Answer to question 1:

Theory of competitive markets from the perspective of consumers and firms:

The theory of competitive markets is considered as a type of market where there are large number of purchasers and sellers and no one has the capability of affecting the market separately. Under the competitive market there is no entry barriers. This market has several buyers and sellers and the products sold under competitive market are homogeneous in type. A perfectly competitive market is considered as an ideal market where there are large number of informed buyers and sellers with no likelihood of monopoly (Greenlaw, Shapiro and MacDonald 2022). A competitive market response towards supply and demand fluctuates with supply curve which represents the product’s quantity. The producers under competitive market are willing to sell the product as per the market price, the supply curve adjusts so that the firm’s cost is comparative to its sales.

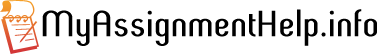

Figure 1: Relating the demand and supply curve for both firm and market

Source: (Mankiw 2021)

From the perspective of consumers, under a perfectly competitive market, they are considered as price takers. This implies that they do not have any influence on the market price and should accept the prevailing price for a given products or services. The consumers under competitive market looks to achieve maximum satisfaction considering their budget constraints. The consumers take purchase decisions by considering the prices of products or services and their supposed worth (Mankiw 2021). Under a competitive market, the consumers compete among themselves. This implies that one consumer competes with another for a product or service, particularly for the diminished stock. For instance, when a customer buys tickets for a sporting event, they frequently compete to get the best seats.

Meanwhile from the perspective of firms, they look to maximize their profits by lowering the costs and increasing the volume of sales. Just like the consumers, firms operating under competitive market are also price takers. Firms do not have power to create influence on market price and they are required to sell their goods and services at the given market price (Herdegen 2024). Besides this, as companies produces products and consumers buys those products, supply diminishes over the time. This enables the firms to increase the price of products or services because of low stocks or an inducement to increase production.

For instance, a firm manufactures 200 LED TV screens and sets at a very competitive price of $1,000 each. With every LED TV screen sold implies that there is one less available for the next consumer. In such a situation, the firm may decide to raise price of the most popular TVs once the stock reaches to a fixed volume.

Discussion involving the role of government in addressing market inefficiencies

Market inefficiencies or market failure is considered as a situation when the market fails to distribute the resources effectively, resulting in suboptimal results for the community or society. Market inefficiencies occur in numerous types each having its own exclusive challenges to economic efficiencies and welfare of the society (Muscat et al. 2021). Market inefficiencies can happen because of externalities, public goods, imperfect competition, information asymmetry and income inequality. The role of government in addressing market inefficiencies are as follows;

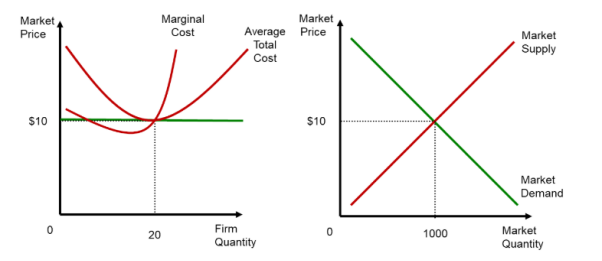

Regulation and Enforcement: The government applies regulations and standards to mitigate externalities. The government addresses negative externalities when the manufacturing or consumption of good or service leads to costs on third parties that are not involved in the transaction (Mayer 2021). For instance, the government applies regulations and standards on industries that creates pollution by inducing them to introduce cleaner production methods and emission reductions.

Public Goods Provision: Understanding the significance of public goods, the government makes investment in critical infrastructure, education and healthcare to improve the social well-being and also encourage economic development. Partnership between public companies and private companies can be used to leverage the resources and expertise in delivering necessary services efficiently.

Redistribution Measures: The government implements progressive taxes, social welfare programs and affirmative action policies to address the instance of income inequality and encourage social cohesion (Gerged 2021). By redistributing the resources and opportunities, the government looks to narrow down the gap amid the affluent and marginalized, encouraging the growth of strong inclusive and equitable society.

