Discussion and Analysis

This report evaluates the company’s proposal to invest into a new manufacturing machinery that will help to manufacture new age electronic vehicles. In order to evaluate the proposed project, the net incremental operating cash flows of the new machine has been calculated, using which the report calculates the net present value (NPV), internal rate of return (IRR) and payback period of the proposal.

These three techniques are the long-term investment appraisal techniques with the help of which the company can evaluate the profitability and financial viability of the project. However, each of these techniques have their strengths and weaknesses which are listed below,

Net Present Value (NPV): It is the matric that helps to assess the project’s present value by discounting the anticipated cash inflow and outflow at the current time. The strengths of NPV include – consideration of time value of money and easier decision-making by comparing distinct projects. However, the weaknesses of NPV include – that it cannot compare projects of distinct size and sensitivity of the cost of project (Knoke, Gosling and Paul 2020).

Internal rate of return (IRR): It is the matric that assess the projected return that will be produced by the project. The strengths of IRR include – consideration of time value of money and no requirement of the calculation of the discount rate. However, the weaknesses of IRR include – avoidance of economies of scale and IRR cannot be calculated if future cash inflow is not satisfactory to recover the initial investments (Xie 2021).

Payback period: It is the matric that assess by what time the project will recover its initial expenditures. The strengths of payback period include – helps to assess project’s liquidity and the risk of the project, simple calculation and project evaluation. However, the weaknesses of payback period include – avoidance of time value of money and subjective in nature (Fetner and Miller 2021).

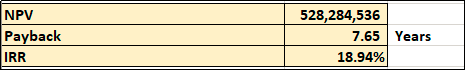

Considering each of the evaluation technique, the NPV, IRR and payback period of the new machinery is calculated as under,

In order to calculate the after-tax operating cash flow, it is assumed that the old machinery is depreciated using the straight-line method and the annual depreciation of the old machinery is $500,000 as it is mentioned that the saving in cost of the old machinery include depreciation cost; however, the amount for the same is not mentioned. Apart from this, no other assumptions have been taken for calculating the NPV, IRR and payback period.

The amount spent on consultation of $8,000,000 has not been considering while calculating the net operating cash flow as it is a sunk cost.

From the calculation it is observed that the project has a positive NPV which signifies that the project will be a profitable one. The IRR of the project is also higher than the cost of capital of the project (10.3%) which signifies that the project will produce a higher return than the expected return. However, the payback period of the project is 7.65 years and as per the company’s policy, in order to accept the project, it should have a payback period of 5 years. Since for this proposed new machinery, the estimated payback period is significantly higher than the accepted payback period. Thus, despite having a favourable NPV and IRR, it is recommended that the company should not accept the project considering the payback period (Alkaraan 2020).

The limitations involve in this appraisal are – (i) investment appraisal techniques work better when there is more than one project; therefore, by comparing distinct projects, it suggests the best one. However, since in this case, there is only one project it is difficult to evaluate the viability of the project accurately. (ii) Also, the depreciation of the old machinery has been taken based on assumption that may different in actual basis (Alkaraan 2020).

Reference List

Alkaraan, F., 2020. Strategic investment decision-making practices in large manufacturing companies: a role for emergent analysis techniques?. Meditari Accountancy Research, 28(4), pp.633-653.

Fetner, H. and Miller, S.A., 2021. Environmental payback periods of reusable alternatives to single-use plastic kitchenware products. The International Journal of Life Cycle Assessment, 26, pp.1521-1537.

Knoke, T., Gosling, E. and Paul, C., 2020. Use and misuse of the net present value in environmental studies. Ecological Economics, 174, p.106664.

Xie, M., 2021. Research on the modified internal rate of return. Turkish Journal of Computer and Mathematics Education (TURCOMAT), 12(11), pp.4087-4090.