The stock market is a regulated market where securities such as bonds, notes, and shares are traded. The market is well organized for buyers and sellers as is governed by forces of demand and supply. It is also preferred as a public entity where trading of firm stock at an agreed price. The companies participating in the stock market are listed in the stock exchange as well as companies trading privately. Stock prices reflect all available information of a company and efficient they are in acquiring accurate new information the more effective the stock market in allocating resources. This paper will explore the Apple stock price movement and the market they serve. Apple Inc designs products, and sales for trade mobile accessories, computer, and other services. The company produces products such as Ipad, Watches and Apple TV, Mac, company also sell software and other services s. The products and services for the company are exercised through online, retail stores and direct sales to the customer with help of cellular carriers e.g. wholesalers and retailer

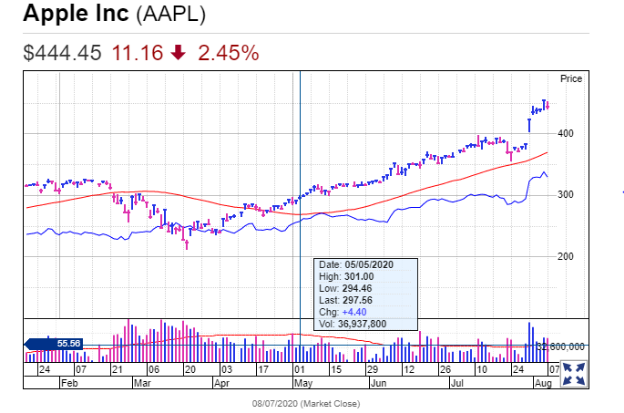

Apple has been successful in American over a while since the rising of the computer revolution in the 1970s. The COVID 19 pandemic has led to a surge of Apple share in the stock market. Analyst predicts that stock market giants will come back strongly after the COVID-19 pandemic. Investors on the dilemma of whether to buy the AAPL stock now as there has been an upswing movement of the Apple stock. iPhone is one of the biggest transitions on Apple’s success. The revenue of Apple rose by 17%amounted to 13.35 billion during the first quarter in March 2020. It was during this period the sales of iPhone dropped by $29.96 billion by 6.7%, the computer sales also fall by 2.9% amounting to 5.35 billion, the Ipad had a slid decrease by 10.3% accounting to 4.37 billion. Apple stock market has been outperforming especially in the border market however the stock of Apple is not a buy currently.

USD/CAD reserves at 1.3330 as of March 2019 to March 2020. In the recent past, the Canadian currency has been on panic for recent months due to the heavy fall of oil prices. One of Canada’s exports is the oil changes in the Equity market has weakened by 1.3665 since May 2017. The fall of oil prices is oil prices cause worry to the banks of Canada. The government of Canadian responded by increased interest rates by July 2017 with a rate of 1.75 percent. The U.S dollar dropped against currencies thus raising the demand for safe currency

Stock prices and exchange rate relationship is significant in establishing the economic policy such as monetary and fiscal policy. When the stock is booming in the market it affects the aggregate demand positively for investors to invest in the market. If the demand is huge contractionary measures such as fiscal policies will be neutralized as they target the exchange rates. Country Policy maker’s champions for the currency which are less expensive to strengthen the export sector. Policies of a kind have the possibility of slowing down the stock market. The exchange rate path can be predicted by the link, particularly between two markets. This is a great benefit to a multinational corporation in controlling the risk of exchange rates and managing their earning. In an investment fund currencies are included, investors’ knowledge of currencies rates is significant in the performance of the fund portfolio.(Yuko 2014) suggested that during 197 Asian financial crises the relationship between currency and market disseminated the crisis. The sharp depression of currencies led to the fall of the stock market. The knowledge about two markets could contribute to preventive action before the escalation of the crisis

Foreign exchange is the worth of county currency in respect of another currency. When a foreign currency rate raises it leads to an appreciation of the local currency and a drop of the foreign exchange rate represents a fall or devaluation of the currency. An appreciation of currency plays a significant role in an economy as foreign product prices fall. In distinction to this, it is harmful as the product become more expensive to other nation.This appreciation of currency leads to about fall in the export of a specific economy which is not a good signal to investors. The stock market represents a place where shares and financial instruments are traded by publicly listed companies. The prices of the stock market are affected by forces of the company and environmental components which company operates, some of the components that affect stock prices are as follows, macroeconomic components, domestic and international components, the market which company trade, political and economic factor, and government policies