Figure 2: Graph showing role of government in pre and post intervention

Source: (Gerged 2021)

Answer to question 2:

Concept of Profit maximization for a competitive firm in context of pricing and costs:

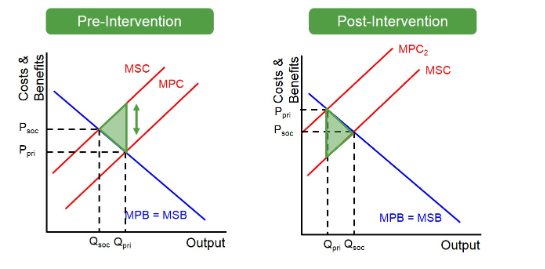

Profit maximization can be considered as the method of deriving highest revenue or profit (Jouida et al. 2021). Profit maximization for a competitive firm is regarded as the procedure of setting prices and level of output to attain maximum possible profit. A firm is able to maximize its profit when the marginal revenue is equal to marginal cost. Marginal revenue is considered as the selling price per unit and marginal cost represents the per unit cost.

Under a competitive market, the market price is viewed equal to marginal revenue. Hence, a firm is able to maximize profit by setting up the market price equal to marginal cost. As the perfectly competitive firms are required to accept the price regarding the output as determined by the product’s market demand and supply, it does not have power to select price it charges. Instead, a competitive firm is allowed to choose so that it can sell the quantity of output at the exactly same price. This means that firms usually face perfectly elastic demand curve regarding the product and the buyers are ready to purchase any quantity of units of output from the company at the prevailing market price (Skrynkovskyy et al. 2022). When a competitive firm decides what number of quantities it wants to produce, then this quantity combined with prevailing prices in the market for output and inputs helps in ascertaining the firm’s total revenue, total costs and eventually the level of profit.

A competitive firm is capable of selling large number of products it wants to sell, as long as the firm is able to accept price at prevailing market. Total revenue is projected to rise with increase in the number of quantities sold. Profit maximization of a competitive firm is dependent on price of product and total number of units sold. if the firm is able to increase the number of units sold at the given price, the total revenue would also increase. On finding that the price of every product sold increases, then the total revenue would also increase.

A firm is able to maximize the profit by producing products where the marginal revenue is equal to marginal cost. The profit of a firm will continue to increase as long as the marginal revenue is higher than the marginal cost for every unit sold (Roe 2021). Maximum profit happens when the marginal revenue is equal to marginal cost and profit falls when the marginal revenue falls below the marginal cost. In a prefect competition, the marginal revenue of a firm is equal to average revenue and market price. While selling every single unit, every firm operating under a perfectly competitive market faces a horizontal demand curve at the given market price.

Figure 3: Graph showing a firm’s profit maximization under a perfectly competitive market

Source: (Roe 2021)

As evident from above graph, the horizonal line shows the market price (P), which also represents the marginal revenue of a firm. The curve which is upward sloping shows the marginal cost (MC) of a firm. Finally, the stage where MR is intersecting MC represents the level of output that maximizes profit.

To summarise with, profit maximization for a competitive firm takes place by producing level of output where the marginal revenue is equal to marginal cost. The decision is completely based on the market price, which the companies cannot influence and also its internal cost structure. By simply aligning the production with this principle, the firm can assure that it is making the best use of resources and also maximizing the profit under the competitive market framework.

Answer to question 3:

Factors that influence aggregate demand and supply

Aggregate demand is considered as the total demand for goods and services in an economy based on the given price level and under a given time period. Meanwhile, the aggregate supply is considered as the total output of goods and services that firms are ready to and able to produce inside an economy based on the given price level and within the given time period (Sahani 2023). There are number of factors that influence the aggregate demand and supply.

Factors influencing aggregate demand:

- Consumption: Consumption is regarded as a notable factor influencing aggregate demand because consumer expenditure helps in driving up performance of an economy. Factors that influence consumption comprises of level of income, consumer debts, confidence of consumers and anticipation regarding future wealth.

- Investment: Investments are although comparatively unstable but it has immense weightage in the structure of aggregate demand. Investment is highly sensitive to rate of interest and it may fluctuate with changes in regulations and taxes (Garegnani 2024). Henceforth, investors usually face the dilemma of risk versus reward.

- Government Spending: The government spending is regarded as the substantial portion of aggregate demand and it number of ways the government spending helps implementing control over economic events. The government has the power of stimulating economic activity with the help of public expenses throughout the period of slower economic growth.

