Introduction

According to Czerny and Zhang, 2015 third degree price discrimination in economics involves a monopolist charging different prices to varying consumer segments for same products and services. There is a direct relationship between 3rd degree price discrimination and the overall willingness and capacity of consumers to afford given goods or services. Under third degree price discrimination, it is easy to identify specific groups basing on time of use, location, sex and age. It is important to note that market segmentation of price discrimination is also referred to as third degree price discrimination. Under third degree price discrimination, consumers are charged basing on the nature or type of market segment. For third degree price discrimination to be successful three conditions must be effectively satisfied by the seller and they include among others price maker, market control or lack of contact between the two groups (Alderighi et al,2015).

There a number of reasons why specific groups have varying demand elasticities and they include; availability of substitutes, differences in tastes and differences income. Variation in airline ticket prices is a clear example of third degree price discrimination

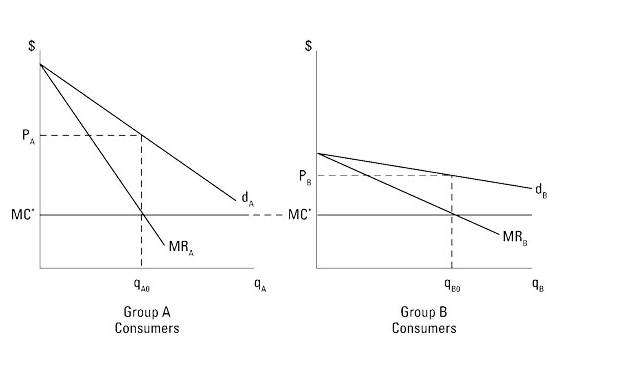

From the graph below there is a clear illustration of 3rd degree price discrimination. The marginal revenue for consumers in group A are represented in the curved labeled MRA. It is clear that there is relative steepness of the demand curve meaning that is not very elastic. The marginal revenue and Demand for consumers in group B is represented in the curves labelled MRB and dB. There is more elastic demand among group B consumers given that the demand curve is flatter (Czerny and Zhang,2015).

MC* is the overall marginal cost or expenses of the ending unit. Where the marginal revenue is equal to the marginal cost, the overall profit maximizing output for every group effectively corresponds to the quantity. Prices, from the graph are determined at across the vertical axis from the output that maximizes the level of profits to the demand curve of the group. Price PA and qA0 is the overall profit maximizing out for consumers in Group A. price PB and quantity qB0 is the maximizing output for consumers in group B.

Figure 1 showing third degree price discrimination (Czerny and Zhang,2015).

How airlines actually practice price discrimination

The high levels of elasticity of demand for inflexible passengers that book tickets in advance lead to customers being charged low fares (Berry and Jia,2010). As per the recent studies carried out in the airline industry, airlines offer a number of options for passengers. In the booking seats there various options available to different passengers like marital status, nationality, age, and leisure and business trip (Bilotkach and Rupp, 2012). To effectively undertake third degree price discrimination, detailed profiling is very important to the airlines. Business and leisure passengers are charged different prices for similar routes depending on the degree of elasticities. Customers who need extra or special services like meals, particular seats are also charged different fares from the others (Basso et al,2009).

Hypothesis

There is a high price elasticity of demand associated with leisure passengers as compared to business passengers who have low price elasticity of demand

JetBlue Airways New York, NY (JFK) –> Charleston, SC (CHS)

| One day Fare = $402.40 Return 9/12/17 at 10:20 am Depart 9/5/17 at 7:38am |

| One week Fare = $329.40 Return 9/18/17 at 10:20 am Depart 9/11/17 at 7:25 am |

| Two weeks Fare = $305.40 Return 9/25/17 at 10:20 am Depart 9/18/17 at 7:25 am |

| Four weeks Fare = $410.40 Return 10/9/17 at 10:20 am Depart 10/2/17 at 7:25 am |

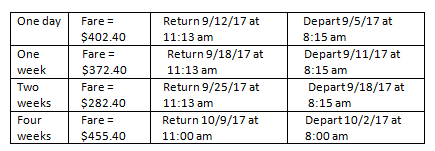

Delta AirlinesNew York, NY (JFK) –>Charleston, SC (CHS)

There is variation on the level of price charged on the various customers on the same routes by both Delta Airlines New York and JetBlue Airways New York. In most case business passengers prefer booking flights late. This is contrary to the leisure passengers who book flights early. Third degree price discrimination in this case is based on advance purchase rebates and thus one group that is sensitive to demand is charged higher than the other. A number of challenges are associated with airlines like capacity limitations of passengers and delays. These costs form part of the fares charged by the two airlines (Bilotkach et al,2010).

Conclusion

In conclusion, for third degree price discrimination to be successfully undertaken in the airline industry it is very important to consider various factors like the elasticities of the different groups of passengers. The identification of the characteristics of different passengers makes it easier to isolate each group and charge different fares for similar routes.

References

Alderighi, M.,Nicolini.M., and Piga,C. (2015). Combined effects of load factors and booking time on fares: Insights from the yield management of a low-cost airline. The Review of Economics and Statistics, 97, pp. 900-915.

Basso, L.J., M.T. Clements, and Ross,W.(2009). Moral hazard and customer loyalty programs. American Economic Journal: Microeconomics, 1, pp. 101-123.

Berry, S. and Jia,P.( 2010). Tracing the woes: An empirical analysis of the airline industry. American Economic Journal: Microeconomics, 2, pp. 1-43.

Bilotkach, V., Gorodnichenko,Y., and Talavera,O. (2010). Are airlines price-setting strategies different?. Journal of Air Transport Management, 16, pp. 1-6.

Bilotkach, V. and Rupp.N.(2012). A guide to booking airline tickets online. In Advances in Airline Economics: Pricing Behavior and Non-Price Characteristics in the Airline Industry, Vol. 3, ed. James Peoples.

Czerny, A.I. and Zhang.A.(2015). Third-degree price discrimination in the presence of congestion externality. Canadian Journal of Economics, 48, pp. 1430-1455.