Investor’s expectation regulates the price of the exchange rate and gives variation in future, inflation rate, countries relation on trade, countries external debt, and countries interest rate differential. Macroeconomic factors such as interest rates inversely affect the stock price performance. The interest rate affects the future cash flow as the rate of lending money to invest in assets. This acts s a discounting rate to the future valuation of cash flow produced by assets.On the other hand, inflation has a vital relationship between stock prices.That rise in prices of stock causes a fall in the rate of inflation in an economy. The inverse relation exists because when inflation occurs the rate of interest rate fall significantly which results in the rise of stock prices

Purchasing power parity is a model that links the stock price levels and the exchange rate of a country also referred to as price based criteria most preferred by the policymakers. The theory states that the nominal exchange rate and the price level between two countries are comparable .moreover when a country currency is on high demand it generates more export and therefore the contribution of the currency increases the imports. Investors need to value the worth of stock before investing which are determined by the nature of the industry, the feature of stock and external components in contrast relative valuation model calculates the stock worth of a firm with its competitors. Price to sell multiple, price-earnings multiples of a firm, cash price multiple are some of the independent methods used to calculate the stock valuation. Relative model is the easiest model is one of the cheapest method preferred by investors as it does not need extended calculations

This study will explore the Apple stock exchange which is the second listed company. Unites state dollar is currencies practiced at on NASDAQ.Shares of Apple stock price came back strongly in 2019 after 8 percent drop in 2018. The stock has increased close to 70 percent to date. The stock market has received a negative impact to the COVID 19 pandemic. Return of the New York stock market where the Apple stock trade declined as the number of COVID -19 cases increased. The market responded as each stage of the pandemic. At the early stage, the market reacted negatively to the COVID-19 thus the response change over time of each stage of the pandemic

iPhone which is the product of Apple accounts for close to 50% of the firm sales.I Phone 11, which is the latest in the market will serve as the key driver in the Apple revenue in the next 15 months. The firm is earning IDC of 60 million in 2019 where the company is expected to sell over 105 million smartwatches by 2023. Apple’s share price has marked conflict between the United States and China. The two countries have not reached an agreement as the firm may be required to occupy more tariffs. Financial analysts have estimated that 4persent earning per share by end of 2020 due to an additional 15percent tariff set in December.

The stock of a firm that produces lasting earning the growth rate makes the best dividends. Apple has been among firms that generate the best dividend prospect. It is easier to boost the dividends when earnings are rising. Apple earning per share have been significantly rising at 14% a year in five years Earning per share of Apple firm has been rapidly increasing and the firm maintains its earning. Before investors invest in firm stock they will do company analysis on the firm historical rate of dividend growth. Apple has recorded an increased rate of 9% annually of dividends. the firm has been attracting investors to invest on stock securities as the historical history of the company has been attractive. The firm has been growing its earnings per share as dividend stock has been attractive to investors.

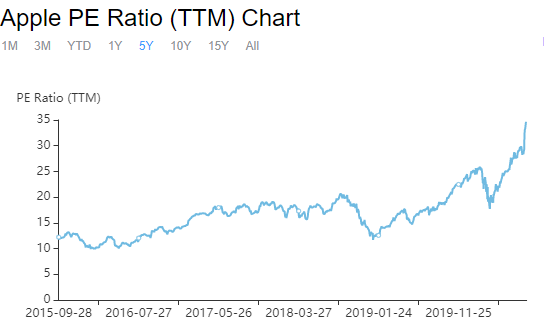

Additionally, Apple Historical earning per share from 1990 to 7th August 2020. The price is calculated by dividing the current stock by the recent earning per share. The number of years a firm takes to earn back the price firm spend on the stock is known as price-earnings ratio The lower the price per earnings ratio stock the more appealing the compared to the higher price per earning as P/E ratio remains constant