- Net exports: The net exports represent the difference amid exports and imports that contributes to aggregate demand. It is mainly influenced by factors such as currency exchange rates, rate of inflation and worldwide economic circumstances (Shapiro 2024). Higher exports and lower imports can lead to rise in aggregate demand whereas lower exports and higher imports can reduce the aggregate demand.

- Future expectations: Consumer anticipation regarding the future economic circumstances can affect the present spending and investment decisions. If the consumers and businesses anticipate stronger economic development, they are very likely to spend and make investment, therefore leading to rise in aggregate demand.

- Interest rates: Interest rates places considerable degree of influence on aggregate demand. When the interest rates are low, borrowing turns cheaper, encouraging the companies to make investment and consumers to spend, which eventually helps in elevating aggregate demand. On the contrary, when the interest rates are high, it discourages consumers from borrowing and spending because of higher cost, in so doing the aggregate demand slows down.

Factors affecting aggregate supply:

- Technological Advancement: The technological improvement helps in increasing the productivity, enabling a greater number of outputs from the same input of labour and capital (Zulianello and Guasti 2023). Improvement in technology can help in increasing the productivity, enabling the companies to produce large-scale output with fewer inputs and eventually shifting the supply curve to right. For example, automation and robotics can help in increasing manufacturing efficiency.

- Input Costs: Changes in raw material prices, labour wages and energy can cause significant effect on the cost of production. For instance, an increase in the price of oil can raise cost of production for several businesses, thereby shifting the aggregate supply curve towards left.

- Changes in relative productivity: Increase in productivity of one sector that is relative to others can lead to shift in resources, optimizing the overall level of efficiency within the economy. For example, shifting from production based to service-based industries in developed economies is mainly driven by high level of productivity in technology and finance sectors.

- Government Policies: Changes in tax rate for business can impact cost of production and profitability. The government regulations such as the environmental regulations or standards of safety can help in affecting the cost of production (Valentinov, Roth and Pies 2021). The subsidies provided by government can help in lowering the cost of production for specific industries, leading to shift in aggregate supply curve towards rightward direction.

- Supply shocks: Another notable factor that affects aggregate supply is supply shocks arising due to natural disasters and political instability. Events such as floods, forest fires, droughts and earthquakes can cause disruptions in production and damage to infrastructure. This causes the aggregate supply curve to shift towards left. Meanwhile global political instability such as wars, political unrest and trade disruptions can lead to adverse effect on supply chains and production.

Answer to question 4:

Role of public policies in addressing of unemployment, inflation and balance of payment deficits:

Addressing unemployment:

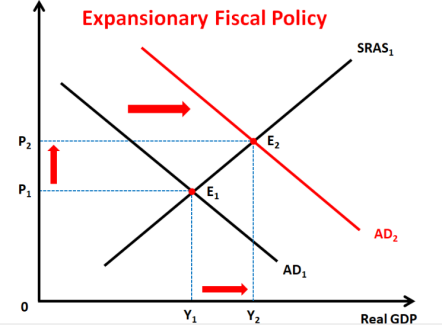

The main purpose of public policies is to lower the incidence of unemployment within an economy by promoting businesses to make investment and expand in creation of a greater number of jobs. The government employs fiscal policies to stimulate economic growth with the help of increased government spending and cutting down taxes. This results in high demand for goods and services and hence creates more jobs (Commons 2024). Besides this, the monetary policies employed by central banks to lower the rate of interest can help in encouraging borrowing and investment. This helps in boosting up economic activity and helps in creation of jobs.

Figure 4: Fiscal policy graph

Source: (Commons 2024)

Besides this, the public policies also include supply side policies which are aimed at increasing the productive capacity within the economy by enhancing education, infrastructure and technology, resulting in long-term creation of job and growth.

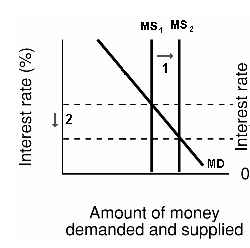

Addressing Inflation:

To address the inflation, the government can lower the spending or increase taxes to slow cut down the demand and slow down the inflation (Kahn 2022). Furthermore, the central banks can raise the rate of interest to make borrowing much more expensive and lower the spending which helps in controlling inflation. Furthermore, the government also makes use of tax policies and public spending so that the demand is influenced within the economy. The fiscal policy measures help in lowering the public spending or increase the taxes to help slow down the economy and implement control over inflation. The supply side policies are aimed towards increasing the productivity and efficiency level within the economy to help implement control over cost-push inflation. This comprises of measures to improve competition, lower the regulatory responsibilities and enhance infrastructure.

