Introduction

Corporate Governance can be defined as the combination of rules, laws and processes which are essential in determining the manner in which a business is operated, controlled or regulated. This includes a combination of internal and external factors which tend to affect the interests of the stakeholders of a company. The stakeholders of a company include the employees, shareholders, customers, suppliers and the regulators appointed by the government. The responsibility of ensuring that the entity follows a good system of corporate governance lies with the Board of Directors of a company. Corporate Social Responsibility (CSR) of a business is a self-regulating concept of the business which suggests that a business should be socially accountable apart from generating profits for the stakeholders (Stuebs and Sun 2015). Another term used to define CSR of a business is the corporate citizenship of the business. Hence, CSR considers a company to be a regular citizen and vests all responsibilities that a normal citizen has with the business. A company is said to be taking part in the CSR activities if it is found to be contributing towards the enhancement of the social and environmental aspects of it. In the modern day business, Corporate Governance and CSR are important activities in enhancing the value of a business.

Evaluation of the Board Structure

The primary aspect analysed as a part of the corporate governance guidelines of Appen Limited is the current structure of the Board of Directors of the entity. According to the guidelines of good corporate governance, the board of directors are responsible for some of the most important activities taking place within an organisation (Appen 2020). Their roles include defining the purpose of a company and defining the values which will be followed by the company. It has been noted that the directors of Appen consist of both executive and non-executive directors. The executive directors are the full time employees of an entity and are work with the best interests of the company in mind. The non-executive directors of the company are not involved in the day-to-day running operations of the business. While there is no fixed formula for the composition of both the directors, it is generally considered that the Board should consist of a majority of non-independent directors. The independence of these directors is determined by their inclusion in the financial, business and other commitments of the business. The non-executive directors should be allowed to use their powers to the fullest extent possible. The structure of Appen also follows a similar pattern. To the most practicable extent possible, the board of directors of the company consists of more independent directors than executive directors (Lozano, Martínez and Pindado 2016). The independence of every individual director is also analysed on a timely basis and this information is included in the website of the company. In case of a non-executive director is related to the company in some manner, then the company thoroughly analyses whether the independence is compromised in any manner. If there are any changes in the Non-Executive Director’s position, the same is announced to the public and the independent status of the director changes immediately. These guidelines are sufficient to ensure that an efficient structure of Board of Directors is in place for the company.

Outline of Compensation Package

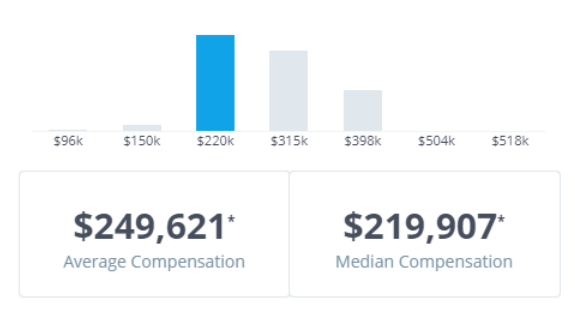

As per the generally accepted corporate guidelines, the company also has a Nomination and Revenue Committee in place. This company helps the Board of Directors in putting together a policy which is useful in attracting highly qualified directors and employees as a part of the company. These people help in enhancing the growth of the company and creating value for shareholders. The remuneration policy also clearly distinguishes the structure of the remuneration of the non-executive directors from that of the compensation of the executive directors and other senior executives. A good compensation package is said to be one which motivates the executives in aligning with the long term objectives of the company. Hence, a remuneration committee should offer competitive salary along with necessary fringe benefits in combination with sufficient levels of performance oriented bonuses to the employees. When these bonuses and benefits are linked to the long-term goals of the company, it can be said that the focus of the executives will be increased towards generating more returns for the shareholders as a part of the business. In case of Appen, it can be said that these policies are well followed in designing the structure of the compensation of the executives and other senior staff. The policies also clearly distinguish between the remuneration earned by the executive directors and the non-executive directors of the company.

Source: Wall Street.com 2020

Other guidelines like encouraging the growth of the company and encouraging the improvement in the performance are all supported by the remuneration policy existing in the company. As of 2018, the company’s data suggests that the compensation taken by Mr Mark Ronald Brayan, the CEO of the company was AUS$ 934000 per year. At that time, the valuation of the company was $1.4 billion. The average compensation of the CEOs of similar companies at that point of time was much higher at $1.5 million. However, since he took over in 2015, the company generated an annual increase of 38% growth in the revenues earned by it. Similarly, the revenues were also up by more than 86%.

Source: Comparably.com 2020

This suggests the value generated by the company on the amount invested by the shareholders was extremely high. The returns provided to the shareholders over a period of three years was also as high as 678% over a period of three years. On the basis of the above data, it can be suggested that even though the compensation received by the CEO is modest, it is not impacting the revenue or the growth of the business in any manner. Hence, it can be termed as effective (Simply Wall St. 2020).

Risk identification and Strategies in place

Some of the most significant risks which are faced by the business of Appen include the non-compliance with the laws governing the organisations operating in the industry. These include not following the best practice guidelines regarding industrial relation, occupational health and safety and environmental law and practices. The other risk is the loss, fraud or theft of the internal controls of the entity and the final risk is the lack of application of important judgements and accounting estimates by the business.

