also provides, both raw materials and finished goods or products to the dispensaries. Therefore, the business approaches included by the organization, has enabled the company to gain its own position in the market, within a few years of time.

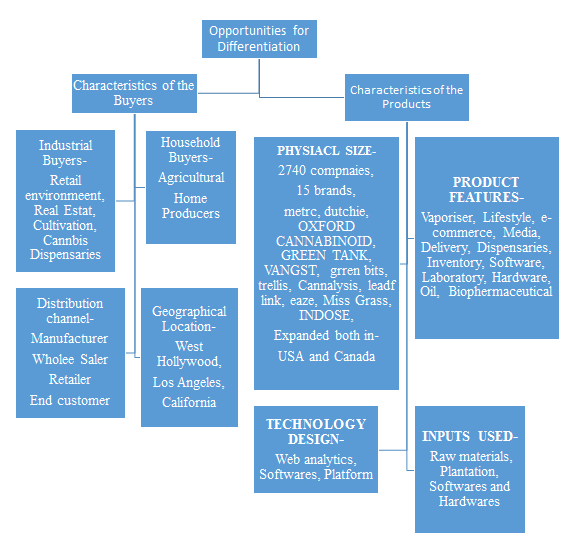

Segment Analysis of Casa Verde:

Market segmentation refers to the process of dividing the market that the company has gained, or can gain, depending upon its potential customers and their products. In the segment analysis, the characteristics of the products of the company and the characteristics of the potential customers of the same have been analysed and discussed (Seigneur, Clarke, and Udell). On this note, the strategic policies for marketing its products and also, the market interests, needs and locations of the company is also reviewed. A segment analysis is important to be done by the companies in order to take a better strategy, and to mark its target audience.

Therefore, in the following essay, the Segment Analysis of the company has been analysed.

| United States of America | Canada | |

| Dispensaries | ||

| Cars | ||

| Vaporisers | ||

| Lifestyle | ||

| Oil | ||

| Hardware | ||

| e- Commerce | ||

| Biopharmaceuticals |

References:

Grant, R.M., 2016. Contemporary strategy analysis: Text and cases edition. John Wiley & Sons.

Parker, L.C., 2018. Emerald Skies Ahead: Ethics and Marketing Implications of the Cannabis Industry (Doctoral dissertation, University of Southern California).

Seigneur, R.L., Clarke, B.M. and Udell, S.D., 2018. The Cannabis Industry Accounting and Appraisal Guide: Indispensable Resources on Taxation, Financial Accounting, and the Appraisal of Cannabis-Related Intellectual Property and Business Interests. Lulu Press, Inc.