Figure 5: Monetary policy graph

Source: (Kahn 2022)

Addressing Balance of Payment Deficits:

The government makes intervention within the foreign exchange market so that the exchange rate can be stabilized by purchasing or selling their own currency. This makes exports highly competitive and imports less attractive (Marire 2022). The government applies trade policies to encourage export and lower down the imports such as offering subsidies to industries that are export based, implementing tariffs on imports and negotiating trade agreements which helps in opening up new markets.

Managing of exchange rate can help in influencing the balance of payments. For example, devaluation of currency can help making export relatively cheaper than imports and enhancing the trade balance. To address balance of payments deficits the public policies encourage foreign direct investment which helps in financing the balance of payment deficits (Blecker 2022). Policies that assist in creation of favourable investment climate such as tax incentives and ease of doing business can attract foreign capital.

To summarise with, it is vital to denote that the efficiency of these policies can vary depending on the given economic circumstances and interaction amid different policies. It is necessary to strike the correct balance amid addressing unemployment, inflation and balance of payment deficits because it is both complex and also challenging for the policy makers.

Economic phenomena and example of government intervention

One of example of government intervention for each of the economic phenomena is given below;

Unemployment: The government may intervene by introducing job training programs. The government decides to equip individuals through demand skills, these programs are aimed at increasing the employment skills and lowering the incidence of frictional unemployment that is caused by time taken by workers to get new employment (Oreiro et al. 2021). The job training program can help in improving the overall level of efficiency of labour market and boost the overall economic productivity.

Inflation: The government may intervene to address the economic phenomena of inflation by raising the interest rates. With the help of central bank the government may raise the rate of interest to increase the overall cost of borrowing to discourage the consumer spending and investment. This helps in lowering the aggregate demand, cooling down the economy and also slowing down the inflation rate.

Balance of payment: The government may decide to intervene by devaluing the domestic currency. With the help of currency devaluation, domestic currency becomes weak, making exports cheaper for the overseas buyers and imports expensive for the domestic buyers (Thirlwall 2021). This will help in improving exports and cutting down the imports, helping in making corrections to balance of payments deficit.

Answer to question 5:

Factors affecting the national GDP and the relationship between firms growth and GDP:

The factors that affect the national GDP and relationship amid firms growth and GDP are as follows;

Interest Rates: An important factor that affects GDP is interest rates. When the interest rates rises, companies and consumers cut back their spending and the economy slows down. Slowing down the demand results in companies laying off employees which additionally impacts confidence of consumers and demand (Istiqomah and Mafruhah 2022).

Consumer Spending: The consumer spending is considered as a notable component of GDP which alone accounts for more than two-thirds of the US economy. The confidence of consumers plays an important role in economic growth. Higher level of consumer confidence provides indication that the consumers are ready to spend, whereas lower level of confidence provides reflection regarding the uncertainty in future and consumers reluctance to spend.

Business Investment: Business investment is regarded as a vital component of GDP because it helps in increasing the productivity capacity and boosting up the employment. Government spending is important component of GDP because it includes investment in capital goods such as machinery, buildings and equipment (Balland et al. 2022). Higher level of investment encourages economic growth by improving productivity capacity.

Labour force: The labour force is a vital factor that influences GDP. The overall size and productivity of labour force directly creates an impact on the GDP. A bigger and more skilled labour force can boost productivity within the economy.

Regulatory Environment: The regulatory environment is another factor that affects the GDP. The government policies, regulations and business environment can help in influencing the economic activities. Effective policies can help in fostering growth while an overregulated environment can stifle the economy.

Considering the relationship between firms’ growth and GDP, it can be stated that as the firms grow, their production increases and directly makes contribution to GDP. Besides this, a firm that is growing usually hire more number of employees, which eventually lowers the unemployment rates and helps in increasing the aggregate demand (Lange 2022). Higher employment results in higher consumer spending and further boosting the economy.

Successful firms usually make investment more in capital goods, research and developing and expanding their projects. Investment in capital goods and high level of investment not only help in improving the firm’s productivity but also stimulates economic development.