Historical Data of Apple PE Ratio

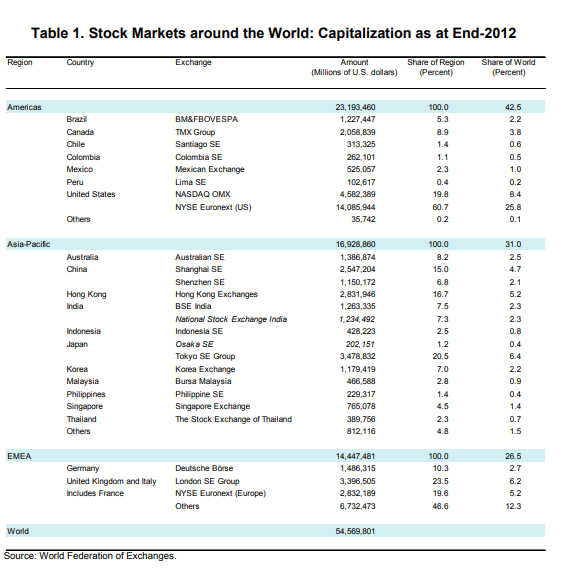

Crouching tiger hidden dragon is a Chinese saying which accounts for today’s Asian stock market. An Asian stock market is a significant tool for the growth of the Region as the market is underappreciated. In most Asian countries the assets of the banking division with debt securities are comparable to the stock market capitalization to the gross domestic product percentage. It contrary to the countries that have developed as the sector of banking dominates the financial market. Asian countries’ equity issuance has been a significant tool for exercising finance. In 2012 the Asian region raised new capital amounted $198 billion by the issuance stock compared to the American $234 billion and combination of Europe, African and Middle east which amounted to $102. Asian stock market with capitalization amounting to $15 trillion capitalization trillion the stock market is equal to Europe, the Middle East, and Africa. The stock market has over 20, 000 listed companies as at the end of 2012. African has over 10,000 countries and total of13,000 companies in Europe and the middle east combined. The stock market in Asian stock

the market has become more united with the international system concerning finance. Foreign investment has significantly expanded in the region’s stock market. After the end of the Asian financial crisis, many companies’ growth was increasing at an increasing rate. The growth of foreign investment in the Asian region has contributed to the growth of many investment industries. Therefore the Asian stock market listing of foreign investment has tripled over the past 10 years compared to 10 percent of African foreign investment and European and the Middle East combined. Asian companies have developed more capital markets with lower cost, high valuation, improved investor recognition, improved and health corporate governance, improved recognition of investment seminars, and corporate training, a labor organization for employee’s recognition and rights.

Despite the Asian stock market is a significant source of funding in the region their full potential remains to be exploited as the pricing prediction and perception of the Asian stock market are more distinctive. The speculative activities are forces that control the prices of the stock market. A drop of the Asian stock market is experienced when the market is dominated by driving forces of speculative activities. Research has suggested returns of stock market variation are largely emerging in the market. The quality of institutions such as governance consideration, legal and political regulatory have played a significant role in the growth and development of the Asian stock market. The stock prices in the Asian market are efficiency is determined by the institutional development and how strong is the regulatory framework for transparency of governance. Market regulations and the stock exchange have a direct connection. Countries which have applied and practicing ideologies of security framework and regulation have

Fewer problems to the pricing of the stock.

Additionally, the development of the Asian market has been accompanied by depth and share turnover. Since 1990 the liquidity has doubled in context with the gross domestic product (GDP) .capitalization of the market has significantly increased, the depth of the market is also greater than any other upcoming market. Nevertheless, China and Indonesia are Asian countries small in size, the market with few participants and the volume of activities are low,The market liquidity of these two countries is minimal thus the stock market is performing poorly which devaluates the stock market piece of the Asian region. Countries such as the Philippines and Hong Kong are still facing challenges of poor governance, the challenge of foreign investors, inadequate information policies, as countries are dominated by few companies. Such factors have contributed to the fail of the stock market in the Asian stock market

Several factors have also contributed to the rise and growth of Asian equity markets, besides; foreign investors have played a significant role in many Asian markets. Investors have contributed to many countries being listed in Asian stock exchange for the growth of the region economy. The majority of investors are found in Indian, Korea, Singapore, Taiwan Province of China The allocation of investments in these countries is relatively small. Improved market infrastructure and the rule of governance has contributed to the efficiency of the market. Improved governance due to transparency and proper disclosure of investment information by most countries. These have contributed significantly to the growth of the Asian stock market. Additionally, the growth of domestic investor firm has been leading force for the equity market. Large share have been invested for the company’s asset in equities .moreover the sector has developed countries thus room for growth is significantly high

Conclusion

This paper explores the relationship between the stock market and exchange rate The link between the two is positive when stock prices are the lead variable and negative prospect when the exchange rate are lag effect. Apple company responds with strong revenue from the products traded such as iPhone which are based on IOS. During 2017he product reported 62% of the Apple revenue which has reported a essential improvement .iPad on other hand reported a revenue of 8%as the revenue is prospected to drop by 2021 to 5%.. The firm has an developing opportunities in countries trading at Asian stock market such as China and India whose concentration is to develop the future market