Executive Summary

This report

contains an analysis of the reports of Wesfarmers Pty Ltd. The reason for

conducting the analysis is to understand the basis of measuring the tangible

assets by the company. It contains a detailed analysis of how the company

initially recognises the assets at the beginning of the financial year and how

it proceeds in measuring them at the end of the financial year. It starts off

with an introduction which contains an overview of what the report is about and

an overview of what constitutes the tangible assets of a company. After which,

it proceeds to the body which contains the main theme of the report, which is

the analysis of the annual reports of Wesfarmers Ltd. and their measurement of

the tangible assets in the financial year 2017. It ends with a conclusion

stating the overview and the learnings of the report.

Table of Contents

Basis for measuring the tangible assets in the balance sheet. 3

Recognition of the tangible assets by Wesfarmers Ltd. 3

Usefulness of the disclosure of the information. 4

Introduction

According to the guidelines of AASB 116, a tangible asset has been defined as one that has some kind of monetary value that can be obtained on the sale of the same. Property, Plant and Equipment are a part of the tangible assets included in the scope of AASB 116 [1]. There are a variety of ways in which the assets can be measured in a particular year. However, before that, they need to be recognised in the books of accounts. Depreciation and amortisation are also a part of the charges that are levied against these assets. At the end of the year, they may either be recognised at fair value or some other manner depending on the accounting policies of the entity. Wesfarmers Pty Ltd. is an Australian entity that has been in existence since 1914 and is a renowned conglomerate operating in a variety of fields in the country [2]. As it contains a huge number of subsidiaries, the company has a huge number of tangible assets that exist in its balance sheet in a particular year and their identification and measurement is an important part of the preparation of the books of accounts of the company.

Basis for measuring the tangible assets in the balance sheet

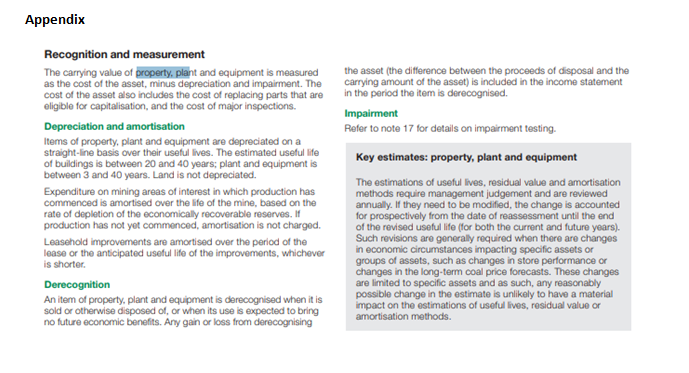

There are various methods available to an entity in which it can measure the value of its tangible assets [3]. As per the guidelines of Paragraph 73 of AASB 116 which suggests that every company should make a mention of the method in which assets are measured at the beginning of the financial period, the depreciation methods used in charging the amortisation and depreciation methods on the assets, rates used in the charge and the manner in which the amount is carried forward in the books of accounts. In case of financial assets depending on the foreign currency fluctuations occurring in the market, the net changes occurring in the value of the assets due to the changes in the currency rates also need to be mentioned [4]. Paragraph 74 of the standard suggests that an entity should also disclose the expenditures that have been occurred in relation to the changes in the value of the assets and the basis of the spending. If the expenditures are not disclosed separately in the statement of comprehensive income, then they should at least be included in the profit or loss incurred in relation to an asset.

Recognition of the tangible assets by Wesfarmers Ltd.

