Question-Answer

A.

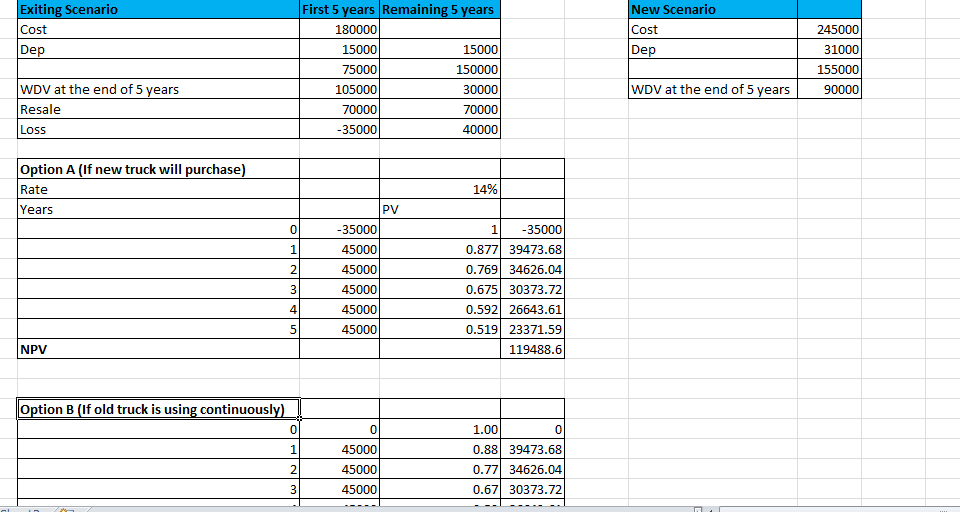

Net Present Value

Net Present Value is a capital budgeting tool which is used in investment planning to evaluate the profitability of a project investment (Cleartax, 2018). The formula has been used in order to evaluate the NPV according to the case study as follow:

| Exiting Scenario | First 5 years | Remaining 5 years |

| Cost | 180000 | |

| Depreciation | 15000 | 15000 |

| 75000 | 150000 | |

| WDV at the end of 5 years | 105000 | 30000 |

| Resale | 70000 | 70000 |

| Loss | -35000 | 40000 |

| New Scenario | |

| Cost | 245000 |

| Depreciation | 31000 |

| 155000 | |

| WDV at the end of 5 years | 90000 |

| Option A (If new truck will purchase) | |||

| Rate | 14% | ||

| Years | PV | ||

| 0 | -35000 | 1 | -35000 |

| 1 | 45000 | 0.877 | 39473.68 |

| 2 | 45000 | 0.769 | 34626.04 |

| 3 | 45000 | 0.675 | 30373.72 |

| 4 | 45000 | 0.592 | 26643.61 |

| 5 | 45000 | 0.519 | 23371.59 |

| NPV | 119488.6 |

| Option B (If old truck is using continuously) | |||

| 0 | 0 | 1.00 | 0 |

| 1 | 45000 | 0.88 | 39473.68 |

| 2 | 45000 | 0.77 | 34626.04 |

| 3 | 45000 | 0.67 | 30373.72 |

| 4 | 45000 | 0.59 | 26643.61 |

| 5 | 40000 | 0.52 | 20774.75 |

| NPV | 151891.8 |

B.

There are many other non-financial consideration other than Net Present Value are present value that should be considered while evaluating investment proposal are as follows:

Environmental Feasibility:

The company should check that modern truck is feasible or not for the environment. The truck should be legally accepted for environmental permission.

Capacity of Labor:

It is also necessary for the company to evaluate the capacity and number of labor that are required to use the modern truck. It has to examine that there is enough labor that can handle or maintain the truck.

Capacity of Modern Truck

It is important to examine the capacity of new modern truck in terms of speed, and time. It is required to evaluate the capacity of truck in order to analyze the future benefits and losses.

C.

Net Present Value is one of the capital budgeting tools which are used by the companies to analyze the best opportunities for investment. The present value of cash flow depends on the interval of time between present time and cash flow (Marchioni, and Magni, 2018). Net present value is basically a gap between the present value of cash inflows and the present value of cash outflows.

Advantage of NPV

The main advantage of evaluation of NPV is that it helps to evaluate the basic idea that the investment will create value for the investor or not.

It also helps to examine the basic idea about dollar received in future are worth less than dollars in future value.

It is also beneficial while this method is taken into consideration to evaluate the cost of capital and the risk inherent in making selection between two projects.

Limitation of NPV

The biggest limitation of using the Net Present Value is that the evaluation is based on guesswork about the organization cost of capital. In this method, the value of real options is excluded which is required to exist in investment.

It is also observed that the result evaluated with the method of NPV is not always accurate.

Net Present Value is

not valuable in order to compare the two different sizes of projects (Woodruff,

2019).

References

Cleartax. (2018) NPV ( Net Present Value ) – Formula, Meaning & Calculator. [online] Available From: https://cleartax.in/s/npv-net-present-value [Accessed 19/10/19].

Marchioni, A. and Magni, C.A. (2018) Investment decisions and sensitivity analysis: NPV-consistency of rates of return. European Journal of Operational Research, 268(1), pp.361-372.

Woodruff, J. (2019) Advantages & Disadvantages of Net Present Value in Project Selection. [online] Available From: https://smallbusiness.chron.com/advantages-disadvantages-net-present-value-project-selection-54753.html [Accessed 19/10/19].