Examples of how firms’ growth impact a country GDP:

One of the prime examples of firm’s growth impacting the GDP of a country is the growth of tech industry in Silicon Valley of USA. Tech giants such as Apple, Google and Facebook have experienced growth and this has eventually contributed to rise in GDP of USA. The growth in GDP of USA was further contributed by these companies providing millions of high-paying job opportunities which led to innovation and productivity throughout numerous sectors.

The existence of these companies has resulted in high consumer spending, substantial amount of investment in research and development and establishment of strong supply chain which benefits both the business and economy. The success of technology industry in the Silicon Valley of USA helped in boosting up the exports of high-end tech products and services, thereby enhancing the trade balance (Decker 2023). As these tech firms achieved growth, they typically expanded their overall production capacity, resulting in higher volume of goods and services produced inside the country. This helped in directly contributing to rise in GDP of USA, since GDP is used in measuring the total value of goods and services produced inside the borders of country.

Answer to question 6:

Advantages of trade between two individuals or country:

Trade between two individuals or countries can be considered beneficial for both because of the comparative advantage. This principle explains that even though one nation is considered highly effective in producing everything, it is still advantageous to obtain specialization in manufacturing goods or service in which they can produce very effectively as compared to the other entity. Some of the advantages of trade between two individuals or countries are as follows;

- Comparative Advantage: One of the standard concept of international trade is that it is beneficial for the countries because it allows the countries to gain specialization based on what they are relatively good at manufacturing (Leigh 2024). Considering that there are wide number of differences in how good countries are able to produce different items of products, trade amid two countries can help in gaining comparative advantage if both have specialization and trade what they manufacture.

For example, considering the USA which is good in producing some of the food items than other goods and France is good in producing wine as compared to other goods. Actually, US has comparative advantage in producing a particular food while France has comparative advantage in making wine. Trading wine and food amid both USA and France can be beneficial or advantageous for both the countries. The idea involving specialization and trading on the basis of comparative advantage should be viewed as a notable driver of growth and development for several nations.

- Access to other goods: Trade enables people living in different nations to get access to goods that they otherwise would not be able to get. For example, producing certain agricultural goods might need certain form of land or climate, which implies that countries would be required to trade in order to acquire those goods that they cannot produce by themselves. Trade between two countries or individuals helps in increasing the variety and innovation. It gives access to wide range of products and services which might not be readily available domestically (Vanhove 2022). Trade between two countries or nation helps in encouraging competition, which helps in driving up innovation and also improves the overall quality.

- Risk Sharing: Another notable advantage of trade between countries or individual is that it helps countries or individuals to share risk, particularly the local risk. To further illustrate this, for example if a country has experienced a major natural disaster that has caused disruption to the production of specific goods, the country might be able to get those goods from another country with whom it carries on trading activities. In contrast to a completely closed economies, one that has no trading relations with other nations would be limited to its own resources.

- Encourages economic growth: An important advantage of trade between two countries or individual is that it promotes economic development. Countries that take part in international trade usually experience faster growth and also improvement in productivity as well as innovation. International trade can help economies of two countries to experience growth in job opportunities and lower instance of poverty (Ehrenberg, Smith and Hallock 2021). When a firm or individual is able to purchase good or service that is produced abroad much cheaper than the domestic market, the living standards of both the nation increases.

- Economies of Scale: When producers are able to specialize themselves and engage in trade that allows them to achieve economies of scale, these producers are able to lower the average production cost and increase the efficiency level. Having gained specialization and trade enables more effective usage of resources. This results in reduced production cost and possibly lower price for the consumers.

To further justify this concept, it is necessary to consider the example of two countries that specializes in wheat and cars. If Country X is specialized in producing wheat while Country X specializes in producing Cars with each country having comparative advantage in their respective items they produce. By trading wheat for cars both the countries will be able to get access to both the goods than they could actually if they produced everything by themselves.

References:

Balland, P.A., Broekel, T., Diodato, D., Giuliani, E., Hausmann, R., O’Clery, N. and Rigby, D., 2022. The new paradigm of economic complexity. Research Policy, 51(3), p.104450.

Blecker, R.A., 2022. New advances and controversies in the framework of balance‐of‐payments‐constrained growth. Journal of Economic Surveys, 36(2), pp.429-467.