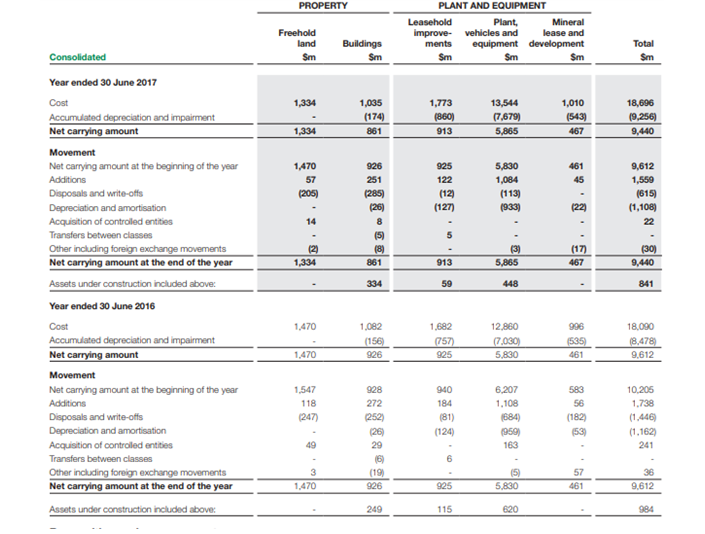

As per the 2017 annual reports of Wesfarmers Ltd., the property, plant and equipment that are owned by the entity at the beginning of the year are measured at their cost which is reduced by the amount of amortisation, depreciation and other charges that are applicable on the asset. In the cost of the asset, other significant items that are included are the cost of the major replacements made to the assets and related significant inspection charges incurred as a part of obtaining the asset. The measurement of depreciation is done on a straight-line basis and charged over the useful lives of the assets. However, depreciation is not charged on land as it is not applicable on the same. As the company is also involved in the mining business, the expenditure incurred on the mines is charged on an annual basis over the useful lifetime of the respective mines and their rate of depletion in a particular year. With regards to leasehold improvements, amortisation is charged on the useful life of the lease asset or the anticipated useful life caused due to the improvements made to the asset, whichever is shorter. Derecognition of an item of plant, property or equipment occurs when the particular asset is sold or disposed due to the impairment of the asset. Another situation is when it is estimated by the entity that a particular asset is not expected to bring any further useful benefits to the entity. Any income or loss that occurs from the disposal of the asset is recognised in the income statement of the entity. The methods used in the depreciation, amortisation and residual value of the assets are reviewed on an annual basis by the entity due to the changes occurring in the economic situations of the organisation [5]. However, these changes are not applied to all the assets which are owned by the entity. In this aspect, the company is following the guidelines of AASB 116.

Usefulness of the disclosure of the information

The primary reason for suggesting that the accounting policies followed by a firm should be disclosed is the existence of a large number of ways in which a particular transaction can be treated. The main essence of disclosing the accounting policies followed in relation to the tangible assets is that it makes it easy for the users to arrive at their own estimates of the changes occurring in an entity and its assets during the course of a year. As the entities tend to mostly disclose only that information which is material, the disclosure becomes important as it clearly states the impact that the changes in the value of the assets have had on the financial statements of an entity [6]. The benefit of disclosure is that it becomes easy for the users to analyse and assess the information by themselves. However, due to the non-disclosure, working out what a particular piece of information means becomes difficult for the users. It also increases the transparency in an entity and assures the users about the fairness of the manner in which it is conducting its business. It also suggests that a company is following the consistency concept in preparing the books of accounts and the financial results of the previous year become easy to compare with those occurring in the current financial year. As the guidelines and regulations suggested by the governments increase the emphasis on appropriate disclosures, it becomes necessary for the entity to comply with them [7]. Accompanying the financial statements with proper notes and disclosures also increases the strength of the company in situations where a legal issue arises about the disclosure of the accounting policies followed by the organisation. The change in the accounting policy in the measurement of an entity is not just limited to the value of the assets itself. It also impacts the net profit, financial position and the future business transactions that a business enters into. Therefore, as the impact is likely to be significant and long-lasting, it is necessary for the entities to disclose their measurement and recognition policies in relation to their tangible assets.

Conclusion

On the basis of the above

discussion, it can be suggested that an asset is the property or other item

owned by a business whose sale is likely to generate economic inflows to the

entity. A tangible asset is one which has an actual existence and can be

recognised as a part of the business. As the methods that are in place in

relation to the measurement of tangible assets are many in number, it becomes

essential for the entity to disclose the recognition and measurement policies

used by it. Wesfarmers Pty Ltd., an Australian entity recognises its tangible

assets at cost less accumulated depreciation and other impairments occurring to

it. The depreciation is charged on the straight line basis. Any changes

occurring in the value of an asset that are likely to be material are also

disclosed. This information is important in the sense that it allows the users

to measure the impact that the accounting policies followed by an entity are

likely to have on the value of the asset.

References

[1] Aasb.gov.au. [Online] Available at: https://www.aasb.gov.au/admin/file/content105/c9/AASB116_08-15_COMPoct15_01-18.pdf [Accessed 26 Sep. 2019], 2019.

[2] Wesfarmers.com.au. [Online] Available at: https://www.wesfarmers.com.au/docs/default-source/default-document-library/2017-annual-report.pdf?sfvrsn=0 [Accessed 26 Sep. 2019], 2019.

[3] M. Greco, L. Cricelli and M. Grimaldi, A strategic management framework of tangible and intangible assets, European Management Journal, 31(1), pp.55-66, 2013.

[4] S. Yang, The disclosure and valuation of foreign cash holdings. In AFA 2015 Boston Meetings Paper, 2015.

[5] S. Stungurienė and Č. Christauskas, Benefits of applying different depreciation methods of long-term tangible assets in a company, Socialiniai mokslai, (4), pp.38-47, 2013.

[6] A. Alhazaimeh, R. Palaniappan and M., Almsafir, The impact of corporate governance and ownership structure on voluntary disclosure in annual reports among listed Jordanian companies, Procedia-Social and Behavioral Sciences, 129, pp.341-348, 2014.

[7] M.A. Müller, E.J. Riedl and T. Sellhorn, 2015. Recognition versus disclosure of fair values. The Accounting Review, 90(6), pp.2411-2447.