In order to overcome these risks, the business has placed a significant amount of internal controls and risk management strategies in place within the organisation. Some of them include the constant review of the adequacy and appropriateness of the company’s policies in risk management and compliance (Buckby, Gallery and Ma 2015). The completeness and accuracy of the company’s reporting policies on the effectiveness of corporate governance policies are also thoroughly reviewed by the business in a timely manner. The Board receives constant advice from the risk management committee about the steps which can be undertaken to manage the risks faced by the business in the short and the long run. Periodical meetings are arranged with the key internal officers, external auditors and other relevant parties to understand the risks faced by the business in a timely manner. These meetings are also used by the business in the review of the company’s risk management system and the internal compliance and control system. Other strategies include following the appropriate guidelines in the appointment of external auditors and in reviewing the financial statements of the entity.

Challenges faced as a head entity

As a major Multinational corporation operating in a wide variety of countries across the world, the company mainly faces the issues of code of conduct and diversity policy in its businesses. As the company tends to employ a wide range of people from different cultures around the world, it can mainly faces the issues related to diversity in its businesses. The other issues faced by the business include employee and crowd pay rates, privacy, community projects and generally, the sustainability of the business model in the long run. These challenges can be overcome only with the help of annual employee surveys suggesting the improvements to be made in the business and the cause and analysis of any breaches occurring as a part of the organisation. The risk management issues faced by the business can mainly be classified into economic risks and environmental risks. The general economic risks include being exposed to the general economic conditions and the risk of customer concentration in a particular area. Some of the other risk management issues include the environmental issues such as the carbon footprints left by the company and an increased threat of environmental pollution caused by the company. The social sustainability issues faced by the company include the engagement and conditions of crowd and remote workers. This risk may go to such an extent that these workers may be classified as the employees of the business and may also paid employee benefits by the company (De Stefano and Aloisi 2019). In order to manage some of these risks, the company has adopted the Modern Slavery policy in the UK and is involved in codifying a policy which can be used across the world by the entity.

Corporate Social Responsibility

Appen can successfully classify itself as a global company because it employs more than a million skilled contractors worldwide. As a company operating at such a high level, there are a wide variety of issues which the entity needs to take care of in conducting its business successfully. These include diversity, social responsibility, environment and corporate governance. As a part of the diversity program, the company tends to employ 61% of its employees as female and 39% of its employees are male. The company also looks to develop more female leaders as a part of its commitment to developing diversity in the organisation. The company also actively supports people suffering from different disabilities. There are around 200 people operating in the company in Philippines with hearing disabilities. As a part of the social responsibility of the entity, Appen has partnerships with Translators without borders and National Council of Disability Affairs in Manila. The company constantly tries to provide workers with basic requirements like sustainable conditions and sustainable wages more than the local minimum wage. In its commitment towards environment, the company has recycling facilities in all of its offices and the resources are also used in a judicious manner. Increasing video calls during the working hours reduces the need for travel and reduces the carbon footprint across the world. The company also produces an annual corporate governance statement and has a strict code of conduct and diversity policy. These suggest that the company mostly has policies which are useful in fulfilling the CSR related duties of the company.

Adequacy of CSR of Appen

The CSR reporting of the entity can be described as being adequate in the current scenario with some scope for improvement in certain areas. One of them is the maintenance of diversity and labour rights. While information is available from a wide variety of sources, there is no clear statement about the manner in which the company is looking to encourage diversity in different places of the business (Sethi, Martell and Demir 2017). There needs to be more emphasis on the local population affected by the business. The rights of the labour across the world should also be protected with a governing policy guarding their rights.

Conclusion

On an overall basis, it can be said that the company’s Board structure and compensatory packages are extremely efficient in managing the performance in an effective manner. However, more emphasis needs to be placed on the business based risks and risk management strategies of the company. Similarly, stricter guidelines are necessary in maintaining the rights of the workforce across the world. Protecting the communities affected by the business and more focus on environmental based issues is necessary for the benefit of the company.

References

Appen. (2020). Environment, Social and Governance – Appen. [online] Available at: https://appen.com/about-us/environment-social-and-governance-summary/ [Accessed 2 Apr. 2020].

Buckby, S., Gallery, G. and Ma, J., 2015. An analysis of risk management disclosures: Australian evidence. Managerial Auditing Journal.

Comparably. (2020). Appen Crowdsourcing Executive Salaries. [online] Available at: https://www.comparably.com/companies/appen-crowdsourcing/executive-salaries [Accessed 4 Apr. 2020].

De Stefano, V. and Aloisi, A., 2019. Fundamental labour rights, platform work and human rights protection of non-standard workers. In Research Handbook on Labour, Business and Human Rights Law. Edward Elgar Publishing.

Lozano, M.B., Martínez, B. and Pindado, J., 2016. Corporate governance, ownership and firm value: Drivers of ownership as a good corporate governance mechanism. International Business Review, 25(6), pp.1333-1343.

Sethi, S.P., Martell, T.F. and Demir, M., 2017. Enhancing the role and effectiveness of corporate social responsibility (CSR) reports: The missing element of content verification and integrity assurance. Journal of Business Ethics, 144(1), pp.59-82.

Simply Wall St. (2020). Appen (ASX:APX) – Share price, News & Analysis – Simply Wall St. [online] Available at: https://simplywall.st/stocks/au/software/asx-apx/appen-shares?utm_medium=finance_user&utm_source=post&utm_campaign=Intro_ticker&blueprint=163562 [Accessed 2 Apr. 2020].

Stuebs, M. and Sun, L., 2015. Corporate governance and social responsibility. International Journal of Law and Management.