Commons, J.R., 2024. Law and economics. In Law and Economics Vol 1 (pp. 432-444). Routledge.

Decker, C., 2023. Modern economic regulation: An introduction to theory and practice. Cambridge University Press.

Ehrenberg, R.G., Smith, R.S. and Hallock, K.F., 2021. Modern labor economics: Theory and public policy. Routledge.

Garegnani, P., 2024. Two routes to effective demand: comment on Kregel. In Capital Theory, the Surplus Approach, and Effective Demand: An Alternative Framework for the Analysis of Value, Distribution and Output Levels (pp. 435-444). Cham: Springer International Publishing.

Gerged, A.M., 2021. Factors affecting corporate environmental disclosure in emerging markets: The role of corporate governance structures. Business Strategy and the Environment, 30(1), pp.609-629.

Greenlaw, S.A., Shapiro, D. and MacDonald, D., 2022. Principles of economics 3e. OpenStax.

Herdegen, M., 2024. Principles of International Economic Law, 3e. Oxford University Press.

Istiqomah, N. and Mafruhah, I., 2022. The effect of budget deficit in Indonesia: A comparative study. Economics Development Analysis Journal, 11(1), pp.110-119.

Jouida, S.B., Guajardo, M., Klibi, W. and Krichen, S., 2021. Profit maximizing coalitions with shared capacities in distribution networks. European Journal of Operational Research, 288(2), pp.480-495.

Kahn, R.F., 2022. Inflation—A Keynesian View. In Richard F. Kahn: Collected Economic Essays (pp. 253-259). Cham: Springer International Publishing.

Lange, O., 2022. Marxian economics and modern economic theory. In Marxism (pp. 215-228). Routledge.

Leigh, N.G., 2024. Planning local economic development: Theory and practice. SAGE publications.

Mankiw, N.G., 2021. Principles of economics. Cengage Learning.

Marire, J., 2022. Relationship between fiscal deficits and unemployment in South Africa. Journal of Economic and Financial Sciences, 15(1), p.693.

Mayer, C., 2021. The future of the corporation and the economics of purpose. Journal of Management Studies, 58(3), pp.887-901.

Muscat, A., de Olde, E.M., Ripoll-Bosch, R., Van Zanten, H.H., Metze, T.A., Termeer, C.J., van Ittersum, M.K. and de Boer, I.J., 2021. Principles, drivers and opportunities of a circular bioeconomy. Nature Food, 2(8), pp.561-566.

Oreiro, J., de Carvalho, L.D., Gabriel, L.F. and da Silva, E.H., 2021. Flexible inflation targeting, real exchange rate and structural change in a Kaldorian model with balance of payments constrained growth. Ensayos Económicos, (78), pp.47-82.

Roe, M.J., 2021. Corporate purpose and corporate competition. Wash. UL Rev., 99, p.223.

Sahani, S.K., 2023. THE EFFECTIVE THEORY OF PRODUCER AND CONSUMER SURPLUS: POSITIVE DEMAND, NEGATIVE SUPPLY. CENTRAL ASIAN JOURNAL OF MATHEMATICAL THEORY AND COMPUTER SCIENCES, 4(8), pp.70-76.

Shapiro, A.H., 2024. Decomposing Supply‐and Demand‐Driven Inflation. Journal of Money, Credit and Banking.

Skrynkovskyy, R., Pavlenchyk, N., Tsyuh, S., Zanevskyy, I. and Pavlenchyk, A., 2022. Economic-mathematical model of enterprise profit maximization in the system of sustainable development values. Agricultural and Resource Economics: International Scientific E-Journal, 8(4), pp.188-214.

Thirlwall, A.P., 2021. Thoughts on balance-of-payments constrained growth after 40 years. In Thirlwall’s Law at 40 (pp. 128-142). Edward Elgar Publishing.

Valentinov, V., Roth, S. and Pies, I., 2021. Social goals in the theory of the firm: A systems theory view. Administration & Society, 53(2), pp.273-304.

Vanhove, N., 2022. The economics of tourism destinations: Theory and practice. Routledge.

Zulianello, M. and Guasti, P., 2023. The demand and supply of pandemic populism: a global overview. Government and Opposition, pp.1-20.